Reasons To Be Bullish On Capital One Financial

Summary:

- Capital One’s shares rallied when Warren Buffett bought the lender, making it a potentially good investment for shareholders in 2024.

- The end of the Federal Reserve’s Bank Term Funding Program could cause stress in the regional banking sector.

- Capital One’s lending business could benefit from hopes of a soft landing in the economy and positive credit conditions, while its strong cash build is undervalued.

Win McNamee

Capital One Financial (NYSE:COF) saw its shares rally in May when an SEC filing showed Warren Buffett exiting bank shares to buy the lender. In this article, I will discuss why it could be a good investment for shareholders in 2024.

An end to the Fed’s lending program could reignite regional banking stress

The first big test for the financial sector, in 2024, could be the end of the Federal Reserve’s Bank Term Funding Program, which supported lenders through the March crisis.

Fed Vice Chair Michael Barr said at a recent event that the program “really was established as an emergency program.”

The BTFP, which is set to expire on 11 March, has seen accusations of banks “gaming” the system. Usage of the program was at record highs of $141 billion in the week to 3 January. Banks and credit unions were able to borrow funds for up to one year, offering U.S. Treasuries and agency debt as collateral, but the Fed has had to face questions about the length of the program, which is being used for arbitrage at healthy banks.

Institutions were able to pay 4.93% and earn 5.40% in accounts with the central bank. Banks will likely be taking advantage of such a facility until it ends, boosting their liquidity into March. Once that ends, it may be that profits could suffer over the year, especially with rate cuts said to be coming in 2024.

Mark Cabana, head of interest rates strategy at Bank of America, said: “If the Fed is going to be moving in the direction of cutting rates and banking-system risk has moderated, then do you need to have this facility renewed in an election year?”

In my view, Capital One can be a good stock to own in the event of further regional bank stress and Buffett made that clear in May. The Oracle of Omaha told investors at the company’s annual meeting that he had been spooked by the speed of the bank run that felled Silicon Valley Bank.

“You don’t know what happened to the stickiness of deposits at all… and that changes everything. You can have a run in a few seconds.”

That seems to be a key driver in his dumping of bank stocks to take a holding of almost $1 billion in Capital One.

Goldman Sachs and Fitch noted this week that regional banks could suffer in the months ahead. Regional lenders with less than $100 billion in assets are tied into securities holdings that are losing money on paper. That gives them less room to invest, while they will find it harder to compete with larger firms for loan growth, the firms said. This will become more important as bank earnings season for the fourth quarter gets underway. Capital One releases its results on 25 January.

A soft landing can help Capital One’s credit conditions

Capital One’s lending business should also be helped by increasing hopes for a soft landing in the economy. The latest Federal Reserve meeting minutes failed to mention the word “recession” in the last few meetings. That compares to a dozen references of the term from previous meetings going back to November 2022.

The resilience of the U.S. economy also prompted the World Bank to predict a soft landing for the global economy.

“It’s rare for countries to bring inflation rates down without triggering a downturn. But this time, a soft landing seems increasingly possible,” a report said.

In its third-quarter results, Capital One easily beat profit estimates, helped by higher interest rates on loans. Net interest income climbed 6% to $7.42 billion in the quarter, compared with about $7 billion a year earlier. In line with the broader market, higher deposit costs led to a lower net interest margin of 6.69% up 21 basis points on the year-ago quarter.

Other highlights from the Q3 earnings included a net income of $1.8 billion, compared with a net income of $1.4 billion in the second quarter of 2023. The company has a provision for net losses of $2.3 billion. Cash and cash equivalents have risen over the last year by $20 billion due to higher interest rates and that will provide strong liquidity for the firm in 2024 and beyond. This can add upside potential in the form of further stock buybacks and/or dividends.

Earnings per share of $4.45 were more than 35% above consensus estimates, while loan growth, non-interest income, and operating expenses were also better than analysts’ estimates.

Richard D. Fairbank, Founder, Chairman, and CEO also noted that “Modern technology capabilities are generating opportunities and driving performance improvements across our businesses.”

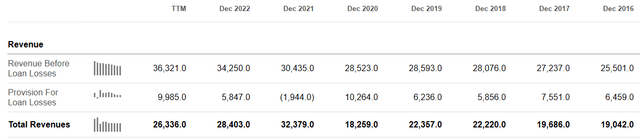

Revenue Growth (Seeking Alpha)

On the other hand, if the economy does move toward recession, Capital One has shown resilience in its revenues, including during the pandemic and the company has the reserves to fend off any problems.

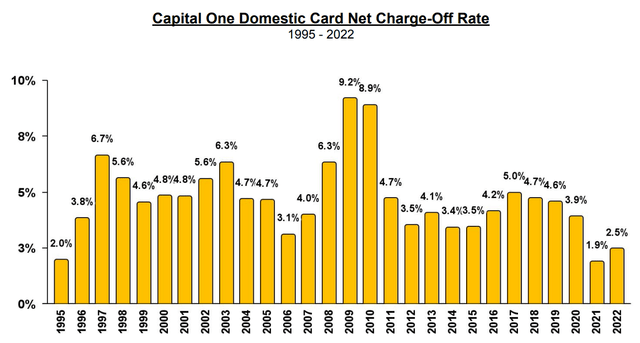

The downside risk for the company is a deterioration in loans and delinquency rates were higher in November at 4.55% from 4.48% in October. The net charge-off rate also rose to 5.19% from 5.08% in October and from 4.43% four years ago.

However, this is while lending activity continued to increase, with end-of-period loans standing at $144.9B, up 13% from $124.2B at the end of November 2022.

The company was supported during the pandemic by the furlough checks handed out that buffered the downturn and supported debt levels, but management would be able to act on a downturn.

Capital One Charge-offs (Annual Report 2022)

Charge-offs at the company remain historically low and the company is building a war chest to protect from a normalization. It may be that technology has created a new normal in charge-off levels looking at the steady downtrend.

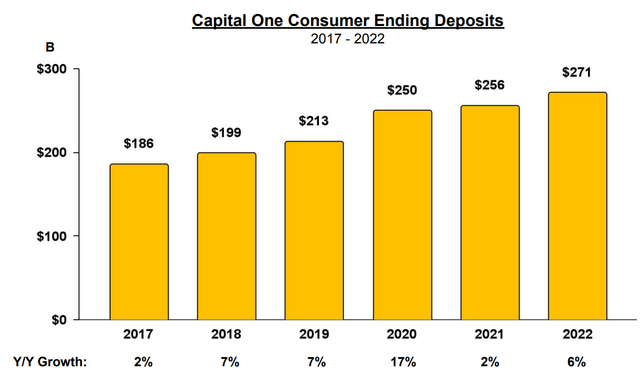

The company has also pivoted its business from being largely funded by capital markets in 1995, to being funded by 78% insured deposits, according to the Annual report 2022.

I believe Capital One’s improved cash position is not being factored into the current valuation with a Price/Cash Flow ratio of 2.34 which is -28.7% lower than its 5-year average and -69% lower than its peers.

Strong management and growing banking footprint

One of Warren Buffett’s famous investment criteria is to invest only in businesses with solid management. This is a seal of approval for Capital One’s business and its cautious approach to growth and its financial situation. Capital One is building a national bank but is doing so “organically.” Consumer deposits reached a record high in 2022 and the company could see further deposits if regional banks see further stress in the year ahead. The company has been number one in J.D. Power’s customer satisfaction surveys for three years running.

Capital One bank deposits (Annual Report)

Downside risks to the investment thesis

The risk to Capital One’s business is the same as other financial institutions with rising bad loans due to higher rates.

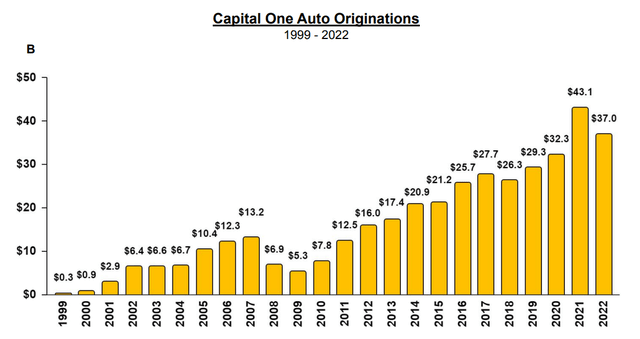

Non-performing loans are expected to have risen to a total of $24.4bn in the last three months of 2023 at the four largest U.S. banks. That marked a $6bn rise over the year, but is still below the $30bn peak during the pandemic. Auto loans are one area that Capital One has leveraged since the pandemic and could be prone to a downturn, but the company has more than enough capital to act as a buffer.

Capital One Auto Loans (Capital One)

Consumers are likely to remain strained in 2024 until the Federal Reserve cuts rates, but the negative credit outlook will be the same for other lenders.

Conclusion

Capital One has seen its stock rise 33% over the last year but it is still 37% lower than the all-time highs set in 2021. Although there has been an increase in delinquency rates, that is coming alongside record credit card borrowing. The company has built a strong cash buffer over the last year, alongside its reserves for bad loans. It is that cash position that could see further gains in the company, with the potential for dealmaking and increased investment. The other option is stock buybacks or an increase in dividend payments. The company’s third-quarter earnings showed them beating analysts’ expectations in many key metrics and another strong quarter in Q4 would boost the share price. The Federal Reserve’s decision to pivot on interest rates will not have a big effect on the first half of the year for Capital One, but the heightened chance of a soft landing will. With the winding down of the Fed’s emergency lending program in March, Capital One will also be a safer stock to own than many other financial sector players in my view. Regional banking sector stocks are tipped to struggle in the year ahead and are still sitting on large unrealized losses that make them unable to leverage or diversify.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of COF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.