Summary:

- Rigetti Computing focuses on quantum computing with superconducting qubit-based processors but faces financial challenges despite technological advancements.

- The company raised $12 million in Q3 2024 but still reported a $17.3 million operating loss, with $92.6 million in cash and securities.

- Rigetti aims to release a 36-qubit system in mid-2025 and a 100-qubit system by year-end, targeting a $7.5 billion market.

- Despite progress, Rigetti struggles to secure lucrative contracts, making IONQ a potentially better investment; I rate RGTI stock a Hold.

John D

Rigetti Computing Overview

While I mostly cover income investments now that I am retired and more interested in steady monthly income than I am in growing my portfolio, I still like to follow some high potential growth stocks, and especially ones that I previously covered. One of those relatively under-covered potential high-flyer growth stocks that I want to take a fresh look at is Rigetti Computing (NASDAQ:RGTI).

Rigetti is one of several companies that is focused on developing a quantum computing architecture. The basic unit of measurement in the development of quantum computing solutions is the Qubit. The specific method used to develop qubits for quantum computing is unique to each solution developer and in the case of Rigetti, they use a superconductor approach to qubit design.

Rigetti systems are powered by superconducting qubit-based quantum processors. Quantum processor chips are the foundation of our technology stack. Manufacturing these chips begins with the ability to design high quality quantum-coherent superconducting microwave devices.

I previously reviewed RGTI stock back in December of last year when I rated it a Hold. At the time, I was concerned that the revenue run rate would not be enough to sustain the company operations for more than another year unless they raised some additional funding to support the nearly $20 million per quarter in operating expenses. This was how I concluded that review:

- As of September 30, 2023 cash, cash equivalents and available-for-sale securities totaled $110.2 million

I have no doubt that their progress over the past few years has given them an edge, but it remains to be seen whether they can capitalize on their efforts before they run out of money. I rate RGTI stock a Hold and will be watching closely as the developments in quantum computing, along with advancements in AI continue to evolve over the coming years.

Although revenues declined in Q3 2024 and the company reported an operating loss of $17.3 million for the three months ended September 30, 2024, the cash and cash equivalents plus securities available for sale at the end of Q3 2024 amounted to $92.6 million. According to CFO Jeff Bertelsen, the company raised come cash during the quarter in an ATM sale of stock.

During the third quarter of 2024, we raised $12 million from the sale of 11.3 million common shares under our current ATM program. As of September 30, 2024, up to 60.2 million of common stock remains available for sale under our current ATM program.

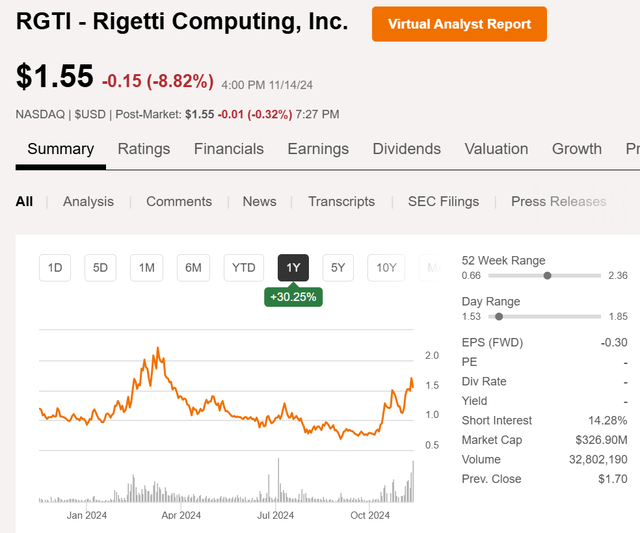

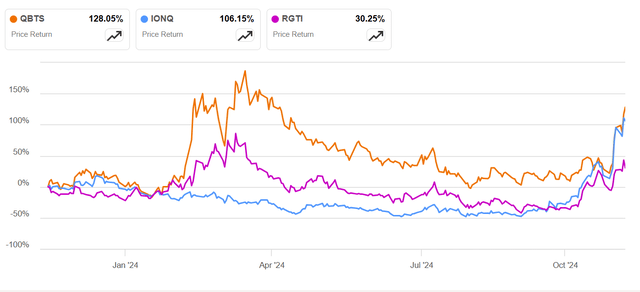

The stock is up nearly 45% since last December and is considerably higher after seeing a jump in the stock price after the Q3 2024 earnings report on November 12. At the close of trading on 11/14/24 even after shedding almost 9%, RGTI trades for $1.55 per share, up from $1.09 a year ago.

However, its competitors are also up as interest in quantum computing stocks appears to be on the rise again, along with AI, cryptocurrencies, and other “risk-on” ventures. In fact, IonQ (IONQ) and D-Wave Quantum (QBTS) are both up over 100% in the past year versus RGTI which is now up 30% in that time.

9-Qubit QPUs and Beyond

Novera QPU (Rigetti)

The technology roadmap for Rigetti is based on configuring the Novera 9-qubit QPUs (quantum processing units) and linking them together to make over 100-qubit processors by the end of 2025, according to the Q3 press release.

The Company plans to introduce a new modular system architecture in 2025. By mid-year 2025, the Company expects to release a 36-qubit system based on four 9-qubit chips tiled together with a targeted 99.5% median 2-qubit fidelity. By the end of 2025, the Company expects to release a system with over 100 qubits with a targeted 99.5% median 2-qubit fidelity. Rigetti plans to develop the 336-qubit Lyra™ system thereafter.

This new modular architecture is based on years of research developing superconducting qubits and refining the multi-bit scaling technology.

“After spending years optimizing the performance of our larger scale 84-qubit Ankaa™ chips and honing our multi-chip scaling technology, we are manufacturing 9-qubit chips at 99.4% 2-qubit median fidelity, and in Q3 of this year we demonstrated tiling of 9-qubit chips without deterioration in performance,” says Dr. Subodh Kulkarni, Rigetti CEO. “We believe the anticipated 4-chip 36-qubit system will be the most ambitious multi-chip QPU architecture in the market, and a significant milestone for the company and the quantum computing industry.”

In another recent development, Rigetti announced that they teamed with Riverlane out of Cambridge, UK to develop quantum error correction that is making progress toward fault tolerant quantum computing with low latency, real-time error correction on Rigettii QPUs.

Rigetti and Riverlane’s recent work demonstrating real-time and low-latency quantum error correction on Rigetti’s 84-qubit Ankaa™-2 system is an important step in our journey towards developing fault tolerant quantum computers.

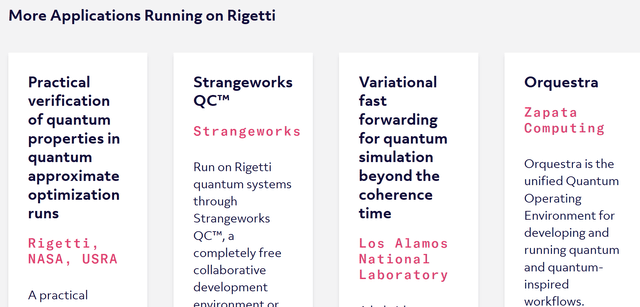

Some applications that run on Rigetti QPUs include some that are described on the website in the screenshot below.

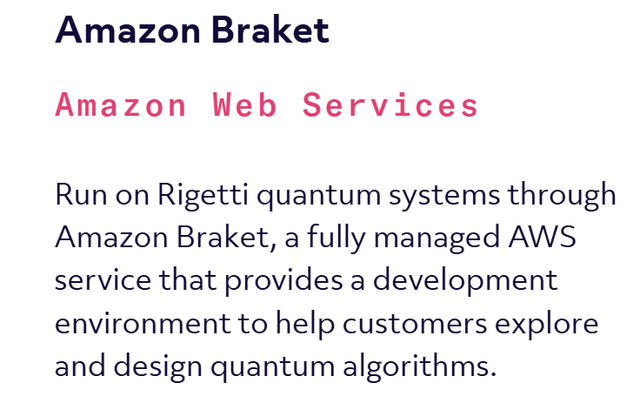

Amazon AWS also partners with Rigetti as an option for quantum computing applications design and testing.

In other recent news a Rigetti Novera QPU was co-located at the Israeli Quantum Computing Center as described in the earnings press release.

Rigetti is excited to share that a Novera QPU has been co-located at the Israeli Quantum Computing Center with Quantum Machines’ OPX1000 control system and NVIDIA’s Grace-Hopper superchip servers, which was made available to partners for research and experimentation. The set-up was recently leveraged for a reinforcement learning project, which was presented at IEEE Quantum Week 2024 in September. The demonstration entailed optimizing single qubit operations on the Novera QPU, and is an exciting use case for using a Novera QPU for quantum machine learning development.

Another business update announced on the Q3 earnings report was the installation of a Rigetti QPU at the National Quantum Computing Centre on its Harwell campus, which officially opened its doors on October 25, 2024.

The facility will support world-class quantum computing research and provide state-of-the-art laboratories for designing, building and testing quantum computers. The state-of-the-art facility includes a fully operational 24-qubit Ankaa-class system that will be made available to NQCC researchers for testing, benchmarking, and exploratory applications development.

Technology Looks Good, How About Rigetti’s Financials?

Most of the revenues that Rigetti realizes comes from government contracts such as DARPA from DOD and some DOE initiatives. In a question asked on the earnings call, it became evident that more government contract awards need to materialize in order for Rigetti to continue its R&D efforts.

Q: And maybe just one more if you don’t mind, but just wanted to ask some of the government funding opportunity. I thought it was interesting you had talked about maybe spending a little more money there on lobbying efforts as we know one of your peers has done. But how do you think about maybe the areas of opportunity for funding? Is there anything out there that you see today that you’ve got a good shot at or anything maybe just any updates around the government funding?

A: (from CEO Subodh Kulkarni) So certainly, we look at the U.S. Government as the main place to fund our work. NQI, the original NQI Act signed in 2018 has expired. NQI reauthorization hasn’t been signed yet and that certainly has impacted our near-term financials including Q3 and for the next quarter or two until the NQI reauthorization is signed. But we are pretty confident as bipartisan support for the NQA authorization to get signed and it will be signed as soon as a new administration is in place.

Regarding other, DoD has some special projects as a DARPA project, fairly sizable, almost $300 million over seven years that we are trying to get part of that award. And there are other opportunities too, but you are right. There are multiple opportunities between DOE and DoD and we are spending more time and effort including some lobbying effort to try to get some of that money.

There is a huge potential market for quantum computing applications and as CEO Kulkarni sums up in his comments on the earnings call, the target market is somewhere in the range of $7.5B over the next 5 years in terms of estimated spending on quantum computing applications. If Rigetti can capture even a small percentage of that market the stock could see some massive gains.

I mean, we have already quantified in our investor presentation that, along with IDC report that the market opportunity for business research applications in the next 5 years is roughly $7.5 billion So, it’s still a very sizable market and that’s really what we are focused on right now, getting our quantum computing capable to take on those kinds of applications, research applications and get a foothold in that $7.5 billion marketplace in about 5 years.

Competition and Risks to Rigetti

There are several competitors working on quantum computing but only a handful that are using the superconductor approach. One of those, and probably the biggest, is IBM (IBM) with its IBM Quantum® framework. Alphabet’s Google (GOOG) and Amazon (AMZN) will also be competing for a share of the $7.5B but are more likely to partner with Rigetti than compete against them. There are also a couple of other small companies that are developing competing capabilities as explained by CEO Kulkarni in his closing comments on the earnings call:

So we think a big part of the $7.5 billion is going to be superconducting, all those other modalities will play a role. And within superconducting really, we think I mean along with us IBM is a key player in that marketplace. There are other competitors too. I mean, Google is there, but they are not quite interested in that kind of a market, nor is Amazon. There’s a Finnish company called IQM and a Dutch company called Quantware. So there’s a few competitors we have in the superconducting besides us and IBM. But we think given our position we definitely expect to be a leader in that space. So we expect a sizable market share of the superconducting portion.

Other companies who are working on quantum computing using other modalities include IonQ (IONQ) and D-Wave Quantum, among others. IONQ soared 21% after it reported Q3 2024 earnings that included a doubling in revenues over the previous year (103% YOY revenue growth) and announced a new $54.5M contract award with the US Air Force Research Lab.

Concluding Thoughts: RGTI Stock is Worth Watching but IONQ Might Be Better

While Rigetti has made progress on the technology front, they have not been very successful at capturing lucrative research contracts to help with continued funding of their R&D efforts. There is a substantial target market for quantum computing applications over the next several years depending on how well the new paradigm performs in real-world settings. The technology is still largely unproven to be significantly better than current CPU/GPU configurations used in most current AI and large dataset computing applications.

While Rigetti has a bit of first mover advantage in the quantum space, the technology is evolving quickly and large amounts of research dollars are being poured into improving the processing speed and fidelity. It would appear that based on the latest earnings reports that IONQ is in better position to capitalize on the investment in quantum technology. I rate RGTI stock a Hold for a potential speculative growth investment pending future developments over the next twelve months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.