Summary:

- Qualcomm Incorporated’s share price has increased by around 60% since the previous article, leading to a downgrade to a hold rating.

- The company has a decent amount of leverage but is not at risk of insolvency, with strong interest coverage.

- Margins and revenues have been on a decline but have started to recover, indicating a potential turnaround for the company.

- Still a big believer in Qualcomm Incorporated, but I need proof of substantial improvements.

JHVEPhoto

Introduction

I wanted to check in on QUALCOMM Incorporated (NASDAQ:QCOM) after how it performed during 2023, and see what is still in store for the company going forward. Since my last article on the company, the share price has gone up by around 60%. In that article, I argued that the fears of Apple Inc. (AAPL) and China becoming self-sufficient are overstated and that QCOM will continue to dominate the high-end mobile market and will reward patient shareholders.

To be honest, I didn’t expect the company’s share price to skyrocket so quickly. However, the company was trading at a big discount, so it is nice to see it worked out. However, given this share price appreciation, I am going to downgrade the company to hold for now, and wouldn’t recommend adding at these prices, or starting a position, as the risk/reward is not very enticing.

Briefly on Performance

As of Q1 ’24, ending 24 December ’23, published 31 January ’24, the company had around $12B in cash and marketable securities, against around $14.5B in long-term debt. It’s a decent amount of leverage that QCOM accumulated, however, there’s plenty of cash to cover the annual interest expenses, and the company is generating a decent amount of operating income. The company generated around $3B in EBIT as of three months ended Dec 24th ’23, while interest expense came in at $178, meaning, the interest coverage ratio is around 16x, so well above what analysts consider a healthy financial position, which is 2x. QCOM is at no risk of insolvency. Now, let’s look at how the company’s margins progressed throughout 2023.

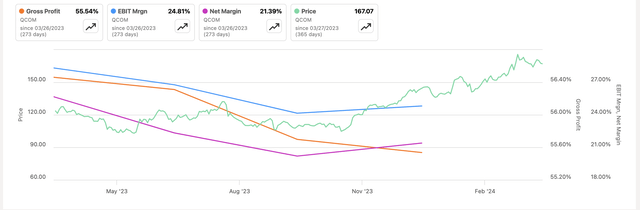

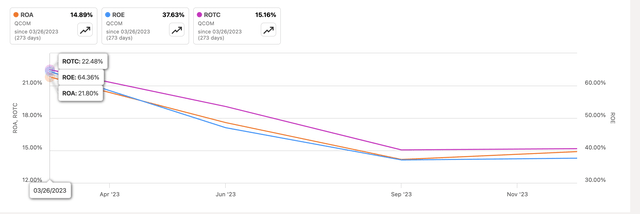

We can see margins across the board have been on a decline, due to the softness in the mobile markets throughout the first half of the year, which weighed on the company’s share price performance, as we can see in the graph below. However, since Q1 ’24, margins have somewhat started to recover driven by a strong recovery in the handset market and automotive revenues, and the share price has steadily risen to reflect the improvement in operations.

A similar situation is unfolding in QCOM’s other efficiency and profitability metrics. It seems that the company is amidst a turnaround, but we will see if this will be sustained in the next section. However, even at the lows the company saw in September, these were still decent returns on assets, equity, and total capital.

Efficiency and Profitability (SA)

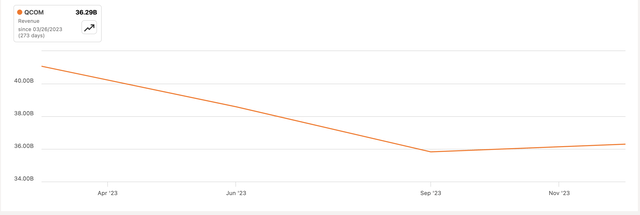

In terms of revenues, we can see the same unfolding as with the rest of the metrics mentioned above. The beginning of the year was tough, and the latest quarter is showing a bottom with actual growth of around 5% y/y in revenues, compared to previous quarters, where comparisons were -24% in Q4, -23% in Q3, -17% in Q2, and -12% in Q1, so a positive number is promising. I will go into more detail on the company’s top line growth in the next section.

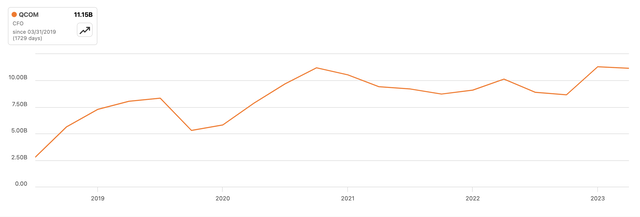

In terms of cash flow, we can see the company’s cash from operations also improving substantially since bottoming in June of 2023, and has leveled off at around $11B. The company last saw these levels back in June 2021, so it is a good recovery so far. Over the last 5 years, the company has steadily increased its CFO and it is hovering near the all-time highs.

Overall, it seems that the recovery is well on its way, and with the handset segment still relatively soft, I could see this continuing to recover for a while, which should bode well for the company’s future valuation.

Comments on the Outlook

Firstly, I would like to cover how the company’s efficiency and profitability may progress in the near future. Throughout 2023, QCOM took action in cost reduction and is looking to continue these measures through the first half of fiscal ’24, so I expect further operating margin improvements over the next quarter or two. Furthermore, as the handset market continues to recover, the company should see efficiencies kick in through higher revenue numbers. The management is capable of finding inefficiencies in the company and trimming what is necessary to bring value to its shareholders, and that is commendable.

If QCOM’s next chips are in high demand, it would be a great time to renegotiate its contract with Taiwan Semiconductor Manufacturing Company Limited (TSM), to lower prices if that means QCOM is going to bring more business to TSMC, but that is pure speculation on my part on how the company could improve its gross margins further. It will all depend on how much in demand the upcoming chips are.

Speaking of chips, the new Snapdragon 8 Gen 4 for phones is slated for an October release. I think this will be in very high demand because it will boast many AI capabilities on the device, even offline. This is going to drive efficiency and performance. Anything to do with AI is going to be in high demand, look at what is happening to companies like NVIDIA Corporation (NVDA), Super Micro Computer, Inc. (SMCI), and Dell Technologies Inc. (DELL). Gen AI-capable chips are going to be all the rage, and I have no doubt this will bring a lot of attention to QCOM going forward. With a massive market share that the company has, and a focus on on-device AI, the company paving the way forward, and will certainly capture a lot of sales from people and organizations that are looking to dive deeper into AI.

Let’s talk a little about competition. In the chipset space, there are a few competitors that could pose a threat to QCOM, like MediaTek Inc. (OTCPK: MDTTF). According to a report by Counterpoint Research, MDTTF has been consistently ranking first in terms of shipments, capturing over a third of the total market share, beating out QCOM, and Apple Inc. (AAPL). However, MDTTF is more makes more of a budget-friendly chip whereas QCOM and AAPL are targeting the high-end market, so if we look at total market share by revenue, AAPL took the number one spot with 39% of the total, while QCOM took second with 34% of total revenue. MDTTF is a distant third with a 15% market share of total revenues.

I don’t think it is fair to assume that MediaTek is going for QCOM’s market share in the segment. However, in the recent leaks of benchmarks of QCOM’s upcoming 8 Gen 4 and Dimensity 9400, Mediatek is outperforming on some of the tests. Take these with a grain of salt, as the chips are not yet released, so a lot of the testing has not been verified.

So, we can see that Dimensity is a formidable opponent, does that mean it is going to gouge out a huge chunk of QCOM’s market share in the high-end market? In my opinion, no. QCOM is a long-established, trusted brand, with a great reputation in the high-end processors. Brand loyalty can be a strong factor in staying with phones that have Snapdragon chipsets. Furthermore, QCOM has strong partnerships with many major phone manufacturers, and I would say that is a significant advantage. Let’s not forget, that QCOM also makes budget-friendly chips, so it is competing in MediaTek’s space also.

In terms of Apple, I don’t think it is a direct competitor to QCOM, the same way Samsung Electronics Co., Ltd. (OTCPK: SSNLF) is not a direct competitor in my opinion. Apple uses its chips, so QCOM chips cannot be used in either of the phones. For Samsung, sure, the company has its chips but all the latest high-end devices are powered by Snapdragon, and QCOM is confident this will continue for a while saying they are “positive with the relationship with Samsung” (transcript). Snapdragon looking to cater to many different phone makers, so the most direct comparison is MediaTek in my opinion. Furthermore, if Apple’s iPhones do well over the next 3 years, given the contract agreement with QCOM to use their modem chips, this will only be a positive for QCOM. If Apple does well, so will QCOM.

In the IoT space, the industry itself has seen softening in 2023. While QCOM is a major player in the space, other companies like Texas Instruments Incorporated (TXN), STMicroelectronics N.V. (STM), and Broadcom Inc. (AVGO) could pose a threat. I don’t think IoT is going to be the major factor in improving the company’s top-line growth. However, once the cyclicality turns positive, as we are seeing already in the mobile market, it will contribute positively to the top line. With a mere 4.7% CAGR over the next 4 years, it is hardly going to be a major catalyst for the company, but a recovery will help. AVGO and STM do not separate their revenues, so it is hard to tell how much they are making.

In terms of Automotive, there are many competitors in the space, and I have covered this in the past. However, so far, it looks like this segment is not going to drive much top line growth in the short run, especially given the company’s guiding some small declines in automotive and IoT (see the transcript above), I am most positive about the mobile segment recovery and innovations in AI space, especially on-device capabilities.

Is the company Buy, Sell, or Hold

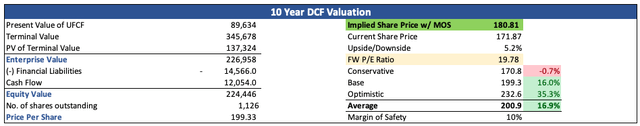

I’ve done Qualcomm Incorporated’s valuation model in the past, with a fair value of around $130 a share, you can find those calculations here. This means that it may not be the best time to start a position right now. However, if we believe in the company’s better performance than before, we could see a different picture, for example below.

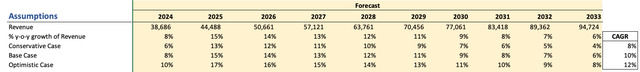

For revenues, let’s say the company’s next chips in laptops, and mobile handsets are in high demand, due to its AI capabilities, and the company sees a slight acceleration, which would bring its CAGR over the next decade to around 10%. Nothing too crazy in my opinion. I am not modeling some 100% y/y growth like in other AI players mentioned at the beginning, so a 10% CAGR over the next decade is reasonable. Analysts are not this positive currently, but if the company can prove it can rejuvenate its growth, I would expect the numbers to change. Below are these estimates for the three scenarios, and their respective CAGRs.

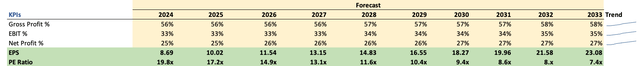

On margins, I am modeling a very small improvement over the next decade across the board. This way I am getting a bit more margin of safety/ room for error in estimates, however, I do think the company will become slightly more efficient over time. The reason is the management’s continual cost-cutting efforts. Below are those estimates.

Margins and EPS assumptions (Author)

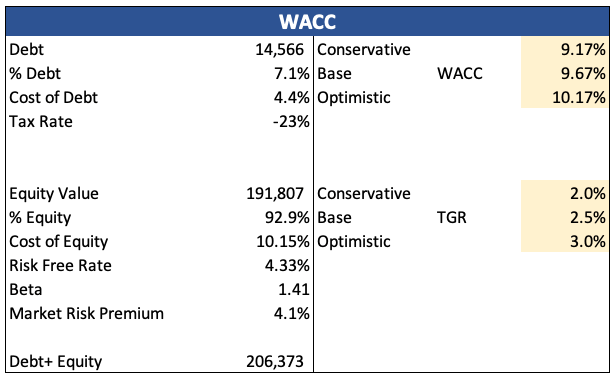

For the discounted cash flow, or DCF, model, I went with the company’s WACC of 9.67% as my discount rate and a 2.5% terminal growth rate. The discount rate is about where I like it to be so I will go with it. Below are my WACC calculations.

WACC Calculation (Author)

Furthermore, I went with an additional 10% discount to my fair value calculation, as I believe that is sufficient when looking at the company’s rather decent financial position. With that said, if the company can grow at a faster rate than what we see right now, the company’s fair value would be around $180 a share.

Theoretical Intrinsic Value (Author)

Closing Comments

The reason I am assigning Qualcomm Incorporated a hold rating for now is that I need to see the company’s top line growth show improvement. Anyone can put any numbers they like into the model, depending on their bias, however, until I see the results of the next chips, and how they are received, I am sticking for now to my $130 per share fair value.

This means, as I mentioned earlier, it may not be the best time to start a position at these levels. The company’s shares have done very well since my last article, and I don’t doubt it will continue. However, I wouldn’t be buying right now, as I would need solid proof of the company’s cost-cutting efforts to improve margins even more, or revenues accelerate, or both. Therefore, I am downgrading the company to a hold.

I am a big fan of QCOM, but I am not the type of person to invest in hopes of improving operations. I need solid proof.

We may continue to see this rally, due to the semiconductor industry’s sentiment finally turning positive, however, the Qualcomm Incorporated stock risk/reward is not very enticing right now, I would say.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.