Summary:

- The Bitcoin rally has boosted crypto-related stocks, including most miners, with significant year-to-date gains.

- Riot Platforms has a strong risk/reward profile and a potential breakout pending from a symmetrical triangle pattern.

- RIOT’s valuation relative to Bitcoin is extremely low, making it a potentially attractive investment opportunity.

Just_Super

The rally in Bitcoin has taken a number of crypto-related stocks to the moon with it thus far this year. The coin itself is flying, but crypto-related stocks, in a lot of cases, have orders of magnitude more in terms of year-to-date gains as a result. One area of the market that’s done very well on this Bitcoin rally is miners, but not all miners are created equal.

About four months ago, I called Riot Platforms (NASDAQ:RIOT) a Strong Buy, noting at the time it looked like Riot would break its multi-year downtrend. The stock looked good at the time, and I thought Bitcoin would rally into 2024. We’ve definitely seen the latter, but Riot melted down and the breakout never materialized. I was wrong, but that’s why we use stops and avoid being a bag holder.

Now that I’ve taken my lumps over being wrong in December, let’s take a look at Riot today, which appears to have a much better risk/reward profile, particularly as it relates to the valuation. Let’s dig in.

A clear line in the sand

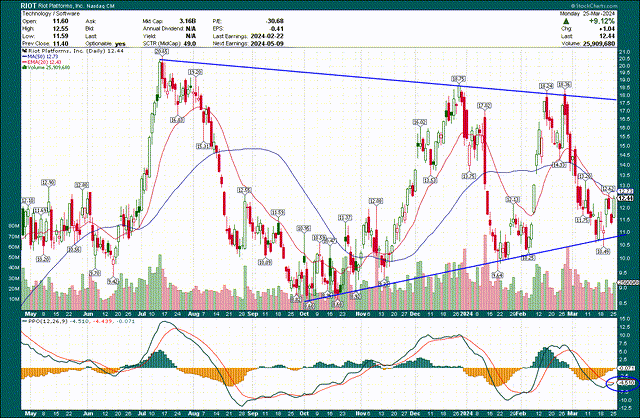

Let’s start with the daily price chart to ground ourselves in the current technical outlook. For me, we have very clear lines being drawn (literally and figuratively) between bulls and bears. We can use these lines to frame out risk and reward quite effectively.

This is a chart of the past ~10 months and we can see the vast majority of this time has been Riot forming a symmetrical triangle pattern. This pattern is huge, so whatever way it ultimately breaks should produce a very large move. We had another successful test of the bottom trendline a few days ago, and the stock was up 9% on Monday. In addition, the PPO really looks terrific given it made a higher low, and the histogram has just gone positive. These things indicate improving bullish momentum, or said another way, a lack of selling momentum. To my eye, that increases the odds that the next big move is up.

As far as levels to watch, this one is very straightforward. I don’t want to own it anywhere under the up-sloping trendline, and we’re looking ultimately for a breakout of the down-sloping trendline to confirm completion of this pattern. That’s probably some time away, but for now, the top of the pattern is still almost 50% higher than today’s price.

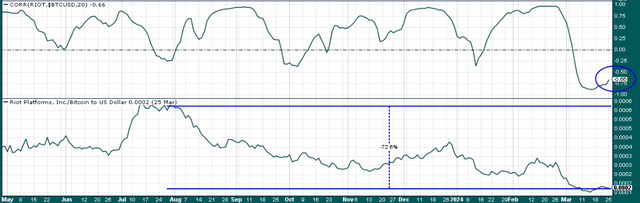

Something that has changed in recent months with Riot, and for the better if you’re trying to get long, is its action relative to Bitcoin itself. With miners, we can measure relative value by comparing Bitcoin’s price action against the miner stock, which is what I’ve done below. In the first panel, we have Riot’s correlation to Bitcoin on a rolling one-month basis, and in the bottom panel, Riot’s stock price relative to the price of Bitcoin.

We can see the correlation of Riot to Bitcoin completely broke down in early March, and is actually negative, oddly enough. In other words, Riot exists basically to mine and sell Bitcoin, but the price of its stock is actually trading inversely to Bitcoin. That’s strange, and I fully expect this to right itself and go positive again. In theory, that could see Riot’s share price “catch up” to the move Bitcoin has made essentially without it.

More importantly, the bottom panel shows Riot’s share price against Bitcoin absolutely imploding in recent months. This measure is down an eye-popping 73% since last July and has steadily eroded for nearly the entire time. What this means is that Riot’s valuation relative to Bitcoin is extremely low right now, so you can think of this as analogous to a company trading for a very low P/E ratio against its historical norms. In that case, the value of the stock is attractive, and I see Riot as exactly the same setup. It exists to mine Bitcoin, so the value of the stock against Bitcoin is the most important measure of value I can think of. Right now, I cannot see any result other than Riot being extremely cheap fundamentally.

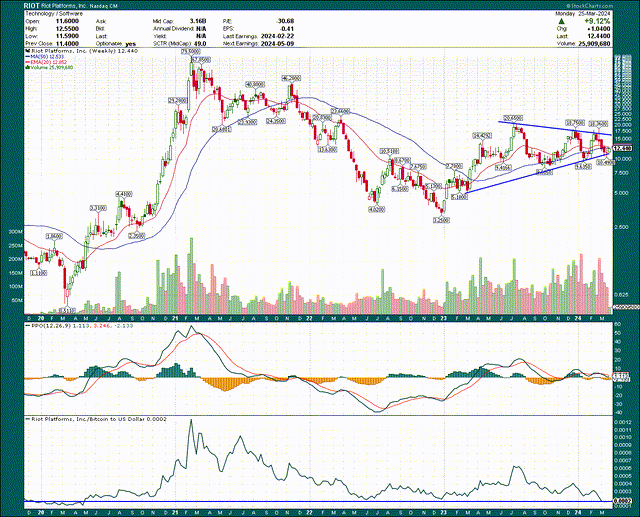

Let’s briefly look at the weekly, longer-term chart to see what’s what on a more zoomed-out view of Riot.

We can see the triangle I mentioned above, and it’s really massive, spanning back over a year depending upon how you draw it. The point is that this kind of coiling results in a big move, so the way this triangle ultimately breaks is of the utmost importance.

One more thing on this chart is the valuation discussion, which I have in the bottom panel here as well. The valuation relative to Bitcoin is not only at multi-year lows but is also at the point where it shot skyward at least three other times in the past. Does that guarantee it will happen again? Absolutely not. Does it make it much more likely? I believe it does, and that’s a big reason why I see Riot’s next move being up and out of this triangle.

Fundamentals support a higher valuation and share price

I’m quite bullish on Riot’s technical picture (in case that wasn’t clear) so long as the up-sloping trendline is respected. Now, let’s take a look at the fundamental picture to see if it’s supportive of the bull case.

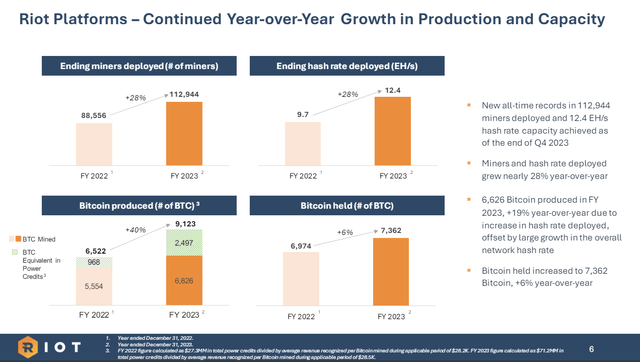

Riot managed to boost its production quite significantly during 2023, and there’s definitely more where that came from. Its hash rate deployment rose 28%, consistent with the number of rigs it grew by during the year. Bitcoin and Bitcoin-equivalent production rose even more, adding 40% from 2022. One thing that I believe is a source of strength for Riot at the moment is its half-billion dollar-plus stash of Bitcoin. At the end of the year, it had 7.4k coins, which are worth well in excess of $500 million today. That affords Riot not only value but the ability to self-finance growth plans, which we’ll look at in a bit.

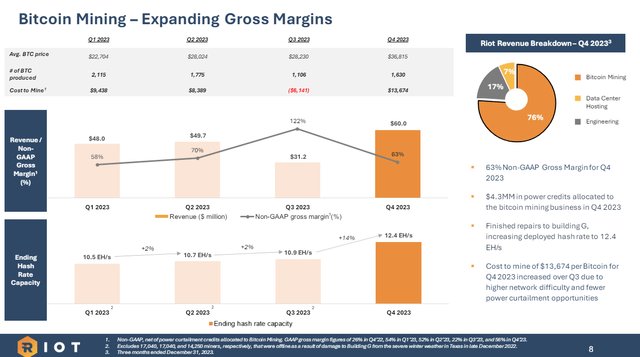

One thing that is a wildcard and a potential risk for Riot, to be fair, is margins.

The cost of mining jumps around a ton for Riot, as do resulting gross margins and operating margins. Investors hate one thing more than anything else, and that is uncertainty. Riot’s margins are a source of uncertainty, so it’s something I watch very closely in each earnings report. The company’s newer rigs provide lower-cost mining capabilities, so in theory, we should see stronger margins. The problem is that network difficulty continues to rise, something that will only worsen over time. Riot can combat this with its growth plans for its rigs, but this is a nontrivial headwind we must monitor.

The upcoming halving event is a big one for miners, as it will effectively increase the cost of mining Bitcoin. However, Riot’s costs – as you can see in the slide above – is very low. It was under $14k per coin in Q4, and while we’ll get a read for Q1 numbers when it next reports earnings, the real impact will be the Q2 update that includes the impact of halving on mining difficulty. Bitcoin at (or anywhere near) $70k means Riot will still be plenty profitable on a gross margin basis, which should also improve as mining scale grows. In addition, the halving is a well-known upcoming event so the stock (and indeed, all miner stocks) is being priced for the impending impact of it.

Looking ahead

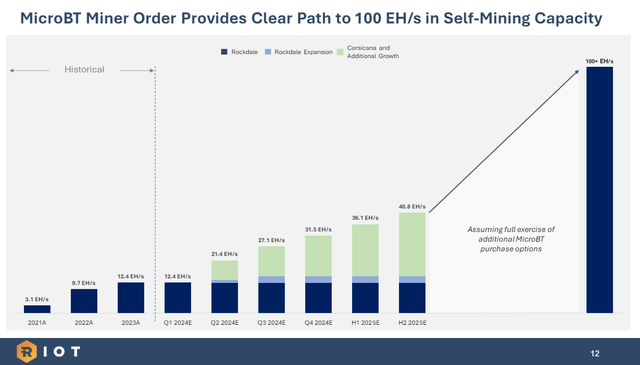

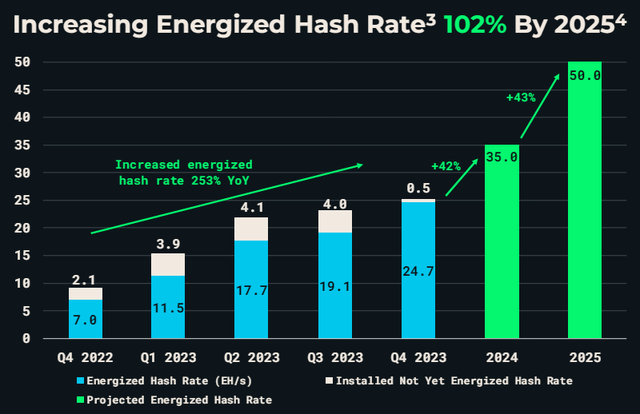

Let’s briefly touch on Riot’s growth plans, as they are immense. The company is just over 12 EH/s right now but has plans to ~8X that eventually.

It can do this via acquisitions, as well as big order volume for newer, more efficient rigs. We can see the growth plan for later this year, as Riot believes it will end 2024 with ~31EH/s, which would be ~2.5X where it started in 2024 if it comes to fruition. Riot has options to buy at least 100EH/s of capacity for the long-term, but first things first, we need to see it execute on reaching its goal of 31EH/s for this year. The point here is that capacity growth potential is massive for Riot, which will help it combat ever-rising network difficulty going forward. Again, this is a key tenet of the bull case.

As a point of comparison, Marathon Digital (MARA) has about 29 EH/s installed right now, on the way to about 50 next year.

Marathon Investor Presentation

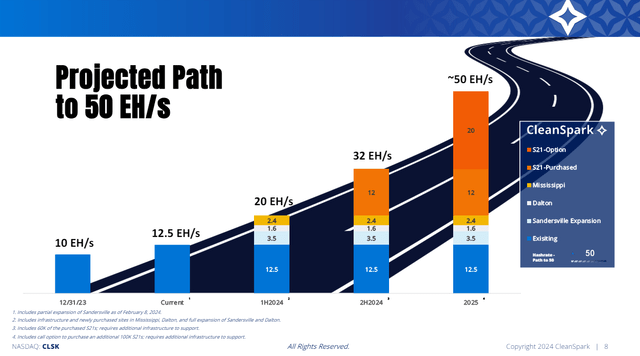

Another large scale miner, CleanSpark (CLSK), is in a similar position.

CleanSpark investor presentation

The company is expecting ~32 EH/s by the end of this year, and 50 by the end of 2025.

On this evidence, Riot is extremely competitive with the other largest scale miners of Bitcoin, meaning it should still be in a very competitive position post-halving. This includes both scale and cost.

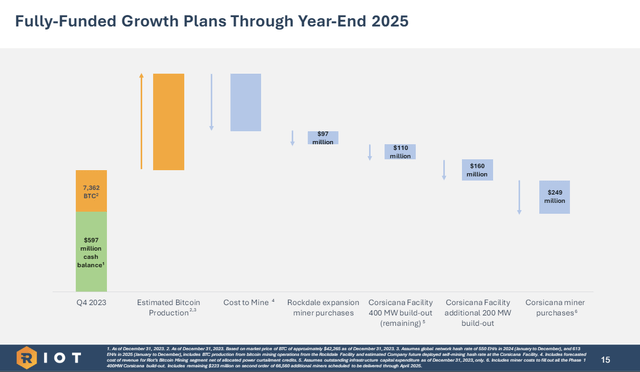

I mentioned above that Riot is in a favorable position with its financing, and we can see that illustrated below.

The company has ~$600 million in cash, nearly that much again in Bitcoin held, and additional Bitcoin coming in every day via mining operations. Its major capex plans are listed above, and you can see even with its Corsicana facility build-out and miners to fill it, Riot is completely self-funded through at least 2025. I cannot stress how important this is for a Bitcoin miner to be in such a favorable financial position, and it only adds to the bull case in my view.

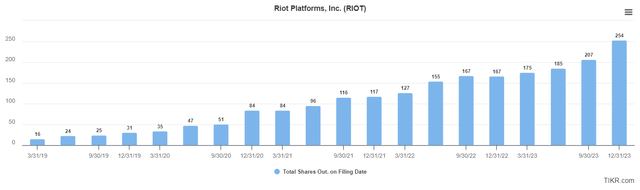

To be fair, Riot has significantly diluted shareholders over time in order to fund its operations.

The share count has mushroomed over time as Riot dilutes shareholders in order to fund operations, but also growth. We’ll have to wait and see what happens but if Bitcoin pricing remains favorable, as it is now, the need to further dilute should diminish over time. The company says it has already fully funded 2024 capex, as well as for 2025, so it would appear to me that barring some massive change, additional dilution should need to occur.

Wrapping up

I got it wrong in December. I identified a setup that ultimately failed, which happens. If every setup materialized, we’d all be billionaires, but that’s not reality. I am, however, sticking with my Strong Buy on Riot because the chart looks quite favorable from a risk/reward perspective, and the valuation of the stock is too low to make sense for me.

On the risk side, the major peril potentially is a selloff in Bitcoin. If the price of the coin itself falls materially, the value of Riot’s holdings will decline, in addition to the margins it produces while mining. The bull case, then, is predicated upon Bitcoin prices remaining high (and ideally moving even higher). If that doesn’t happen, Riot’s break will likely be to the downside on the price chart.

Rising network difficulty is the other potential headwind, as we know that rises quite sharply over time. Riot has plans in place to combat this, which we looked at, but planning on something and executing on something are totally different. If Riot cannot execute properly on its growth plans, that’s another derailer for the bull case. In addition, rising difficulty brings with it potential margin issues, as outlined above.

Overall for me, however, I’m seeing a lot of bullish signs, and I’m sticking to my Strong Buy rating predicated upon the factors I listed above.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in RIOT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.