Summary:

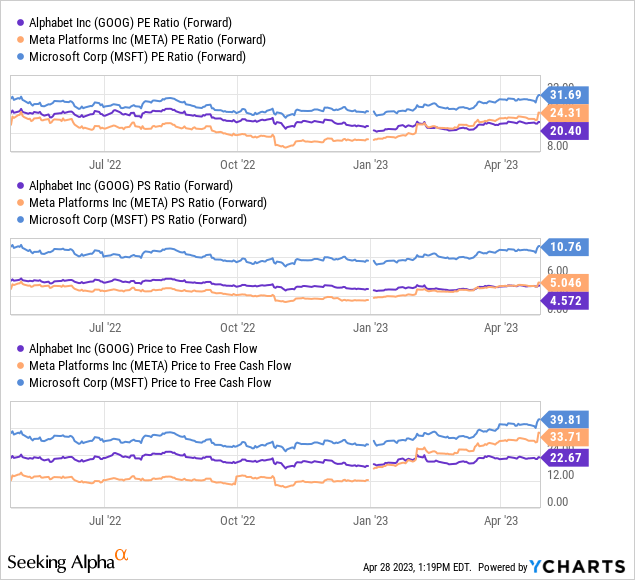

- Google has been called out for being cheap; on paper, it is, especially compared to its peers.

- However, Google isn’t cheap because the market is missing something; it’s cheap because the market understands it’s being outperformed in ads and AI.

- Compared to Meta Platforms in advertising and Microsoft in AI, Google is a laggard with no direction or vision, evidenced by its 180 in CapEx from Q4 to Q1.

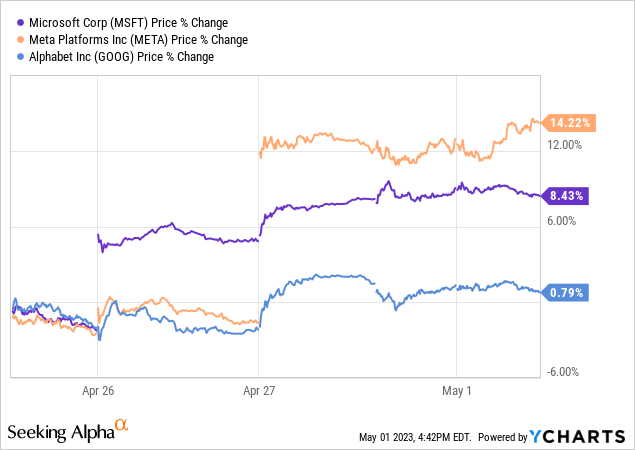

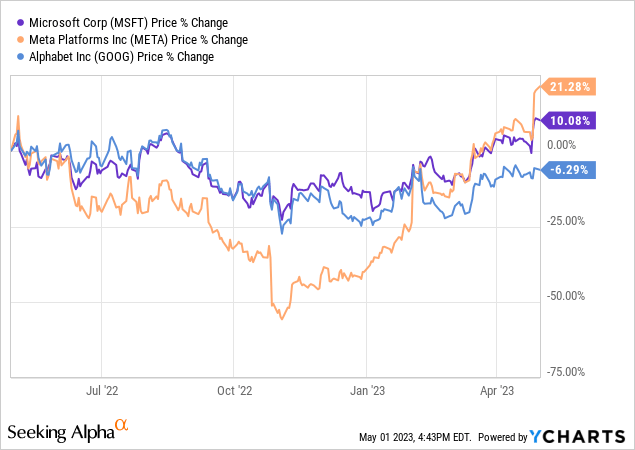

- Google doesn’t offer anything the market can’t get elsewhere, and the performance over the last week and last year proves it.

stockcam/iStock Unreleased via Getty Images

It seems to be a trend to get the first thoughts of a company’s earnings report out as soon as possible – the more immediately after the print, the better. But much like journalism, the spread of opinions too quickly after an event has become pervasive in crowdsourced financial media. And with the Q1 earnings season well underway this past week, there was no shortage of calls for saying what’s cheap and what’s overvalued within hours of reports. And most, if not all, of this information was based solely on the reporting company’s numbers. Being the data-driven person I am, I want as much relevant data and numbers as possible (emphasis on relevant because data overload is a problem, too). Because in the aftermath of peers’ reports, it became clear to me Google (NASDAQ:GOOG) (NASDAQ:GOOGL) is cheap for a reason – in fact, a few reasons – and they’re not good reasons. And it’s because I had Microsoft’s (MSFT) and Meta Platforms’ (META) reports to give me the perspective.

Microsoft and Meta are relevant to Google because the other two have direct competitive connections, even though not all are competitors. As an example and what I’ll compare in this article, Microsoft competes with Google in AI (ChatGPT and Bard plus hosted AI), while Meta competes with Google in advertising. And since they reported in the same few days, it was best to wait for all this information to conclude if Google is truly worthy of buying due to perceived undervaluation.

To start, here’s the reason why other contributors see Google as cheap and undervalued.

Google ranks the “cheapest” among its peers in forward P/E, forward P/S, and price to free cash flow. So on paper, Google certainly appears cheap.

But what if it was cheap for a reason? Better yet, what if it was cheap because Alphabet isn’t offering investors anything they can’t get elsewhere? This became increasingly clear as I analyzed it and its peers’ reports.

The two areas of major importance are ones I alluded to at the beginning of the article:

- Advertising

- AI

Very simple and very short, but these two things project the entire basis of what Google’s future looks like.

Advertising And Relative Performance

Starting with advertising in the Q1 report, it wasn’t very uplifting. However, the flat to slightly down results in ads weren’t surprising. The industry has been dealing with a tough few quarters as macroeconomic headwinds prevail for advertisers pulling back marketing budgets. So when I see Google’s ad segments not doing too hot, it’s not terribly concerning, considering it’s only Q1.

| Total Ad | $54,661 | $54,548 | -0.2% |

| Q1’22 | Q1 ’23 | Y/Y Growth % | |

| Search | $39,618 | $40,359 | 1.9% |

| YouTube (Ads) | $6,869 | $6,693 | -2.6% |

| Network | $8,174 | $7,496 | -8.3% |

These aren’t terrible numbers, especially compared to last year’s quarter where it reported pretty impressive growth of 22.3%. But what I didn’t understand was the little to no guidance as to how advertising will shape up for the current quarter or the rest of the year. And the color management did provide didn’t sound particularly encouraging.

…our results in the first quarter reflected ongoing headwinds due to a challenging economic environment and the outlook remains uncertain…With respect to Google Services, within advertising, Q1 results reflect the resilience of search with its unique ability to surface demand and deliver measurable ROI. Excluding the impact of foreign exchange, the revenue growth of search was similar to last quarter. In YouTube, we saw signs of stabilization in ad spend on a sequential basis.

– Ruth Porat, CFO, Q1 ’23 Earnings Call

Not much of an outlook when management can only refer to the reporting quarter (yes, this was its “outlook”). Similar growth isn’t exactly calming as last quarter wasn’t terribly strong, and it has to subtract foreign exchange to make the comparison, when in reality, at the end of the day, the report doesn’t allow for that. Stabilization is good but, again, not terribly encouraging as it doesn’t lend itself to what’s coming for the quarter or the year. Stable now could be weak later.

And this is where the comparison comes in. How does other online advertising compare to it?

Well, Meta Platforms seemed to already be beyond “stable” and “similar” as it was expected to see revenue growth of -0.94% but wound up with revenue growth of 2.6%. This was exactly Google’s revenue growth for Q1, but not because of advertising. Meta’s ad business (which is nearly all of its revenue) rose 4.1%. That’s a bit of a difference from Google’s negative 0.2% ad revenue growth.

What’s more, Meta provided revenue guidance of $30.75B for Q2 (growth of 6.7% year-over-year), and this growth is coming from advertising as it’s principally all of its revenue (>98%). In fact, advertising in Q2 will likely be over 7% due to the drag from Reality Labs – much like Q1.

Advertising may not be returning at Google, but Meta is finding advertising strength all its own, or it has utilized AI much better over the last several months, or both.

Either way, what does Google have to offer me regarding advertising growth?

Nothing positive or competitive.

Competition In AI – You’re Either Leading Or Catching Up

The competition for AI only started reaching a fever pitch when ChaptGPT was released publicly in November. At that point, if your company wasn’t already heavily invested and working on AI solutions, you were miles behind. Microsoft, being the heavy investor it is in OpenAI, not only directly but through its cloud infrastructure, was well on its way to dominating the generative AI market.

Google, for its part, was likely working on AI but more than likely was caught with its pants down in terms of agility to release. After all, Bard was only released a little more than 40 days ago. And the release had interesting quirks and bugs to fix – especially one during the initial demo – things you usually polish before going to a public display of what you’ve been working on.

But I’m not here to bash Bard, as ChatGPT has its own issues requiring some serious work. This is the nature of an exciting emerging technology in the public’s hands. Both will have hurdles to overcome. But Microsoft’s ability to spend toward it seems to be the difference, and now Google, after less than three months of guiding for flat 2023 CapEx compared to 2022, is doing a 180.

The question is, is the change of heart from a position of strength or weakness?

…as it relates to CapEx, for 2023, we now expect total CapEx to be modestly higher than in 2022. As discussed last quarter, CapEx this year will include a meaningful increase in technical infrastructure versus a decline in office facilities. We expect the pace of investment in both data center construction and servers to step up in the second quarter and continue to increase throughout the year.

– Ruth Porat, CFO, Q1 ’23 Earnings Call

This compares to February’s call:

For 2023, we expect total CapEx to be generally in line with 2022, with an increase in technical infrastructure versus a decline in office facilities.

– Ruth Porat, CFO, Q4 ’22 Earnings Call

This change after three months can be attributed to one of two things. The first is AI competition has caught Alphabet flatfooted; it needs to invest higher regardless of where the cash will come from. Or, 2023 is looking better, and there’s no time to waste to get more weight behind data center and AI investments.

Considering the lack of enthusiasm for the business prospects for the year, I lean toward the former. And considering the swift pivot, it appears to have no choice.

I wasn’t the only one curious about this development as an analyst on the earnings call asked the same question I had going over the report: “…help us understand the modest step-up in CapEx relative to 3 months ago?” To which management responded with a non-answer. Here’s the entire CFO’s response. You tell me if you see any answer to the spirit of the question.

And in terms of CapEx, we do now expect that total CapEx for the year for 2023 will be modestly higher than in 2022. And I tried to point out that we’re expecting a step-up in the second quarter, and that will continue to increase throughout the year. And as we discussed last quarter, AI is a key component. It underlies everything that we do, and we’re continuing to invest in support of AI, support of our users, advertisers and our Cloud customers, since we are commenting on here. And then as we talked about last quarter, the increase in CapEx for the full year 2023 reflects the sizable increase in technical infrastructure investment, on the flip side, a decline in office facilities relative to last year.

Half of it just restated what the CFO said in the prepared remarks, and the rest just, well, restated the restated answer. But none of it answers why the change from just three months ago because it’s not like management didn’t know about AI and Microsoft’s gauntlet throwdown in February

Granted, the analyst’s question was poorly worded and gave a large window to dodge the question, so I can’t say management really was asked about why the change relative to three months ago. But the CEO’s answer tells me it’s because the company is way behind competitors.

Obviously, we have launched Bard as a complementary product to search. But we will be bringing LLM experiences more natively into search as well. I do think, first of all, on – we will be rolling it out in an incremental way so that we can test it, create and innovate. So I think we will approach it that way. I think overall, I think it can apply to a broad range of queries. So I think I’m excited that it can allow us to better help users in a category of queries, maybe in which there was no right answer, and they are more creative, etcetera. So I think those are opportunities.

This is a garbage answer. And it’s corporate speak for “we got caught with our pants down, and we’re pushing things out to say we have something.” And don’t miss the part where it’s basically doing Google things and testing a release of a product in production. It sounds like the demo days aren’t behind the company – or above them, for that matter.

There’s no excitement, regardless of the CEO repeating he’s excited. None of that was technologically appealing – especially focusing on queries where there’s no right answer; real innovation there…not – nor is it telling investors why its technology is better than Microsoft’s. The bland tone said more than a direct answer would’ve.

Google is playing catch-up. It’s that simple. And the catch-up isn’t impressive. The pivot in CapEx from the last call signals to the market it made a mistake in not investing heavier in it after missing the ball in the first inning. Now it’s stepping it up, once again behind the curve.

It’s called being a day late and a dollar short. And Google has owned that saying perfectly.

Not Really All That Cheap

So is Google cheap? As I presented at the beginning of the article, it sure looks like it. But that’s only on paper. When you see how its main business – advertising – is performing and how the company is bringing itself into the 2020s with AI, there’s nothing to offer an investor. Its competitors in either Meta or Microsoft have the technological and market advantage in their respective industries. Google, competing in both, has proven it has no leadership in either. Its revenue growth is less, and its vision is missing the mark.

There’s a reason it’s cheap, and there’s a reason it has wholly underperformed its competitors both in the last week and the last year. Meta has course-corrected, and Microsoft has been able to cast and maintain vision, and they have been rewarded. Without either of these traits, it has made Google a ho-hum investment.

This is called a value trap, and Google has been the poster child for it over the last few years. Management has run its course; it’s time for a change. A Nadella kind of change. Otherwise, Google will continue to be a follower and not a leader in its main investment cases, ads or AI.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Decrypt The Cash In Tech With Tech Cache

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name. Second, become one of my subscribers risk-free with a free trial, where you’ll be able to hear my thoughts as events unfold instead of reading my public articles weeks later only containing a subset of information. In fact, I provide four times more content (earnings, best ideas, trades, etc.) each month than what you read for free here. Plus, you’ll get ongoing discussions among intelligent investors and traders in my chat room.