Summary:

- Exxon Mobil’s common stock price recently reached a new high despite the company reporting an impairment charge.

- The impairment charge does not affect reported cash flow but indicates that past income (and sometimes future as well) statements were (or will be) overestimated.

- Investors should prioritize conservative accounting methods and evaluate management’s reputation for honesty when reviewing financial statements.

- GAAP accounting allows for a lot of management choices that investors really never know about. This can provide considerable variability even with GAAP numbers.

- Management achieved the $9 billion cost cutting goal and so has raised that goal to now $15 billion.

bjdlzx

For those investors currently invested in Exxon Mobil (NYSE:XOM) the common stock price recently hit a new high. Ironically, there are probably more new highs to come even as the energy giant reports that it will take an impairment charge as it expects lower first quarter earnings.

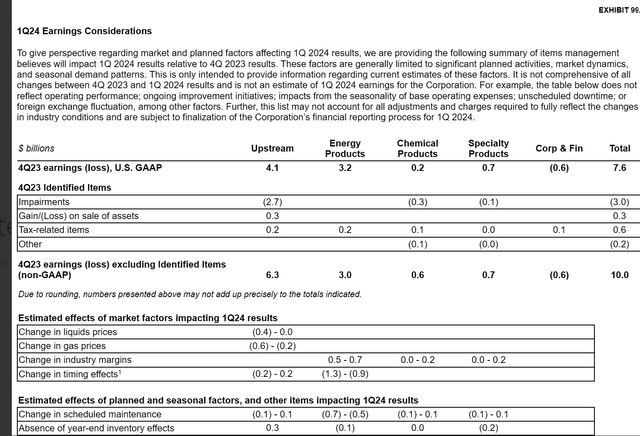

Exxon Mobil First Quarter Items As They Affect Fourth (Exxon Mobil SEC Filing April 3, 2024)

For the first group of charges:

Any impairment charge is noncash. So, there is no effect on reported cash flow. However, that $2.7 billion charge is a realization that past income statements had an overstatement and therefore, the valuation on the balance sheet was too high. Evidently something upstream was not as profitable as management had originally believed.

This points up the fact that depreciation is really an estimate based upon a bunch of estimates that management makes. Auditors often rely upon the reserve report and management estimates as they have really no expertise as to the reasonableness of management assumptions as long as those assumptions are “in there” and not way out of line with typical industry estimates.

An Aside On Auditors

There is a natural conflict for auditors in that they are paid by the companies they audit. In the case of Exxon Mobil, the auditing fee is very large. This puts a fair amount of pressure on the auditing firm at times because that fee is hard to replace if it is lost. Exxon Mobil would be considered a major customer in just about any other business.

Back To the Main Discussion – First Items

Since management honestly is essential when reviewing the financial statements, a management with a reputation for scrupulous honestly is essential.

However, many investors stop there. Conservatism should always be preferred over aggressive when it comes to the different methods and assumptions allowed in accounting. An understated income statement is probably preferred by investors over an aggressive one because then impairments are less likely to happen. But that does not mean, as is the case here, that they will not happen.

Exxon Mobil taking those impairment charges, especially during the good times, takes a lot of potential pressure off the auditors to potentially “stand their ground” with a major client. Many companies “clean house” during cyclical downturns and bad years. Right now oil prices are rising. This would appear to be a decent year. It says a lot of good things about management to take an impairment charge when many do not feel that need.

There are many upstream choices that the investor never sees. For example, management can often choose between a well production life of say 25 years and 30 years (or anything in-between). Management can also choose if the well is worth anything due to the likely technology changes that make a rework profitable or should the well be totally depreciated due to the ongoing rapid pace of technology changes that are likely to continue (as many CEO’s maintain).

The net result is that investors unknowingly often end up comparing figures that are not “apples to apples” because they do not know the management assumptions. The only safety net they have is a personal evaluation that management seems to be “the conservative type”. It is an investment risk that many of us never fully “come to grips with”.

Second Group

Many times, rising prices result in a timing issue. The benefits of rising prices or the penalty of lower prices do not go away. They are simply delayed by product that takes time to get to the destination. This kind of change can easily be made up.

Scheduled Maintenance

Scheduled maintenance is a recurring cost that is “lumpy”. This cost happens regularly but it also happens all at one time. During my lifetime as an accountant, I ran into many accountants that wanted to spread something like this over the full year because then earnings were “smooth”. Supposedly big-time accountants were those that were able to deliver those sought after “smooth earnings”. There is an argument for many of these charges benefitting more than one quarter. But conservative accounting likely would be to take what is essentially a maintenance charge all at one time.

This is really a personal thing as there are many costs that could go either way. Some costs must be clearly expensed when incurred, whereas some have arguable benefits over the fiscal year. The key is that accounting is not always “black and white” nor is it “clear cut”. Despite a whole lot of protests to the contrary, the real world has this area where there are choices rather than hard and fast rules. There are people on both sides of this that argue that the other side should not exist as well. Therefore, management that believes in conservative accounting, which appears to be the case here, is management you want to elevate consideration investing in.

This type of management will tell investors the news whether it is good or bad. That allows an investor a considerable amount of accuracy that may not be available elsewhere. Personally, I favor blunt managements, and this appears to be that kind of blunt management I favor.

I have seen accounting treatments I whole heartedly disagreed with. But I was also sure the auditor would approve the treatment. I personally prefer the Exxon Mobil method whenever possible as that was my choice throughout my professional life.

Again, many investors are not aware of this discussion. They are even less aware that GAAP has choices and that partners in accounting firms tend to listen to the client and “bend” where possible. The larger the accounting fee, the more flexible partners tend to be. It is just a fact of life. Partners are aware of the “shades of grey” and they are also aware of where the money comes from.

To Summarize

These charges will affect the income statement. They are far less likely to affect long-term cash flow. This points to the fact that one quarter is often not sufficient to cause the market worries or elation frequently seen during earnings season. Material changes are not that common in quarterly reports. But often when a material change occurs, the investor never forgets and often “overcorrects” by magnifying every little detail as a result.

It is hard to stay “level headed” after a painful experience. But in investing it is an absolute must.

The other take is that GAAP accounting has some “give”. Therefore, the numbers that investors see may not be quite as comparable as one may be led to believe when both are GAAP numbers. Unfortunately, the comparability issue is largely subject to debate because management has numerous decisions to make that are allowable under GAAP.

This situation probably makes the cash flow statement far more important than the income statement. That GAAP cash flow is far less likely to be influenced by management decisions that affect income. One key check is that income plus depreciation (amortization too) should very roughly equal cash flow before working capital adjustments.

Most companies spend the quarterly report on the income statement. Yet most companies should probably spend a fair amount of time on the cash flow statement. It turns out in the corporate world, there was a lot of resistance initially to a cash flow statement. That has translated into little or no discussion of this important document. Cash flow is the lifeblood of any company. It would be a lot healthier to spend some quarterly time on the cash flow statement. It probably would educate investors considerably as well.

The extreme is that if income is reported without cash flow, then that reason needs a thorough check. Rapidly growing companies can report income with working capital soaking up the cash generation. But that also needs a thorough investigation. But one sure sign of potential trouble is no cash flow combined with slow or no growth over a period of time.

So What Is Going On With The Stock?

In the meantime, the stock price hit a new high recently.

Exxon Mobil Common Stock Price History And Key Valuation Measures (Seeking Alpha Website April 8, 2024)

Since impairment charges and timing differences normally are not things that the market wants to hear about (let alone turnaround and other big or significant expense). The performance of the stock price is something of a mystery until you realize that many commodity stocks trade on current industry pricing and that pricing outlook.

There was a further announcement that production might be shut-in while the project for delivery of natural gas for the Guyana gas-to-power project completes even though the rest of the project is behind. However, this is not a permanent situation. In addition, the amount of production involved is not all that material to a company like Exxon Mobil even if the total eventually hits $1 billion (which it might).

Additionally, TotalEnergies SE (TTE) announced the delay of a final decision on a neighboring project that Exxon Mobil is a partner in.

Overshadowing all of this “bad” news is a bullish commodity price environment. That sentiment appears to be overwhelming anything the company or its partners have announced to the contrary.

Therefore, the market is looking ahead to better quarters on the way unless there is news to indicate that the company will not participate in the better times, or those better times are coming to an end.

However, oil, natural gas, and related products are extremely volatile. The outlook can change very quickly. The safety factor here is that the price-earnings ratio, though high for the industry, is very low for the stock market in general right now.

This points to the fact that the industry has some recovery potential to return to a more normal valuation in relation to other stocks. That relation is important because the actual value at the time a more normal valuation is obtained (related to other stocks) could depend upon the outlook of Mr. Market about the stock market’s future.

Cost Savings

Also impacting the long-term performance of the stock is the announcement by management that they have increased the goal of cost savings from $9 billion to $15 billion because that $9 billion cost savings goal was already met. This will make the company more profitable throughout the business cycle, which will also likely lead to a higher valuation.

Management stated that they now expect to more than double earnings using the 2019 conditions as an assumption for projected earnings. This is very likely to revalue Exxon Mobil stock, which many will state “sat there” for about a decade because the stock is now moving to a grow and income status from really a dividend play.

Lowering the company breakeven through cost cutting is seen by the market in a very positive light.

Summary

The company does have a merger with Pioneer (PXD) to complete after merging with Denbury (DEN). This may well make comparisons and forecasts difficult for a little bit. It is definitely not a good idea to be settled into fixed numbers until the financials eliminate optimization and one-time merger costs. That can take about six months to a year.

There is also the effect of some potential outcomes from the arbitration proceedings on the acquisition of Hess (HES) by Chevron (CVX) even though those latter two continue to insist that the acquisition will go as planned with Chevron being in control of the Hess interest in Guyana. There is potentially a wider range of future earnings scenarios than is usual for this oil giant.

On the other hand, it is very likely that in the short-term three-to-five-year period, that price-earnings ratio will expand closer to seventeen unless there is a cyclical market drop to a bottom. Even if that does not happen, the cost cutting campaign assures more cash flow at any given pricing environment than in the past. The company should have a lower breakeven point over time as well. That provides a safety net for more upside potential than downside risk.

The last point is that the current management continues to turn the company from a dividend play into a growth and income play with more room to increase that dividend from rising earnings in each business cycle. For this reason Exxon Mobil remains a strong buy.

Oil and gas often out-performs bear markets. Since there has been a lot of “house cleaning” throughout the industry beginning in 2015 and really ending with the 2020 coronavirus challenges, the industry (and this company) is again poised to outperform any correction that may happen in the immediate future.

This information points to a likely asymmetric return of limited downside but revaluation of more profitability in the future. For a company of the stature of Exxon Mobil, that is a rare achievement. The stock is very likely to provide above average returns with the lower risk that comes with an integrated major. A double in stock price given the merger and the cost achievements would not be out of the question. There will be more certainly after the merger related events are history.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM HES either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor and this is not a recommendation to buy or sell a security. Investors are recommended to read all of the company's filings and press releases as well as do their own research to determine if the company fits their own investment objectives and risk portfolios.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.