Summary:

- Riot Platforms’ bid to buy Bitfarms signals potential consolidation in the competitive Bitcoin mining industry.

- Riot is reducing costs by purchasing power plans from utilities in Texas and using a flexible approach to mining.

- Scaling production capacity is crucial to overcome the effects of difficulty and sustain production levels in the face of halving rewards.

- However, comparison with peer Marathon Digital shows that Riot may not have increased hashrate fast enough to avoid a YoY revenue shortfall compared to last year, when it will report second-quarter revenues in July.

- Therefore, there are volatility risks which explain my Hold position, but, with a focus on maximizing self-mining operations, the company could represent a long-term opportunity.

da-kuk

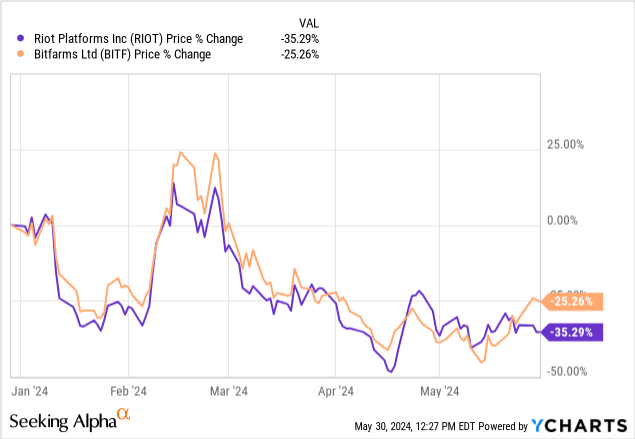

I covered Riot Platforms (NASDAQ:RIOT) with a Hold thesis in June 2021 highlighting the way it was scaling, and since it has lost 71.5% in value and is trading at around $10. Its growth strategy saw it recently make a takeover bid for Bitfarms (NASDAQ:BITF) for about $950 million. This, I believe should be followed by other deals in a highly competitive crypto-mining industry where it is getting more difficult to produce Bitcoins.

This difficulty was exacerbated by the Bitcoin (BTC-USD) halving event last month, which marked a drastic reduction in the rewards perceived by miners for each block they add to the blockchain as operating costs remain on the high side in a market where prices may be pressurized.

Against such a backdrop, this thesis shows that despite a 35% year-to-date downside, Riot is not a buy.

Instead, this could represent an opportunity given the way it is managing direct costs to mine while also scaling operations.

Reducing Costs to Address The Issue of Lower Rewards

First, energy remains the largest cost item for Bitcoin miners, as it limits the ability to bring the hashrate online or increase production capacity.

Thus, for Riot, power costs were $16,764 in the first quarter of 2024 (Q1) and represented 73% of the total direct cost to mine. The remaining 27% includes labor, insurance, network maintenance, equipment repairs, land lease and taxes, network costs, and other utility expenses.

Looking across this highly competitive industry, miners like Bitfarms normally target low-cost, stranded, and renewable electricity. However, Riot has a different strategy, one consisting of purchasing power plans from utilities in Texas. Moreover, instead of just using all of them to maximize crypto output, these are used on an economically efficient basis. In other words, Riot only uses part of the energy purchased for business operations and sells the rest to utilities in exchange for credits to apply to future energy bills.

Second, in addition to energy, the efficiency of mining operations also depends on the Bitcoin mining machines and the type of cooling used. In this respect, to compensate for the drop in revenue, miners improve the average energy efficiency of their fleet by replacing older, less efficient miners with newer, more efficient miners.

As for Riot, it has chosen MicroBT M66S machines for its Rockdale facility and one of the particularity of this machine is its ability to use immersive liquid cooling, a technology the miner is deploying for its Corsicana facility purchased in 2022. For investors, immersion cooling is more efficient than air cooling and data centers equipped with this technology can consume as much as 50% less energy.

Overall, flexible power plans, a more efficient mining fleet, and cooling technology are ways to improve margin profiles, but, equally pressing, is the need to increase production capacity since the reward earned for adding each block on the blockchain was divided by two, or from 6.25 BTC to 3.125 BTC after halving. This entails a reduction in mining revenues unless additional hashrate is added.

Mining Difficulty and How Bitfarms Could Have Boosted Riot’s Position

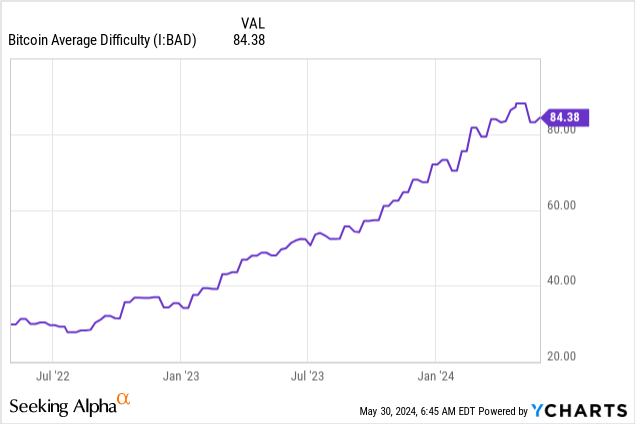

To complicate matters further, there is also mining difficulty. Thus, looking at production, only 1,364 BTC were mined in Q1 representing a substantial 36% YoY drop. This is explained by a doubling in average difficulty, from around 40 in the first quarter of 2023 to 80 in the same period this year, as shown in the chart below. This was caused by an increase in global hash rate, making it more difficult to mine the next block as miners boosted production in the pre-halving period to profit from higher rewards.

ycharts.com

Now, unless a miner diversifies into AI or another industry verticals, the only way to overcome the effects of difficulty and sustain production levels is to increase the hash rate. For Riot, this means more than doubling the 12.4 exahash deployed at the end of Q1 to 31 exahash by end-2024. Now, while the company is executing plans to add capacity organically, acquiring Bitfarms which intends to boast 12 exahash by the end of this year would have greatly accelerated its endeavor.

However, the takeover was rejected on the basis that it undervalued Bitfarms which initiated a strategic review or a re-assessment of a company’s strategy and finances to achieve optimum shareholder value through a merger, sale, or other transaction.

Moreover, from the competitive standpoint, the 43 (31 + 12) exahash would have placed Riot closer to Marathon Digital (MARA) which plans to increase capacity to 50 exahash by the end of 2024. To achieve such a feat, the world’s largest Bitcoin miner has been aggressively acquiring mining sites and was able to boost the hash rate from 11 exahash to 27 exahash at the end of Q1.

Thus, by scaling, miners increase their hash rates to obtain more block rewards while at the same time, it provides them with a larger base of operations on which to spread fixed costs, resulting in better gross margins. In addition, it also entitles them to more influence regarding network changes, as voting power is proportional to a miner’s hash power.

Thus, with 27 exahash compared to only 12.4 exahash for Riot, Marathon is in advance. From this perspective, Riot seems to be playing catch up with the Bitfarms acquisition.

Riot Has Increased Hash Rates Organically but This Could Not Be Enough

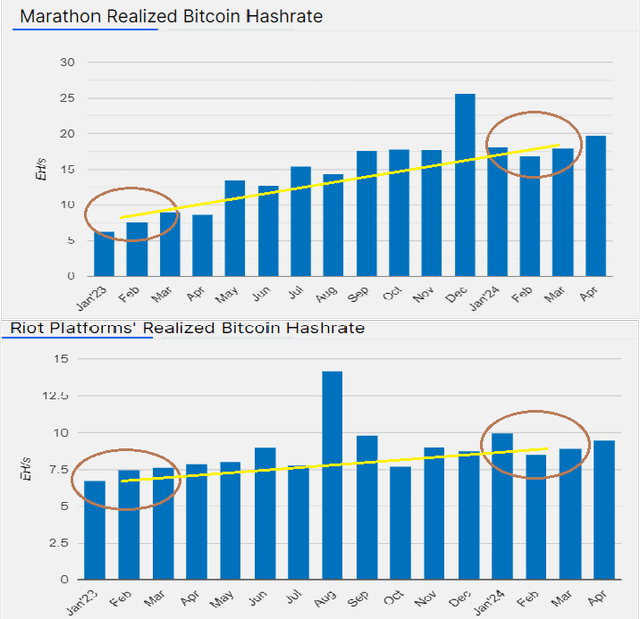

Moreover, in addition to the absolute number of Bitcoins mined, investors are likely to focus on the degree to which miners can avoid revenue shortfalls. In this respect, a comparison of the realized Bitcoin hashrate, which is the hashrate actually achieved over the installed operational capacity shows that Marathon has increased its production capacity faster in Q1, indicated by the steeper gradient of the yellow line below, while the pace has been slower for Riot.

Difference between production capacity prepared using chart data from (pro.theminermag.com)

In these circumstances, given that mining difficulty remains above 80, likely Riot will again suffer from lower mining revenues for Q2 compared to the same period last year. This is further justified by its BTC production for April being 41% lower YoY.

As a result, it may have to sell more Bitcoin to offset this shortfall and not suffer a dent in revenues. However, prices will likely be under pressure as other miners who have not been able to boost production capacity in time to offset the effects of mining difficulty may be constrained to sell some of the coins they have HODLed, possibly as much as $5 billion in total as per analysts at 10x Research.

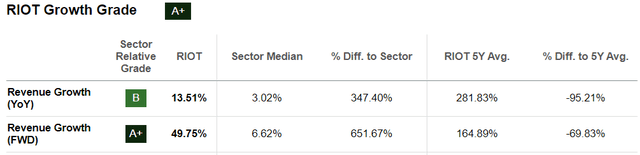

As a result, Riot could see a further decline in its revenue growth relative to its five-year average of nearly 282% as pictured below, which could in turn prove volatile for the stock.

Riot is a Hold with its Power Credit Differentiator

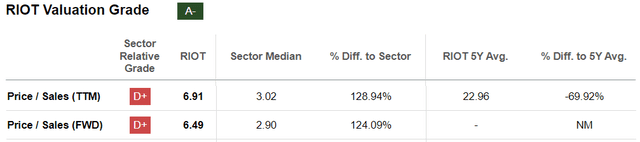

This means potential volatility risks when the company reports Q2 results at the end of July. Volatility also grappled Riot’s stock when its takeover bid was rejected, and may again impact the stock in case another miner merges with Bitfarms. This is the reason why with a trailing price-to-sales of 6.91x three times lower than its five-year average of 22.96x as tabled below, it is not the right time to invest, but I am not bearish.

The reason is analysts estimate revenue growth to pick up at 54% YoY for 2024. This is explained by the miner deployed a hashrate of 12.4 exahash at the end of Q1 resulting in an 18% YoY increase in production capacity. At the same time, the energization (powering up) of its Corsicana facility as part of the first phase deployment puts it on a clear path to achieve 31 exahash by the end of 2024.

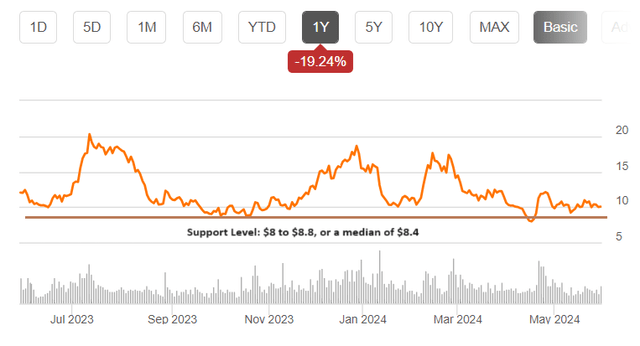

Thus, for those who want to position themselves, the support level has been in the $8 to $8.8 range during the last year as pictured below, yielding a median of $8.4, which would be a reasonable entry price.

Chart prepared using data from (www.seekingalpha.com)

Furthermore, looking at finances, the miner had 8,490 coins entering into Q1 which is worth about $594.3 million considering a unit price of $70K. When added to the $688.5 million of cash in its balance sheet totals $1.28 billion. This signifies it has sufficient money to cover operating expenses which averaged $216 million in the last three years, in case the halving/difficulty combination takes a bite at its revenue. Also, after terminating hosting contracts or leasing data center space to miners, at its Rockdale facility, the focus is on maximizing self-mining operations.

Therefore, the stock is a Hold while it delivers on increasing hashrate efficiently. It could again benefit this summer ahead of what’s predicted to be one more record-hot summer in Texas. For this purpose, as part of its long-term power agreements, it already received power credits totaling $71.2 million for the twelve months that ended in December last year, compared to only $27.3 million during the same period in 2022. This equates to approximately 1,017 BTC considering a unit price of $70K per coin, or 12% of its actual Bitcoin reserves, which is significant.

Equally important, had the power curtailment credits been applied to the cost of sales, the gross margins would have increased by 2% on a non-GAAP basis, or from 45% to 47%.

Volatility Risks are not excluded as the Industry Consolidates

However, its energy strategy could induce volatility risks to the stock in case the United States were to face an energy crunch as a result of higher activity for AI and Bitcoin. In this respect, Riot has already been criticized by Greenpeace, as the “largest and most energy-intensive Bitcoin mine” causing pollution and climate change. In response, the miner put forward its flexible approach to Bitcoin mining which contributes to grid stability, especially in the summer when there is more demand for power.

Finally, Bitfarms has received additional expressions of interest implying other parties could be interested in its assets, triggering a wave of consolidation in the mining industry. Potential bidders could include miners who instead of, or in addition to, investing to build or expand mining capacity opt to acquire or merge with existing ones. However, after having accumulated a 9.25% stake, Riot could be its largest shareholder and plans to request a special shareholder meeting to add independent directors to Bitfarms’ board. Therefore, chances are it could eventually gain the upper hand.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.