Summary:

- Rigetti Computing has been up over 716% over the past month solely on what I believe to be investor excitement around quantum computing that’s too premature to be sustainable.

- Despite the massive potential in quantum computing, the Company’s financials show significant losses and a high cash burn rate, which honestly raises my concern about its long-term viability.

- The stock’s valuation shows that it’s highly overvalued at current levels, and the stock trades at twice its price targets.

- Going forward, I’ll be watching RGTI from afar for materialization in its partnerships, but until then, I don’t advise investors to jump in.

- I hereon share my cautious sentiment on Rigetti and why I think the stock run up will cause a crash in the near term.

Adventure_Photo/E+ via Getty Images

Investment Thesis

I’m adding Rigetti Computing, Inc. (NASDAQ:RGTI) to my coverage. I won’t say the recent market interest in quantum computing didn’t get to me; it did. After reviewing the company’s earnings and financials, I think this name will be a past-tense winner for the next year. Look, I understand that we’re progressing in the realm of quantum computing, but I think we’re fairly far from any real profit-making on quantum computing. The stock has gone up 716% in the past month and a whopping 1,114% in the past six months. Needless to say, Rigetti is now running solely on investor confidence and excitement around the cloud computing business after news broke out about Google’s Willow chip, making a buy right now a suicide mission (not the movie).

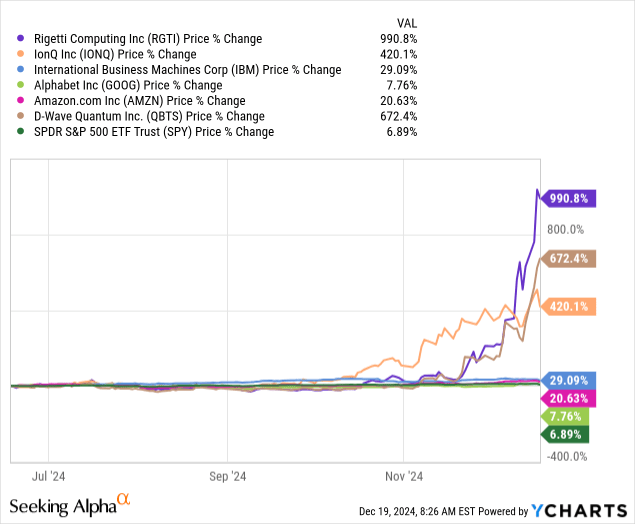

YCharts

The stock, as mentioned, has run up so much over the past two months. The six-month chart shows the stock up 990.8%. Mind you, this is higher than all its peers in the quantum computing industry, the large cap and small cap alike. Its peer IonQ (IONQ) was up 420% during the same period, D-Wave Quantum (QBTS) up 672.4%, International Business Machines (IBM) up 29%, Alphabet (GOOG) up 7.6%, Amazon (AMZN) up 20.6%, all against the S&P 500 up a mere 6.8%. Despite the run-up, analysts haven’t revised their estimates, with Zack’s Consensus estimates on earnings remaining unchanged over the past 30 days. This makes me wary about what’ll happen once earnings come around and all this excitement is put in check. So before you buy the stock at current levels, tell me why.

The company’s appeal lies in its potential in quantum computing, and that’s all there is, for now, potential. The company’s innovative Quantum Cloud Services (QCS) platform allows clients to access its quantum processors remotely, and I’ll get to this in a second. While that’s cool and all, the company isn’t profitable and hasn’t been in a while. 3Q24 revenue was down 23% to $2.4 million, and operating losses came in at $17.3 million. That, along with the IBM and Google competition, isn’t a good look.

A Quick Rundown On Quantum Computing

The market has been in a frenzy lately and quantum computing stocks are soaring on the idea that the “next big thing” is quantum computing. It got more intense after Google revealed its new Willow chip, able to perform calculations in under five minutes, as opposed to the 10 septillion years that it would take the world’s most powerful supercomputers. Anyway, what is quantum computing? It’s a revolutionary approach to computing, to say the least, and it’s able to tackle problems that are currently impossible to tackle, things well beyond our understanding, including climate change, food shortages, drug discovery, etc. Scientists have been working on the concept for over 40 years, and they’re now closer than they ever were, historically speaking. But how close is close?

According to McKinsey estimates, quantum computing could be valued at around $1.3 trillion by 2035. According to Fortune Business Insights, the global quantum computing market size was valued at $885.4 in 2023 and is projected to grow from $1,160.1 million in 2024 to $12,620.7 million by 2032 at a CAGR of 34.8%.

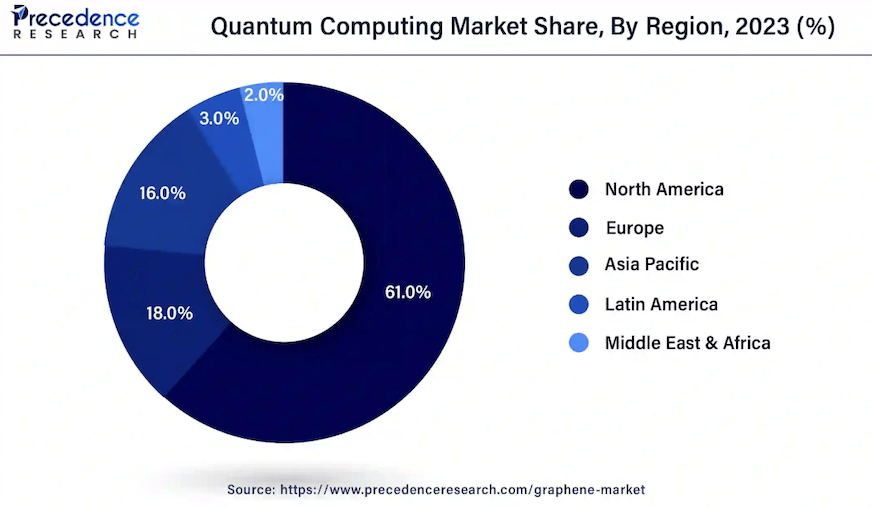

According to other sources, the market is expanding at a CAGR of 30.9% from 2024 to 2034, with the North America quantum computing market size at $511.83 million in 2023, snatching up over 60% of the market share.

Precedence Research

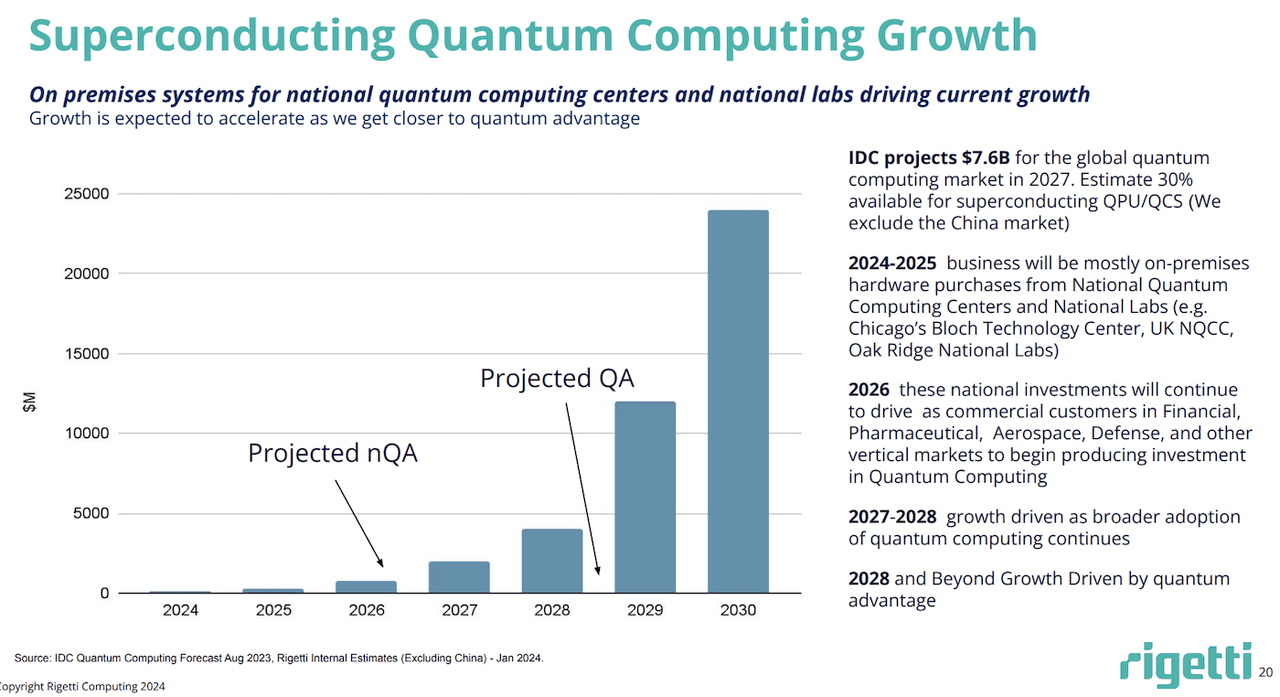

According to the company 3Q24 presentation, these are the projections over the coming years.

Financials And Burning Cash

Although management is focused on new innovations, and according to its 3Q24 earnings report, awaits the deployment of “its anticipated 84-qubit Ankaa 3 system with the goal of achieving a 99% plus median 2-qubit gate fidelity by the end of 2024.” As for 2025, it also holds some new advancements, including:

a new modular system architecture at Rigetti. By mid-year 2025, we expect to release a 36–qubit system based on 49–qubit chips tied together with a targeted 99.5% median 2-qubit gigabit gate fidelity. By the end of 2025, we expect to release a system with over 100–qubit’s with a targeted 99.5% median 2–qubit gate fidelity.

While this is all impressive, the question remains: will the company be in business long enough to see these come to fruition?

Revenue for 3Q24 came in at $2.38 million, down 23% year-over-year and missing analysts’ estimates by 30%. EPS came in at $0.79 loss per share, an improvement from $0.17 loss in 3Q23, exceeding analyst estimates by 14%. Net loss came in at $14.8 million, narrowed by 33% from a year ago quarter at $22.2 million. Needless to say, the company needs to raise money if it plans to stay afloat, and the $100 million it raised recently might be sufficient for now but wouldn’t justify the current run-up or jumping into the stock at current levels.

Valuation

The company’s market cap is currently at $2.9 billion and the stock has been up over 899% over the past 52 weeks with a beta of 2.73, making Rigetti’s price volatility much higher than the market average. According to data from Refinitiv, the PT mean and median, are both on an upward trend since mid-September. The PT mean was $2.75 in September, maintained in October, up to $3 in November, and is currently at $3.25. The PT mean was at $2.75 in September, too, and similarly maintained in October, up to $2.88 in November, and is currently at $3.50. This may seem positive, but the stock is now more than twice its PT, so it’s definitely not the time to buy. The EV/Sales ratio is 245.8, higher than all its peers, starting with IonQ at 206.5, D-Wave at 189.05, IBM at 3.99, Google at 6.63, and Amazon at 3.85, and the sector median at 4, according to data from Seeking Alpha. This indicates that the company is expensive at current levels.

On profitability, the company is lagging behind, with a negative Net Income Margin of 510%, lower than the sector median of 4%, indicating the company is still struggling to turn revenue into profit. Rigetti has a few risks, but one that stands out to me is its high cash burn rate and dependency on government funding. I, on the other hand, recognize the company’s efforts in government collaborations and the possible reauthorization of the National Quantum Initiative Act as possible tailwinds. On the latter, earlier this month, the United States’ leadership in quantum technology introduced the initiative, authorizing $2.7 billion in federal funding to accelerate quantum R&D for the next five years and to address the “valley of death,” which is a phase where technologies that prove promising fall between research and commercialization.

According to U.S. Sen Maria Cantwell, Chair of the Senate Committee on Commerce, Science, and Transportation:

Advancements in quantum science and technology are a game-changer. From healthcare breakthroughs to clean energy solutions, quantum applications in sensing, computing, and communications will reshape our future.

While still unclear on how much of a cut Rigetti would get out of this and when that cut will materialize into profit, I am watching this going forward.

What’s Next

Going forward, I’m watching for new partnerships, as I think that’s one thing that could get me excited about possibly revising my rating. The company is currently in bed with Nvidia (NVDA) at the Israeli Quantum Computing Center with a goal to “understand from a fundamental standpoint how a QPU interfaces with the CPU and GPU. The reason that that will be extremely important for us as well as the whole industry, and really that highlights the importance of superconducting quantum computing.”

For now, I think investor confidence is standing on clouds, as we have yet to see tangible signs of the company turning its process of innovation into profit. Until that happens, I will be on the sidelines, advising investors to road the wave up to explore exit points out of the stock and take home the gains for Christmas. Rigetti, in my opinion, is too hot to buy at current levels and with such a high-risk profile. I expect better entry points will arise down the road, and I wouldn’t be in a rush to jump into the stock at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.