Summary:

- Qualcomm’s FY Q2’24 results showed strength, both on the top and bottom line, as the company’s handset and automotive business continues to do well.

- FY Q3’24 is somewhat expected to be the trough quarter, and there should be a positive set up going forward, with multiple tailwinds driving growth.

- Revenues from Chinese OEMs grew 40% in FY H1’24, with the trend expected to continue.

- Qualcomm has grown its design win pipeline to $45 billion, and it is on track to achieve more than $4 billion in automotive revenues in FY 2026.

- Qualcomm announced that its Snapdragon X Plus and Snapdragon X Elite are expected to launch in multiple next-generation Windows AI PCs from multiple leading global OEMs in mid-2024.

JHVEPhoto

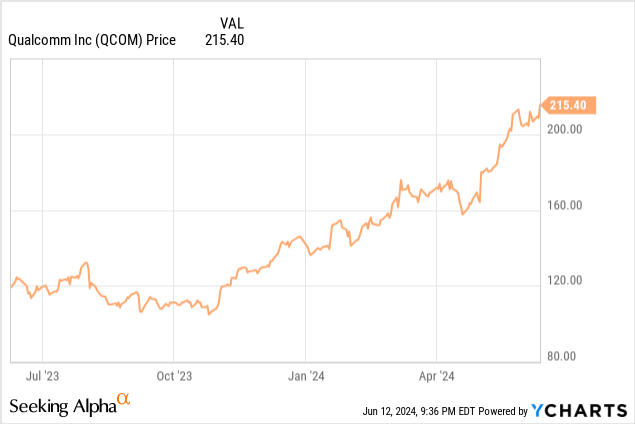

Qualcomm (NASDAQ:QCOM) reported strong FY Q2’24 results, and since the late 2023 call that the handset recovery is imminent and that the company has become an attractive contrarian play, the stock has been up more than 100%.

I have been writing extensively about Qualcomm on Seeking Alpha, which can be found here. I continue to see that Qualcomm is well positioned to be a key player as on-device AI becomes normalized, and that the company is still often an underestimated AI play.

Let’s dive right into the earnings review.

FY Q2’24 review

While revenues came in-line, stronger margins resulted in EPS beat.

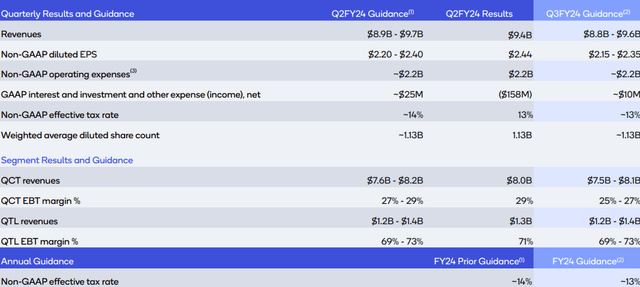

Qualcomm reported revenues of $9.4 billion in FY Q2’24, higher than market consensus of $9.3 billion and higher than the midpoint of the guidance range of $8.9 billion to $9.7 billion.

Revenues from QCT segment came in at $8.0 billion, in-line with expectations and guidance.

Revenues from QTL segment came in at $1.3 billion, in-line with expectations and guidance.

QCT segment EBT margins came in at 28.5%, higher than consensus of 27.9% and near the top end of the guidance range of 29%.

This was a reflection of strength across the handset and automotive segments.

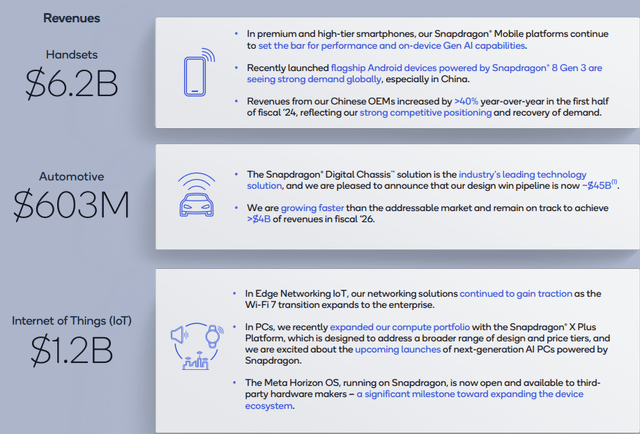

The QCT handset revenues came in at $6.2 billion, due to strong Android smartphone launches with the Snapdragon 8 Gen 3 mobile platform.

The QCT IoT revenues came in better than expected at $1.2 billion, increasing 9% sequentially.

The QCT automotive segment reached another record, with revenues up 35% from the prior year due to increased content in new vehicle launches with its Snapdragon Digital Chassis products.

QTL segment EBT margins came in at 70.8%, higher than consensus of 70.0%, and in-line with the midpoint of the guidance range.

EPS was strong, coming in at $2.44 per share, higher than the top end of the guidance range of $2.40, and 5% higher than consensus.

Qualcomm generated $3.4 billion in free cash flows in the quarter, up 236% from the prior year, as the business continues to recover.

Qualcomm returned $1.6 billion to shareholders during the FY Q2’24 quarter, which includes $731 million in stock repurchases and $895 million in dividends.

The quarterly dividend was also increased by 6% to $0.85 per share.

Guidance

The guidance for FY Q3’24 was positive, as better than expected revenue and margin guidance led to a beat on EPS guidance.

Qualcomm guided for FY Q3’24 revenues to be between $8.8 billion and $9.6 billion, 1% higher than consensus at the midpoint.

This includes a revenue guidance of $7.5 billion to $8.1 billion for the QCT segment and $1.2 billion to $1.4 billion for the QTL segment.

QCT segment EBT margin was guided to be between 25% – 27%, in-line with expectations.

QTL segment EBT margin was guided to be between 69% to 73%, beating expectations of 68%.

With revenues guided better than expected and margin outlook improving, the EPS guidance was also ahead of expectations.

EPS was guided to be between $2.15 – $2.35, 4% higher than consensus at the midpoint.

Qualcomm guided investors to FY Q4’24 EPS of $2.45, which is in line with consensus expectations heading into the print.

This does imply a sequential revenue growth of 5% and sequential EPS growth of 8%, which could prove conservative against the backdrop of the increasing benefit from the Apple ramp in the quarter, along with the recovery in the smartphone market, and better demand trends in Autos and IoT.

As such, while guidance for FY Q4’24 was in-line with expectations, it could prove conservative.

Another thing to note is that FY Q3’24 is somewhat expected to be the trough quarter, and there should be a positive set up going forward, which will include a recovering smartphone market, better mix on stronger growth in the high-end smartphone market, content growth in relation to AI smartphones, recovery in IoT revenues following cyclical headwinds, and a robust ramp in Autos revenue.

Handset and growing diversification

Firstly, on handsets, one of the best data points in the FY Q2’24 quarter was the robust android premium growth.

Qualcomm shared that revenues from Chinese OEMs grew 40% in FY H1’24, with the trend expected to continue.

In my view, this is certainly very positive because the market has been valuing Qualcomm based on a depressed growth outlook given that the assumption is that growth will slow in the future due to its moderating position with its two large customers, Samsung and Huawei.

With this data point, it does help reassure investors that there are additional growth opportunities outside of Samsung and Huawei, especially from Chinese OEMs.

Of course, there is also the tailwind from on-device AI that will help handset revenues.

Qualcomm’s Snapdragon 8 Gen 3 is seeing strong demand, especially in China and with Samsung Galaxy S24 series, and it is expected to launch in a wider range of premium and high-tier smartphones, along with flagship smartphones in the second half of 2024.

On-device AI grows in demand (Qualcomm)

Qualcomm’s diversification beyond handsets is something that does not get much attention, but I do think that with the market trends stabilizing, we have now got a more positive set up with the growth in Autos and IoT enabling Qualcomm to somewhat hedge against the typical smartphone seasonality.

Within the automotive segment, Qualcomm has grown its design win pipeline to $45 billion, and it is on track to achieve more than $4 billion in automotive revenues in FY 2026.

Within the IoT segment, Qualcomm’s networking solutions continued to gain traction as the Wi-Fi 7 transition expands to the enterprise. In addition, the Meta Horizon OS that runs on Snapdragon is now open and available to third-party hardware makers. This will continue to expand the device ecosystem.

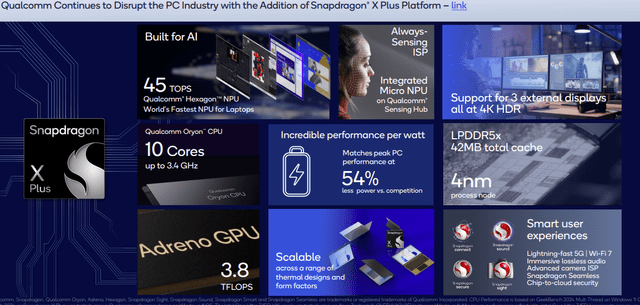

Even its opportunity within PCs is somewhat ignored. Qualcomm announced that its Snapdragon X Plus and Snapdragon X Elite are expected to launch in multiple next-generation Windows AI PCs from multiple leading global OEMs in mid-2024.

Qualcomm claims that the Snapdragon X Elite is the “leader in performance on-device AI and power efficiency for the Windows ecosystem and is optimally positioned to lead the transition to true AI PCs”.

Valuation

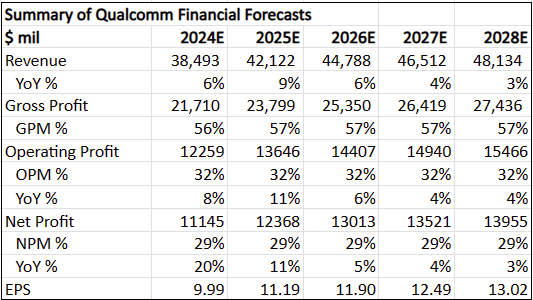

I made some adjustments to the five-year financials for Qualcomm, reducing 2024’s estimates and becoming more optimistic about growing handset demand driven by growing on-device AI in 2025, along with a more positive setup for automotive and IoT sales in 2025.

Summary of my 5-year financial forecasts for Qualcomm (Author generated)

My intrinsic value goes to $162, based on assumptions of 20x 2028 terminal multiples and a 10% discount rate.

My 1-year and 3-year price targets go to $200 and $238 respectively. They imply 20x 2024 P/E and 20x 2026 P/E.

Conclusion

Qualcomm delivered a quarter that exceeded expectations.

They showed strength in their handset business, with 40% growth in revenues from Chinese OEMs, assuring investors that it has other areas for growth.

On-device AI is expected to further drive demand for handsets further, as more smartphone players integrate AI features into smartphones, which should also drive an upgrade cycle.

The automotive segment continued its position of strength, with the design win pipeline growing to $45 billion.

Of course, the new opportunity opening up in PCs with the Snapdragon X Plus and Snapdragon X Elite expected to launch in multiple next-generation Windows AI PCs from multiple leading global OEMs also marks another area for diversification and growth.

Qualcomm is an underestimated AI play today, but I think one year from now, as AI features on smartphones become the norm, Qualcomm will be regarded as a leader in enabling AI.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 70% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!