Summary:

- Quantum computing stocks have seen significant momentum recently, with some stocks appreciating 5-10x, driven by investor enthusiasm.

- Rigetti’s stock was trading at $11.15 on December 17, 2024, a 9x jump year-over-year. As a result, now the company has a market cap of ~$2.7 billion.

- Technology-wise, Rigetti’s roadmap looks ambitious but is also loaded with some execution pitfalls.

- Rigetti’s reliance on government funding and ongoing cash burn make the current valuation unsustainable and highly risky for investors.

- I’d not risk buying RGTI after its recent pop-up – the likelihood of “burning hand” is now too high, in my opinion.

adventtr

Significant Momentum In Quantum Computing Stocks

Over the past few weeks, we’ve witnessed significant momentum in quantum computing stocks, driven by investors’ enthusiasm for this technology. What’s interesting, even Wall Street professionals are guessing the underlying catalyst for 5-10x appreciation in some stocks like Quantum Computing (QUBT) or Rigetti Computing, Inc. (NASDAQ:RGTI), my today’s research object.

We can’t identify a clear catalyst for this kind of equity appreciation in the space over that time, but we do see continued indications that investment in quantum should continue growing at a rapid pace.

Source: SA News, Morgan Stanley analysts

In fact, quantum computing research and development has increasingly been encouraged by government funding and resources, which is expected to help fuel companies’ growth in this field.

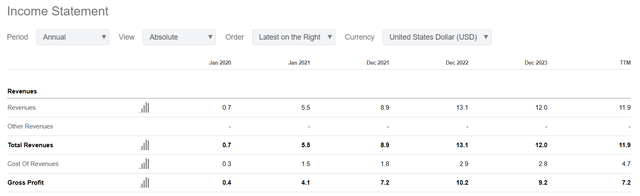

Following the market’s excitement about it, Rigetti’s stock was trading at $11.15 on December 17, 2024, a 9x jump year-over-year. As a result, now the company has a market cap of ~$2.7 billion, although its reported revenue declined in Q3 FY2024 (on a TTM basis, the revenue and gross profit declined by 0.84% and 21.7% YoY, respectively):

Seeking Alpha, RGTI’s income statement

Recent Financials And Prospects

The company reported Q3 FY2024 sales at $2.4 million, a 23% decline from $3.1 million in Q3 FY2023, missing the top-line consensus by ~$1.01 million, according to Seeking Alpha. Their recently shipped 24-qubit quantum system for the UK’s National Quantum Computing Centre (NQCC) generated some revenues, but with a lower gross margin profile, further constraining RGTI’s GP – as a result, the gross margins slumped from 73% to 51% in Q3 FY2024. In my view, this margin erosion clearly illustrates the company’s failure to successfully manage ambitious R&D projects while also meeting its financial targets.

Yes, from an expense perspective, Rigetti was able to reduce OpEx slightly in Q3 FY2024 to $18.6 million from $19.1 million in Q3 FY2023, but this decline was largely the result of the end of the Ampere Ford contract, which sucked up $1.1 million in costs last year. Rigetti remains woefully unprofitable, accounting for a net loss of ~$14.8 million in the quarter, down from $22.2 million in Q3 FY2023 (the gain was primarily offset by a $2 million positive non-cash adjustment for the derivative warrant and earn-out liabilities).

Additionally, as I see it, Rigetti’s cash position is an ongoing worry. As of 30 September 2024, it had about $92.6 million in liquid cash and securities, which is like 1.3 years of running its operations at the current scale (based on the operating loss in Q3, which was -$17.3 million). Though management claims that today’s cash runway will cover operations through mid-Q1 2026, with over $60 million of cash burn per year on the books, it appears a new round of funding will need to be raised pretty shortly. In fact, Rigetti already raised ~$12 million in Q3 through its ATM program, and up to $60.2 million of common stock can still be sold under the program. Yet, the firm’s record of shareholder dilution – more than 60% dilution between 2022 and 2024 – sets the alarm bells for potential investors.

Technology-wise, Rigetti’s roadmap looks ambitious but is also loaded with some execution pitfalls. By mid-2025, the company should introduce a “36-qubit solution based on its modular multi-chip design, which aims for a 99.5% median 2-qubit gate fidelity.” Rigetti expects to scale to 100+ qubit systems by the end of 2025, and a 336-qubit LiRAR system is on the way. Although these successes are essential for real quantum applications, Rigetti’s track record suggests it might be failing. For instance, as another Seeking Alpha analyst Bashar Issa pointed out recently, the company’s 84-qubit Ankaa-2 platform released last year had a 2-qubit gate fidelity of only 98%, which is well short of what you would need in real-world situations. So although promising, the move towards modularity is an implicit acknowledgement of its former monolithic architecture.

The competitive environment further complicates Rigetti’s smooth growth path. The quantum computing industry is dominated by giant corporations such as IBM (IBM), Google (GOOG) (GOOGL), and Amazon (AMZN), all of which are pouring billions of dollars into superconducting qubits. So even if Rigetti’s superconducting qubit focus provides advantages in gate speed and coupling with classical computation, it’s far behind its major competitors in potentially profitable scalability. Google’s Willow chip, for example, contains 105 qubits and does calculations in minutes that conventional supercomputers would take billions of years. In the meantime, IonQ (IONQ) and PsiQuantum are working on alternative modalities such as trapped ion and photonic qubits, which give longer coherence times and higher accuracy but at slower gate rates.

Of course, RGTI’s collaboration with Riverlane on quantum error correction (QEC) is a clear advance, as “QEC is key to fault-tolerant quantum computing.” Similarly, its partnership with Nvidia (NVDA) at the Israeli Quantum Computing Center (IQCC) also illustrates the potential for hybrid computing applications. But these initiatives are still in their infancy and haven’t turned into meaningful revenues yet.

Rigetti’s Valuation – No Room For Error

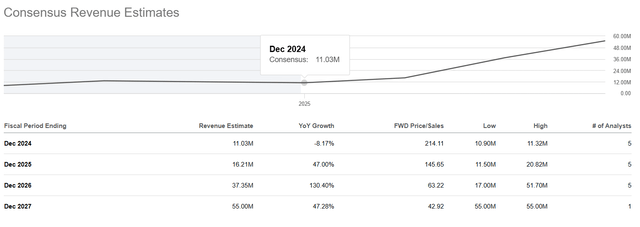

As of note, Seeking Alpha’s data show that consensus expects only $55 million in Rigetti’s sales by FY2027 – that would place the implied FY2027 P/S ratio at almost ~43x, times more than the median multiple in the industry.

As the NQI Act has run out of funding in 2023, no one knows how it will be funded going forward. Though there is bipartisan support for reauthorization with a $2.7 billion cap over 5 years, the fact that it has been delayed already has a negative effect on Rigetti’s bottom line.

So again, given a forward revenue multiple of 214x (FY2024) and the expectation of a multiple contraction to just 145x in FY2025, the stock seems to be priced to perfection and doesn’t leave much room for error. No need to speak of the “margin of safety” in this particular case.

So I’d not burn my hands buying into this kind of strength of the stock.

Upside Risks To My Thesis

I may be underestimating the larger quantum computing momentum and the company’s ability to exploit the industry’s expansion. The recent stock-rising signals increased optimism about quantum’s transformational potential, and Rigetti’s alliances with Riverlane and Nvidia give it a unique opportunity to exploit hybrid computing. The modular multi-chip design is a switch, but it fits the market and may lead to faster scaling than I’m expecting. Additionally, bipartisan approval of the $2.7 billion NQI reauthorization could offer Rigetti a much-needed cash injection, making it easier to manage expenses without shareholder dilution.

Your Takeaway

While Rigetti’s technologies and alliances look promising indeed, the company’s performance, dependence on government grants, and market competition are all in play, placing uncertainty on its near-term prospects. I think the current balance sheet’s liquidity will likely not be enough to fund the company’s full potential without further dilution. The lack of a clear way to break even is also a major concern. So investors should tread lightly on Rigetti, and the speculative enthusiasm fuelling its recent stock price rally may not hold up against these pressures.

Again, I’d not risk buying RGTI after its recent pop-up – the likelihood of “burning hand” is now too high, in my opinion.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.