Summary:

- I recognize the excitement around Rigetti Computing, Inc., but I also know that when expectations run too high, stocks become vulnerable to sell-offs.

- I believe $12 per share for RGTI stock will, in hindsight, look overvalued, making this a risky setup for investors.

- Rigetti’s cash burn and limited revenue growth suggest the company will need to raise capital soon, which could dilute shareholders.

- This setup isn’t for me, and recommend taking profits before the market forces a reality check.

- Paying 200x sales is too rich for me.

Peter Hansen

Investment Thesis

Rigetti Computing, Inc. (NASDAQ:RGTI) is a soaring quantum computing business. And even though I recognize that it makes no sense to be cautious in the face of a raging stock, I’m also experienced enough to know that when investors’ expectations are too high, a stock becomes primed for a sell-off.

And with RGTII, investors’ expectations are too high. Even the most ardent bull would recognize this aspect. Even in the face of the NASA contract win to one of its peers.

The only question that’s left, is who is going to walk away with cash in their pockets and who is not?

I recommend that investors call it a day here before it’s too late. Given enough time, I believe that in hindsight, $12 a share for RGTI will look to have been a high price for its stock.

Rapid Recap

More than a year ago, in September 2023, I said,

I find that paying 12x forward sales for Rigetti to be simply too high a multiple.

For a long time, that cautiousness was the right call. But little could have made me assume that a fully-fledged rally would take place more than a year later.

Previously, I assumed that its share price didn’t provide me with the right level of risk-reward. And today, I’m confident that this setup isn’t for me.

Rigetti Computing’s Near-Term Prospects

Rigetti specializes in quantum computing, leveraging superconducting qubits for high-speed operations.

Their systems are designed for hybrid computing, working with both CPUs and GPUs, in a highly scalable system.

With innovations like multi-chip architectures, Rigetti delivers high-fidelity quantum processors tailored for research and machine learning applications. By developing fast gate speeds, Rigetti aims to provide cutting-edge quantum solutions for academia and industry.

As discussed on its Q3 2024 earnings call, Rigetti’s roadmap positions it as a leader in quantum computing.

By 2025, the company plans to release a 100+ qubit system, paving the way for practical applications. Its management team’s confidence stems from its successful construction of 9-qubit chips, demonstrating scalability without performance degradation.

Yet, Rigetti also faces some challenges. For one, it must secure sufficient government funding, such as DARPA contracts, to continue its mission.

Moreover, Rigetti has strong competitors which include International Business Machines (IBM), Alphabet/Google (GOOGL) (GOOG), and IonQ (IONQ), which are also pursuing quantum operations. This is a nascent endeavor, so for now, there may be enough of a growing pie to fill every company’s need, but at the same time, we must recognize that none of its peers are pushovers.

Given this balanced background, let’s now discuss its fundamentals.

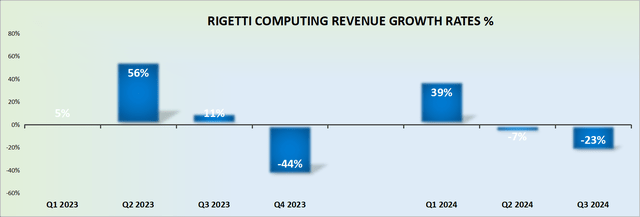

Revenue Growth Rates Are Erratic

Look at the graph above. What sort of growth rates can we expect in 2025? 10% CAGR? 20% CAGR? 100% CAGR? It’s really tough to say confidently. Recall, the company provides no formal guidance.

And that’s the thing. Investing is about finding the right setup. The proper setup is the setup that works for you, repeatably and consistently.

Along these lines, generally speaking, a business with somewhat predictable growth rates, makes it easier to extrapolate the growth of these companies and provides investors with a higher degree of confidence. That’s why secular growth names trade at a very high valuation. Or, better said, relatively higher valuations than a cyclical business.

What investors want is a vague degree of certainty. In the short term, anything can happen, as we are seeing right now with RGTI.

But to make money in the market, knowing when to buy is only half the problem. And probably the less important half. Knowing when to sell, is when the money is made.

You need to have a clear plan of when to sell before you get involved with an investment. Think of it this way, you can either sell into strength or be a forced seller into weakness. And remember, nobody times the top of a stock.

With this context in mind, let’s now discuss its valuation.

RGTI Stock Valuation — About 280x Sales

Roughly speaking, Rigetti holds about $80 million of net cash, including marketable securities. For a business that just burnt through $52 million of free cash flow in the past 9 months, this is clearly not a lot of cash.

And this brings me to the contentious discussion. Think about this, in the trailing 9 months, Rigetti produced less than $10 million in revenues. And for the company to bring in that revenue stream, it used about $50 million of free cash flow. These figures are approximate, but they work.

This means that to bring in $1 of revenue, the business has to use $5 of free cash flow. This is an upside-down income statement. That’s not a viable business.

What’s more, 2024 isn’t over yet. Consequently, I suspect that when 2024 comes to an end, the record will show that this business has used more than $60 million of free cash flow.

Put in other words, at its current run rate, Rigetti will be fully out of cash by the end of 2025. This means that in the not-too-distant future, Rigetti will dilute shareholders as it raises funds.

Is it reasonable to pay about 280x this year’s sales for RGTI? Yes, IonQ is also priced at around +200x sales. But this valuation for the quantum peers is simply too speculative for me. I recommend that investors use this opportunity to cash in their gains.

Investment Risks

Markets can remain irrational longer than it makes sense. It’s entirely possible that the animal spirits for quantum computing will propel the stock a lot higher. Shorting the stock would be a mistake.

Nevertheless, I stand by the charge that it never matters in the market what you make, it matters what you keep.

Meanwhile, in the background, let’s see whether insiders are buying into Rigetti’s prospects?

From what we see above, there’s been no insider buys in the past two years. But there has been a high level of selling in the past 3 months. To me, this doesn’t inspire a lot of confidence that management is buying into this company’s story.

The Bottom Line

I believe a capital raise is inevitable for Rigetti Computing and may occur sooner rather than later. This could serve as the catalyst that bursts the current bubble, leaving latecomers exposed.

Investors should carefully consider whether the risk-reward setup justifies holding on at these levels.

Personally, I would just cash in now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

![SEC form 4 [dot] com](https://static.seekingalpha.com/uploads/2024/12/18/17546952-17345056601910777.png)