Summary:

- I am usually positive on Seeking Alpha stocks rated a ‘Strong Buy’, given the Quant Rating system’s long term record in beating the S&P500. But I QUBT is an exception.

- Despite a $3 billion market capitalization, TTM revenues are tiny at only $400,000. The hype around the NASA deal is unjustified as it is only worth $26,163.

- QUBT is bleeding money and has been saved by a $90 million raise in the last 2 months, management has made questionable capital allocation choices and directors seem overpaid.

- Valuations indicate irrational exuberance at MCAP/TBV of 32x. Technicals look bullish but the hype-based euphoria is likely to reverse sharply.

- Amusingly, the company’s origins are in a completely different industry; it made a huge pivot from beverages to quantum computing back in 2018.

Martin Barraud

Thesis

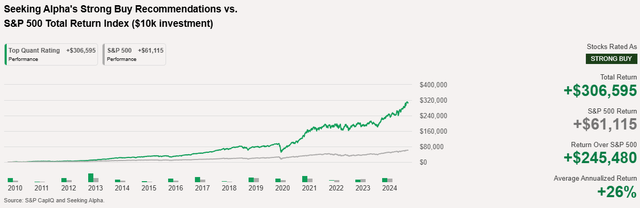

I usually like to scan Seeking Alpha’s “Strong Buy” Quant Ratings for ideas, especially since it has a terrific long term record of outperforming the S&P500 (SPY) (SPX) (IVV) (VOO):

Seeking Alpha’s ‘Strong Buy’ Quant Ratings’ Performance Record (Seeking Alpha)

I came across Quantum Computing (NASDAQ:QUBT) when I read Steven Cress‘ (Seeking Alpha’s Quant Head) article on the stock. However, after doing my own due diligence, I have come to a bearish conclusion as I believe QUBT stock is riding on irrational exuberance.

- Revenues are tiny and the NASA deal is miniscule

- QUBT is forced to raise funds, management has questionable capital allocation policies and excessive cash compensation for directors

- Valuations indicate irrational exuberance

- Technicals look bullish but the hype-based euphoria is likely to reverse sharply

- The company’s origins are in a completely different industry

Revenues are tiny and the NASA deal is miniscule

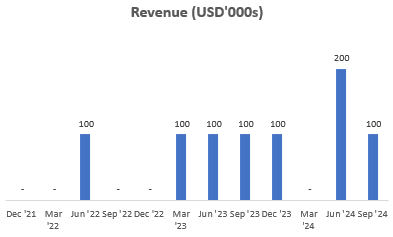

Quantum Computing currently has a market capitalization of $3.04 billion. However, its revenues are miniscule at a mere $100,000 in Q3 FY24 and $400,000 over the last year:

Revenue (USD’000s) (Company Filings, Author’s Analysis)

The market seems to have reacted very buoyantly on QUBT stock on recent developments such as a contract win with NASA. However, I think this is far overblown since detail from USASpending.gov shows that this contract win is worth a mere $26,163!

I also don’t expect their first order and second order for thin film lithium niobate (TFLN) photonic chips won in Nov’24 to be worth much either as the company is still in the very early stages of proving the TFLN technology.

TFLN chips use light instead of electricity to process and transmit information using special optical properties of a material called lithium niobate, when it is used in a thin-film form. The idea is that it enables high-bandwidth data transmission at a much lower power consumption efficiency.

QUBT is forced to raise funds, management has questionable capital allocation policies and excessive cash compensation for directors

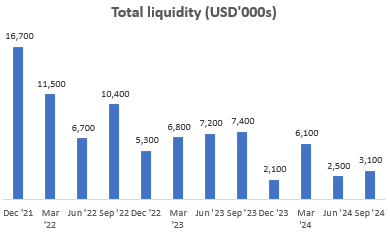

QUBT has $3.1 million in total liquidity as of Q3 FY24, with all of it in cash and cash equivalents:

Total Liquidity (USD’000s) (Company Filings, Author’s Analysis)

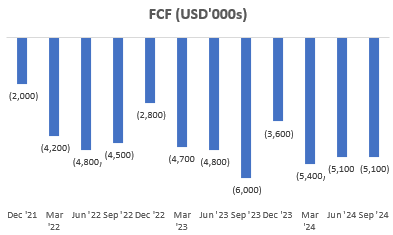

But it is continuously bleeding $5.1 million in FCF every quarter:

FCF (USD’000s) (Company Filings, Author’s Analysis)

This means the company doesn’t have enough funds to last the next quarter. Note that the company also has total debt and leases of $7.8 million on its books.

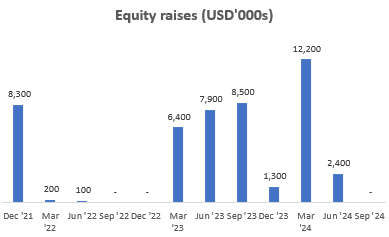

Naturally, it has had to rely on equity raises to keep the funding going and I expect more attempts to follow:

Equity Raises (USD’000s) (Company Filings, Author’s Analysis)

On the bright side, since the release of its Q3 FY24 earnings report, the company has announced capital raises worth $40 million and $50 million ($90 million total), which would solve its funding issues for at least the next 4.5 years at current levels of FCF burn.

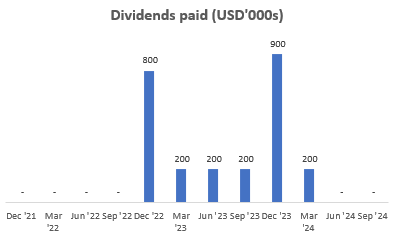

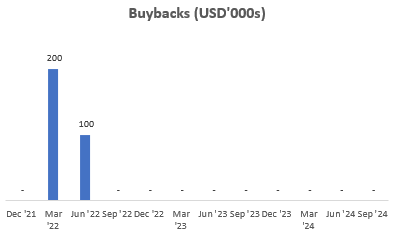

Another concern is that I believe the company has some questionable cash allocation policies. For example, why issue dividends (even if they are preferred) and conduct buybacks far in excess of the miniscule level of revenues that were being generated?

Dividends Paid (USD’000s) (Company Filings, Author’s Analysis)

Buybacks (USD’000s) (Company Filings, Author’s Analysis)

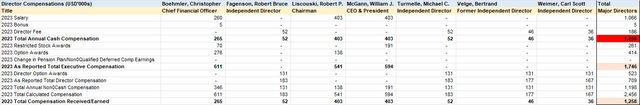

Lastly, it is worrying to me that the company has been paying major directors $1.26 million in annual cash compensation, including $403,000 salaries for each of the Chairman and CEO, and a $260,000 salary for the CFO:

Director Compensations (USD’000s) (Capital IQ, Author’s Analysis)

Clearly, this compensation is funded by equity shareholders providing capital to the company. I think this is rather excessive and unfriendly to minority shareholders.

Valuations indicate irrational exuberance

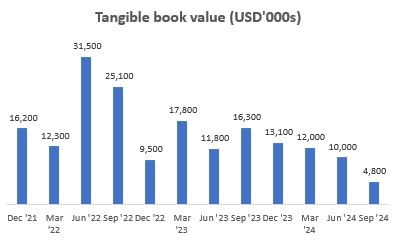

QUBT has a tangible book value (TBV) of $4.8 million as of Q3 FY24. Notice that this has been dwindling at an accelerated pace over the past few quarters:

Tangible Book Value (USD’000s) (Company Filings, Author’s Analysis)

But one would have to add the $90 million of funding raised recently. So including this, given the $3.04 billion in QUBT stock’s market capitalization currently, the implied MCAP/TBV ratio stands at a very high 32x. I view this as a sign of irrational exuberance.

Technicals look bullish but the hype-based euphoria is likely to reverse sharply

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

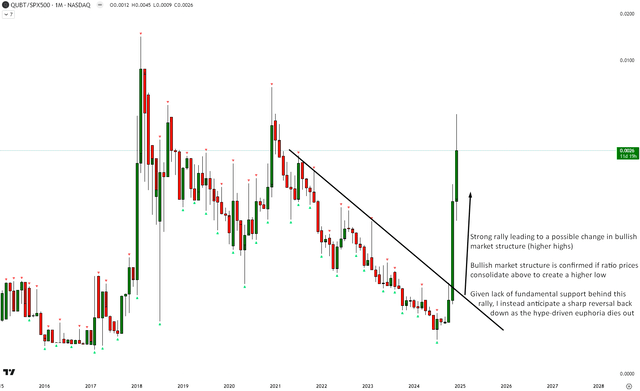

Relative Read of QUBT vs SPX500

QUBT vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

Technically relative to the S&P500, QUBT is showing a strong rally and a possible change in bullish market structure as it has already posted a higher high. A sustained higher low would confirm the bullish trend switch. However, given the lack of fundamental backing behind this move, I instead anticipate a sharp fall from grace as the hype-driven euphoria dies out.

The company’s origins are in a completely different industry

Another amusing sign that raised question marks in my mind is the fact that Quantum Computing used to be in a totally different industry with the moniker – Innovative Beverage Group Holdings. It changed its whole identity; name and business focus from beverages to quantum computing back in March 2018. In my experience, this kind of business hopping into “trendy” areas is usually not a great sign as questions such as ‘What is the rationale or competitive edge’ is hard to answer.

Takeaway & Positioning

I initially started my research on Quantum Computing with an optimistic view as I believe Seeking Alpha’s ‘Strong Buy’ Quant Ratings deserve that favorable bias given its terrific longer term performance track record in beating the S&P500. However, as I found out more about the company, it became very apparent to me that the stock is driven by extreme irrational exuberance with hardly any fundamental backing to justify its meteoric price 2241% price rise over the last 4 months:

QUBT has a market capitalization of a bit over $3 billion currently but a miniscule $400,000 in TTM revenues. Details from USA Government Spending shows that the NASA deal is worth a mere $26,163. I also doubt the company’s first commercial order it won in Nov’24 is worth much given the early stages of TFLN technology. More worryingly, the company is eroding FCF rapidly and is only being saved by $90 million of capital raises over the last couple of months. Without this, it would have run out of funding for the Dec’24 quarter. Puzzling to me is why the company has paid dividends and made buybacks in the past, even without a sustainable revenue-generating business model. Also, directors’ cash compensations seem excessive to me as it is in excess of what the company is making in revenues currently.

On the valuations side, the QUBT stock trades at a MCAP/TBV of 32x, which I think indicates some irrational exuberance. Technically relative to the S&P500, QUBT is riding sky high on bullish momentum for now. However, I anticipate this to turn given the lack of strong fundamentals backing this appreciation in the stock’s value. Another amusing fact that raises my skepticism is the fact that a bit more than 6 years ago, QUBT used to be in the beverage business; an industry totally unrelated to quantum computing!

Overall, I expect QUBT to fall from grace. Hence, I am rating the stock a ‘Sell’.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.