Summary:

- Qualcomm Incorporated’s diversification from smartphones is facing mounting challenges, leading to recent underperformance.

- Management attempted to drum up more confidence at its recent investor day, but the market’s reception has been assessed as lukewarm.

- Qualcomm seems well-positioned to benefit from new growth vectors, but the transition will take time to pan out.

- QCOM has consolidated well over the past few months, suggesting it’s positioned to maintain its uptrend bias.

- I argue why the market’s skepticism over Qualcomm’s near-term uncertainties shouldn’t deter long-term investors from buying more.

Adam Berry/Getty Images Entertainment

Qualcomm: AI Traction Seems Missing

Qualcomm Incorporated’s (NASDAQ:QCOM) efforts in driving diversification from its smartphone-driven growth thesis have hit a snag. Accordingly, QCOM has underperformed its semiconductor peers (SMH, SOXX) since its peak in June 2024. As a result, the market has become more discerning in selecting top AI infrastructure leaders partaking in the next phase of the AI growth inflection. Notwithstanding its Android chipset leadership, QCOM hasn’t been able to garner the premium valuation the iOS leader has attained. As a result, investors in Apple (AAPL) have continued to outperform Qualcomm investors as the Cupertino company seeks to divest its exposure to QCOM’s modems.

In my previous Qualcomm update, I upgraded the stock as I anticipated a potential bottoming in its bear market. I highlighted challenges in Qualcomm’s diversification to other fledgling growth vectors, as the market seems unconvinced with its execution. As a result, I’m not surprised that QCOM has also underperformed the S&P 500 (SPX, SPY) since then, as investors reassessed its bullish proposition.

Qualcomm held an investor day recently, as management enunciated its plans to diversify its growth drivers further. The Android chipset leader is keen on assuring investors that it will move away from the assessed slower-growing smartphone chipset market as it seeks to establish itself in automotive, IoT, and Edge AI.

Qualcomm Needs To Shake Off Smartphone Tagging

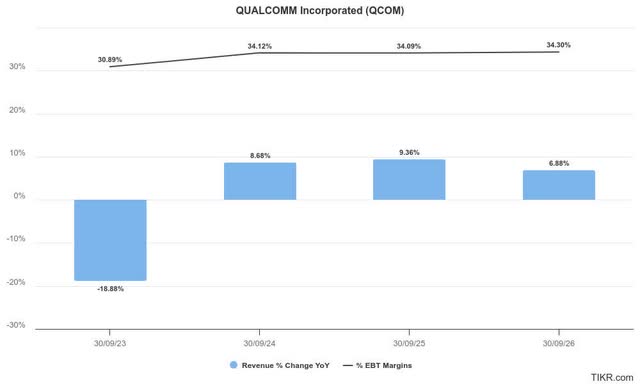

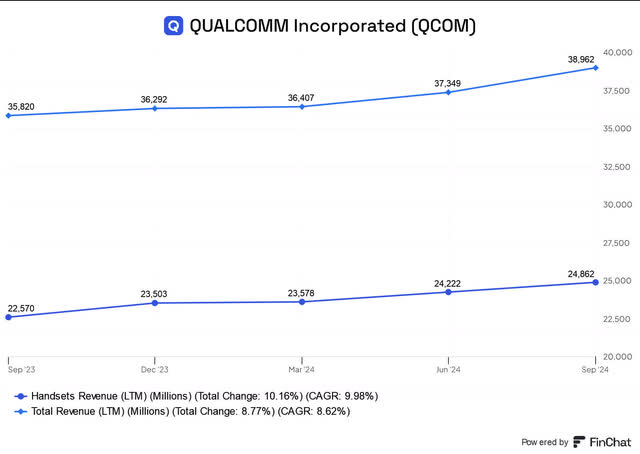

Qualcomm handsets revenue (FinChat)

Accordingly, Qualcomm telegraphed its commitment to lowering its handset revenue to 50% of its total revenue base. As a result, it indicates a significant reduction from its trailing twelve-month metric, as handsets accounted for nearly 64% of its total revenue exposure. However, Qualcomm’s diversification is expected to be achieved only by the end of the decade, lowering the potential for a near-term growth inflection.

In addition, management is confident in achieving a $900B TAM across its key growth vectors. Accordingly, management anticipates an AI PC reaching more than 100M units by 2029. Qualcomm also anticipates solid growth in edge devices, reaching more than 50M devices through 2030. Furthermore, management highlighted its growing $45B automotive design win pipeline, underscoring its confidence in its diversification thesis. As a result, Qualcomm expects to achieve an additional $22B in combined revenue through 2029.

Qualcomm: Market Pessimism Overstated?

Notwithstanding the company’s optimism about its long-term growth opportunities, I assess that the market remains lukewarm over its near-term uncertainties. Although Wall Street’s estimates on Qualcomm have been lifted, its “D” growth grade underscores the need to convince the market before a more robust valuation re-rating.

Moreover, the market also needs to consider Apple’s modem business loss as the Cupertino company moves in-house. It could intensify Qualcomm’s near-term execution risks, even as it seeks to diversify its revenue exposure through 2029.

Despite that, analysts seem confident that the impact on the company’s profitability metrics is not significant. Notably, the AI-driven smartphone upgrade cycle has the potential to drive higher ASPs over time. In addition, the increased production scale of its IoT and AI PC business segments is expected to help mitigate headwinds attributed to Apple. Hence, I assess the market’s pessimism on Qualcomm’s fledging growth optionalities could be overstated. Given the confidence of management to provide more clarity over the revenue outlook of these opportunities over the next five years, it should help allay fears of the cyclical risks in its smartphone segment.

However, recent investor pessimism could also be attributed to the more intense geopolitical uncertainties between the US and China. The incoming Trump administration’s hawkish stance on slapping additional tariffs on China could spur a retaliatory response, potentially impacting Qualcomm’s China revenue. Therefore, it could affect the company’s growing automotive business in China, given the country’s burgeoning EV market, on top of impacting its handsets business. In addition, Chinese smartphone makers could also seek to diversify their reliance on Qualcomm and MediaTek (OTCPK:MDTTF) moving ahead as more Chinese companies seek to lower their US exposure. These near-term challenges are expected to weigh on QCOM’s sentiments, suggesting investors must exercise patience.

Is QCOM Stock A Buy, Sell, Or Hold?

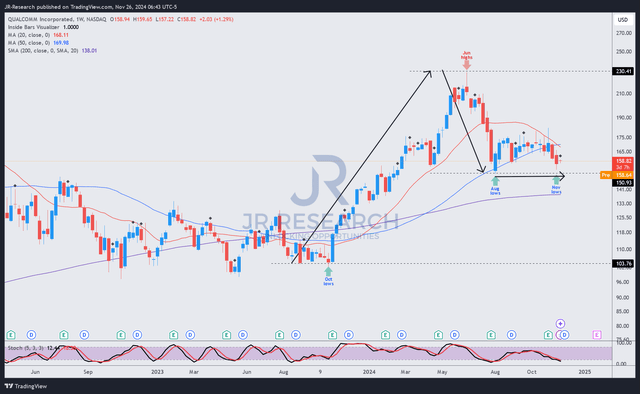

QCOM price chart (weekly, medium-term, adjusted for dividends) (TradingView)

QCOM’s price action suggests the surge toward its June 2024 highs has been digested as the market reassessed its optimism on the stock. QCOM’s forward adjusted PEG ratio of 2.29 is almost 20% over its tech sector (XLK) median. Hence, it’s clear that the market has rotated out of QCOM, as its momentum grade has been downgraded from “A+” to “D+” over the past six months.

Despite that, dip buyers seem prepared to hold the defensive line above the $150 level. While I have assessed an accumulation phase over the past three months, buying sentiments on QCOM are expected to remain tepid. However, Qualcomm’s fundamental thesis has remained intact, bolstered by its rock-solid profitability, notwithstanding the anticipated loss of its Apple business.

Moreover, management’s ability to pencil in pivotal revenue metrics for its crucial growth vectors through 2029 is expected to provide much-needed clarity for long-term investors. Although near-term geopolitical, cyclical, and smartphone headwinds could affect its re-rating opportunity, long-term investors should find the current levels attractive to accumulate.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMH, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!