Summary:

- Rigetti Computing is a quantum computing stock that has rallied over 300% in the last year.

- The company has established great partnerships and made interesting breakthroughs.

- I believe RGTI could be a standout in the QC market, though it’s a speculative investment.

DKosig

Thesis Summary

Rigetti Computing (NASDAQ:RGTI) is up over 300% in the last month, and 50% in the last two days alone.

Quantum computing stocks rallied yesterday after Alphabet (GOOGL) announced a significant breakthrough in their technology.

Rigetti has also made some recent breakthroughs and established meaningful partnerships that have helped the stock reach new highs.

While quantum computing may still be a pipe dream, it is slowly becoming a reality, and investors are being quick to gain exposure.

While Rigetti is a speculative investment, and hard to value, I think adding some exposure to the quantum computing “market” is a good idea.

What Does Rigetti Do?

Rigetti builds quantum computers and the processors that power them. But what is Quantum computing exactly?

Here’s how I explained it in my recent Google article.

The best way to understand this, perhaps, is to compare QC to traditional computing. Where today’s computers use bits and binary code composed of 1s and 0s, a quantum computer would use a similar language, but with limitless possibilities, meaning a bit could simultaneously be a 0 and a 1 at the same time.

This unlocks limitless possibilities when it comes to processing information, and would completely change how we think about computing.

Source: Google Article

Rigetti builds the hardware needed to run supercomputers and also operates Forest, a cloud platform that allows developers to develop quantum algorithms.

Why Did The Stock Rally?

A lot of Quantum stocks rallied yesterday, as the hype around Google’s new Willow chip caught on.

However, Rigetti rallied over 50%, and it’s not just because of Google. The company had its own positive news to deliver.

Together with Quantum Machines, Rigetti successfully used AI in order to calibrate ks in scaling quantum systems.

Source: CTO of Quantum Machines

By using AI to calibrate their quantum computers, these companies may have unlocked a whole new level to this industry, addressing what Yonatan Cohen claims is one of the most significant bottlenecks in the industry.

This achievement builds on the work the company has done with the aid of NVIDIA (NVDA), which also highlights how Rogetti’s strategic partnerships are beginning to pay off.

Financial Metrics

Now, a look at the financials and the latest quarter results.

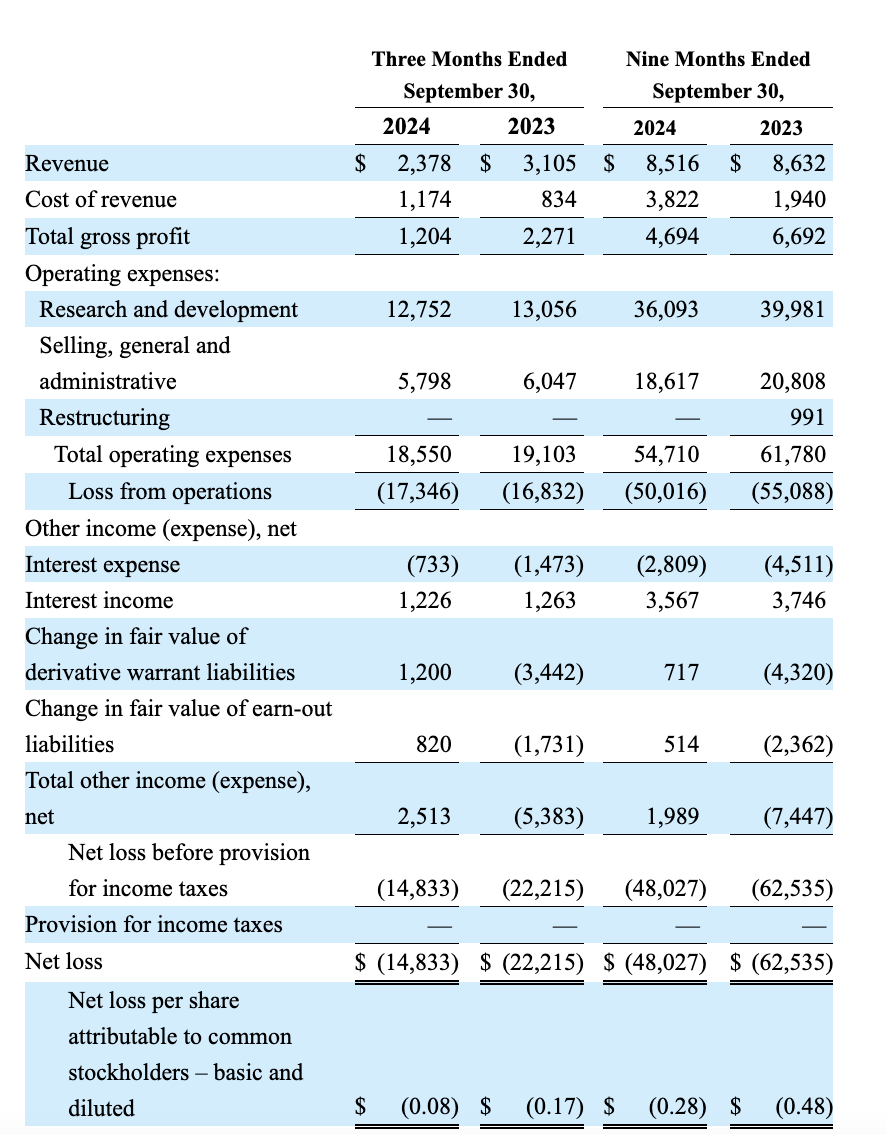

Income statement (10Q)

As we can see, revenues were actually down YoY, and we haven’t really seen any growth in revenues in 2023, while the cost of revenues has been increasing.

This is to be expected with a company like Rigetti. It’s pretty much like investing in a biotech that is still in the research phase.

The company operates at a loss, and with $92 million in cash right now, it may well have to seek further financing soon.

With that said, the company now sits in a great position to raise cash through equity, and though we will no doubt face volatility, the future could be bright for Rigetti.

Future Outlook

Quantum computing could be the next big thing after AI, and investment in the industry is already heating up.

The National Quantum Initiative Act, which should be put into place in 2025, would increase funding for the industry.

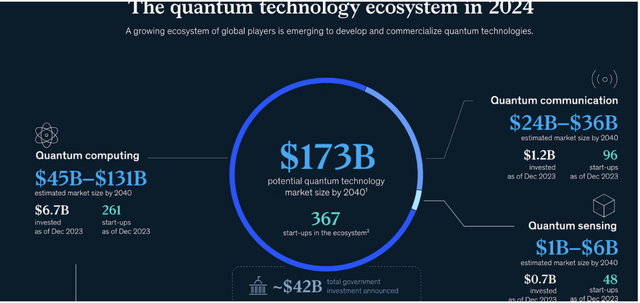

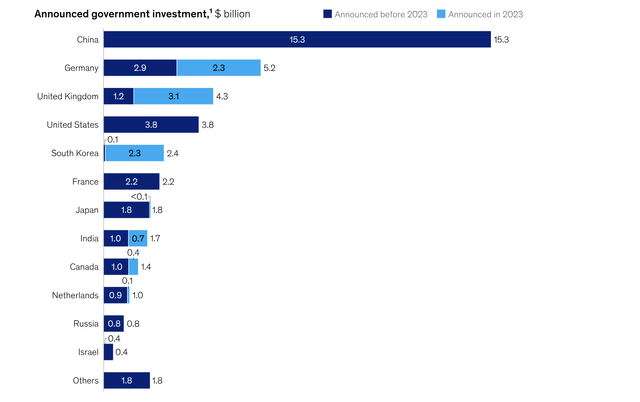

QC spending by country (McKinsey)

The U.S. is falling behind, with China and even some European countries outspending the United States.

And while any forecast is still speculative, McKinsey forecasts a $173 billion market in Quantum computing by 2040.

Quantum computing promises to revolutionize the fields of AI, health, logistics, cybersecurity, and pretty much every other industry.

Could Rigetti Be The NVIDIA of Quantum Computing?

The big question then is, who is going to be the NVIDIA of quantum computing? Large players like Google and even IBM (IBM) have shown some promising designs, but so has Rigetti.

Rigetti is working on being the supplier of chips for quantum computing, and their roadmap for 2025 includes a 100-Qubit system.

I see some similarities between Rigetti and NVIDIA, as the company not only produces hardware but also has Forest, which I would liken to CUDA, as it is an ecosystem that allows developers to build software for quantum computers.

Risks

While quantum computing sounds promising, this stock is up over 500% in the last year, and the valuation is just very high.

Trading at over 100x 2025 revenues, this stock isn’t for the faint of heart. Expect also a need for more financing, which means possible shareholder dilution.

And of course, we can’t underestimate the threat from other players in the industry, particularly Google, which just reported a big breakthrough.

Takeaway

All in all, I think it’s worth getting some exposure to the quantum computing market, even if it is still very speculative. Especially under these macro conditions, it seems like there’s an appetite for these kinds of stocks. I’d recommend opening a small position in a few companies or buying a Quantum ETF. With that said, from what I can gather, Rigetti looks like it may be ahead of its competitors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RGTI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Macro moves markets, and this is what I do at The Pragmatic Investor

Join today and enjoy:

– Weekly Macro Newsletter

– Access to our Portfolio

– Deep dive reports on stocks.

– Regular news updates

Start your free trial right now!