Summary:

- Qualcomm stock has outperformed my expectations, as AI hype drove its recent surge.

- The Company’s second fiscal quarter earnings release underscored the significant recovery in its critical Chinese market.

- Qualcomm is well-positioned to continue gaining share as the AI smartphone upgrade cycle accelerates.

- Given its tepid growth grade, the market seems to have overrated Qualcomm’s opportunities.

- With the QCOM potentially surging into over-optimistic levels, investors must be extra cautious about buying more shares.

JHVEPhoto/iStock Editorial via Getty Images

Qualcomm Stock Outperformed My Expectations

Qualcomm Incorporated (NASDAQ:QCOM) stock’s performance has surprised me. The smartphone chipset maker saw QCOM stock re-test its recent highs after Qualcomm released its second fiscal-quarter earnings report.

Investor optimism is palpable as Qualcomm looks to capitalize on the AI hype across its product line. Qualcomm seems to have gained the edge over Apple’s (AAPL) AI developments, even as the Cupertino company expects to launch its generative AI strategy in June’s WWDC.

The market is likely assured that Qualcomm’s downstream inventory digestion in China is over. Qualcomm reported a 40% surge in revenue from Chinese smartphone OEMs, demonstrating the recovery in Android-based smartphones, as seen in Huawei’s resurgence in the first quarter of 2024. As a result, Apple suffered a disappointing Q1 in China, losing market share to its Chinese rivals. Qualcomm is not expected to benefit from Huawei’s 5G forays. However, Qualcomm anticipates an improvement in the premium mix, as “the percentage of premium and high-tier devices is increasing.” As a result, it is also expected to bolster Qualcomm’s operating performance, allowing the company to participate in the AI smartphone upgrade cycle.

Qualcomm To Benefit From AI Smartphone

Qualcomm management underscored the benefits to Qualcomm astutely, as highlighting its ability to capitalize on the “increased semiconductor content in Qualcomm’s chipsets.” In addition, advancements in NPU are fundamental to delivering AI applications seamlessly, attributed to the “demand for computational capability to run AI models.” As a result, Qualcomm expects the AI smartphone upgrade cycle to continue lifting market share gains for the company.

Benchmark analysts believe AI smartphones’ market share could rise to 47% of the market by 2027, up significantly from 11% in 2024. In addition, Qualcomm is projected to capture “over 80% of the market share for GenAI-related mobile phone chips over the next two years.”

Qualcomm management believes we are still in the nascent stages of the AI-driven upgrade cycle. As a result, I assessed Apple’s expected entry into the AI smartphone era shouldn’t hamper the opportunities afforded to the leading Android chipset players like Qualcomm. Coupled with Qualcomm’s RF capabilities, it should bolster the company’s overall AI stack, as AI inferencing is expected to move closer to the edge. Therefore, the demand for low-power and highly efficient AI inferencing workloads should drive consumers toward more advanced premium AI smartphones.

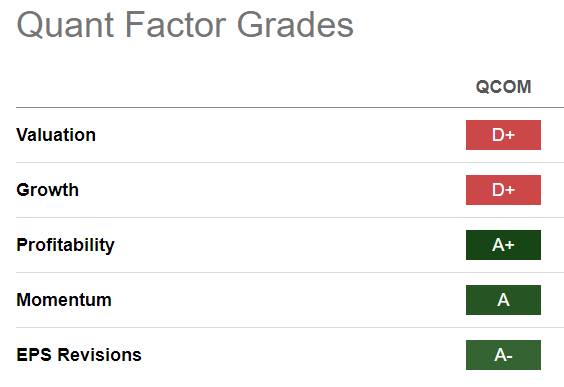

QCOM Quant Grades (Seeking Alpha)

Notwithstanding the optimism driven by the surge in Qualcomm’s edge-AI capabilities, Qualcomm’s forward revenue growth isn’t expected to be in the double digits. Even though Qualcomm is expected to continue to benefit from its revenue diversification to the PC, automotive, and IoT segments, growth will likely be driven mainly by its smartphone chipset business.

Qualcomm reported a total revenue of $9.4B; QCT accounted for $8B of Qualcomm’s FQ2 revenue base. Handset revenue was robust at $6.2B (66% of the total revenue base and 78% of the QCT revenue base). While automotive revenue surged 35% to $603M in the quarter, it isn’t expected to be a key revenue driver in the near term. Despite that, Qualcomm is confident that its automotive business could deliver $4B in revenue by FY2026, as its total design pipeline reached $45B. Therefore, Qualcomm’s auto business seems to have dodged the cyclical slowdown in EV growth, suggesting the growth momentum could remain intact. Therefore, it could emerge as one of Qualcomm’s critical growth drivers in the medium term as the segment continues to scale.

QCOM Stock Valuation Less Attractive

Despite that, QCOM’s “D+” growth grade will likely hamper a more aggressive valuation re-rating, even as QCOM surged toward its recent highs. I believe the market has already revalued QCOM in line with Qualcomm’s advancements in smartphone recovery in China. In addition, the market has also likely re-rated Qualcomm’s growth opportunities in the AI smartphone upgrade cycle, lowering the appeal of QCOM’s risk/reward.

With QCOM’s forward adjusted EBITDA multiple of 12.1x surging well above its 10Y average of 10.2x, it corroborates the premium already factored in its “D+” valuation grade.

Is QCOM Stock A Buy, Sell, Or Hold?

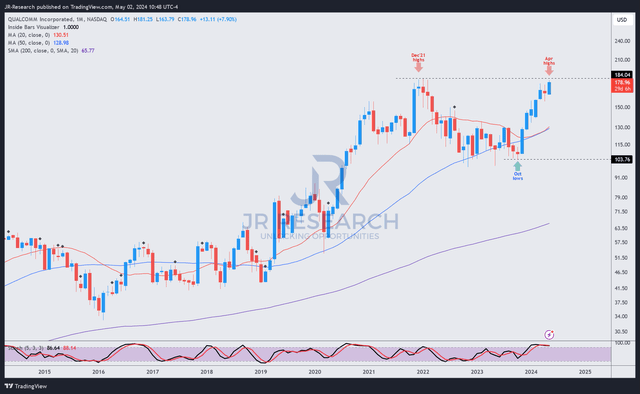

QCOM price chart (monthly, long-term, adjusted for dividends) (TradingView)

QCOM’s robust price action suggests it could re-test its all-time highs above the $193 level. I’ve yet to glean a sell signal on QCOM, although a partial rotation away to other battered plays might seem appropriate.

QCOM is already valued at a premium. I expect Qualcomm to be a prime beneficiary of the premium AI smartphone upgrade cycle. Despite that, we shouldn’t rule out Apple’s potentially more decisive response as the Tim Cook-led company looks to regain lost market share amid AAPL stock’s weak buying sentiments currently.

Apple is a formidable competitor that shouldn’t be underestimated. Moreover, QCOM’s smartphone chipset-driven business is expected to be more cyclical without a growing services business. While Qualcomm’s highly profitable QTL business is expected to generate robust cash flow profitability, it isn’t expected to be a critical growth driver, notwithstanding its stability.

As a result, Qualcomm’s cyclical business model needs to be carefully factored into your valuation considerations. I assessed that a more aggressive valuation re-rating is increasingly unlikely unless Qualcomm could demonstrate its ability to regenerate double-digit revenue growth, as it did between FY2020 and FY2022.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!