Summary:

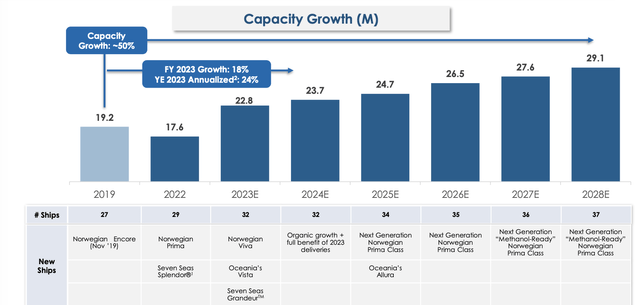

- The company is expected to add seven more ships to its fleet by 2028, increasing its capacity by 19,000 berths, a 26.7% increase.

- The company expects net per diem and net yield to continue to grow by 9-10.5% and 5-6.5%, respectively in 2023, driven by strong demand.

- Despite inflationary pressures, the company has shown that it can still achieve growth and maintain profitability.

piola666

Investment Thesis

Did you know that starting in 2024, you can purchase fully furnished residences on a cruise ship? According to CNN, a company called “Storylines” is set to launch its upcoming ship with one- to four-bedroom residences, studios, and two-story penthouses, with prices ranging from $400,000 to $8 million on a 12- and 24-year lease. This trend of offering residences on cruise ships is a sign of how the industry is changing and evolving. Today, modern cruise ships can carry up to 6,000 passengers and 2,000 crew members, almost three times the capacity of the Titanic. Norwegian’s latest Oceania Vista line offers rooms up to $42,000 for a 1,000 square foot space for 20 days. It had seven more ships to come. Inflation? Maybe.

Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH), once the pandemic loser, now returns. The company just reported its Q1 2023 earnings, exceeding expectations across all key metrics, indicating its resilience and strong demand for its services. Despite inflationary pressures, the company has shown that it can still achieve growth and maintain profitability. Norwegian Cruise Line has the opportunity to further cut operational expenses while also boosting revenue, which might result in better margins. We believe that its stock has more room to run.

Company Profile

The company operates three brands with a fleet of 28 ships, offering innovative and contemporary ships, upscale experiences, and luxury voyages, to over 490 destinations worldwide, with a commitment to exceptional service and immersive experiences for guests.

Key Takeaways from Q1 2023 Earnings:

- The company met or exceeded guidance for all key metrics in the first quarter.

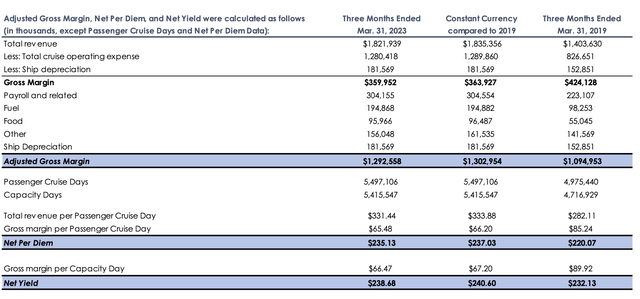

- Demand for its services is still strong. Net per diem and net yield sequentially improved from last quarter to surpass the 2018 level and were expected to grow by 9–10.5% and 5–6.5%, respectively, in 2023.

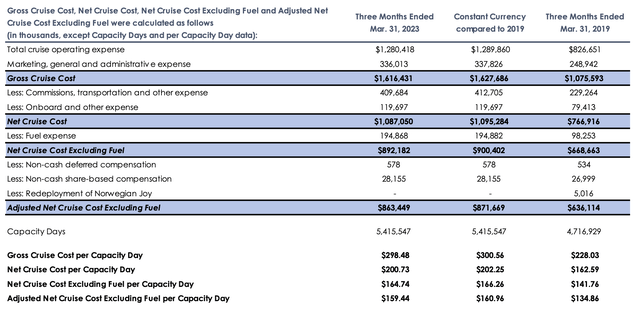

- The company continued to optimize its operating costs. Adjusted net cruise costs excluding fuel per capacity day were expected to decrease to $159 in 2023 from $186 in 2022.

Growth Drivers

New ships to increase revenue streams

The company had 30 ships in its fleet and expected to add seven more by 2028. This will add an additional 19,000 berths, a 26.7% increase.

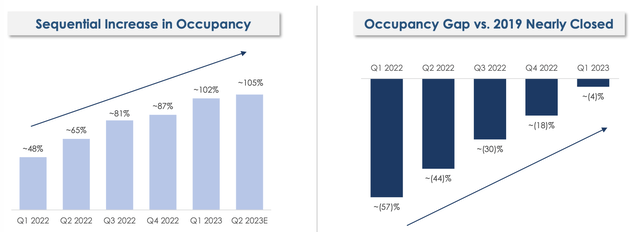

The new capacity can potentially increase the company’s revenues. Its occupancy rate improved sequentially to 101.5% and is expected to increase to 103% by the end of 2023.

Valuation multiple expansion due to improved margins

The company is working on a couple of initiatives to improve margins. One of them is to target upmarket consumers. Take the company’s new ship Oceania Cruise, for example, it offers a range of complimentary services and amenities, including free roundtrip business class air on intercontinental flights, unlimited shore excursions and beverages, pre-paid gratuities, and specialty restaurants. Higher-tier accommodations also include additional perks.

According to the company’s website, its price can range from $899 to $57,000 per person. This can improve margins by increasing the average revenue per guest, and leveraging labor costs. Another initiative is to increase advance ticket sales. According to the company, its advance ticket sales were up 60 percent in Q1 2023 compared to Q1 2019.

We believe that the advance sale may be a strategy for the company to manage inflation. If consumers feel that the rate of inflation will continue to climb, they would probably like to reserve it in advance. This will increase the net yield for the company.

The company can change the price for a future advance sale to account for unanticipated inflation surprises, even if the inflation rate increases more than the price increase included in the advance sale ticket. After all, the pace of inflation is probably going to decrease over time. Therefore, when inflation weakens, the company stands to gain.

Demand operating metrics (NCLH)

The company has increased its net yield and net per diem over time, and the metrics exceeded the 2019 level as well, reaching a record high. This suggests the company has strong pricing power with customers. We think the ongoing increase is likely. Its margins may rise as a result of an increase in net yield or net per diem. Its valuation multiple might rise as a result of this.

SG&A leverage offset by inflation pressure

During the quarter, the company reduced operating costs thanks to improvements in the supply chain, back-office efficiency, crew costs, and travel costs. Its adjusted net cruise expenses, excluding fuel, per capacity day, were forecast to remain unchanged by the end of 2023 despite improving year over year.

This showed that the inflationary pressure was outweighing the cost-cutting efforts. Moreover, despite a sequential improvement to 103.5%, the occupancy rate was still below where it was in 2019. The company’s efforts to convert double occupancy cabins to studio cabins in order to serve high end consumers are partially to blame. This can also put some pressure on the occupancy rate. Although the business continues to reduce costs overall, given the ongoing inflation in the service sector, it is likely that going forward, the margin improvement from SG&A leverage can be less significant than the top line contribution.

Cost operating metrics (NCLH) Occupancy rate (NCLH)

Risks

Leverage risk

While the company had made progress in its recovery, it was not completely out of the woods yet. In 2022, the company experienced a significant free cash outflow of $1.5 billion, and it is expected to generate another outflow of approximately $1.3 billion this year. Although the company has $1.9 billion in liquidity, including $701 million in cash, its financial condition remains tight. However, the recent increase in the company’s export-credit facility by 1.7 billion euros in April 2023 may provide some relief.

Overall, the company will need to continue to manage its financial resources carefully to ensure a sustainable recovery.

Valuation

The company has not implemented a significant share repurchase program. Shareholder returns will therefore be based on the company’s sales growth and the expansion of valuation multiples as a result of improved margins.

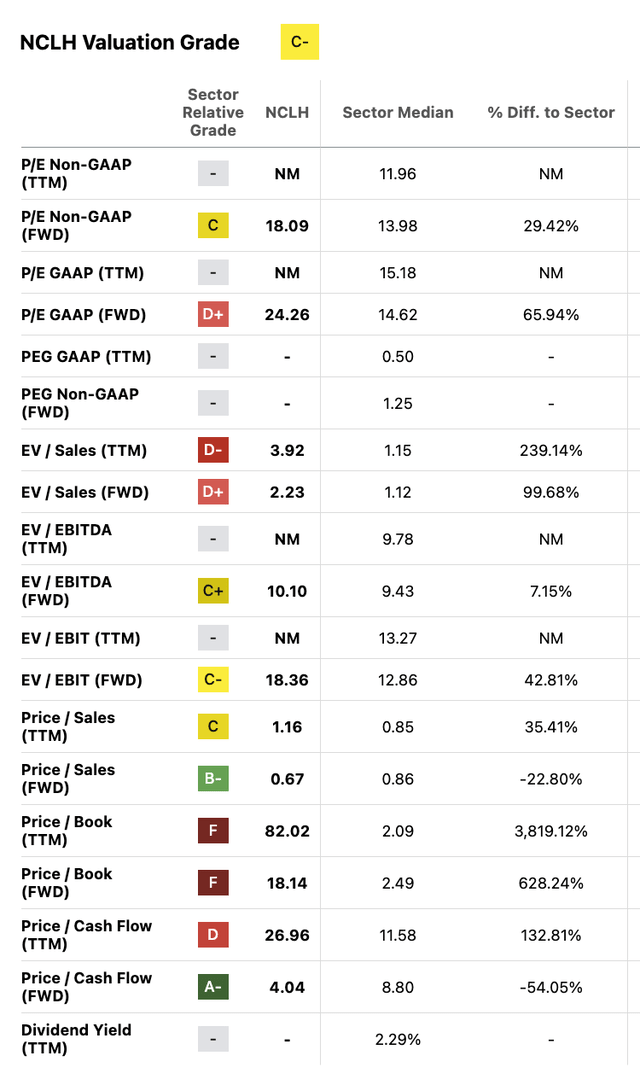

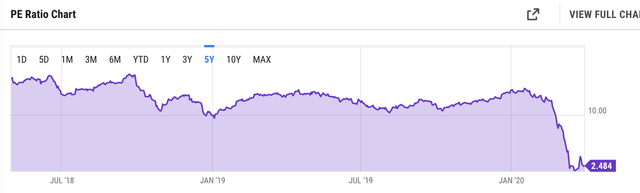

Compared to the median P/E ratio of its sector and its 5-year average, the company’s P/E ratio is notably elevated. One potential driver of the P/E ratio divergence is the company’s focus on high-end consumers and promotional advance ticket sales, which have helped to expand its margins and growth prospects.

Valuation multiple comparison (Seeking Alpha) Historical P/E ratio (YCharts)

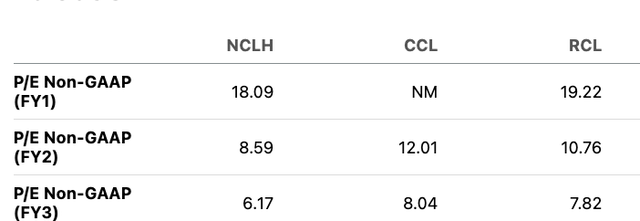

According to its earnings call, the company has secured all construction and financing contracts for its upcoming ship deliveries, covering the period from now until 2028. This gives the market clarity on its revenue path. Analysts predicted its P/E ratios for 2024 and 2025 to be 8.6x and 6.2x, respectively, slightly lower than its competitors'((Carnival Corporation & Plc (CCL), Royal Caribbean Cruises Ltd (RCL)) estimates and below its five-year historical average of 10–12x. This provides space for investors to benefit during a 1- to 2-year holding period.

Valuation multiple for peers (Seeking Alpha)

Summary

With a more leveraged capital structure than it had in the pre-pandemic period, the company returned to expansion. In an inflationary market, the company has demonstrated exceptional pricing power and high occupancy rates, positioning itself to win in the long run. The company was able to control operating expenses, opening doors for margin improvement. Its P/E ratios for 2024 and 2025 were lower than the 10–12x average over the previous five years. This gives investors room to make profits over a one- to two-year holding period.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.