Summary:

- Despite strong 4Q FY2024 earnings, Qualcomm’s stock fell below its pre-earnings release level due to a broader semi sector pullback and rising geopolitical risks under Trump’s administration.

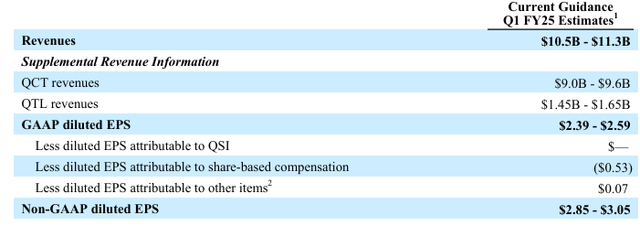

- 1Q FY2025 outlook indicates a strong growth momentum continues, driven by the Snapdragon 8 Series, topping all market consensuses.

- The company forecasts a “mid-single-digit growth” in QCT Handset revenue (60% of total revenue in 4Q), despite the absence of Huawei revenue in its 1Q FY2025 guidance.

- Gross margin is expected to decline QoQ in 1Q FY2025, but net income margin is set to expand further, driven by slower growth in operating expenses.

- The stock’s discounted valuation at 14.3x non-GAAP P/E fwd reflects cautious sentiment, while the recent selloff presents an attractive entry point near the strong resistance level of $156–$158.

JHVEPhoto

Why Is Stock Down After a Strong 4Q Earnings Report

Despite a 4% post-earnings rally following a strong 4Q earnings report, QUALCOMM Incorporated (NASDAQ:QCOM)’s stock price reversed course and is now down 7%, trading below its pre-earnings level. This decline is largely attributed to growth concerns from a possible “Trade War 2.0” with China under Trump’s administration.

Given QCOM’s high revenue exposure to China, I believe the near-term sentiment has turned cautious, as escalating tensions could prompt retaliation from the Chinese government. Such actions might discourage Chinese firms from relying on QCOM’s technologies, potentially impacting the company’s revenue growth outlook and lowering its valuation.

While QCOM is actively working to diversify its customer base outside of China, this transition will take time. Despite these, the company’s current fundamentals remain strong, with 4Q revenue and EPS beating estimates, along with a solid forward outlook.

After the recent pullback, the stock’s 14.3x of non-GAAP P/E fwd appears attractive, with near-term geopolitical risks largely priced in. As the price approaches a strong resistance level at $157-$158, I have initiated a strong buy rating on QCOM. The biggest long-term downside risk to my bullish view is the potential for geopolitical tensions to escalate significantly beyond current market expectations, which remains unpredictable.

Growth Rebound Driven by Snapdragon 8 Series

The company model

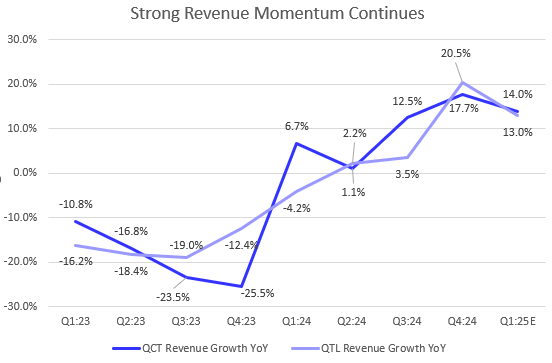

QCOM’s 4Q FY2024 revenue came in at $10.24 billion, beating consensus and reaching the high end of its revenue guidance of $10.3 billion issued in 3Q FY2024. The QCT segment (84.7% of total revenue) grew by 17.7% YoY, accelerating from the 12.5% YoY growth seen in 3Q FY2024. During the recent Snapdragon Summit, the company highlighted its partnerships with Meta Platforms, Inc. (META) to power Llama 3.2 on Snapdragon devices and with Amazon.com, Inc. (AMZN) to develop a cloud-to-edge solution through its AI Hub, which has grown over 50% QoQ.

AI Hub is QCOM’s embedded AI and machine learning solution integrated into Snapdragon platforms. During the 4Q FY2024 earnings call, management described the Snapdragon 8 Elite as “the world’s fastest mobile processor,” emphasizing its dominance in the Android ecosystem and its capability to handle more complex AI applications on handsets.

Since the OCT Handsets revenue segment accounts for 60% of QCOM’s total revenue in the recent quarter, I believe the segment’s growth momentum will continue. Management also noted that the new Snapdragon 8 Elite has successfully launched with Xiaomi, Honor, OPPO, and Vivo and is expected to roll out with Samsung and others in the near future. Moreover, the recently announced Snapdragon X Plus 8-core is expected to gain more share in the PC market, with many leading OEMs relying on it to power their devices.

1Q FY2025 Guidance Will Not Include Huawei Revenue

For 1Q FY2025, the midpoint of the revenue guidance is 2.7% above market consensus. Given its consistent track record of beating revenue estimates over the last five quarters, I project that 1Q revenue will likely meet the high end of its guidance, implying 13.8% YoY growth in 1Q FY2025.

As shown in the chart, both the QCT and QTL segments are expected to maintain higher YoY growth. As a reminder, the 1Q FY2025 revenue guidance does not include any revenue from Huawei products, resulting in a YoY revenue inconsistency since Huawei revenue was included in 1Q FY2024. Adjusted for this, QCT Headset revenue growth would be higher than 5% YoY (mid-single digit based on the company’s guidance).

Net Margin Continues Improving

The company model

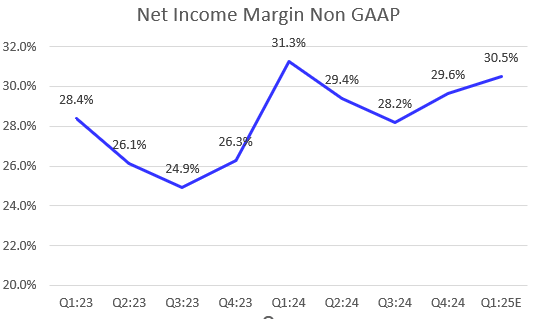

In 4Q FY2024, QCOM’s non-GAAP net income margin expanded sequentially to 29.6%. Based on its 1Q FY2025 non-GAAP EPS guidance, I estimate the margin could further improve to 30.5%, though it would still remain lower on a YoY basis.

During the earnings call, analyst Stacy Rasgon from Bernstein Research highlighted that QCOM’s 1Q FY2025 gross margin could decline by 100 to 150 bps QoQ from 57% in 4Q FY2024. And the management admitted a lower sequential gross margin outlook reflects a “reasonable way” to estimate the business going forward. I think the removal of Huawei revenue in 1Q may contribute to some headwinds on gross margin. Nevertheless, I believe the sequential expansion in net income margin is primarily driven by slower growth in operating expenses.

Elevated Geopolitical Uncertainties Under Trump Administration

Despite last week’s selloff, QCOM still outperformed the iShares Semiconductor ETF (SOXX) by approximately 2%, indicating that the stock’s decline is primarily tied to the broader semi sector’s pullback. However, given QCOM’s large business exposure in China, the company faces higher geopolitical risks under Trump’s administration. These include potential export restrictions on China and possible retaliatory tariffs from the Chinese government. Although management currently anticipates over 40% QoQ handset revenue growth from Chinese OEMs in 1Q FY2025, escalating tensions could dampen demand for QCOM’s products, posing structural growth headwinds. However, I believe QCOM’s current valuation has partially priced in these concerns.

Valuation

The stock is trading at an attractive valuation, following a nearly 30% pullback from its June 2024 high. According to Seeking Alpha, QCOM’s valuation multiples are now below their 5-year averages. The previous decline in valuation can be attributed to a 33% YoY drop in non-GAAP EPS in FY2023, following its peak in FY2022. However, the company reached an inflection point in 1Q FY2024, with earnings starting to rebound, showing a 21% YoY growth for FY2024. Despite this recovery, its P/E and EV/sales TTM multiples remain below their FY2022 highs.

Looking forward to FY2025, continued earnings growth is expected to bring its non-GAAP P/E fwd down to 14.3x, which is 41% below the sector average. Let’s step a step back. At its lowest price of $103.6 in 2023, QCOM’s non-GAAP P/E based on its FY2023 EPS of $6.22 was 16.65x, which was about 6% higher than the current 15.7x non-GAAP P/E TTM. While the higher multiple at that time may have reflected the significant decline in earnings, I believe the lower multiple likely reflects cautious sentiment in the market.

Lastly, as the current price nears a strong resistance level in the $156-$158 range, I believe this pullback creates an opportunity to turn bullish on the stock.

Conclusion

While QCOM delivered a strong 4Q FY2024 earnings report, with solid growth driven by the Snapdragon series and AI Hub, the stock’s recent pullback coincided with a broader market retreat. Its lower valuation reflects heightened geopolitical risks in China, particularly under the Trump administration. QCOM’s growth heavily relies on Chinese OEMs, and any escalation in geopolitical tensions could significantly impact demand. While the scale and timing of these risks are unpredictable, the current valuation seems to have priced in these concerns. Additionally, QCOM’s product innovations, like the Snapdragon 8 Elite and X Plus 8-core, offer growth opportunities. From a technical standpoint, the selloff might have found support near a strong resistance level, making this an attractive entry point. That said, I’m bullish on QCOM.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.