Summary:

- Rigetti Computing is unlikely to benefit materially from the $2.7 billion funding from the National Quantum Initiative, which seems to be the catalyst for the stock’s sharp rise up recently.

- RGTI management has a patchy record in revenue and margins execution vs consensus expectations.

- At current quarterly FCF burn levels, the unprofitable Rigetti Computing has enough liquidity to last just over 2.5 years, due to a recent $100 million equity raise.

- RGTI’s valuation drivers suggest the stock is in an unreasonable hype mode, as forward revenue estimates remain unchanged despite the stocks’ sharp climb up.

- Technicals show strong bullish momentum but is nearing a major resistance area. Overall, I believe it is wise to steer clear of RGTI, but also not to be bearish on it as the market’s bullish momentum is hard to fight.

Anthony Paz – Photographer/iStock via Getty Images

Thesis

I am perplexed by the sharp rise in Rigetti Computing (NASDAQ:RGTI) (NASDAQ:RGTIW):

- RGTI is unlikely to benefit materially from NQI funding

- Management has a patchy record in revenue and margins execution

- At current cash burn levels, the company has been forced to raise money

- RGTI’s valuation drivers suggest the stock is in an unreasonable hype mode

- Technicals show strong bullish momentum but is nearing a major resistance area

My analysis and thesis is applicable to the equity warrants of Rigetti Computing as well, since the value in exercising the warrant and obtaining the stock is dependent on the value of RGTI’s equity prices’ outlook.

RGTI is unlikely to benefit materially from NQI funding

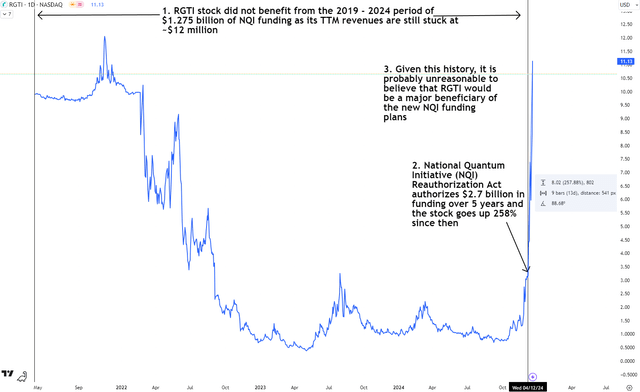

In December 2018, the United States’ National Quantum Initiative (NQI) authorized $1.275 billion in funding for quantum research and development over a 5 year period. Recently in early December 2024, US Senators introduced a new batch of funding worth $2.7 billion via the NQI Reauthorization Act, which has prompted a sharp share price acceleration of almost 256%:

RGTI Stock Catalysts and Price Action (TradingView, Author’s Analysis)

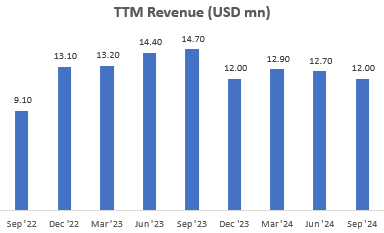

What I find particularly curious is the fact that throughout the 2019 – 2024 period, RGTI stock did not benefit from NQI funding as its TTM revenues have remained in the low-teen millions of dollars:

TTM Revenue (USD mn) (Company Filings, Author’s Analysis)

Given this history of not being a major beneficiary of NQI funding, and the absence of any clear commercialization catalysts (I don’t view the collaboration with Quantum Machines as anything close to commercial yet), I am skeptical about whether there would be a tangible and sustainable benefit accruing to RGTI from the new $2.7 billion pot of funds.

Management has a patchy record in revenue and margins execution

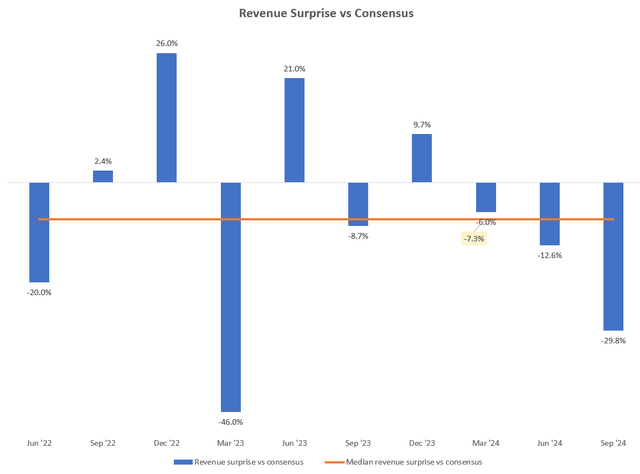

RGTI has a rather poor record of beating expectations since it has frequently missed consensus revenue estimates:

Revenue Surprise vs Consensus (Capital IQ, Author’s Analysis)

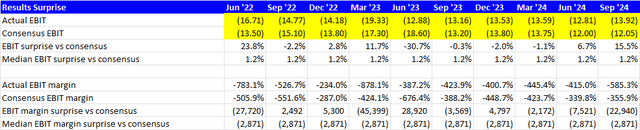

And has posted larger EBIT losses than what sell-side analysts had pegged in, particularly over the last couple of quarters:

EBIT Margin Surprise vs Consensus (bps) (Capital IQ, Author’s Analysis)

I believe actions and results speak louder than words and commentary. Hence, I am skeptical in believing in management’s bullish speak, especially when it comes to commercialization.

At current cash burn levels, the company has been forced to raise money

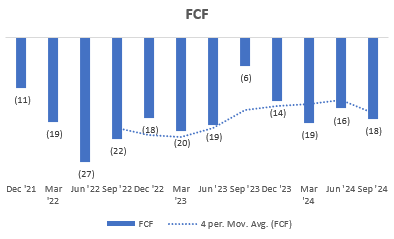

RGTI is losing an average of $18 million in FCF every quarter:

FCF (USD mn) (Company Filings, Author’s Analysis)

In the latest Q3 FY24 earnings call, management said this about their costs outlook:

…don’t think we’ll see a significant increase in OpEx

– CFO Jeffrey A. Bertelsen in the Q3 FY24 earnings call

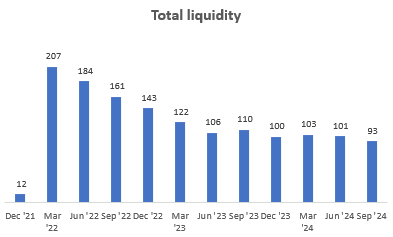

I don’t trust this narrative as much, since management has a track record of underperforming expectations. Now, the total liquidity in the company stood at $93 million as of Q3 FY24; $20.3 million in cash and $72.3 million in US treasury securities.

Total Liquidity (USD mn) (Company Filings, Author’s Analysis)

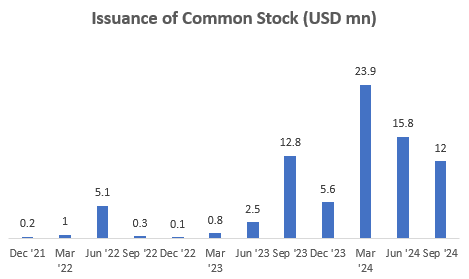

Assuming a run-rate burn of $18 million every quarter, this means the company had just about 5 quarters until it ran out of money. This has forced the company to go to market to raise more money in the near future since the company has not been issuing debt:

Issuance of Common Stock (USD mn) (Company Filings, Author’s Analysis)

Not reflected in the chart above is the fact that the company has announced a capital raise of $100 million in late Nov’24. This would bring its total liquidity to around $193 million; enough funds to last it a bit more than 2.5 years at the current levels of FCF burn.

RGTI’s valuation drivers suggest the stock is in an unreasonable hype mode

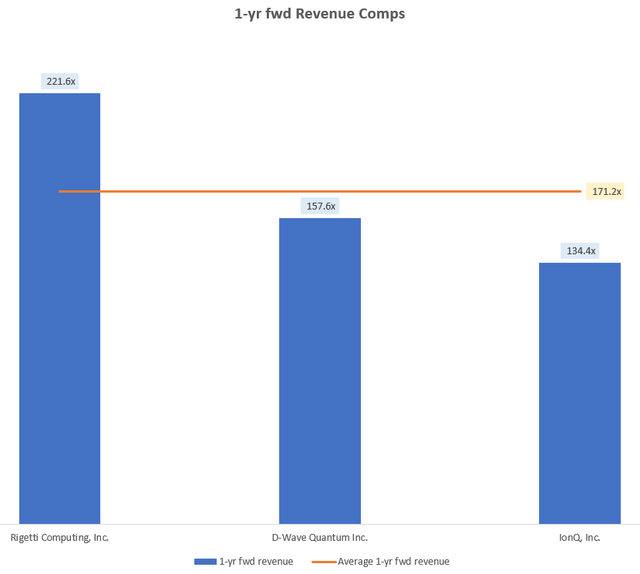

RGTI is currently trading at a 1-yr fwd Revenue of 221.6x; a 29.5% premium to the comps average of 171.2x:

1-yr fwd Revenue Comps (Capital IQ, Author’s Analysis)

Peers used in comps include D-Wave Quantum (QBTS) and IonQ (IONQ)

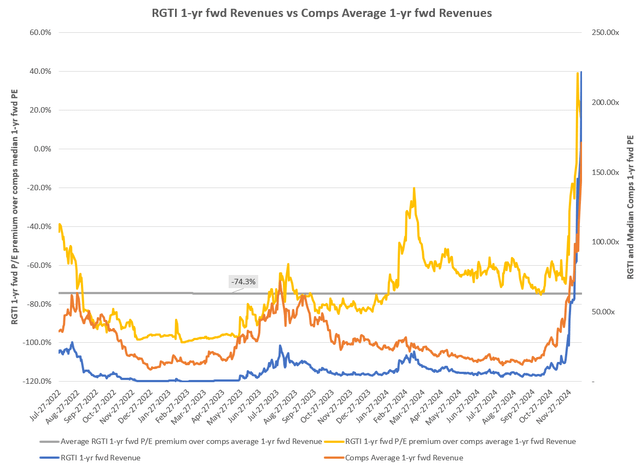

This premium valuation vs comps is rather unusual, as RGTI has typically traded at a large 74.3% discount vs the comps average:

RGTI 1-yr fwd Revenues vs Comps Average 1-yr fwd Revenues (Capital IQ, Author’s Analysis)

What is confusing to understand is why RGTI has outperformed, even when companies such as Quantum Computing (QUBT) has been the beneficiary of more positive developments, such as the winning of a contract with NASA, although that is arguably overhyped as the value of that deal is only $26,000.

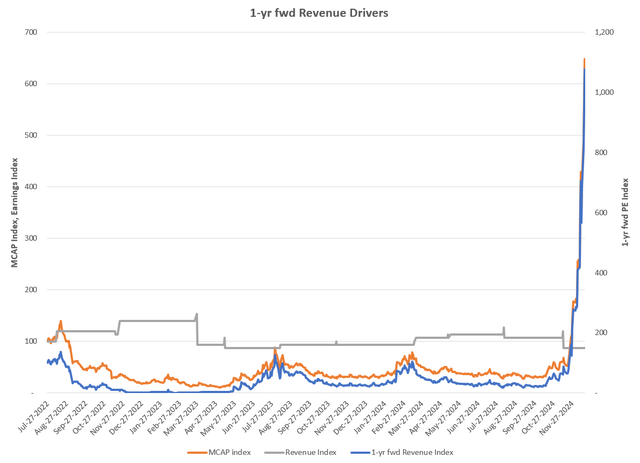

There is a clear sign that the recent, sharp appreciation in the stock is purely due to a hype since all of the increase in the price (orange line in chart below) is explained via a re-rating of the valuation multiple (blue line in chart below) at stable to falling forward revenue estimates (grey line):

1-yr fwd Revenue Drivers (Capital IQ, Author’s Analysis)

Technicals show strong bullish momentum but is nearing a major resistance area

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

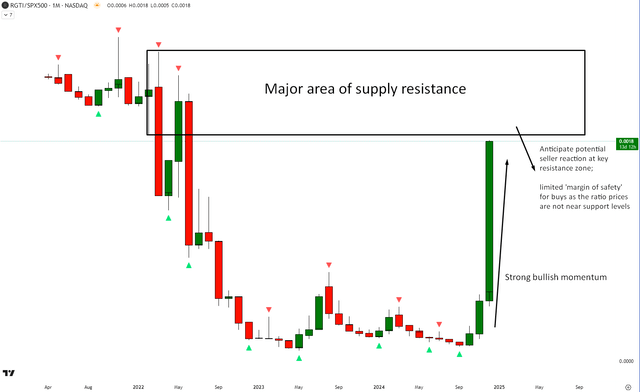

Relative Read of RGTI vs SPX500

RGTI vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

Relative to the S&P500 (SPY) (SPX) (IVV) (VOO), RGTI is in a powerful bullish trend. However, it is nearing a major area of supply resistance ahead, leading to a low ‘margin of safety’ for buys even on purely technical, momentum-chasing terms.

Takeaway & Positioning

So far, I fail to see any evidence of fundamental tailwinds driving the RGTI stock. The meteoric rise in recent days seems to coincide with the announcement of $2.7 billion in 5-year funding by the US government for quantum research and development. However, looking into the history of this funding shows that Rigetti Computing, with its stagnant revenues, has failed to benefit from the last $1.275 round of funding over 2019 – 2024. And I struggle to see any major change to this trend.

Management also has a track record of missing consensus revenue and margin expectations. To add to the woes, the company is loss-making and liquidity and cash burn analysis suggested that prior to the recent $100 million equity raise, it had enough funding for only the next 5 quarters. Now there is enough runway for a bit more than 2.5 years at the current levels of FCF burn.

Valuations-wise, there are clear signs that RGTI is trading on mere hype, as forward revenue estimates have not shown any upgrades despite a sharp rise in the stock’s price. Furthermore, the company has started to trade at a ~30% premium vs peers, which is abnormal since it used to trade at a hefty 74% discount historically. Technically, relative to the S&P500, the bullish momentum is strong but nearing a major resistance area ahead.

All in all, I can’t see why RGTI stock is trading like it is currently. I may be wrong to be skeptical if the company comes up and announces multiple major contract wins that lead to large, multi-million dollar revenue streams. Maybe there is something in the pipeline and the market is trading in anticipation (or prior knowledge?) of that fact. Without visibility, though, I believe it is prudent to stay away, but not go so far as to bet against it given the strong bullish momentum thus far.

Rating: ‘Neutral/Hold’

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.