Summary:

- Vale S.A. plans to invest $3.3 billion in Brazil and Canada to increase copper and nickel production.

- The company aims to expand copper production capacity to 500,000 tons by 2028, focusing on Salobo and Sossego mines in Brazil.

- Vale’s shift towards higher-cost commodities like copper and nickel is significant amid potential supply shortages and market trends.

CUHRIG

Introduction

Vale S.A. (NYSE:VALE) is making headlines again.

On June 20, Bloomberg reported the miner is looking to spend $3.3 billion on improvements at its operations in Brazil and Canada to boost copper and nickel production over the next four years.

The Brazilian mining giant sees the potential to expand production capacity to about 500,000 tons of copper by 2028 mainly through improvements to its Salobo and Sossego mines in Brazil, Vale said in its latest estimates for its base metals unit. Vale produced 321,000 tons of the wiring metal last year. Nickel also gets a capacity lift. – Bloomberg (emphasis added)

This is a big deal, as Vale is slowly but steadily increasing its footprint in higher-cost commodities compared to the lower-cost iron ore it is known for.

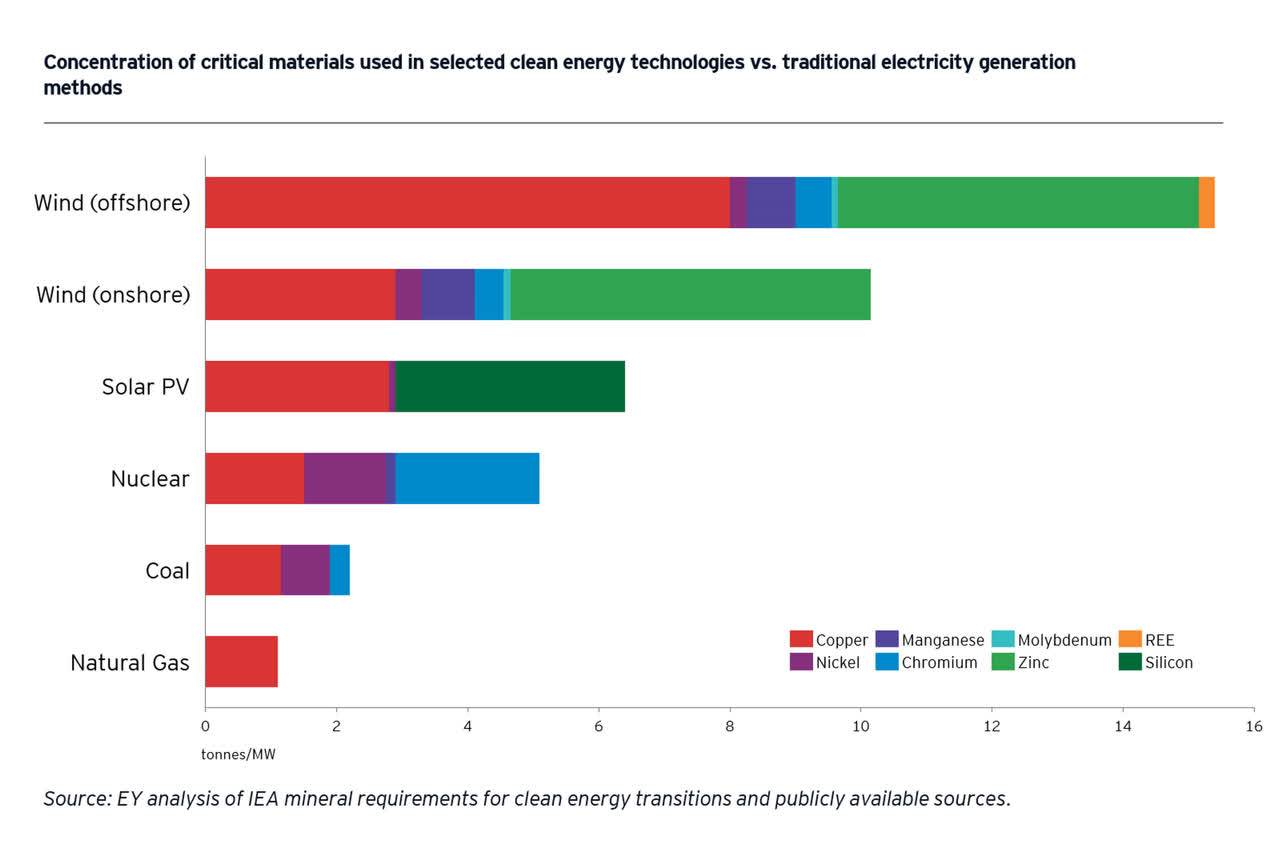

Although steel (iron ore) is a key commodity in every renewable energy technology, the best commodities to be in are copper, nickel, and even rarer commodities like manganese, molybdenum, and others.

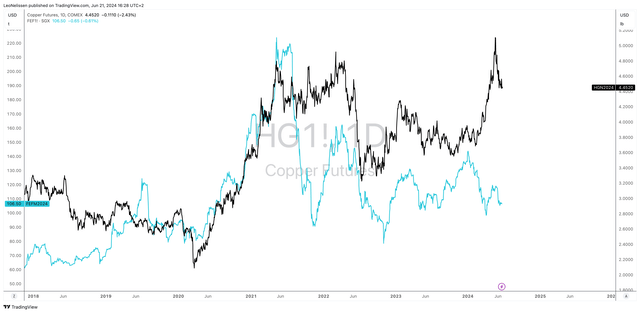

This year, we even got a massive squeeze that propelled copper futures to new highs as the market started to panic about potential supply shortages down the road.

As we can see below, COMEX copper futures climbed to $5.10 per pound in mid-May. Iron ore, however, hasn’t gone anywhere since 2021, as displayed by SGX Chinese iron ore futures in Singapore (the blue line).

TradingView (COMEX Copper, SGX Iron Ore)

The problem here is that while secular growth may be strong, cyclical growth is not supporting higher commodity prices – at least not yet.

Hence, Vale shares are down 7% since I wrote my most recent article on March 16, titled “Is Vale A Phoenix Rising From The Ashes? Decoding The Recent Slump.”

In light of the company’s poor stock price performance and investments in promising commodities, I’m using this article to update my bullish thesis.

So, let’s dive into the details!

It’s All About Production Growth And Efficiencies

Vale isn’t like most dividend (growth) stocks that I usually discuss. Vale is super cyclical and a great trading vehicle for investors looking to bet on economic cycles.

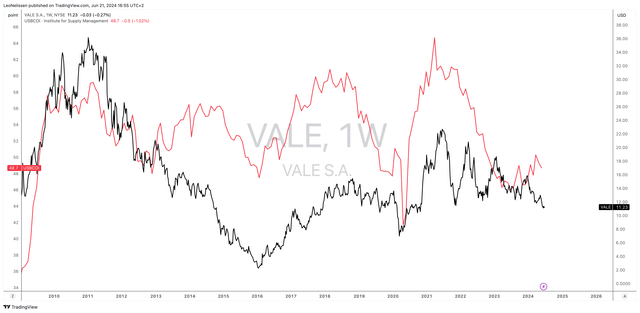

The chart below compares the VALE stock price (black line) to the leading ISM Manufacturing Index. While Vale’s stock price depends on more than just manufacturing sentiment in the U.S., it tends to be a good indicator for cyclical mining stocks.

Unfortunately, right now, Vale’s share price is telling us the worst isn’t over, as it is diverging from the recent upswing in the ISM index.

Nonetheless, Vale itself is upbeat about future demand, as it is consistently expanding its output, benefitting from iron ore prices that are still roughly 30-40% above the pre-pandemic average.

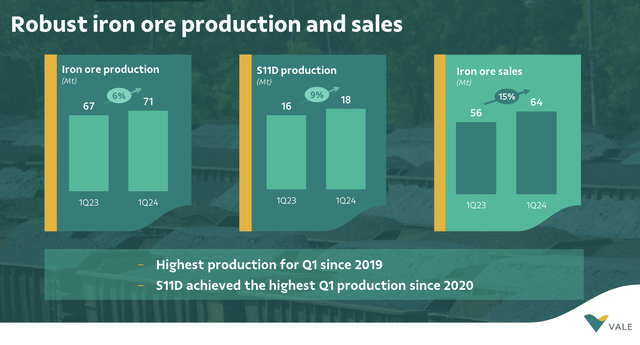

For example, in 1Q24, iron ore production reached its highest first-quarter sales since 2019, with a 15% year-over-year increase to 64 million tons.

According to Vale, its strategic focus on operational excellence and process reliability has significantly improved its production efficiency, particularly at the S11D mine, which has shown consistent performance improvements.

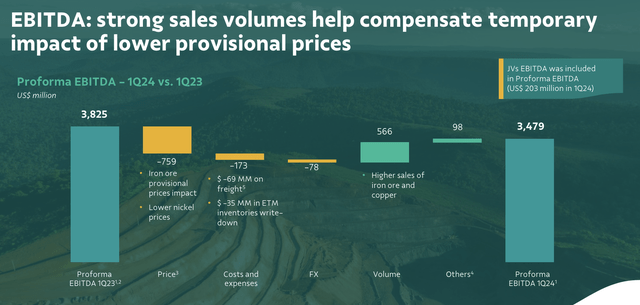

Unfortunately, commodity prices offset volume improvements, as pro forma EBITDA declined by 8%, as we can see in the overview below.

Speaking of improvements, Vale has plans to add 50 million tons of iron ore capacity by 2026 through multiple projects, including Vargem Grande, Capanema, and S11D+20.

The Vargem Grande project was almost 90% complete during the first quarter and is expected to start operations at the end of this year.

In addition to boosting iron ore production, the company is increasingly focusing on the energy transition, as I already briefly mentioned.

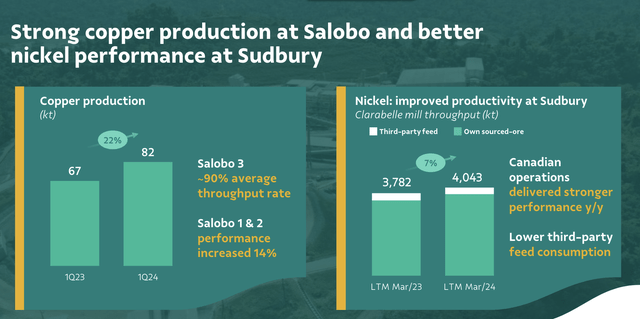

In the first quarter, the company’s copper production saw a significant 22% quarter-on-quarter increase, which was driven by the successful ramp-ups at the aforementioned Salobo III plant and improved performance at the Salobo I and II plants.

Even last year, commentators were very upbeat about these Salobo expansion plans:

The operation expansion comes at a time when miners are scrambling to either acquire copper reserves or boost production amid forecasts that demand of the metal will outstrip primary supply within the next four years. The mismatch in supply and demand is likely to result in copper prices surging 20% by 2027, according to BloombergNEF analysts. – Mining.com

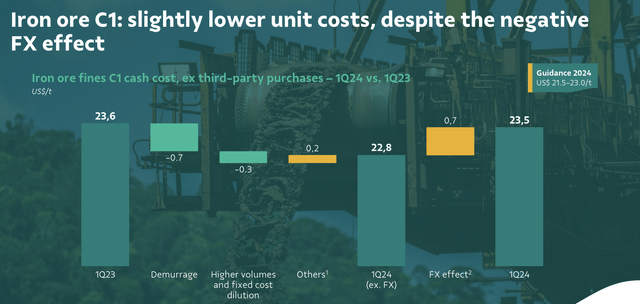

In general, the company performs quite well in this environment, as it is consistently improving operating efficiencies, with first-quarter C1 cash costs of $23.5 per ton of iron ore. That number could have been $22.8 if it weren’t for unfavorable currency translations.

This improvement in efficiency was attributed to lower demurrage costs (fees related to shipping), improved shipping and port loading, and higher fixed-cost dilution due to increased production volumes.

In other words, investments in growth are paying off, as it can now produce more units of commodities per unit of production expenses.

On top of that, the company’s strategy of buying iron ore from smaller producers and blending it with their own production helps in diluting fixed costs and maximizing returns.

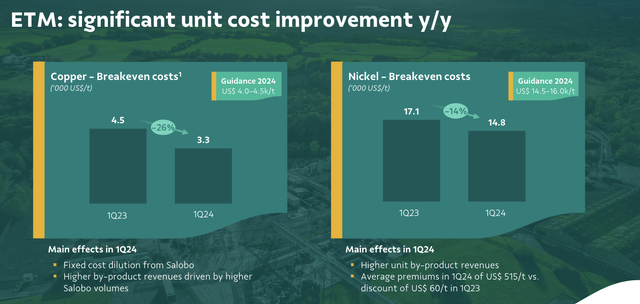

It also lowered breakeven costs for copper and nickel by 26% and 14%, respectively, mainly supported by fixed-cost dilution, which I expect to continue.

So, what does this mean for shareholders?

Shareholder Value

In 1Q24, VALE achieved $2.0 billion in free cash flow. $1.8 billion of this was used to reward shareholders.

On March 11, the company paid a $0.4419 per share semi-annual dividend, which translates to an annualized yield of roughly 10%.

However, this needs to be taken with a grain of salt, as VALE’s dividends are highly volatile and subject to free cash flow.

While we can assume that higher free cash flow will translate to juicy dividends, management is unwilling to commit to anything regarding payout ratios and special dividends.

This is what the company said during its 1Q24 earnings call. I added emphasis.

[…] market conditions have improved lately, which give us some good expectations of potential cash generation through year-end but we also compare those vis-a-vis where we are on the leverage ratio, minimum cash, provisions and outflows. So I think it’s early, and we think it’s early to point out to potential incremental dividends, but we will certainly assess that through year-end. And if there’s any opportunity, we will certainly consider with our Board as we always do, right, and we’ve been doing this consistently over the last several years. – VALE 1Q24 Earnings Call

The good news is that debt shouldn’t be an issue, as the company is expected to end this year with $12.3 billion in net debt, roughly 0.7x expected EBITDA.

Speaking of expectations, using FactSet data in the chart below, we’re in no man’s land, as analysts expect annual EPS to remain in the $2.10 range through at least 2026. This makes sense, as analysts tend to refrain from taking a directional view. They often straight-line current conditions.

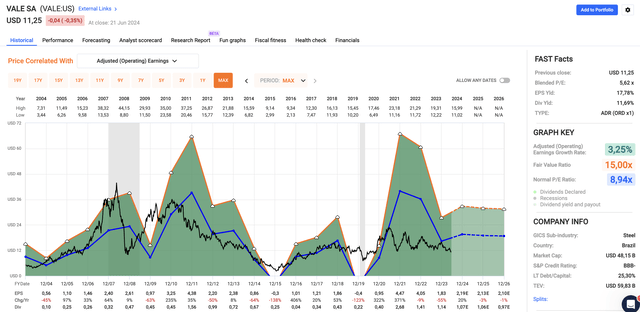

That said, even in this market, VALE is very cheap, as it trades at a blended P/E ratio of just 5.6x, well below its long-term normalized P/E ratio of 8.9x.

A return to 8.9x earnings would indicate a fair stock price of $18.80, 66% above the current price. The current consensus price target is $16.00.

The problem is confidence.

In this environment, investors are simply not willing to jump into iron ore. They are unsure what Chinese demand will look like in the months ahead and if we could see a cyclical growth recovery in Europe and the U.S.

If we get to see a growth recovery, I believe we will see a rapid increase in iron ore futures and a VALE stock price surge well above $20.

And, although growth expectations are weak, VALE’s stock price has incorporated a lot of weakness, which is why I stick to a Buy rating, as I expect a bottom in the $9-$11 area.

The only reason why I do not own VALE is my focus on mining machinery producers like Caterpillar (CAT) that come with consistent dividend growth instead of special dividends and less commodity price risk.

VALE is great for dividend investors looking for cyclical exposure with tremendous upside. However, conservative investors should be very careful here, as VALE is highly volatile.

Takeaway

Vale is gearing up for significant growth by investing $3.3 billion to boost its copper and nickel production, aiming for a capacity of 500,000 tons of copper by 2028.

Despite recent stock price struggles and volatile commodity markets, Vale’s strategic focus on operational efficiency and expansion in higher-cost commodities like copper and nickel sets it apart from its iron ore roots.

With solid free cash flow and a promising future, I maintain a bullish outlook on VALE.

However, while it’s a great opportunity for those seeking cyclical exposure with high upside, conservative investors should tread carefully due to its volatility.

Pros & Cons

Pros:

- Growth Potential: Vale is investing $3.3 billion to significantly boost copper and nickel production, targeting 500,000 tons of copper by 2028.

- Operational Efficiency: Ongoing improvements in operational efficiencies, especially at key mines, improve production capabilities and cost management.

- Strong Free Cash Flow: In 1Q24, Vale generated $2.0 billion in free cash flow, with substantial returns to shareholders.

- Attractive Valuation: Trading at a P/E ratio of just 5.6x, VALE is undervalued compared to its historical average, suggesting significant upside potential – especially if economic growth improves.

Cons:

- Stock Volatility: Vale’s shares are highly volatile.

- Uncertain Dividends: Dividends are inconsistent. However, during strong years, dividends can be extremely high.

- Commodity Price Risks: Heavy reliance on iron ore and exposure to uncertain Chinese demand can negatively impact Vale’s financial performance.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CAT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.