Qualcomm: Whispers Of Value Amidst The Legendary Chip Bull Run

Summary:

- Qualcomm Incorporated is a fabless chip designer that generates revenue from the mobile handset market through its leadership in CDMA Technology.

- Apple’s potential to design its own modems for iPhones poses a material risk to Qualcomm’s future earnings growth.

- However, Apple would likely still use Qualcomm IP, so some revenue would shift from the QCT segment to the QTL segment.

- Qualcomm’s financials show strong revenue growth in the recent quarter, particularly in the QCT segment.

- The current rate of share buybacks makes Qualcomm’s valuation compelling given modest growth expectations, total addressable market increases, and expected increases in ASPs of AI-enabled consumer electronics.

G0d4ather

Business Overview

QUALCOMM Incorporated (NASDAQ:QCOM) is a fabless chip designer that generates the bulk of its revenue from the mobile handset market. The company reports two primary business lines, Qualcomm CDMA Technology (“QCT”) and Qualcomm Technology Licensing (“QTL”).

QCT, as the name suggests, grew out of Qualcomm’s historical innovation in CDMA technology. CDMA stands for Code Division Multiple Access, a technology that gives multiple users access to the same radio frequency band. This greatly increased bandwidth on cell networks when it was first commercialized and was presented as an alternative to the TDMA, time division multiple access, standard. The unit economics of CDMA were quite compelling for cell network providers, many of whom shifted to CDMA in the 1990s.

Qualcomm pioneered this technology and initially commercialized it from partnerships/collaboration with mobile phone OEMs and cell network base station operators. Qualcomm needed to attack the commercialization of CDMA in three ways: 1) designing the required chips; 2) getting the required modems built into mobile handsets; and 3) getting the required chips built into mobile base stations.

After successfully executing this throughout the late 1990s and early 2000s, Qualcomm developed quite a meaningful moat in mobile radio frequency modems. This has allowed them to grow into one of the leading fabless chip designers today.

In the current state, QCT develops and supplies integrated circuits and system software based on 3G/4G/5G technologies, including RFFE (radio frequency front-end), for use in mobile devices; automotive systems for autonomous driving; and IoT (Internet of Things) including consumer electronic devices; industrial devices; and edge networking products. Qualcomm charges a royalty based on the total device price instead of a flat rate for its chips. This is a critical piece of the assessment of Qualcomm’s valuation, and a point we’ll return to later.

QTL grants licenses or otherwise provides rights to use portions of its intellectual property portfolio, which includes certain patent rights essential to and/or useful in the manufacture and sale of CDMA technologies and related chip designs. It has grown into a meaningful contributor to Qualcomm’s overall results, generating over $1b in revenue in the recent quarter.

Qualcomm’s fundamental strength comes from its leadership in RFFE chips, which run on CDMA technologies. Even Apple Inc. (AAPL), a leading fabless designer with an abundance of cash, has tried and failed to match Qualcomm’s RFFE chips. Snapdragon is Qualcomm’s flagship line, and the Snapdragon 8s Gen 3 is the current most advanced product. Qualcomm has a defensible competitive advantage in this space but will be less protected by patents in the future than it was in the past.

Valuation Stories: Underlying Assumptions

In the “valuation” section below, I present three valuation scenarios: a bull, base, and bear case. Before getting there, I’d like to discuss the assumptions that underpin these scenarios.

Generally, I assume Qualcomm will face headwinds stemming from the loss of Apple revenues (discussed in the “Apple Risk” section) and ongoing litigation. Aside from a recent settlement with Apple, which challenged that Qualcomm should charge a price based on the cost of its chips instead of total handset cost, Arm Holdings plc (ARM) has also brought litigation to Qualcomm.

Nuvia, recently acquired by Qualcomm, had an architecture licensing agreement with ARM prior to the acquisition, while Qualcomm has a technology licensing agreement. ALAs are more profitable for ARM than TLAs, and ARM is generally accusing Qualcomm of using IP from Nuvia’s ALA with ARM while only paying TLA rates. The outcome of this litigation is uncertain, but could result in some margin pressures for Qualcomm or one-time cash payments from Qualcomm to Arm.

Historically, Qualcomm was well protected by patents, but this moat is eroding over time as patents expire. Management has still done well to monetize this with the QTL segment, but given Qualcomm’s aggressive royalty model, the company will likely face earnings headwinds in the future.

For these reasons, I am quite conservative with Qualcomm’s earnings 10-year CAGR and terminal P/E.

My bull case generally assumes the overall mobile handset market will grow and Qualcomm’s Android revenues will stem the loss of the Apple contract. Further, Qualcomm’s moves into autonomous driving and edge computing will steadily grow earnings over time, alongside industry-wide growth in semiconductors. Further, I assume aggressive dividend growth and buybacks, which are the two assumptions that present the most value for prospective shareholders. Qualcomm enjoys very cash-generative operations and historically rewards shareholders with this.

Finally, I expect the penetration of AI-enabled consumer electronics will increase the average selling price of these devices over time. Qualcomm earns a royalty on total device cost, not on the cost of its chips, so ASP increases will be margin accretive for Qualcomm over time.

My base case assumes Qualcomm will struggle to grow earnings given Apple contract headwinds and ongoing litigation. If Qualcomm is unable to defend its pricing power (royalty rates), it will be difficult to grow earnings in the future. This headwind leads to a lower terminal P/E, lower overall dividend growth, and fewer share buybacks.

My bear case assumes Qualcomm will be unable to grow earnings given all the current headwinds. It suggests Qualcomm is quite overvalued currently and will neither buy back shares nor grow its dividend in the future. This is quite a pessimistic viewpoint considering management has not indicated its intention to stop buying back shares or paying dividends. Regardless, future earnings headwinds could lead to these difficult decisions, and shareholders would be punished with an underperforming stock.

My bull case suggests Qualcomm is undervalued, and this is backed up by Seeking Alpha’s Quant Valuation rating showing Qualcomm trading at a meaningfully lower valuation than competitors and right around its historical averages. While Qualcomm’s growth is far from superb and mirrors the cyclicality of the mobile, tablet, and wearables markets, I believe the fundamental total addressable market, or TAM, growth provides sufficient reason to believe Qualcomm is capable of growing earnings on average 5% per year.

The ongoing increases in chip complexity and evolutions of wireless connectivity support Qualcomm’s market positioning. Even if the company sells fewer chips (loses Apple as a customer), it maintains a strong portfolio of IP that should drive meaningful revenue and earnings growth in the future. I am investing based on my bull case, but urge investors to consider all three cases and gauge their risk tolerance accordingly.

Apple Risk: Qualcomm Losing iPhones?

As patent protection has faded in recent years, the looming threat (which has been looming for years) is Apple designing its own modems for iPhones. There have been numerous delays to this project in the past but considering Qualcomm’s extremely high royalty rates, Apple has a strong incentive to design Qualcomm out of iPhones. For a $1,000 iPhone, Qualcomm receives about $13 currently.

Apple has tried to shift off of Qualcomm once before between 2016 and 2019 in a brief stint with Intel Corporation (INTC)-designed modems. However, it reverted back to Qualcomm as Intel risked missing the 5G wave. Qualcomm and Apple settled all existing lawsuits, many of which had accumulated throughout the 2010s, around this time as well.

The settlement in summary:

Qualcomm and Apple today announced an agreement to dismiss all litigation between the two companies worldwide. The settlement includes a payment from Apple to Qualcomm. The companies also have reached a six-year license agreement, effective as of April 1, 2019, including a two-year option to extend, and a multiyear chipset supply agreement.

Apple subsequently acquired Intel’s modem division and is certainly working hard to design Qualcomm out of its ecosystem of phones, tablets, and wearables. These modems are complex though, and the ongoing evolution of cell connectivity makes it hard to catch up. Still, I wouldn’t bet against Apple and its leadership in custom silicon design.

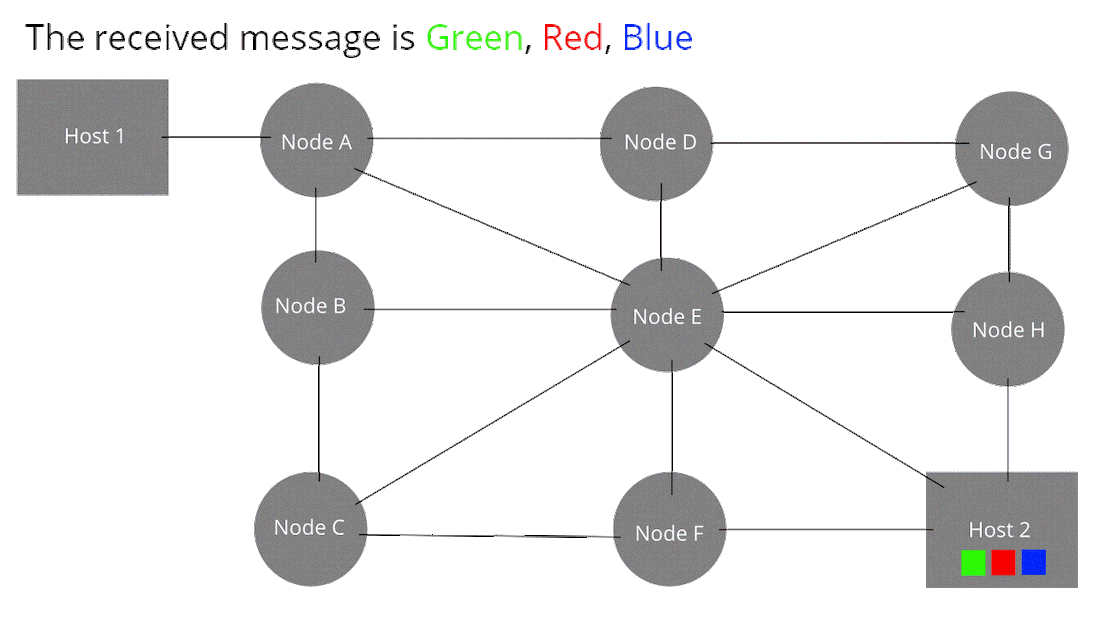

Mobile modems enable CDMA technology, as described above. CDMA is complicated but generally operates similar to packet switching on the internet. Packet switching involves bundling bits of data into packets with a header and a payload value. Multiple packets are sent independently through the network and then decoded and reorganized at base stations.

Base stations (nodes) have chips that read the header value, which determines the endpoint of the packet (the device it’s being sent to), and the endpoint (in this case a mobile receiver/modem) would read the payload and process the output.

Wikipedia

The complexity of chip design certainly makes it a tall task to disrupt Qualcomm, but I wouldn’t doubt Apple. This remains a considerable medium to long-term risk. It’s also highly likely that Apple would rely on patent / IP licensing from Qualcomm’s QTL segment, so this is not a zero-sum game for Qualcomm.

Qualcomm maintains leadership in Androids, so mobile handsets will continue to be a significant revenue segment of Qualcomm in the future. It’s unlikely Qualcomm will be designed out of the Android ecosystem, which relies more on merchant silicon than Apple and its custom silicon.

Bringing mobile connectivity to the edge with 5G and 6G in the future remains a fundamental tailwind for Qualcomm. The ongoing increase in connectivity at the edge and in industrial use cases will provide long-term TAM growth for Qualcomm, so I am quite bullish on the long-term story here.

Financials

Revenue in the December quarter (fiscal Q1) was $9.9b, up 15% sequentially, up 5% YoY, and above the high end of the guidance range of $9.1b-$9.9b. The company earned $2.75 per share on a non-GAAP basis.

Chip revenue (QCT segment) reported revenue of $8.42b, up 14% sequentially, up 7% YoY, and ahead of guidance. Management expected handset chip revenue to be down sequentially but reported a surprise beat at $6.69b, up 23% sequentially and up 16% YoY. Demand for Androids was strong in China, and Samsung Electronics Co., Ltd. (OTCPK:SSNLF) is working on the Galaxy S24. Automotive revenue came in at $598m, up 31% YoY.

On the licensing side (QTL segment), revenue came in at $1.46b and was above the midpoint of guidance of $1.40b and, while down 4% YoY, was still up 16% sequentially. In the March quarter, Qualcomm guided for revenue of $9.3b at the midpoint. Revenue from both QCT and QTL are expected to be $7.9 billion and $1.3 billion, respectively, at the midpoints of guidance.

Qualcomm expects to earn between $2.20 and $2.40 per share in the second quarter.

Over the past five years, Qualcomm has achieved 13% revenue CAGR while decreasing shares outstanding by 5% a year. EBIT has grown at an average of 19% yearly for the past five years. Qualcomm has a meaningful debt load of about $15b but maintains a cash pile of around $12b. While interest expenses have increased in recent years, growth in interest income has outpaced that in the current rate environment, so net interest expenses have been decreasing.

Meanwhile, net income has shown very cyclical growth over the past 10 years, but the fact that 2014 net income exceeds that of 2023 net income signals that Qualcomm’s core business is not growing. Fiscal years 2021 and 2022 were quite rewarding for QCOM shareholders, but aside from that earnings growth has been meager.

Valuation

From a valuation perspective, I believe Qualcomm is undervalued in a Bull scenario considering current growth prospects and the rate of share buybacks. Share buybacks make me particularly bullish on the stock.

I compiled a bull, base, and bear case valuation model to gauge Qualcomm’s valuation. The most critical assumptions in the models are shown in the table below. Notably, my bull case assumes continued aggressive share buybacks and dividend growth exceeding its historical pace.

| Bull Case | Base Case | Bear Case | |

| Earnings CAGR (10 Yr) | 5% | 1.50% | -0.50% |

| Est. 2033 Earnings | 11.78b | 8.37b | 6.82b |

| Terminal P/E | 15 | 10 | 5 |

| 2033 Est. Shares Outstanding | 700m | 950m | 1120m |

| 2033 Est. Share Price | $370 | $166 | $124 |

| Est. Price Return CAGR | 8% | -0.23% | -3.10% |

| Current Dividend Rate | $3.20 | $3.20 | $3.20 |

| Est. 10-Yr Dividend CAGR | 10% | 5% | 0% |

| Est. 2033 Dividend Rate | $8.30 | $5.21 | $3.20 |

| Est. 2033 Dividend Yield | 2.24% | 3.14% | 2.58% |

Please note that my valuation model is rough and the assumption of continued aggressive buybacks may not be reasonable. Any dilutive events like acquisitions or equity offers could destroy the thesis here.

Given the semiconductor industry’s history of consolidation, it’s likely that Qualcomm will pursue one or more acquisitions within the next ten years. Recent history suggests Qualcomm is unlikely to use stock in acquisitions. In 2021, the company acquired Nuvia in an all-cash deal for $1.4b. More recently, Qualcomm abandoned a proposed acquisition of ADAS chip maker Autotalks. Given the acquisition was less than $1b, it’s safe to assume this would have been an all-cash deal, although the terms of the deal were not disclosed.

The extent of dilution is impossible to predict, but management’s commitment to capital returns to shareholders should be a huge positive for prospective investors.

All that said, I am in the “bull camp” of my three scenarios. I believe overall TAM growth will support Qualcomm’s earnings despite the various headwinds presented. This earnings growth, albeit small, will fund continued buybacks and dividend growth. Accordingly, I believe Qualcomm presents a compelling valuation for long-term investors and am initiating with a Buy rating.

Closing Thoughts

Qualcomm is not as dominant in the mobile modem market as it once was. While it maintains a lucrative position for now, this position is at high risk of being disrupted by Apple, which presents a meaningful risk to Qualcomm’s growth outlook. Yet, the semiconductor industry presents an opportunity for long-term secular growth, and Qualcomm looks to be one of the few remaining fairly valued chip makers in the current AI frenzy.

Qualcomm’s exposure to AI exists in consumer electronics and the company will likely benefit from an increase in average selling prices, which benefits their royalty model well.

Overall, Qualcomm presents a reasonable likelihood of future compounding and a compelling valuation relative to peers. Therefore, I am initiating coverage of Qualcomm with a Buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.