Summary:

- Riot Platforms’ aggressive expansion and investments in advanced mining infrastructure position them as a major player in the Bitcoin market.

- Shareholders face heavy dilution due to frequent public offerings of stock to raise necessary capital.

- The post-halving landscape presents challenges for miners, and Riot Platforms’ profitability remains uncertain.

da-kuk

Investment Thesis

I believe as Riot Platforms (NASDAQ:RIOT) navigates the post-halving landscape of Bitcoin now that the halving occurred last weekend, their aggressive expansion and significant investments in advanced mining infrastructure position them as a major player poised to capitalize on potential market upturns. However, I think this expansion is turning out to be expensive and shareholders have to contend with heavy dilution.

Key to Riot’s growth strategy is their ability to manage the strong financial pressures from their increased depreciation costs due to its rapid asset expansion. This is being compounded by frequent public offerings of stock that raise necessary capital but risk shareholder dilution. While some analysts are not as concerned, as evidenced by the recent upgrade from “Neutral” to “Strong Buy” by J.P. Morgan, I am more reserved. I absolutely believe in the long run potential of Bitcoin, as I wrote about in my recent Blackrock iShares IBIT ETF analysis, but I am more concerned about the pressure that miners are facing, Riot Platforms included.

Given the critical need for price increases from here to sustain profitability post-halving, I believe Riot’s stock remains a hold. However, if Bitcoin continues to appreciate rapidly and aligns favorably with Riot’s operational advancements, I definitely think there could be a strong case for an upgrade to buy.

Background: Understanding The Impact of The Halving

The Bitcoin ecosystem recently underwent its quadrennial halving event, a significant occurrence that slashed the mining reward from 6.25 to 3.125 BTC per block. The per block reward reduction has big implications for miners, with some projecting that about 15% of Bitcoin miners may shut down due to unsustainable profits, as the cost of mining remains high while the rewards have halved.

With this, the impact of the halving is particularly severe for miners with less efficient setups or those facing higher electricity costs. Only the most efficient miners, equipped with the latest technology and accessing the cheapest power, are likely to endure the new economic realities of the Bitcoin network. Post-halving, I believe the industry is seeing a shift where only well-capitalized and technologically advanced miners can maintain profitability. This scenario may lead to further centralization of mining operations, as smaller players could be forced out of the market. This is definitely a market where Riot can outperform their competitors. My concern is that this may not be enough on its own for them to be profitable.

The decreased reward per block fundamentally changes the economic landscape for Riot Platforms. Going into the halving (last month) Riot, BTC mining yield wasn’t quite increasing even before the halving. So my concern is that the new reward structure exacerbates the challenge.

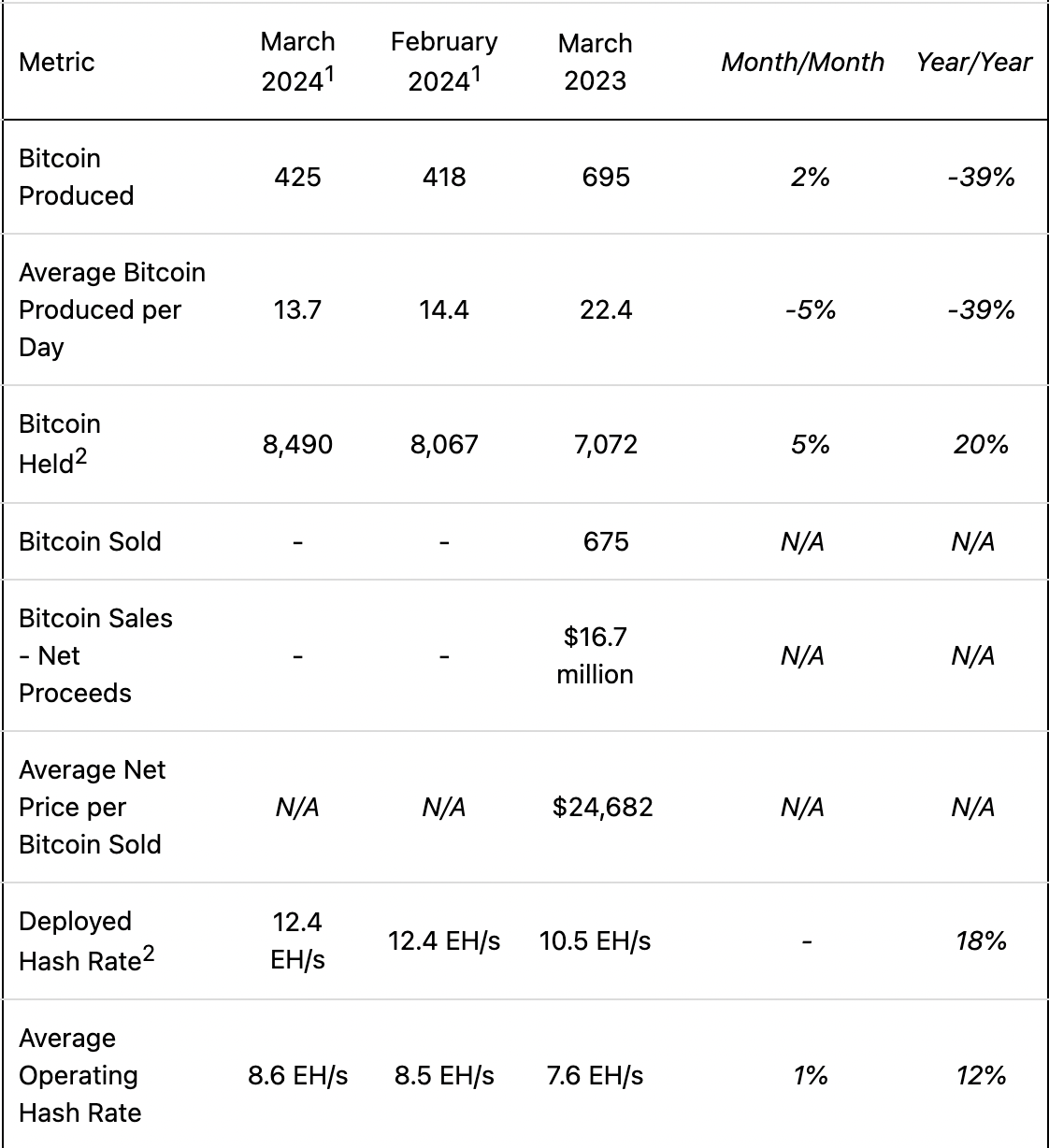

Earlier this month, Riot reported a 39% decrease in Bitcoin production year-over-year for the month of March, highlighting the problems with mining rate stability even pre-halving. While the firm has ordered more mining rigs to bring on more capacity, I don’t believe the efficiency of the ones they currently have was maximized.

RIOT March 2024 Report (Seeking Alpha)

What I find notable is that the average operating hash rate was below the deployed in both March 2023, February 2023, and last month. While the proportion has stayed roughly the same, it means the company is likely not operating at peak efficiency.

Historically, halving events have led to increased Bitcoin prices over the long term, driven by reduced supply and increased scarcity. However, the period right after (the immediate aftermath) can be turbulent for miners if the price of Bitcoin does not increase proportionally to offset the reduced block rewards, Riot included.

Depreciation Is A Problem

Over the last few years, Riot shareholders have had to deal with dilution, partially caused by strong depreciation expenses, driven by their accelerated mining rig upgrade cycles.

The depreciation and amortization expenses alone totaled approximately $246.5 million for 2023, up substantially from $105.9 million in 2022 and $26.1 million in 2021. This surge in depreciation costs is attributed to the company’s aggressive expansion and mining rigs (partially in anticipation of this most recent halving_. As noted from their 10K:

Depreciation and amortization expense during the years ended December 31, 2023 and 2022 totaled $252.4 million and $108.0 million, respectively. The increase of $144.4 million was primarily due to higher depreciation expense recognized for the Rockdale Facility and the significant increase in the number of recently acquired and deployed miners. -RIOT 2023 10K

The company’s strategy to handle these soaring costs largely consisted of issuing additional shares to raise capital. In 2023 alone, Riot conducted large at-the-market (ATM) equity offerings, receiving net proceeds of approximately $761.773 million from the sale of 62.2 million shares (10K). Keep in mind that at the time of this writing, their total market cap now is only $2.3 billion.

While these offerings provided what I believe to be necessary capital, they also led to strong shareholder dilution. I think this really needs to change for investors (including myself) to get more bullish on the stock. I personally like Bitcoin because the quantity of coins is capped. It does not appear the same is true for Riot Platform shares.

While this has been fairly necessary for funding the substantial capital expenditures required to stay competitive in the Bitcoin mining industry, it introduces a significant forward dilutive risk. This is one of the main reasons why I am a hold on the stock. Since I am a hold I’m not going to attempt what I think the current fair value of the stock is (the dilution factor adds too much uncertainty).

Bull Thesis (What Could I Be Missing?)

In a recent update from J.P. Morgan, Riot got an upgrade from “Neutral” to “Overweight” with a price target of $15. As of the time of this writing, JPM reiterated their rating this morning.

The bullish outlook by J.P. Morgan’s analyst was influenced by Riot’s initiatives aimed at expanding its mining capacity and improving fleet efficiency, particularly with its plans to boost its hash rate at the new Corsicana facility to nearly 20 EH/s throughout 2024.

The bank’s endorsement comes amidst a broader adjustment of price targets for Bitcoin mining stocks by J.P. Morgan, reflecting recent positive movements in Bitcoin prices and overall network hash rate, which supports a more optimistic financial outlook for companies like Riot Platforms.

To be clear, I think there is a good chance even with the decline in Bitcoin mining yields in Q1 that the company made ~some~ sort of profit. In the 10K, they note:

A 10% increase or decrease in both the price of Bitcoin produced during the year ended December 31, 2023 and the fair value of Bitcoin as of December 31, 2023, would have increased or decreased net income by approximately $48.9 million -10K.

Since December 31st, Bitcoin is up over 50%. Extrapolated to one quarter of 50% gains and this would result in about $61 million in net income adjustments in Q1. This doesn’t mean this is sustainable however (we all know how volatile Bitcoin is). Rather, this is the firm benefiting from securities on their balance sheet going up in value. This does not indicate the viability of the underlying mining business.

Conclusion

I believe Riot Platforms, one of the major players in the U.S. Bitcoin mining landscape, finds themselves at a juncture following the 2024 Bitcoin halving event.

The halving on April 19th has drastically reduced block rewards, likely extending the financial strain due to the company’s aggressive expansion of mining rigs and the rising costs of technological upgrades. These challenges are reflected in Riot’s significant increase in depreciation expenses and the substantial capital raised through share offerings to fund its operations, which, while necessary, dilutes shareholder value.

While I am long run bullish on Bitcoin itself, I think the company’s mining strategy may face headwinds due to their strong at-the-market offerings to fund capital upgrade cycles. After a while, the market may balk at these equity demands and not provide a share price high enough to support future share offerings.

For now, I am a hold. If the price of Bitcoin appreciates exponentially, or the company is able to sustainably mine Bitcoin (and generate net income after depreciation expenses) then I could be convinced to upgrade the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the Managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.