Summary:

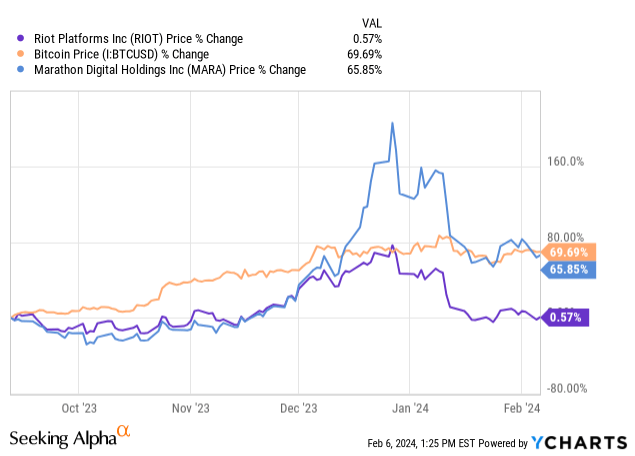

- Riot Platforms has seen a decline in its stock price and has badly underperformed Bitcoin since late December.

- The company changed HODL strategy in January, seemingly out of a sense of urgency with the looming halving.

- Riot’s mining fleet has been inefficient compared to other miners.

- With massive growth planned for this year and 2025, shareholders should be mindful of how BTC per EH/s numbers change in the coming months.

South_agency

It has been nearly five months since I last covered Riot Platforms (NASDAQ:RIOT) for Seeking Alpha. At that time, the company was enduring a bit of PR problem as Riot’s power credit revenue during extreme summer heat was scrutinized. This is an excerpt from my summary back in September:

When I covered the company in late July, I said I was not buying the rip. Now that the shares are 40% lower from where they were when that article was published, you could talk me into getting slightly more aggressive with a DCA strategy. I think anything under $10 is probably a reasonable starting point if you’re looking to build a RIOT position.

While the price of RIOT shares dipped below $9 per share shortly following that article, the stock did ultimately rally up near $19 near the end of last year.

Notably, even during the rally in December, Riot Platforms has largely failed to outperform Bitcoin (BTC-USD) since my last RIOT article was published. Considering Marathon Digital (MARA) has been able to maintain pace with BTC over the last 4 months and even outperform for period of time, I think revisiting the RIOT idea is warranted.

Production and HODL Strategy

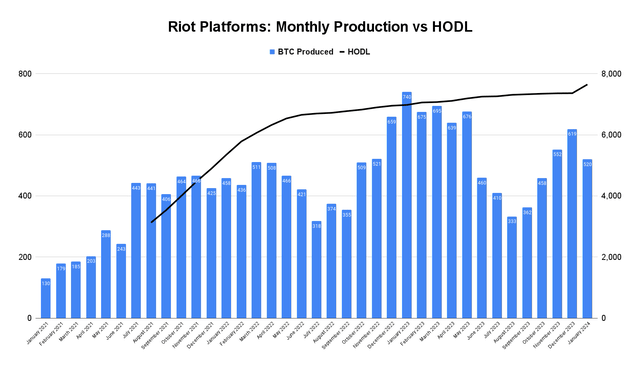

During the month of January, Riot produced 520 BTC on 12.4 EH/s. What stands out to me from the company’s first update of the year is the noticeable move higher in Riot’s HODL stack. Of the 520 BTC mined during the month, Riot only sold 212 coins. From the January update:

As we approach the halving, which is expected to occur in April 2024, Riot also intends to leverage our ability to obtain Bitcoin at a significant discount to its current market price by retaining a greater proportion of our monthly Bitcoin production in the near term.

This is a drastic change to the balance approach from Q4 as the company sold 96% of the 1,629 BTC that was mined between October and December.

Monthly Production/HODL (Riot Platforms, Author’s Chart)

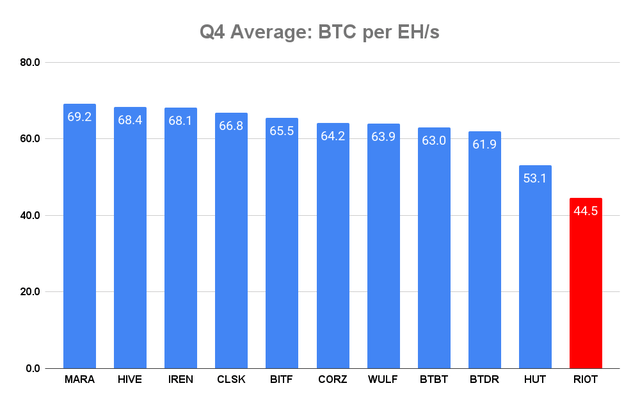

My personal read on this is the company is seeing the urgency of the upcoming block reward halving in April and has decided the best way to approach the next couple months is to keep as much BTC as possible. If Riot’s mining fleet was efficient, the company may not have as much urgency. However, over the last four months Riot’s BTC mined per EH/s has been a massive laggard compared to the rest of the industry. Here’s the averages for Q4 for Riot and many of the top to mid-tier public miners:

Miner Efficiency (Company Filings, Author’s Chart)

At just 44.5 EH/s in Q4 and just 41.9 in January, shareholders would be justified in showing some concern at this juncture. All else being equal, if the fleet stays the same this figure will be closer to 20 BTC per EH/s in May. That is not a recipe for long term success and I don’t think curtailment efforts in Q4 are the reason why these efficiency numbers are so low.

| Revenue | Mining | Power Credits | DR Credits | % From Mining |

|---|---|---|---|---|

| May 2023 | $16.5 | $0.5 | $2.3 | 85.5% |

| June 2023 | $10.6 | $8.4 | $1.7 | 51.2% |

| July 2023 | $12.1 | $6.0 | $1.8 | 60.8% |

| August 2023 | $8.6 | $24.2 | $7.4 | 21.4% |

| September 2023 | $9.0 | $11.0 | $2.6 | 39.8% |

| October 2023 | $12.5 | $1.0 | $1.9 | 81.2% |

| November 2023 | $19.6 | $0.2 | $1.7 | 91.2% |

| December 2023 | $25.3 | $0.0 | $0.5 | 98.1% |

| January 2024 | $9.5 | $2.2 | $1.1 | 74.2% |

Source: Riot Platforms, $ in millions

In the table above, I’m showing monthly reported revenue from Riot Platforms broken out by segment and the percentage of total revenue from mining. We can see the obvious decline in mining as a revenue source from June through September during the hot summer months. However, 90% of Riot’s revenue came from mining during Q4 and the company’s BTC per EH/s ranking was still subpar.

Hash Growth

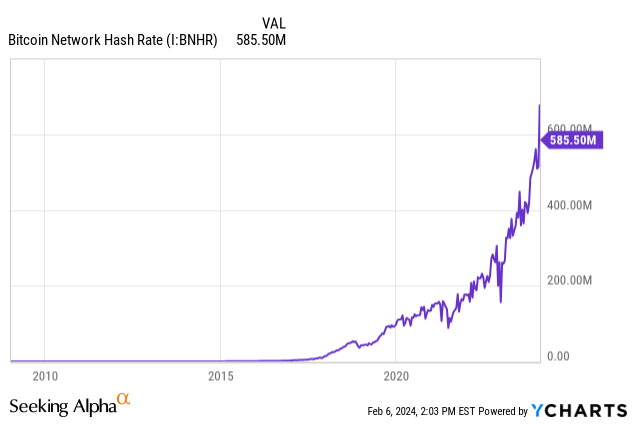

The fundamental problem for all Bitcoin miners is the declining token issuance coupled with the ever increasing demand for the block reward. Even when Bitcoin’s price struggled during “crypto winter,” global hash rate has gone up in virtually a straight line. Since the token issuance is fixed, the increase in demand for Bitcoin mining rewards reduces mining share for each individual miner unless the operator grows hash in line with global growth:

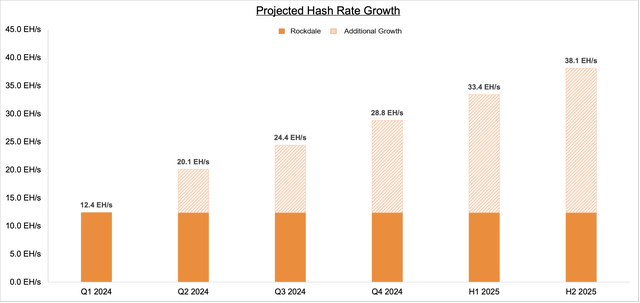

Projected Hash Growth (Riot Platforms)

Riot is projecting to grow to 20.1 EH/s by the end of Q2 and 28.8 EH/s by the end of year. If the company can achieve this, it would put Riot back on a comparable scale of production to that of Marathon Digital.

Additional Considerations

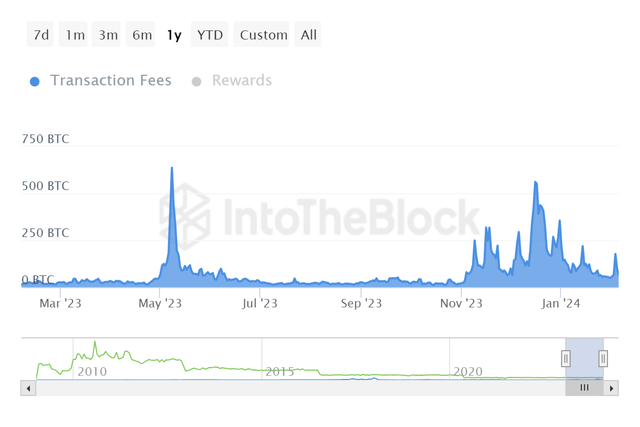

While it’s fair to point out the block reward halving as an obvious risk to miners, there is an opportunity to grow rewards through network transaction fees if network usage remains high and participants continue to show a willingness to pay for priority.

Bitcoin Transaction Fees (IntoTheBlock)

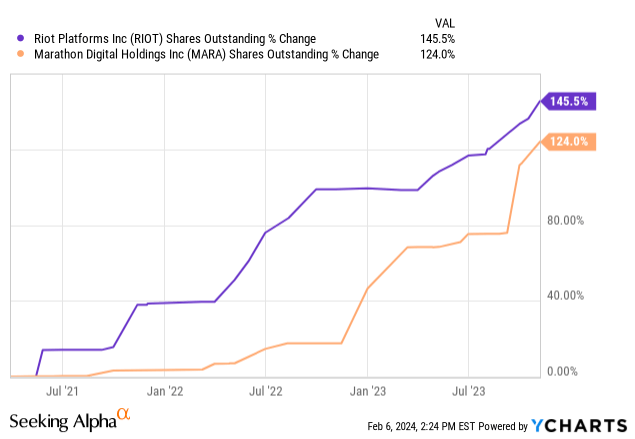

While November and December were phenomenal months for fees from the miners’ vantage, January did come back down to earth a bit. Until transaction fees become a larger portion of miner revenue permanently, companies like Riot will likely experience the kind of boom/bust cycles we’ve seen during previous halving events. These cycles are often financed by debt and/or dilution:

In Riot’s December update, the company disclosed 230.8 million shares outstanding. This would be a 11.3% increase in shares from the Q3-23 report. That said, Riot doesn’t carry a large amount of debt like some of the other mining peers in the sector and had $590 million in cash at the end of 2023. From a balance sheet standpoint, few miners are in a better situation.

Summary

I still approach Bitcoin miners the same way I did before the spot ETF approvals in January. For me, they are leveraged plays on Bitcoin that will outperform during the good times and underperform the asset during the bad times. One should have a high risk tolerance when trading these entities and recognize the long term headwinds facing the industry if transaction fees don’t become a more meaningful long term driver of mining rewards. I still think RIOT is an interesting trade, but I do think it’s possible we see some additional weakness in the shares between now and the time the company can energize new machines. I’m on the sidelines at the moment but will likely revisit the idea in the months ahead.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BTC-USD, MARA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not an investment advisor. I trade RIOT fairly often. I don't currently have a position but that can certainly change in the weeks ahead.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.