Summary:

- JinkoSolar Holding Co., Ltd. is a global leader in solar tech but struggles with profitability and stock performance, heavily reliant on government policies and market pressures.

- Despite a low valuation and high dividend yield, JinkoSolar’s declining earnings and financial challenges make it a risky investment, especially with the upcoming U.S. election.

- JinkoSolar’s strong production capacity and technological advancements are notable, but the solar industry’s dependence on subsidies and policies creates uncertainty.

- Given the current dynamics, I rate JKS as a “Hold” due to its profitability issues and the potential impact of the U.S. election on the industry.

Robert Way

Thesis

My analysis is that JinkoSolar Holding Co., Ltd. (NYSE: NYSE:JKS) has been a market leader in solar energy innovation and globalization in the solar energy market but has lagged the market in terms of its financial performance and stock valuation both recently and over the long haul. And despite being one of the pioneers, its strong technological advancements and expansion into new market technologies, JKS faces significant challenges like decreasing profitability, and has been heavily reliant on government policies and external market pressures. With that said, the U.S. presidential election next month isn’t helping, and it could potentially impact the company either positively or negatively, depending on the energy policy of the new administration.

About JinkoSolar Holding Co., Ltd.

JinkoSolar is one of the world’s largest solar module manufacturers. Headquartered in Shangrao, China, and founded in 2006, the company has extensive capacity for the entire solar value chain: from silicon wafers to solar cells and modules. JinkoSolar sells products under its brand name and also provides energy storage systems and solar project services.

JinkoSolar operates production facilities in China, Vietnam, and the US, while serving customers across the U.S., China, Japan, and Europe. Its markets include utility, commercial, and residential units. In 2023, it had 110 GW of solar module capacity and 90 GW for solar cells.

The company is a global leader in the new renewable energy paradigm, with 14 production facilities and a sales network in more than 20 countries worldwide. It has received several innovation awards for its advanced solar tech, such as N-type TOPCon cells, as well as for its high-performance products.

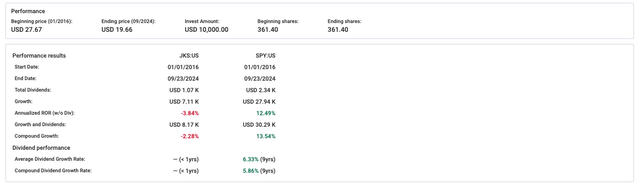

JKS’s Performance vs. S&P 500

I’ll be blunt: JKS doesn’t inspire much confidence over the long run, especially when stacked up against broader market indices like SPDR® S&P 500 ETF Trust (SPY), which has grown at 12.49% per year since 2016. Conversely, JKS stock has had an annualized return of -3.84% without dividends (its most recent heyday was a nice run from September 2020 – July 2022 — but it’s been all downhill since then). Even factoring in dividends, JKS still comes up short with a -2.28% return compared to SPY’s 13.54%.

Sure, JKS paid out $1.48 per share in dividends for FY 2024, but that doesn’t make up for the stock’s poor performance. Bottom line: JKS has been a far worse investment than a broad market index like SPY. The big question: is the stock due for a turnaround?

JKS’s Valuation

At the time of this analysis, JKS is trading at $19.66, which is way below its fair value—the fair value P/E ratio is 15x, but it’s currently sitting at just 7.83x, which could mean the market’s sleeping on it.

One piece of data that really stands out is the 15.06% dividend yield—that’s huge for a semiconductor-related stock, but don’t get too excited yet. Yields that high can be sketchy if the company’s earnings aren’t growing, and JKS has an adjusted operating earnings growth rate of -11.42%, showing profitability is slipping.

Furthermore, JKS’s debt isn’t out of control, with a long-term debt-to-capital ratio of 30.95%. Yes, it’s manageable, but it doesn’t give the company a ton of wiggle room in an election-induced downturn without having to refinance or restructure.

Bottom line: in theory, JKS should have a lot going for it, being in the solar energy space as the world moves toward renewables. But solar is still heavily dependent on government policies and subsidies, which can make earnings unpredictable. For new investors, if you’re willing to take a gamble on the election, there’s a good case to be made for betting on a turnaround.

JinkoSolar’s Financial Performance and Strategic Expansion Highlights

Before getting into how the U.S. presidential election could impact trade policy and clean energy incentives, a brief look at JinkoSolar’s recent fundamentals, performance, and financials will help set the stage for how these policies might affect the company’s path forward.

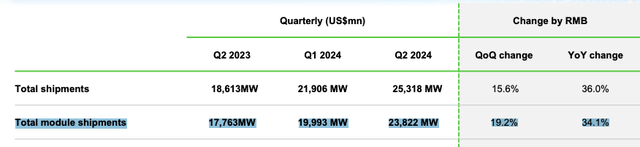

JKS Q2 2024 EARNINGS Power Point Presentation

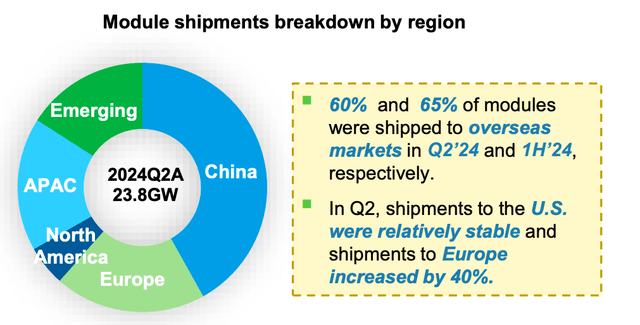

With that said, the most recent financials published by JinkoSolar hint at growth: module shipments for Q2 2024 were up 34.1% year-over-year at 23.8 GW— the industry leader —with a global footprint of more than 260 GW shipped to almost 200 countries.

Projected Sales for 2024

The company projects strong sales for 2024 in the near term, with more than 80% of its capacity already contracted. More broadly, management said demand is climbing in the US, Europe, China, and emerging markets as JinkoSolar continues to maintain technological leadership in the space: N-type cell utilization rate approached 100%, which means that the company has almost fully utilized its production capacity for these next-generation solar cells.

Efficiency Gains and Market Dominance

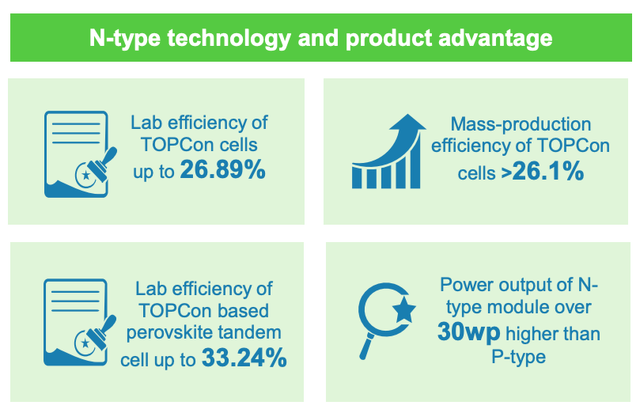

High-efficiency N-type cells like the TOPCon variety that JinkoSolar manufactures are known for their durability and are marginally more efficient than older types such as PERC cells (Passivated Emitter and Rear Contact): N-type cells are around 5-6% more efficient than PERC cells and deliver up to 4% more energy output.

JKS Q2 2024 Power Point Presentation

Furthermore, the company has improved its efficiency, reaching 33.24% for its N-type TOPCon perovskite tandem solar cell, slightly up from 32.33% last year. Its mass-produced 182 TOPCon cells have surpassed 26.1% efficiency and JinkoSolar expects its TOPCon technology to dominate with 90% market share in 2024 and fully saturate the market by 2025.

Meanwhile, in a further localization move, JinkoSolar has signed an agreement to establish a 10 gigawatts (GW) solar cell factory in Saudi Arabia. Since Saudi Arabia encourages local production, JinkoSolar may be able to charge higher prices for these solar products. The plant is expected to begin operations in 2026 and sets up JinkoSolar an early mover advantage in the Middle Eastern solar market.

Global Demand and U.S. Growth

Globally, JinkoSolar’s demand is strong, with 60% of its solar shipments in Q2 going to international markets. The U.S. is a key market for them, thanks to growing demand for electricity (especially due to AI-related needs) and government support through the Inflation Reduction Act (IRA), which promotes renewable energy growth — more on this below.

JKS Q2 2024 EARNINGS Power Point

Notably, its shipments to Europe jumped by 40%, further highlighting JinkoSolar’s growing global footprint. It also ranked first in the PV Module Reliability Scorecard for the 10th consecutive year. Moreover, it was accorded the highest rating of AAA in PV Tech’s Q2 2024 ModuleTech Bankability Report, signifying its impeccable quality and reliability.

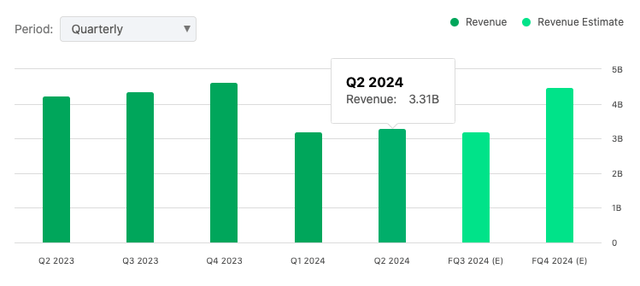

Revenue Growth and Investor Rewards

JinkoSolar reported that revenue increased 4.4% in Q2 2024 (but down from 2023), to $3.3 billion. JinkoSolar also tightened its operational belts, reducing days of accounts receivable to 89 and cutting inventory turnover to 82.

To reward investors, JinkoSolar declared a $1.50 per share dividend and repurchased 5.6 million shares, valued at $130 million. Looking ahead, they plan to significantly expand production by the end of 2024, targeting 195 GW of mono wafers (basic building blocks used to make solar cells) and 130 GW of solar modules (the actual panels that generate electricity)

The 2024 U.S. Presidential Election’s Potential Impact on JinkoSolar’s Future

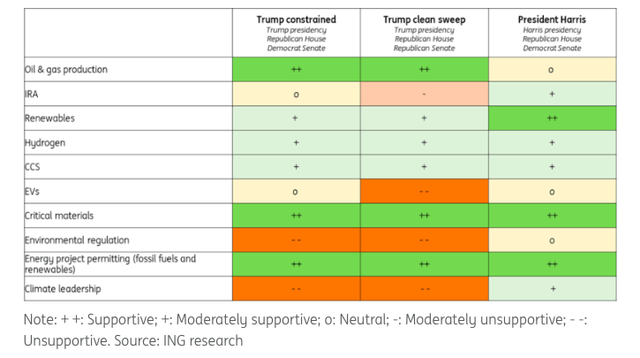

Given the divergent energy policies of Kamala Harris and Donald Trump, the 2024 U.S. presidential election could make an enormous difference to JinkoSolar’s business.

How the US election could impact the energy transition (ING)

Pro-Clean Energy Agenda: Harris’s Potential Boost to Solar

It seems reasonable to say that a win for Harris in 2024 would also bring a massive windfall for JinkoSolar and other solar companies, as her policies will likely continue the Biden administration’s ultra-aggressive pro-clean energy agenda.

As President, [Harris] will unite Americans to tackle the climate crisis as she builds on this historic work, advances environmental justice, protects public lands and public health, increases resilience to climate disasters, lowers household energy costs, creates millions of new jobs and continues to hold polluters accountable to secure clean air and water for all. – Carbon Brief.

This agenda is on full display in the Inflation Reduction Act (“IRA”), which has already become a game-changer for renewables everywhere. The IRA has turbocharged the solar industry through billions of dollars in tax credits, subsidies, and other incentives aimed at scaling up clean energy projects and domestic manufacturing of solar components.

The Inflation Reduction Act lit a fire under clean energy, pulling in over $265 billion in new projects. More than 330,000 jobs popped up in clean energy fields nationwide. Furthermore, the U.S. Department of the Treasury released new data earlier last month on American consumer energy savings under the IRA and reported that, in 2023, 3.4 million American families saved $8.4 billion on clean energy and energy efficiency investments.

Solar deployment, in particular, has surged — capacity jumped from 7 gigawatts before the IRA to 125 gigawatts by 2023. Naturally, this rise in capacity benefits solar manufacturers like JinkoSolar. It opens up new opportunities to expand their operations and market share in the U.S. market and the law’s incentives make it more financially viable for companies to build or purchase solar technology domestically, reducing reliance on imports.

Harris has long been a champion of clean energy, and she’s likely to push for further expansion of the IRA’s rules. If she wins the election, her administration could potentially introduce additional tax credits or subsidies that continue to make the U.S. an attractive market for solar companies. This, combined with efforts to protect domestic manufacturers from predatory trade tactics—such as imposing higher tariffs on Chinese solar imports—creates a more favorable landscape for companies like JinkoSolar, which are vying to increase their presence in the U.S.

And if you’re wondering how a “Chinese-based” solar company like JinkoSolar mitigates the impact of tariffs on Chinese solar imports, it has a significant manufacturing presence in the U.S., specifically in my home state of Florida in Jacksonville (which opened in 2019 and produces solar panels). This plant produces about 400 megawatts of solar panels annually and employs several hundred workers.

Simply put, any further increases in these tariffs could make it more costly for companies like JinkoSolar to import components from their Asian factories; however, with its U.S. production facility, JinkoSolar can benefit from tariff exemptions and qualify for tax incentives like those provided by the IRA.

Trump’s Uncertain Stance on Solar and Clean Energy

If Donald Trump is a victor in 2024, things could get shaky for solar companies. He’s said he’s a “fan” of solar, but he doesn’t seem to be a fan of clean energy in general – or of energy policy beyond pushing old-school fuels to burn, like oil and natural gas.

Solar energy has not been part of Donald Trump’s stump speech or stump tweets. Experts like Sanjay Patnaik from the Brookings Institution are surprised because Trump hasn’t clearly outlined his stance on solar power, making it difficult to predict what he might do.

Trump’s campaign platform, which is called Agenda47, mentions cuts to subsidies (which could include solar), but there are no specifics about limiting solar energy development in the U.S. But wind is criticized several times.

Meanwhile, another document worth mentioning since it has been a repetitive talking point of the Harris campaign — dubbed Project 2025 and authored by the Heritage Foundation — advocates deep slashes in renewables programs, including those for solar. Even though Trump hasn’t directly supported this plan and has repeatedly disavowed it to the press, Politico insists that it’s similar to what he proposed in his previous term, when he tried to cut funding for renewable energy projects.

During Trump’s presidency, support for solar and clean energy programs slowed down a lot. The Department of Energy’s Loan Programs Office (LPO), which funds big energy projects like solar farms, became much less active. Not many new loans got approved. In fact, his administration even considered shutting it down because they didn’t think the government should be picking which energy projects to fund.

Most of the loans that did go through were for nuclear energy or fossil fuel projects. So while some things moved forward, clean energy, especially solar, took a back seat.

Energy expert Nick Loris (VP at conservative energy firm C3 Solutions) says Trump’s policies on solar are a mixed bag. Corporate tax cuts and easier permits might help, but getting rid of tax credits for clean energy could hurt solar projects.

One thing Trump and Biden agree on is tariffs on solar imports. Trump expanded these tariffs, which helped American manufacturers, but also slowed solar growth. Biden’s administration kept some of these tariffs but focuses more on cutting emissions, which doesn’t always line up with tariffs that slow solar down. Trump, meanwhile, plans to exit the Paris climate agreement, where the U.S. promised to cut emissions.

Some Republican lawmakers might push Trump to keep solar investments as it’s been a big win for rural areas, and the IRA, overall, boosted solar energy. If Trump repeals these, it could hit the solar industry hard.

Other Risks & Headwinds for JinkoSolar

Despite the sequential revenue growth, total revenue took a big hit, dropping 21% year-over-year, mostly due to lower solar module prices. This led to a drop in gross margin, which slid to 11.1% in Q2 2024, down from 15.6% last year. The solar industry’s facing oversupply and price pressure. Pricing recovery is slow, with only slight improvements expected in Q3 and Q4 2024. Some module prices might stabilize as capacity limits kick in, and weaker players leave the market.

Operating expenses jumped 24% from last quarter and 18% from last year, mainly due to a fire write-off in Shanxi. Total expenses hit 16% of revenue, up from 11% in Q2 2023. This pressure led to a $13.9 million net loss for shareholders, despite positive adjusted net income.

JinkoSolar’s cash took a hit, dropping from $2.4 billion in Q1 to $1.91 billion in Q2. Meanwhile, total debt rose to $3.86 billion, up from $3.66 billion last quarter. Net debt spiked to $1.95 billion, increasing financial leverage. The company cut its 2024 CapEx to RMB9 billion, focusing on key projects like the Saudi Arabia facility, which may limit future expansion.

And lastly, adding to these challenges, JinkoSolar is dealing with falling supply chain prices, some dropping below cash cost. This caused lower utilization rates across the industry. The fire in Shanxi made things worse, leading to big equipment write-offs that hurt the quarter’s results.

JKS Rating

I’m going to start my coverage of JKS here with a ‘Hold’ rating. The company is in a growing renewable energy market, has strong production capacity and technological improvements, yet the company’s earnings have declined, its stock price has fallen, and the solar industry is still strongly influenced by government subsidies and policies. The big (red) elephant in the room, like the upcoming US election, can significantly add to the risk in the industry. While the valuation is quite low, the company’s continued profitability challenges and uncertain industry dynamics leave me unwilling to recommend a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.