Summary:

- Riot Platforms rated as hold in April, now downgraded to strong sell due to 17.26% share decrease post Bitcoin halving.

- Bitcoin halving has increased operational challenges for miners like Riot, leading to financial losses and potential share dilution for funding.

- Despite potential leverage to Bitcoin price movements, Riot’s operational inefficiencies and financial struggles make direct Bitcoin investment a more profitable strategy.

Michael M. Santiago/Getty Images News

Investment Thesis

Back in April, I covered Riot Platforms (NASDAQ:RIOT), and rated the company as a hold. Since then, shares have fallen roughly 17.26%, while the market has increased by 10.74%.

The recent Bitcoin halving has introduced considerable challenges for miners, including Riot. Post-halving, each ASIC miner now needs to work twice as hard to mine the same amount of Bitcoin, yet the anticipated price increase for Bitcoin has not materialized to offset this increased difficulty. In June 2024, Riot’s Bitcoin production fell 45% year-over-year, highlighting the operational inefficiencies and heightened challenges the company faces due to this halving.

As a result of this, Riot Platforms is now losing money (estimated for the upcoming quarterly report). I am concerned the company is going to have to reach for even more share dilution to fund the business, which would result in further shareholder losses. With this, I’m now downgrading my belief on the stock to a strong sell.

Why I Am Doing Follow-Up Coverage

As I mentioned above, when I covered Riot last in April, I marked the company as a hold. My reasoning for this was that miners were banking on Bitcoin (Bitcoin)’s prices doubling in order to sustain the competitive nature and costs. If Bitcoin’s prices had moved higher post halving, I would have been more bullish.

However, this did not seem to be the case. Bitcoin prices have fallen, partly caused by miners needing to sell their stashed Bitcoin in order to support their valuation.

Some miners have taken the approach of attaching Bitcoin miners to saunas to subsidize the cost of operating them, also known as selling the heat. While this has been helpful for some miners, I just don’t see Riot doing this, and I am skeptical of the company’s ability to find a long run sustainable way to augment mining costs (I will talk about the ERCOT grid program in the valuation section). Historically, they have not had a long run sustainable cost basis.

With this, I believe updated coverage is warranted. The purpose of this article is to demonstrate the effects this halving has had on their valuation.

Bitcoin Miner Economics

In the wake of the Bitcoin halving on April 19th of 2024, the core economics of the Bitcoin market are undergoing significant shifts. In the long run, the market is expected to absorb the increased supply of Bitcoin as struggling miners are forced to sell their reserves and eventually exit the business. This will occur because it is becoming increasingly difficult for miners to operate profitably under the new, more challenging conditions. As these less efficient miners leave the market, the remaining miners, who can sustain operations, will only mine Bitcoin at prices that are economically viable over the long term.

This selective survival of the fittest should gradually lead to a higher equilibrium price for Bitcoin. The process works through the gradual reduction of Bitcoin supply as miners capitulate, leading to reduced sell pressure in the market. As a result, Bitcoin’s price is likely to move higher over time, driven by the reduced supply and the sustained demand from investors and users.

This increase in price is actually good for miners who are built for longevity and have a sustainable operational model. These miners can weather the tough periods and emerge stronger, receiving the rewards of higher Bitcoin prices in the future. However, Riot does not appear to be built for longevity. Despite their efforts to increase their hash rate and improve operational efficiency, Riot’s financial health and operational sustainability are of concern for me. The company has faced significant production declines and financial losses.

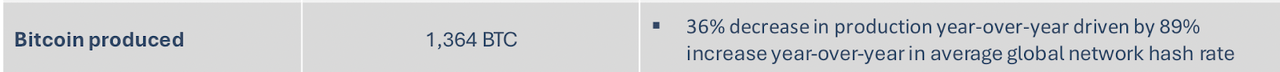

In addition to the pressures placed on Riot from the Bitcoin halving, they seem to just be struggling overall with mining efforts. For example, during the latest earnings call, Colin Yee, Riot CFO, stated:

During the first quarter of 2024, we mined 1,364 Bitcoin, which represents a decrease of 36% from the 2,115 Bitcoin we mined during the first quarter of 2023. This was primarily due to the significant increase in the Bitcoin network difficulty, which has more than doubled since January 2023 -Q1 2024 earnings call.

Keep in mind, this was before the halving, which occurred in April.

Riot Bitcoin Mining Results (Riot Platforms)

While the company mentioned during the call that they expect this number to move back up due to their increased hash rate capacity, I am unsure if they will be achievable due (we saw their mining yields drop significantly in June). While they saw an increase in Bitcoin mining from May to June (they produced 255 Bitcoin), up 19% from May, they still year-over-year saw a 45% drop.

Valuation & Financials

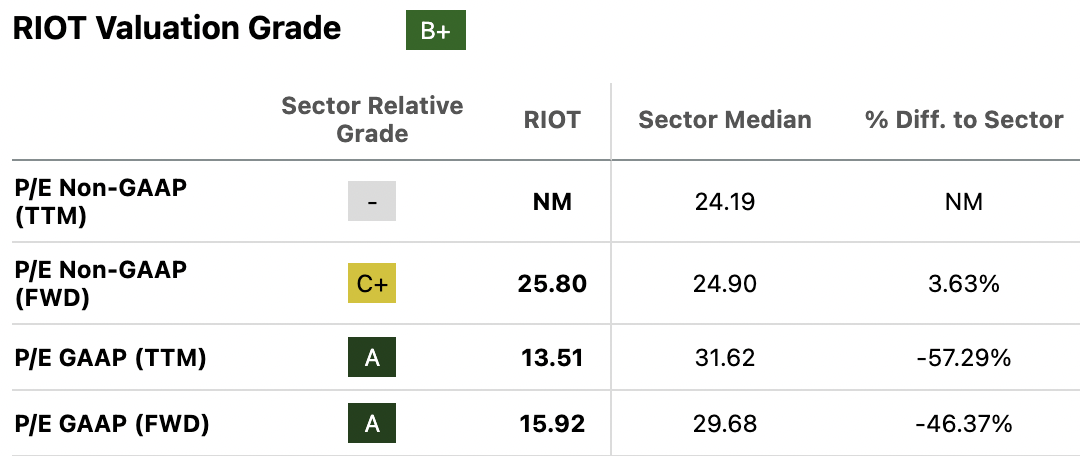

On the surface, Riot’s forward P/E ratio may appear to make the stock attractive. While the company is forecasted to report GAAP profitability over the next 12 months, a big portion of what management is focusing on is their ERCOT program, buying power from the grid at low demand times to help the grid load balance.

Riot Platforms P/E Ratios (Seeking Alpha)

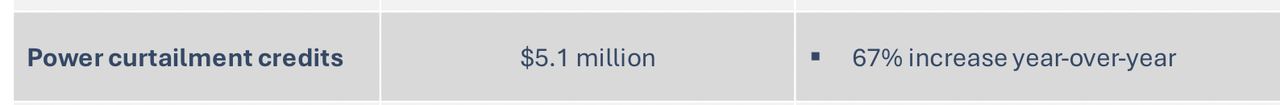

In essence, ERCOT’s program works by providing companies (like Riot) incentives and credits to purchase power at non-peak hours of grid operation. Management has praised this program as a way to help them keep their average costs per Bitcoin mined low (this is their answer to the Sauna heat capture business model).

Unfortunately, I am highly skeptical this will be enough for Riot. Management in their Q1 earnings presentation highlighted the benefit. $5.1 million (and up 67% year over year). This is promising growth, but a small part compared to total revenue in Q1 ($79 million).

Power Curtailment Credits (Riot Platforms)

With this, Riots business appears highly commoditized to me. They are primarily mining Bitcoin and selling it on the open market. They took a 45% production hit when the halving occurred, and were down 36% in mining volume before this as well, which tells me they are not succeeding in grabbing market share (% of Bitcoins mined per day).

This leaves me still at a strong sell. Their forward price to sales ratio stands at 6.96, 130.56% above the sector median (3.02). I am not confident at all in their ability to hit production targets for Bitcoin mining, given they saw a mining volume collapse even before the halving.

With this, I think the stock should be valued at just the sector median price to sales. If the stock converged at this multiple, it would represent 56.7% downside in shares, assuming no dilution.

Bull Thesis

Despite what I believe to be core challenges Riot Platforms faces in their business model, there remains (what I believe to be) a single, solid bull thesis that should be considered.

This lies in the price of Bitcoin.

I believe the price of Bitcoin is likely to move higher in the long run due to its deflationary nature, increasing scarcity, and growing adoption. If Riot can survive the current operational and financial difficulties, they could benefit significantly from the long-term increase of Bitcoin prices. They do have 9,334 Bitcoins as of the end of June.

This Bitcoin reserve effectively provides Riot with significant leverage to Bitcoin’s price movements. As Bitcoin prices rise, the value of Riot’s holdings increases, potentially offsetting some of the operational losses and enhancing the company’s overall valuation. This could be a huge levered Bitcoin investment, much like MicroStrategy (MSTR).

With this, many Bitcoin bulls argue that issuing stock in dollars to mine Bitcoin is a smart move. The logic here is that Riot is raising capital in an inflationary currency (USD) to invest in a deflationary asset (Bitcoin). Over time, assuming the value of Bitcoin continues to appreciate relative to the dollar, this strategy could pay off. This approach could be particularly advantageous if Bitcoin experiences significant price increases, allowing Riot to convert their mining operations and reserves into substantial profits.

Despite the potential upside here, there are considerable risks. I believe Riot’s operational inefficiencies and financial struggles raise doubts about their ability to capitalize on long-term Bitcoin price increases. I think that investing in straight Bitcoin is a much better way to play Bitcoin, therefore potentially a more profitable strategy than investing in Riot’s future. Direct Bitcoin investment eliminates the operational risks associated with mining companies such as Riot and provides direct exposure to Bitcoin’s price movements.

To be clear, I am long run bullish on Bitcoin itself, just not Riot Platforms. If you’re curious on my thoughts on Bitcoin itself, I wrote a piece on BlackRock iShares Bitcoin Trust (IBIT) in April.

Takeaway

Since the Bitcoin halving in mid-April, Riot has been facing significant operating challenges that have led me to adjust my past hold rating from April to a strong sell. This halving has caused each ASIC miner to now need to work twice as hard to mine the same amount of Bitcoin without a corresponding doubling in Bitcoin’s price. This has led to a notable decline in Riot’s Bitcoin production, down 45% year-over-year in June 2024. Despite the bullish long-term outlook on Bitcoin, Riot’s financial health and operational inefficiencies present considerable risks to investors. I believe this strategy of investing in a Bitcoin miner that consistently issues will not be as lucrative for investors as investing in straight Bitcoin. The company’s valuation metrics, particularly their high price-to-sales ratio, suggest that the stock is significantly overvalued compared to their peers.

I believe that with the company’s recent performance, I do not think they are well positioned to recover in the long run (I do not see what part of their strategy will lead them to be long run profitable). Given the lack of a clear path to profitability, the ongoing dilution risks, and the operational challenges post-halving, I now believe Riot is a strong sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.