Summary:

- Qualcomm stock endured a 35% bear market before bottoming in August 2024. However, it has struggled to replicate its recent success.

- Its entry into AI PCs and potential share gains in AI smartphones should underpin its return to topline growth.

- Qualcomm’s automotive diversification efforts have delivered a solid performance recently amid a growth normalization phase in EVs.

- I explain why it’s timely for investors to consider adding more positions to QCOM, as the inflection point is close.

JHVEPhoto

Qualcomm: Investors Endured A Steep Bear Market

QUALCOMM Incorporated (NASDAQ:QCOM) investors endured a deep bear market after the stock topped out in June 2024 before declining 35% through its early August 2024 lows. QCOM’s recent recovery has been somewhat languid, suggesting investors remain cautious about lifting its valuation further.

In my previous QCOM article, I highlighted caution, arguing why its below-average growth grade didn’t justify its last surge. While the Android handset maker experienced encouraging signs of a recovery in its crucial Chinese market, I found its overoptimism unwarranted. Therefore, I urged investors to be wary about chasing its AI-led enthusiasm.

Qualcomm’s Diversification Efforts Are Working

Qualcomm’s upbeat fiscal third-quarter earnings release in late July 2024 calmed investor nerves by outperforming Wall Street’s estimates and outlook. As a result, I assess that the market has likely turned increasingly confident about Qualcomm’s AI growth prospects, potentially translating into more robust opportunities in smartphones and other fledgling segments.

Accordingly, its automotive segment delivered an 87% increase in revenue, underpinning its resolve to diversify from its core handset segment. Qualcomm reported more than 10 new design wins in its automotive portfolio, validating its momentum in the automotive industry. While still nascent, I assess that Qualcomm’s execution capabilities have been bolstered, augmenting the possibilities of a further valuation re-rating. Notwithstanding the growth normalization phase in the EV market, Qualcomm’s solid growth profile has validated its offerings in the connected vehicle market. As the EV market emerges from its cyclical downturn, it should position Qualcomm well to partake in its subsequent recovery, as secular EV growth drivers have remained intact.

Furthermore, Apple Inc.’s (AAPL) entry into the AI smartphone era is expected to bolster consumer sentiment about the need to upgrade their current handsets into an AI-capable one. The prolonged rollout of Apple Intelligence could also afford Qualcomm and its Android peers an early advantage, although it might not be sustained. Despite that, QCOM’s investments and leadership in AI smartphones are expected to benefit from its increased market share growth. The company highlighted that the premium tier has experienced healthy market share growth (amid an overall flat market). Accordingly, Qualcomm has seen its premium market share expand to 31%, up from 21% previously. It has also observed more Chinese customers trading up in anticipation of the AI smartphone features. Therefore, I assess that it should benefit Qualcomm’s pricing power, potentially leading to improved margin accretion opportunities.

In addition, Intel Corporation’s (INTC) troubles on its foundry roadmap have significantly strained its overall roadmap. Therefore, it could help Qualcomm potentially execute with less intense competition as it seeks to redefine the competitive landscape in the AI PC era. Apple reportedly accounted for 60% of AI PCs shipped in Q2, corroborating its market leadership in the segment. Despite that, the robust growth estimates for AI PCs suggest significant opportunities exist for Qualcomm to penetrate, lifting its diversification efforts further.

Management indicated that AI PCs could account for 50% of the overall market by 2027. IDC’s estimates are more aggressive, suggesting that “AI PCs will represent nearly 60% of all PC shipments worldwide” by 2027. Therefore, Qualcomm’s timely entry into the AI PC market is astute and thoughtful, leveraging its efforts and capabilities in Arm-based mobile processors into the x86-dominated field. Notwithstanding my optimism, we are still early into Qualcomm’s ability to penetrate, given the heightened competitive levels with the x86 peers and Apple’s capabilities. Therefore, I assess that the market will not likely consider a significant share gain for now unless management provides a much more robust forward guidance.

Qualcomm Needs To Lift Its Outlook Markedly

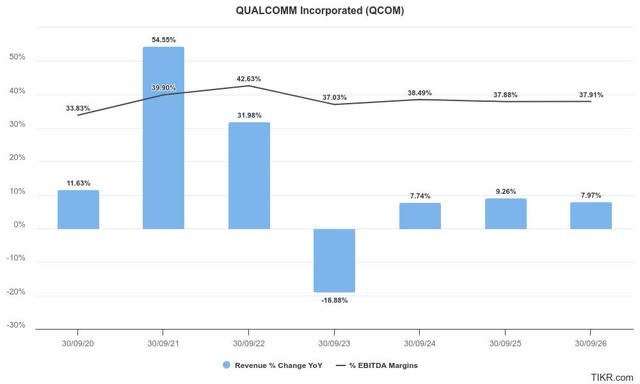

Qualcomm estimates (TradingView)

Accordingly, Qualcomm is expected to return to topline growth this FY and maintain a stable growth cadence through the FY2026 forecast period. As a result, investors will not likely send QCOM down further into a tailspin unless smartphone cyclicality worsens. Despite that, Qualcomm’s profitability growth isn’t expected to be significant, suggesting the market will likely be cautious with its entry into AI PCs.

Despite recent estimate upgrades, QCOM’s “D-” growth grade indicates that Wall Street isn’t convinced about Qualcomm’s growth diversification efforts yet. Therefore, I assessed QCOM’s forward-adjusted PEG ratio of 1.62 (10% below its sector median) as not offering a substantial margin of safety for investors at the current levels.

Is QCOM Stock A Buy, Sell, Or Hold?

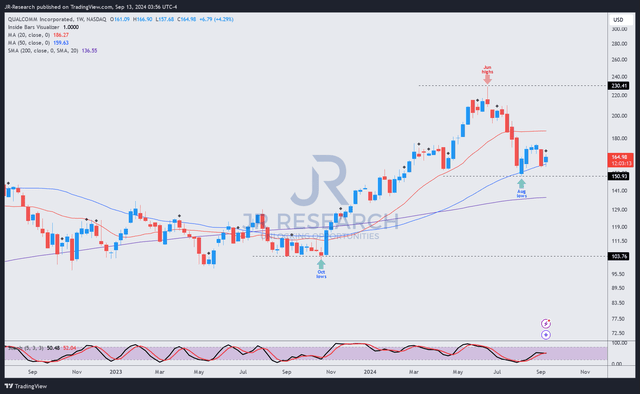

QCOM price chart (weekly, medium-term, adjusted for dividends) (TradingView)

Despite that, I’ve also assessed robust buying sentiment underpinning QCOM’s $150 support level. It’s generally favorable “B-” momentum grade underscores the stock’s continued upward bias, bolstering a potential dip-buying opportunity.

Although I would have preferred a much more favorable margin of safety for QCOM, it’s a fundamentally strong stock (“A+” profitability grade). In other words, paying a fair valuation for a wonderful company is assessed to be reasonable. The market also seems to agree, given its uptrend bias and solid buying momentum just above its August lows. Therefore, I have determined that an upgrade based on an improved risk/reward profile is justified.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!