Summary:

- The overall quantum computing market is taking off, driving massive gains for QC-related stocks such as Quantum Computing and its peers.

- As AWS provides structured services for companies that want to play around with quantum, QUBT has the chance to be an early adopter in this new market.

- But with $3.1 million in cash and continued CAPEX at the TFLN foundry, I think QUBT will need to raise some additional funds in the next 2 quarters to grow.

- I think QUBT won’t be profitable for at least the next 2–3 years. The base revenue of the company is still too low to service the operating costs.

- The company’s technology promises great potential in the long run, but in the short run, I feel the risk is greater than the reward, and it’s best left as a speculative investment.

adventtr

The Company And Its Market

According to Seeking Alpha’s description, Quantum Computing Inc. (NASDAQ:QUBT) is one of the leading integrated photonics companies with a mission to make quantum technology affordable. They’ve created products like the Dirac systems – “portable, room-temperature devices that provide low-power quantum computing for applications such as artificial intelligence, cybersecurity, and remote sensing.” The company also has proprietary products, such as the quantum random number generator (uQRNG) and specialized quantum authentication devices.

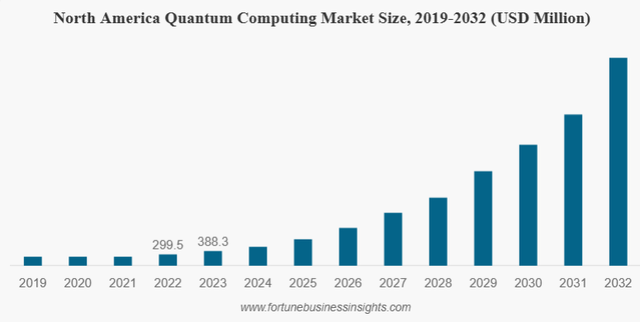

The overall quantum computing market is taking off. While researching this topic, I saw that most analysts expect a robust future going forward. For example, Fortune Business Insights estimates that the global quantum computing market will reach $12.62 billion in 2032 from $1.16 billion in 2024 to $12.62 billion by 2032 at a CAGR of 34.8%. It’s a growth driven by the AI and problem-solving capabilities quantum computing brings to healthcare, finance, and more sectors.

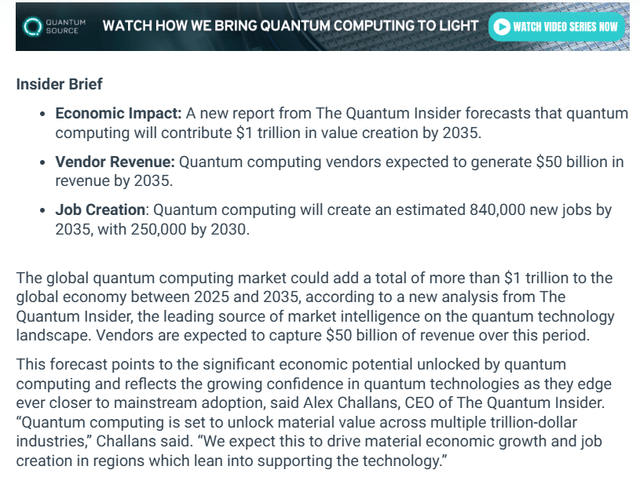

The Quantum Insider concurs with this sanguine view, projecting that the quantum hardware and software market could grow to around $5 billion by 2030 (and even larger, if aggressive estimates for revenue of $15 billion per year). Cloud-based access services should also fuel this expansion – first with revenues being driven by access services (which will take over), followed by hardware and consulting.

Rising investment in quantum technology – with major financings in 2024 – only feeds the industry’s optimism. For example, the launch of Amazon Web Services’ (AMZN) Quantum Embark Program is a very welcome move for QUBT as it indicates the growing demand in real life, not just in research papers. The program will equip companies to adopt quantum computing, and that will likely lead to more customers of QUBT’s products and services as businesses demand high-quality quantum solutions. As AWS provides structured services for companies that want to play around with quantum, QUBT has the chance to be an early adopter in this new market – which makes QUBT known, and it helps set it on a positive quantum computing trajectory early.

Recent Financials

From QUBT’s 10-Q filing (and earnings call in particular), we see the company is still at a very early stage in its journey, despite being founded over 20 years ago.

QUBT’s top-line growth was slight in Q3, but noticeable ($101,000 vs. $50,000 last year). This double in revenue is mostly from contracts, like the undersea quantum LiDAR prototype for Johns Hopkins University. This is promising growth, but the total number of dollars generated is also incomprehensible for a company with a market cap approaching $1 billion. We also saw some problems with the gross margin, which is notably lower than last year – from 52% in Q3 2023 to 9% in Q3 2024. The management explained it by saying that the direct costs of the Johns Hopkins project were quite high. I don’t consider this as a red flag because the whole growth story seems to be just getting started, but on the other hand, it may mean that even with the growth of revenues, the company may find it difficult to show real profit unless it gets higher margin contracts or ramps up operations way more significantly (which is a consensus judging by the market’s reaction as of late, but it’s far from being a fact yet).

Meanwhile, the OPEX has decreased by ~18% YoY to -$5.4 million in Q3 2024, which is a sign that management keeps an eye on the bottom line, in particular in employee, consultant, and legal expenses. The R&D costs were flat at $2.2 million, which, I think, is good as QUBT is staying true to its innovation culture, which is very important for a technology startup in its early stage.

The total assets of QUBT as of 30 September 2024 stood at $76.8 million, compared with $74.4 million at the end of 2023. The $7 million raised through secured convertible debt financing and the additional $4.5 million raised through the ATM facility post-quarter end were driving that increase. Cash and cash equivalents were $3.1 million, up $1 million compared to the year ended 2023. I see, there’s no denying that QUBT is completely dependent on outside capital to operate. Its liabilities almost doubled to $10.9 million from $5.6 million at the end of 2023, mainly because of convertible debt. The number of shares kept standing at ~90 million (so there was even a little drop from the Q2 figure of 90.6 million), but the increasing debt load is worth watching as it could limit liquidity down the road. In fact, I don’t think the debt is the main concern here – it’s manageable and likely worth it. What stands out more is the likelihood that the company will once again dilute existing shareholders. Given how much the stock has soared recently, it seems quite probable in the near term. In fact, over the past 6 months, the stock has increased tenfold, reflecting the market’s enthusiasm for quantum computing.

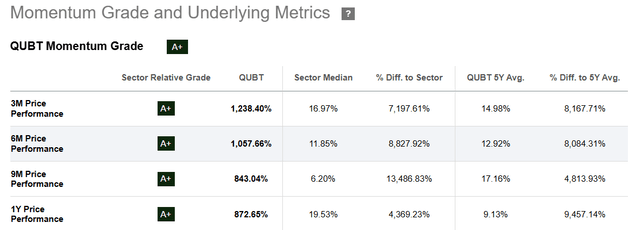

Seeking Alpha, QUBT’s Momentum

With $3.1 million in cash and continued capital expenditures at the TFLN foundry, I think QUBT will need to raise some additional funds in the next 2 quarters to continue. That dependence on external capital is a significant risk, especially in a monetary environment with higher interest rates where debt is more expensive and equity dilution is becoming an issue for the shareholder.

What’s Next For QUBT?

The surge in QUBT stock began just a few days after the CEO made an important statement (in early October this year). He pointed out “great progress in implementing the sales and marketing plan, particularly the Dirac-3 product and thin-film lithium niobate (TFLN) foundry services.” The growing demand from the industry, and collaborations with some of the top companies – including a letter of intent by Comtech Telecommunications for TFLN optical chips – have established QUBT as an early leader in quantum computing, and the market believed in it. That belief has been further enhanced by the company’s presence at large industry conferences, where it has attracted both new customers and investors. In addition to that, the recent news that QUBT has resumed SEC and NASDAQ reporting obligations has been an important announcement, bolstering investor confidence in the form of better governance and transparency.

In early November, the CEO also announced that the new TFLN foundry services will be available in 2025 and that they believe that this facility will produce steady, non-dilutive cash flows in the medium term to offset the cash burn of the company. So it started to look as QUBT has better positioned itself for high revenue growth which might turn the corner for its financial future. Analysts have started revising the price targets up with massive upside potential – now QUBT holds a “Strong Buy” from Wall Street analysts and just a “Buy” from SA analysts.

But the road to profitability and positive cash flow for QUBT in the future will depend on several factors, I suppose. The first will be a proper commissioning and scaling-up of the TFLN foundry. Management believes this plant will generate cash flow in the early days of the deal as TFLN devices are increasingly used in telecom and data center applications. But it’s not yet clear when they’ll begin to generate real money from this facility, and any further delay could make the company even worse off. Second, QUBT has to obtain higher-margin deals to optimize its gross margins. It’s not sustainable long-term to continue to be based on small, low-cost work such as the Johns Hopkins contract. Third, the company should still be carefully controlling operating costs while investing in R&D – getting this right will be the key to keeping innovation alive without adding to the balance sheet.

Looking longer term, I think QUBT won’t be profitable for at least the next 2–3 years. The base revenue of the company is still too low to service the operating costs, and the high cash burn rate will mean further capital raising.

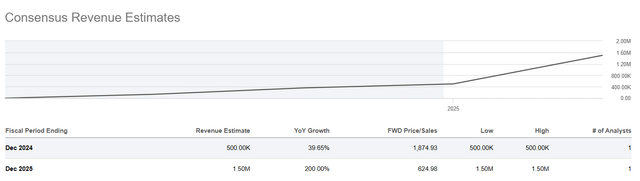

Quantum Computing currently has only 1 Wall Street analyst covering its stock, whose opinion forms the sole consensus, according to Seeking Alpha. This analyst predicts that next year’s revenue (FY2025) will amount to just $1.5 million – when compared to the company’s current market cap of almost $1 billion, this figure is essentially negligible. The recent surge in market cap we’ve witnessed doesn’t appear to be strongly supported by fundamental factors, even when considering the upcoming launch of the factory.

The TFLN foundry might provide steady cash flow, but I see no way that it will pay back the losses on the company. Also, the quantum computing market is still young, and QUBT’s technology might not be available everywhere for years. This very long time-to-market maturity adds another dimension of risk to the company’s cash flow in the medium term.

Your Takeaway

I wouldn’t consider buying QUBT stock at its current stock price levels, even if its risk-to-reward proposition looks attractive given the recent news and change in market sentiment around the tech behind the business.

For its part, the company’s strategic development is taking off – especially in the creation of its TFLN foundry and continued growth of its quantum computing platform. Partnerships with NASA, Los Alamos, and other prestigious institutions support the technology and provide a huge potential revenue stream in the future. But the current – and even prospective numbers from consensus – aren’t that rosy. The company is burning cash at a fever pitch, gross margins are tight, and profits are a fantasy to date. I think it’s wise for investors to be prepared for massive volatility and possible further dilution as QUBT seeks more capital to support its activities. The company’s technology promises great potential in the long run, but in the short run, I feel the risk is greater than the reward, and it’s best left as a speculative investment. I’ll be watching on the sidelines, maybe waiting for a better price.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.