Summary:

- Riot Platforms’ stock has underperformed compared to the actual Bitcoin asset and other Bitcoin miners like Marathon Digital.

- Bitcoin miners like Riot Platforms are unprofitable on a Gross Profit level due to the business model’s poor operational leverage.

- After adjustments, I estimated that Riot Platforms has a Gross Loss of -$163.6 million, meaning it is losing money per Bitcoin produced.

LPETTET/iStock Unreleased via Getty Images

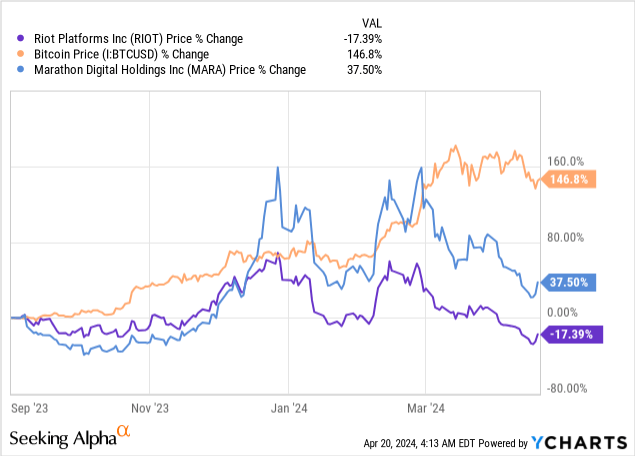

In my view, investors are much better off owning the actual Bitcoin than any Bitcoin miner. This is especially true for underperformers like Riot Platforms (NASDAQ:RIOT). While the actual Bitcoin (BTC-USD) asset has skyrocketed, owning RIOT stock has been a money loser. In my view, this is not bound to change in the future due to the company’s difficult business economics.

RIOT Stock Underperforms

The bottom for Bitcoin prices was around September 2023. This can be the starting point we can use to compare the performance of Riot’s stock with the underlying Bitcoin asset. As seen in the chart below, buying Riot stock drastically underperformed both Bitcoin and Marathon Digital (MARA) which is the leader in this space, having the largest market cap.

In my article on Marathon Digital, I highlighted two main reasons that I believe Bitcoin miners in general will underperform owning actual Bitcoin. The first reason is centered around decreasing demand from investors for Bitcoin mining stocks, such as Riot Platforms, once Bitcoin ETFs become widely available. Since the SEC approved Bitcoin ETFs last January, it has been much easier for the everyday layperson with a 401K to get Bitcoin exposure.

The second reason is the difficult business economics suffered by Bitcoin miners. The more Bitcoins are mined, the more resources are needed to be spent to mine the next Bitcoin. On top of this, Bitcoin halving occurs every four years. Therefore, in one stroke, the number of Bitcoins that miners produce is instantly cut in half. This event essentially halves the company’s future revenues, which is more than any one-time gain a miner, like Riot Platforms, could see from Bitcoin’s price increase.

Finally, most miners are unprofitable on a Gross Profit level due to the business model’s poor operational leverage. A simple definition from Wall Street Prep describes Operating Leverage as something that “measures the proportion of a company’s cost structure that consists of fixed costs rather than variable costs.” Despite the headline numbers, it is my view that Riot Platforms suffers from the same issue as well.

Riot Platforms Headline Results Look Strong

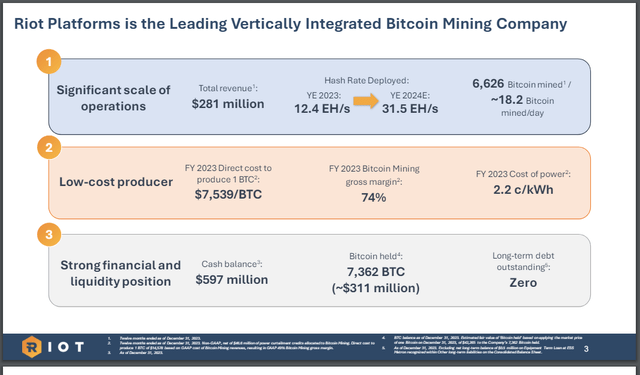

The press headlines would make you believe that Riot Platforms is firing on all cylinders. However, after digging through the results a little bit more, it is in my opinion that is not the case. The company achieved all-time highs in 2023, ending the year with $281 million in total revenues compared to $259.2 million in 2022.

The company produced 6,626 Bitcoins in 2023, an increase of 19% compared to the 5,554 Bitcoins the previous year. In the press release management commented that the increase in production was “notwithstanding the impact of the Company’s effective employment of its power strategy, under which Bitcoin production was suspended while the Company received significant benefits from power credits earned.”

In other words, Riot Platforms earned $71 million in power credits by curtailing its operations and returning the electricity back to the power grid. I don’t like this aspect of Riot Platform’s business, as it ultimately is a form of “market timing.” In other words, management needs to make a call on whether to mine or return power back to the grid. Rather than produce the maximum amount of Bitcoin in 2023, Riot Platform was ultimately “betting” (or hedging) that the price of Bitcoin would remain stagnant or fall.

It did not in 2023 as Bitcoin went on a massive rally. It is in my view that Riot Platforms missed some of these gains as for reference, Marathon Digital’s Bitcoin production was up roughly 3x in 2023 compared to Riot Platform’s 19%. This is a line item that I will continue to watch out for in upcoming releases.

As of March 2024, the company has a strong balance sheet with $685 million in cash on hand and 8,490 unencumbered Bitcoin. This is about $1.3 billion worth of liquidity based on March month-end Bitcoin prices. The company has virtually no long-term debt obligations.

The company also is on track with getting its Corsicana Facility in Texas to full operations. The company has an initial target of a total rate of 28 EH/s in 2024 (increased to 31 EH/s), 38 EH/s in 2025, and eventually 100 EH/s. According to the company’s press release.

With the Corsicana Facility’s 400-megawatt substation now operational, we remain well on track to increase our self-mining hash rate capacity to 31 EH/s by the end of 2024, which will represent a significant increase in our operational capabilities. We are excited about the incredible pipeline for growth the Corsicana Facility provides over the next several years, and we look forward to further executing on that plan

Adjusting Riot Platforms’ Gross Profit

In a previous article, I showed that Marathon Digital is unprofitable on a gross margin basis. Therefore, imagine my surprise when I read Riot Platform’s investor presentations and press releases that it is able to mine Bitcoin at a profit.

This seemed sort of odd to me, as I viewed Bitcoin mining as a type of commodity business. When it comes to mining rigs and optimizing such, there isn’t any real “secret” to it. Most miners have the same access to 3rd party rig suppliers and technologies to lower electricity costs. Marathon is a major player in the space, with a market capitalization of $4 billion (compared to Riot Platforms’ $2.1 billion). Thus, it should have had access to the same technologies and strategies. Could Riot Platform be any different? Has it discovered some sort of “secret sauce” to Bitcoin mining?

The short answer in my view is no. Rather, the differences between Riot Platforms and Marathon come down to an accounting choice on how to treat the depreciation of mining rigs. In 2023, the company reported a cost of $7,539 to produce one Bitcoin, giving the company a gross margin of 74% for the year. However, looking at Riot Platform’s Cost of Revenue comes with an important disclaimer “Bitcoin Mining cost of revenue consists primarily of direct production costs of mining operations, including electricity, labor, and insurance, but excluding depreciation and amortization”

Riot Investor Presentation

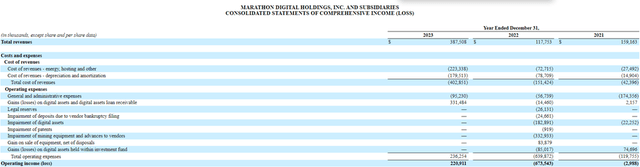

In other words, Riot Platforms’ Cost of Revenues excludes the very important cost of the depreciation of its Bitcoin rigs/ miners. Remember that mining Bitcoin essentially only has two inputs, electricity and the machine/rig used to mine Bitcoin. As seen in the screenshot, Marathon Digital’s 10-K clearly indicates depreciation and amortization as part of its Cost of Revenues, giving the company a negative Gross Profit.

Marathon Digital 10-K

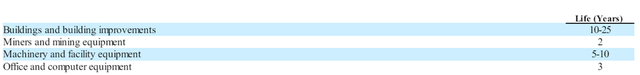

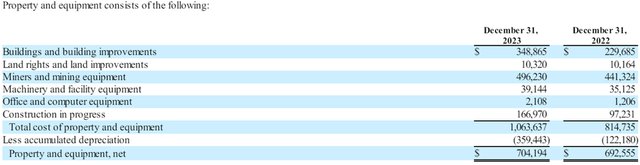

According to Riot Platforms’ 10-K, the company had a depreciation and amortization of $252.4 million in 2023. This cost, according to the notes, “was primarily attributable to the depreciation of our miners.” In my view, depreciation of mining rigs should be part of Cost of Revenues given the fact that mining rigs have a very short useful life.

Riot Platforms only gives its mining rigs a useful life of 2 years, making it closer to a variable cost rather than a long-lived fixed cost. Re-classifying mining rigs from fixed costs (below Gross Profit) to variable costs (Cost of Revenues) shows that Bitcoin miners in general have poor Operational Leverage.

Riot 10-K

I want to note though that I am not making any claims on whether or not Riot Platforms’ treatment of this cost is appropriate from an accounting perspective. That is a question for the accountants/ auditors. I am merely making the adjustments to make the proper “Apples to Apples” comparison.

So let’s make the proper adjustments. In 2023 Riot Platforms had total Revenue of $280 million. Its total Cost of Revenue was $254.3 million, consisting of $96.6 for Bitcoin mining, $97.1 for Data Center hosting and $60.6 for Engineering.

Now let’s include 75% of the company’s depreciation expense, which is $189.3 million. In my opinion, 75% of depreciation expense is a conservative number considering that mining rigs make up a bulk of the company’s Property and Equipment and the relatively much shorter lifespan of such equipment. This gives us an estimated Gross Loss of -$163.6 million. This is much larger than Marathon Digital’s Gross Loss and demonstrates that Riot Platforms is losing money per Bitcoin produced.

Riot 10-K

Conclusion

As mentioned in my previous article, I am not a fan of Bitcoin miners due to their overall poor business economics in my opinion. Riot Platforms is even worse than Marathon Digital, given that its Gross Loss is much larger. In my view, the company also failed to take full advantage of the massive Bitcoin rally due to its “unique power strategy.”

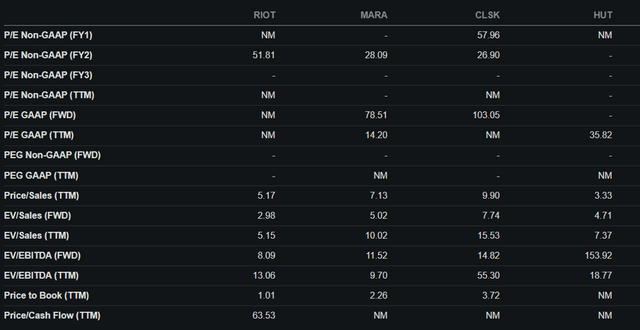

Riot Platforms might be among the cheaper options compared to other Bitcoin miners at 5x Price to Sales. However, with the easy availability of actual Spot Bitcoin ETFs, I would prefer to avoid Riot Platforms altogether.

Relative Valuation (Seeking Alpha)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BTC-USD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.