Summary:

- I warned investors about PayPal’s high valuation in 2021, then bought it at a good price in December 2023, yielding a 44% return.

- Using a 12% earnings growth rate and a 4.33% earnings yield, PayPal’s Time Until Payback (TUP) is 11 years, better than the S&P 500’s 14 years.

- I rate PayPal as neutral (Hold) today, with a buy price around $77 per share, assuming earnings expectations remain consistent.

- For new investments, wait for a lower stock price or favorable earnings forecast; PayPal’s niche is solid but needs improvement to compete effectively.

franckreporter

Introduction

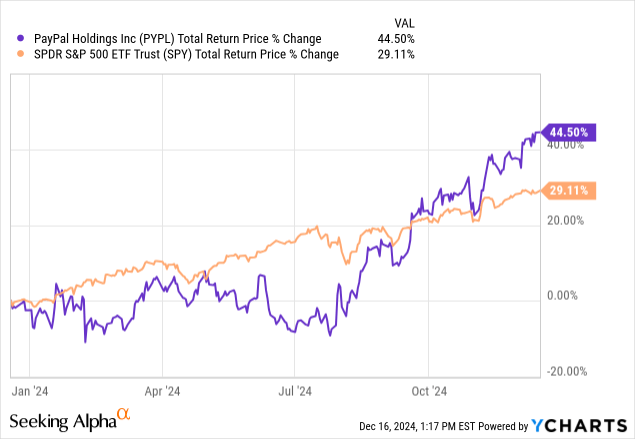

One of the most rewarding and satisfying parts of doing what I do for a living is when I can both warn investors about the downside risks of a stock before it falls deeply, then eventually buy the stock at a good price and get great returns afterward. And since I only write “Buy” articles on stocks I’ve actually purchased myself, I get an extra reward when the ideas I write about perform well. PayPal Holdings, Inc. (NASDAQ:PYPL) is one such stock. After warning investors about the high valuation on my YouTube channel back in January 2021, then writing four “Neutral” articles on Seeking Alpha as the stock price was falling, I was eventually able to buy the stock at a good price in December of last year and write the “Buy” article “I Was Bearish On PayPal, But After A 77% Decline Now I’m Buying“. I haven’t covered PayPal during the past year since buying the stock, so now seemed like a good time to write and update. Here is how the stock has performed since my buy article on 12/19/23:

It took some time for PayPal to form a bottom, but now the stock has returned 44% in a year and significantly outperformed an S&P 500 dominated by AI stocks.

In this article, I will reevaluate PayPal’s earnings potential to see how long it would take an investor to earn back their initial investment if they bought today via PayPal’s earnings. In other words, I want to know if an investor purchased PayPal’s business for $100 today, how long it would take for the business to produce $100 in cumulative earnings. I call this metric “Time Until Payback”, or “TUP”, for short.

PayPal’s Time Until Payback

To perform this calculation, we need two metrics. First, we require the earnings yield, and next, we need the average long-term earnings growth rate expectation. Once we have those, estimating the Time Until Payback is mostly just math. However, some additional decision-making is required when calculating both the earnings yield and earnings growth rate. This includes whether to use trailing for future earnings, whether to use adjusted or basic earnings numbers, and whether to use historical earnings trends or to use recent or forecasted earnings trends to arrive at an earnings growth rate expectation.

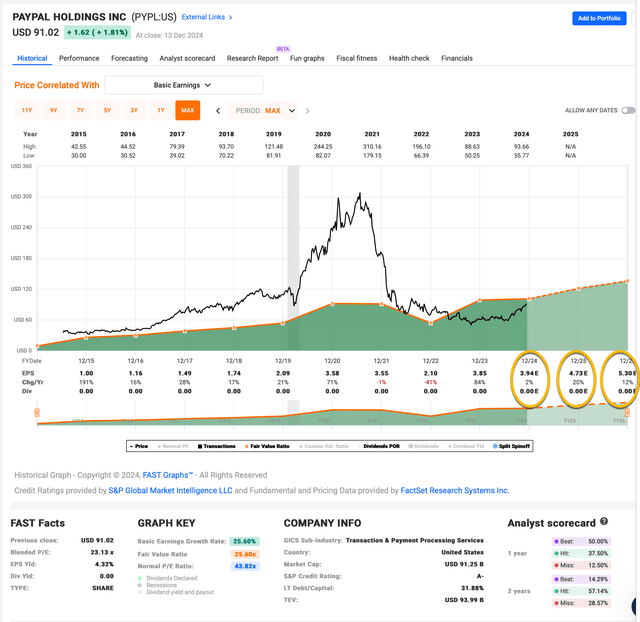

When I bought PayPal stock last year I used Forward Basic Earnings from FAST Graphs, and I assumed PayPal could grow those at an average 12% rate for the next 10 years. At the time, 2023 EPS was expected to be $3.75 per share. If last year we had forecast that 12% per year earnings growth rate for 3 years we would get $4.20 in 2024, $4.70 in 2025, and $5.27 in 2026.

FAST Graphs

The Basic EPS expectations for PayPal are circled in yellow in the FAST Graph above. While this year’s earnings are expected to come in a little short of the 12% growth level, expectations for 2025 and 2026 are currently spot on target with $4.73 expected in 2025 and $5.30 per share expected in 2026. Given that this investment is working out well so far, and expectations remain in-line with my previous assumption, I’m going to stick with a 12% basic earnings growth rate going forward for PayPal for today’s Time Until Payback valuation.

Next, we need the earnings yield. For that, I will use the $3.94 they are expected to earn this year and the $91.02 the stock price trades at as I write this article. The earnings yield is simply the P/E ratio inverted, so we put the Earnings over the Price (E/P), and express it as a percentage. In this case, the numbers for this year work out to an earnings yield of +4.33% at the current price. Now we just need to calculate how much in earnings we could collect over time if we owned the business.

The way I think about this is that if I bought the whole company for $100, then a 4.33% earnings yield means the company would earn $4.33 on that $100 in the first year of ownership, plus 12% growth, or $4.85. The next year, earnings could be expected to grow +12% again, so the $4.85 of earnings would grow to $5.43, for a total of $10.28 collected after two years. I want to know how many years it would take to earn my initial $100 investment back using this estimation process. I posted a table below to show the progression.

| Year | Earnings On $100 | Cumulative Earnings |

| 1 | $4.85 | $4.85 |

| 2 | $5.43 | $10.28 |

| 3 | $6.08 | $16.36 |

| 4 | $6.81 | $23.17 |

| 5 | $7.63 | $30.80 |

| 6 | $8.54 | $39.34 |

| 7 | $9.57 | $48.91 |

| 8 | $10.72 | $59.63 |

| 9 | $12.00 | $71.63 |

| 10 | $13.44 | $85.07 |

| 11 | $15.06 | $100.13 |

| TUP = 11 Years |

Using these assumptions, it will take PayPal about 11 years to earn an amount equal to the initial investment at today’s price. Each investor must decide for themselves the amount of time they feel comfortable with before buying any stock, of course. But on a relative basis, compared with the average stock in the S&P 500, which I estimate has a 14-year TUP right now, PayPal remains a good relative value at today’s price. Personally, unless we are dealing with a really fast-growing business with earnings growing over 20% per year, I prefer to have a TUP of 10 years or less when I buy a stock. For example, when I bought PayPal last year at this time, the TUP was about 10 years. So, I’m going to give PayPal a neutral (or Hold) rating today, with the caveat that it’s still cheaper than most stocks in the S&P 500 as long as PayPal can grow earnings as expected.

The price at which PayPal would become a buy, assuming the earnings expectations remain the same, would be about $77 per share. After their next earnings report, assuming future expectations are similar to what they are now, when I start using 2025 earnings as a base, that buy price will likely rise a fair amount. Perhaps I’ll write an update when that happens. Until then, the $77 level is a good entry point for the stock.

Conclusion

As with any investment, where the fundamentals take a decade to break even, there are risks. When I’m making retail transactions, for example, I almost always use Apple Pay, rather than PayPal. I don’t even need my phone to do so and can simply pay with my Apple Watch. This is extremely convenient, and it’s hard for me to envision ever using one of PayPal’s products for this. That said, as someone whose business operates online, I do regularly use PayPal for more business oriented transactions. And though I rarely use Venmo, most younger people use it regularly, and the majority of the population doesn’t use Apple products at all. So, I think PayPal has a solid niche, and it functions relatively well. I do think they are going to need to improve over time in order to compete and grow their business at a faster rate from here. Ultimately, it’s up to management to work on that challenge. As an investor, my job is to find businesses in which to invest where the risk/reward is in my favor and the numbers look good while making reasonable assumptions. That’s the approach I took with PayPal when I thought it was overvalued in 2021 and most of the risk was to downside, and that’s what I did when I bought the stock last year when the reward was more strongly to the upside.

When we invest, I think it helps to simply admit that we can’t know all the information we would prefer to know before investing. So, we need to develop methods that tilt the odds in our favor. Getting the Time Until Payback, using reasonable assumptions, down to an acceptable time, is a good tool to help avoid some of the biggest mistakes. The TUP is better at today’s price than most of the rest of the market, but for new money, I would wait for a lower stock price or a good forecast after the next earnings report before buying.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you have found my strategies interesting, useful, or profitable, consider supporting my continued research by joining the Cyclical Investor’s Club. It’s only $400/year, and it’s where I share my latest research and exclusive small-and-midcap ideas. Two-week trials are free.