Summary:

- The company announced restructuring actions that will result in approximately 6,000 job cuts and aim to achieve annual pre-tax savings of $700 million to $900 million.

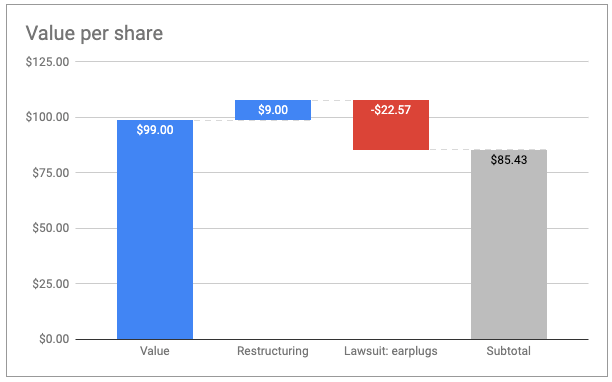

- The potential benefits of the restructuring could add $7 to $22 per share.

- The potential liability from the earplugs litigation could be anywhere from $6 billion to $25 billion with an expected value of $22 per share.

- The new fair value of $85 per share does not include any premium the market may assign to the spin-off of the healthcare unit.

Andrii Yalanskyi

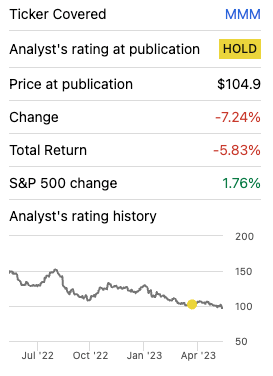

In my last article, I valued 3M (NYSE:MMM) shares at $99 and recommended staying away till we have more details on the risks regarding the litigations. Since then, the stock price has declined below my target valuation.

Seeking Alpha

Since that article, the company has released Q1 2023 earnings and announced restructuring ahead of the healthcare spinout. In this article, I will briefly summarize the earning release, double-click on the restructuring and refresh the valuation.

Q1 earnings

On April 25, 3M released its earnings report for the first quarter of 2023. Revenues decreased by 9.7% and EPS decreased by 25.7%, however, the decrease was lower than the street expectation. While the figures showed a decline of 9.7% in revenue, the adjusted organic sales decline was 5.6%, of which approximately 60% was attributed to the decrease in disposable respirator demand and the exit of Russia in 2022.

Also, 3M announced restructuring actions. These actions will impact all functions, businesses, and geographies, resulting in approximately 6,000 global job cuts. In addition to the reduction of 2,500 global manufacturing roles announced earlier in January 2023, the restructuring aims to achieve annual pre-tax savings of $700 million to $900 million. Besides laying off employees, management is expecting to reduce costs, simplify supply chain structures, and streamline go-to-market business models. They expect these initiatives to lead to improved margins and cash flow.

Despite the challenges, 3M remains confident in its full-year outlook for 2023. The company affirms its expectations, which include adjusted total sales growth ranging from -6% to -2%, reflecting adjusted organic sales growth between -3% and flat. Additionally, 3M projects adjusted earnings per share between $8.50 and $9.00, compared to the consensus estimate of $8.61. The company also anticipates an adjusted operating cash flow of $5.8 to $6.3 billion, contributing to a 90% to 100% conversion rate of adjusted free cash flow.

Valuation

Based on my assessment of the restructuring actions, ongoing earplug lawsuits, and Q1 earnings results, I maintain my original valuation of $99 per share for the existing business, as detailed in my previous article. However, I recognize that the risk posed by the PFAS and earplug litigations may have been underestimated in the 7.8% cost of capital. As a result, I will refine the liability associated with the earplug lawsuits.

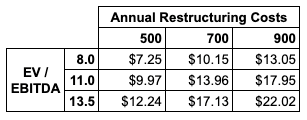

But first, let’s dive into the potential benefits of the restructuring. This initiative could add significant value to the company, ranging from $7 to $22 per share. However, the most likely scenario suggests a benefit of around $9 per share. While 3M anticipates annual savings of $700 to $900 million from the restructuring, I conservatively estimate that the actual savings might amount to $500 million.

Author estimates

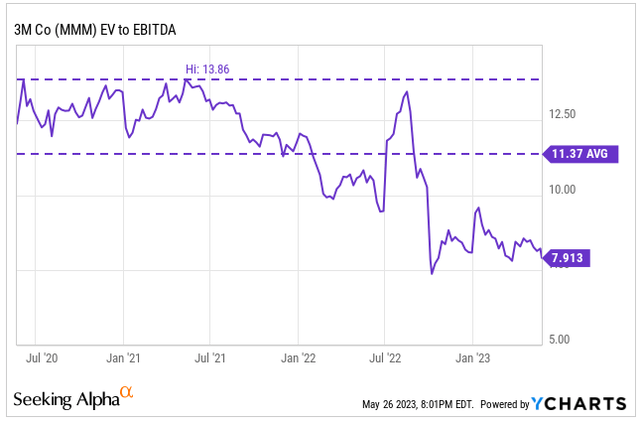

To incorporate these potential savings into my valuation, I have applied multiples of EV/EBITDA. I considered three scenarios: 8x (based on the current multiple), 11x (slightly lower than the three-year average), and 13.5x (close to the highest multiple achieved in the last three years).

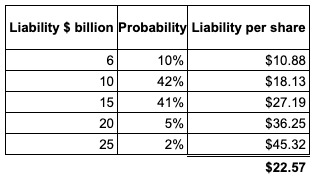

Now, let’s delve into the potential liability of the earplug litigation. The estimated liability for 3M in this regard ranges from $6 billion to $25 billion. However, I believe the most likely liability falls within the range of $10 billion to $15 billion.

To incorporate this potential liability into my valuation, I have employed a probability-weighted approach arriving at a value of $22.57 per share.

Author estimates

Taking into account the restructuring and the earplug litigation, the fair value decreases to $85 per share.

Author estimates

This valuation does not take into account the spin-off of the healthcare unit. Theoretically, the summation of the healthcare unit and the rest of 3M should be $99 per share as the spin-off does not add value or create incremental cashflows, in fact, there could be some dis-energies as a new back office and support functions need to be created for the healthcare unit.

Having said that, the market may assign a premium to the spin-off unit as the separation could enable the healthcare business to focus specifically on key areas such as wound care, healthcare IT, oral care, and biopharma filtration. By separating the healthcare business, 3M aims to create a more focused approach for each unit, allowing them to sharpen their strategies and enhance their competitiveness. The spinoff is anticipated to be finalized by the end of 2023. As part of the spinoff, 3M will retain a 19.9% ownership stake in the healthcare company. Over time, there is a possibility that this stake may be divested.

Conclusion

Although the stock price of 3M has declined below my valuation of $99 per share, taking into account the Q1 earnings, restructuring, and potential liability from earplug litigations, the fair value decreases to $85 per share. However, it’s important to note that this valuation does not consider any potential upside if the market assigns a premium to the spinoff unit. Therefore, I recommend staying on the sidelines for now and monitoring the developments, as further details and market reactions may provide a clearer picture.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.