Summary:

- Riot Platforms has failed to consistently show profitability in its mining operations, even after the recent Bitcoin bull market.

- The company’s profits are attributed to Bitcoin’s fair value changes, which may become negative given its recent declines.

- Riot Platforms has raised over $1B in investor cash on a TTM basis, which is nearly half of its current market value. This suggests significant and potentially fruitless equity dilution.

- The company may have some support from its tangible book value. To me, that depends on whether or not its physical investments can be used for non-Bitcoin activities.

- RIOT’s political risk appears high as more voters and politicians question its voracious power needs, which can be argued to provide limited general economic benefit, particularly given ERCOT’s grid difficulties.

asbe

In December of 2021, I published a bearish view regarding the blockchain mining company Riot Platforms (NASDAQ:RIOT) in “Why Riot Blockchain May Never Generate Consistent Profits.” The stock has declined by ~64% despite a significant Bitcoin rally over the past year. RIOT is also down 28% YoY despite an 86% increase in Bitcoin’s value. Analyst sentiment remains very mixed, with many bullish and bearish outlooks.

Given Bitcoin is back at a high level and facing some stagnation to its rally, I believe it is another excellent time to analyze Riot Platforms. The company has changed over the past two and a half years, and the cryptocurrency market has shifted even more, going through a full negative and positive cycle since.

With Bitcoin at a high, we should imagine Riot’s current profit level may be in the higher range of its forward potential. Thus, it may be headed for even greater financial pressures if it cannot earn a consistent profit after years of development and higher cryptocurrency prices. Further, with Bitcoin crashing by over 5% on Thursday, we must consider RIOT’s exposure to a potential reversal in Bitcoin’s value.

Bitcoin May Have No Value in the Long Run

Over a decade ago, Riot’s business model likely would have sounded nonsensical to most people. The company owns massive Bitcoin “mining” facilities through data centers. This requires Gigawatts of power, enough energy to power hundreds of thousands of homes. Mind you, its operations are focused in Texas, which has had notorious difficulty with the ERCOT grid in recent years due to rising demand. As such, Texas has paid Riot Platforms through energy credits to avoid consuming power during peak demand periods. The company has reported this as “providing power,” but it is more than not using it during high-demand periods and getting paid for that.

All of this power is used to make more Bitcoins. Those who have read my work know that I do not believe Bitcoin is a viable currency, given its poor transaction efficiency “scalability problem.” What I understand is not necessarily important in the short-term, as if people believe in Bitcoin, it will have value. However, in the long run, I think it will likely be other cryptocurrencies that do not have scalability issues and extremely excessive power demand requirements that prove viable. Riot may adapt to this by shifting toward other cryptocurrencies.

Of course, potentially viable alternatives like Ripple cannot be mined. I argue that “mining” is a crucial issue with many cryptocurrencies. Riot’s servers are dedicated to solving “complex cryptographic puzzles” that become more difficult once Bitcoins are mined, artificially limiting supply growth. This validates transactions, but in a highly inefficient manner where the transaction ledger must be updated across a comprehensive decentralized platform of miners. Cryptocurrencies like XRP that do not use this inefficient method can do transactions in seconds (as opposed to ~30 minutes) at much lower power costs.

For me, Riot Platform is far too dependent on Bitcoin, a Dinosaur in the cryptocurrency market—the vast majority like Bitcoin for its speculative volatility. Most people think of Bitcoin in terms of its dollar value, directly implying that its value compared to fiat currency is more important than its value as a replacement of fiat currency. This is to say that Bitcoin has value only because people think it has value – not because it can replace fiat currency.

Rising Power Retail Prices Signal Political Risk

The most significant issue with its profitability is the cost of power. Including all of its facilities, its power cost was 2.6c/kWh last month. Due to seasonal fluctuations, its annual average power cost should be above that level. Its power costs are far below retail levels due to long-term power contracts and its effort to buy at low-cost periods and avoid consumption during peak demand. Since it has contracts to buy, it has earned sales by selling this pre-contracted power during expensive periods. It could be argued that its most profitable business segment is these gains from not operating.

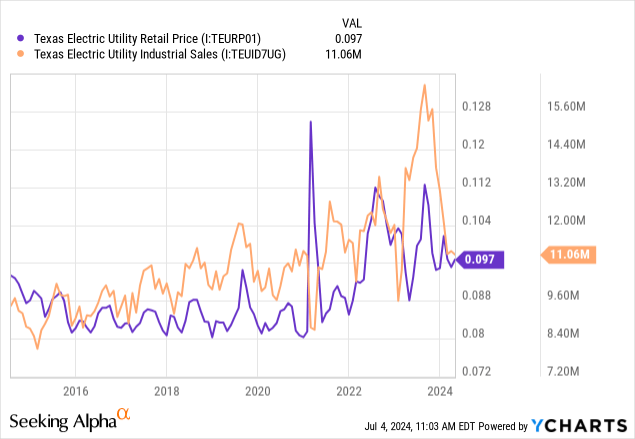

Still, there is a generally positive trend in Texas’ power costs, likely partially driven by rising demand from industrial sources like Riot. See below:

Given Texas ‘ power grid issues, it is unclear if Riot will manage very low power costs indefinitely. Key figures in the Texas state government sought to survey its power consumption in an “emergency survey.” However, Riot, with aid from the Texas Blockchain Council, blocked this through a lawsuit, leading to the destruction of all relevant data. From this, I conclude that Riot’s exposure to political strains will likely grow, as people and politicians may see it as an enormous drain of scarce power that is not going to a clear economic purpose. Of course, I am confident that Riot would argue that mining Bitcoin serves some purpose, but politicians and voters struggling with rising electricity bills may disagree.

Unprofitable In Good Times and Bad

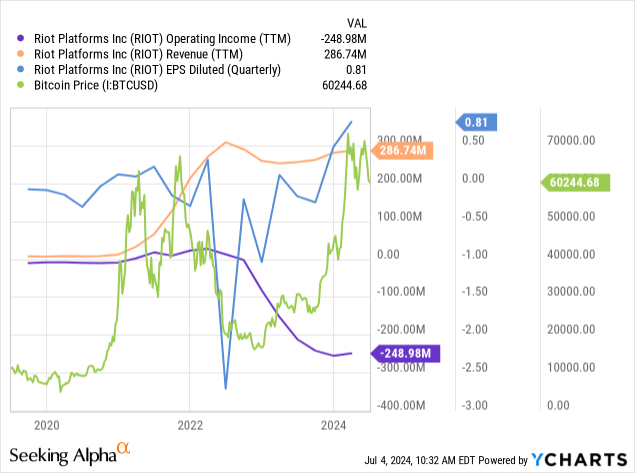

Most cryptocurrency-centric stocks are highly correlated to Bitcoin and other major cryptocurrencies. RIOT has partially lost its correlation to Bitcoin, given its operating income has collapsed to terribly negative levels despite an increase in revenue. See below:

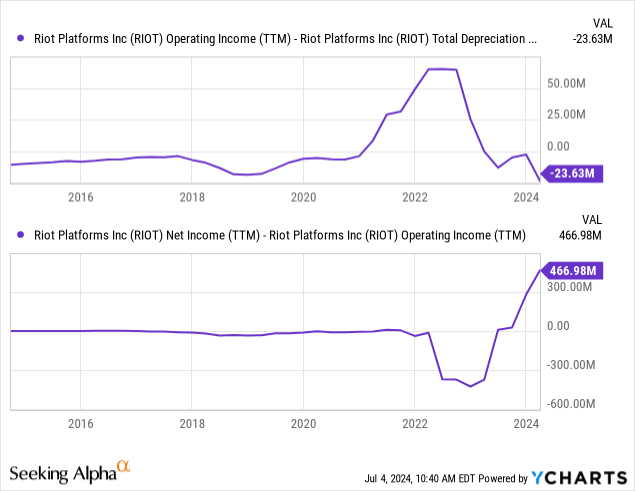

Critical differences exist between how YCharts accounts for Riot’s operating income and how the company does. Per its annual report, we can see that it counts changes to Bitcoin’s value as an operating factor, whereas such (changes to fair value) are more typically viewed as non-operating, which is how YCharts accounts. Riot’s operating income is very negative, attributable to its relatively low profit margins after its power costs and other overhead. Of course, if we add back depreciation and amortization, or “net operating income,” we can see it closer to breakeven but still generally below that threshold. Further, by looking at the difference between its operating income and net income (per YCharts’ accounting), we can see its exposure to Bitcoin’s price. See below:

Riot Platform holds around 9.33K in BTC, which is worth around $538M at today’s price. As the price of Bitcoin rose in 2023, the company reported a positive change in the fair value of Bitcoin of $184.7M (10-K pg. 42). That figure is the primary driver of its positive net income on a TTM basis. However, even if we deduct all depreciation (some of which will be realized as its assets age), the company does not earn a consistent profit on its core operations, primarily mining.

The Bottom Line

I am skeptical of Riot Platform’s current business model. Not only is the premise of Bitcoin mining likely flawed (in my opinion), as well as the concept of Bitcoin-as-a-currency, but it has also failed to earn a positive net operating income even during a period of high Bitcoin prices. Of course, that point can be debated based on how we account for changes to Bitcoin’s fair value. Its income is positive due to unrealzied gains on higher BTC prices. Now that we’re seeing negative pressure in BTC, it seems that those gains could become losses.

From an operational standpoint, its most profitable activity is not using the power it bought at a lower cost. That is interesting, but I do not believe it will be an avenue for long-term consistent profitability. Today, its Bitcoin production is down dramatically YoY as it continues to shift toward lower production at greater Hash Rate efficiency.

While Riot’s strategy has failed to earn consistent profits in a would-be-strong period, it has some value. The company owns electronic assets, some of which could theoretically be converted into a traditional data center if it shifted away from Bitcoin. The critical issue with this is that most of its computational power comes from Application-Specific Integrated Circuits instead of CPUs and GPUs. These “ASIC” chips are specifically designed for cryptocurrency mining and use more power to do so more efficiently. If the cryptocurrency mining market fails due to a prolonged decline in cryptocurrency prices or higher power costs, these components may be of little value.

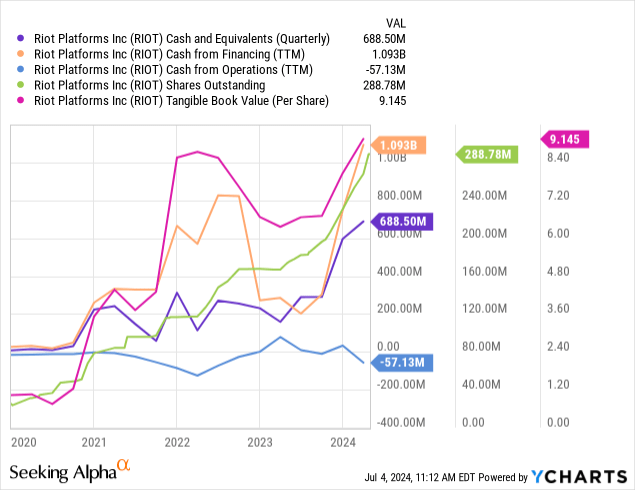

Still, Riot has no material financial debt and other valuable assets. Its tangible book value per share is $9.15, which is near its current share price of $9.6. Its cash position is historically high at $688M. That said, its value is at high dilution risk. The company is likely losing cash on an operational basis today and is instead utilizing tremendous cash from financing via very aggressive share sales. See below:

On a TTM basis, the company raised ~$1.09B from financing (primarily equity sales). However, its market capitalization is only $2.76B, so continued dilution at this pace could rapidly deteriorate equity holders’ value. In other words, the company is raising a lot of cash from investors and has failed to show a positive ROI from these investments. While its tangible book is near its market capitalization, I estimate that its liquidation value would be below its book value as I do not believe its chips are worth what they’ve paid for them, given I also think the Bitcoin mining industry is inherently unsustainable.

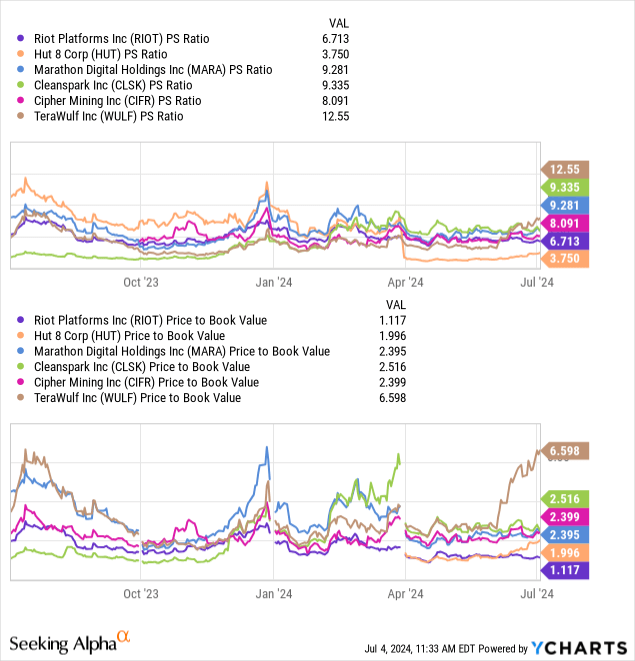

Compared to its peers, Riot does have a lower valuation based on price-to-sales and price-to-book. See below:

It is larger and more established within its industry but has a weakened reputation due to low returns on equity-dilutive investments. Consistently positive operating profits are unseen in the industry, so it isn’t easy to distinguish between their valuations.

I feel that companies can bring in a great deal of money from retail investors interested in popular trends or capitalizing on “FOMO.” In my experience, genuinely profitable growth industries usually focus on private capital markets with access to “smart money.” Those firms who can garner media attention with popular media buzzwords like “Bitcoin,” “AI,” and similar may find public markets a better avenue to raise capital, given institutional investors are more likely to be skeptical of its profitability potential. This is not to say that Riot or its peers are dishonest, only that retail investors should understand that companies can earn a lot of money from retail investors through equity sales if investors are willing to overlook profitability potential consistently.

In my opinion, retail investors in RIOT are overlooking its failure to earn a positive income despite massive projects that have required immense equity investor capital dilution. Again, if it cannot earn a solid operating profit during high Bitcoin periods, I do not see how it can thrive in the long term. My view is based on my belief that Bitcoin’s feasibility as a currency is very low. I am sure some may disagree with my opinion. However, even if we assume Bitcoin maintains the $50K to $100K range, it is unclear if Riot will see consistent positive operating cash flows.

For these reasons, I am bearish on RIOT and expect it will decline due to equity dilution, negative operating income, and potentially significant losses, given recent declines in BTC-USD. That said, I would not short-sell RIOT. RIOT’s short interest is 20%, giving it some risk of a positive breakout in a short squeeze. Although I am bearish on Bitcoin, it could continue to rise where Riot may temporarily see improved profits.

Lastly, and most importantly, if we assume Riot ends its equity dilution habit, its tangible net asset value may not be dramatically below its market capitalization. The company has a strong cash position and physical assets likely have some value even if it ended its mining focus. That said, I cannot provide a feasible value estimate for its physical assets because we’re not seeing a positive net operating income. Still, I think RIOT is overvalued broadly due to dilutions (and generally negative returns on investment) and not necessarily due to a significant premium to its theoretical net asset value.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.