Summary:

- I believe the recent share price rally is mainly driven by speculation tied to Bitcoin’s price increase, rather than strong fundamentals or earnings results.

- I find the company’s rising mining costs concerning, especially with an increase in the average cost per Bitcoin mined, now at $35,376.

- I remain concerned about Riot’s diminishing power credits from the ERCOT market due to grid stabilization, with the integration of large-scale batteries supporting renewables penetration.

- I foresee delays in the company’s expansion plans and lowered hash rate projections hurting long-term growth, making its 2024-2025 targets hard to achieve.

- Despite a low P/B ratio, I believe the recent Bitcoin rally may be short-lived, while structural challenges continue to undermine the company’s outlook. I maintain a sell rating for this stock.

luza studios

Riot Platforms, Inc. (NASDAQ:RIOT) has seen its share price jump by over 40% since November 6, recovering from this year’s downward trend.

However, this increase doesn’t appear to be due to the Q3 earnings, which came out on October 30.

In my view, the recent rally is tied to the increase in Bitcoin’s share price, likely driven by Donald Trump’s expected win.

It seems that shareholder excitement is at all-time highs, with promises from the new administration to make the US the crypto capital of the planet.

However, in this article, I will do something that (probably) most investors during the bull run haven’t done: analyze the fundamentals and the different strategic initiatives of the company.

I will advance here that my sell rating is not based on a pullback following the recent rally (although this event is likely to happen). My bear thesis revolves around the company’s cost structure and delayed expansion plans, which led management to issue a lower guidance in Q3 this year.

Let’s start with what, I believe, is the most pressing factor for the future growth of the company.

Rising Cost of Mining Bitcoin

Let’s start with dessert.

The average cost to mine Bitcoin in Q3 2023 was negative $22,741. Just to be clear, this cost was negative due to the net gain generated by not mining during peak power demand and selling their pre-contracted power back to the grid.

As a matter of fact, in Q3 last year, Riot received $49.6 million in power credits, which exceeded the total mining costs, resulting in a net gain.

Well, in the last quarter, mining costs were (positive) $35,376.

Let’s now understand the contributing factors behind this increase, starting with the Bitcoin halving event in April this year.

As we all know, the block reward was cut from 6.25 BTC to 3.125 BTC per block. Therefore, to achieve the same Bitcoin revenue as in 2023, miners now need to secure rewards from more blocks, which naturally increases the average cost per Bitcoin.

In my view, the halving event was not the main contributing factor. If we look closer at the last 10-Q published, we can see a significant decline in power curtailment credits, from $49.6 million in Q3 last year, down to $12.4 million.

As I mentioned before, these credits are earned when Riot curtails mining during high electricity price periods and sells power back to the grid.

Back in 2023, electricity prices were highly volatile, particularly in the Texas ERCOT market. However, in the past quarter, ERCOT experienced less frequent and less severe price spikes, leading to a 75% decline YoY in power credits for the company.

So, what is the outlook for ERCOT?

Well, it seems that the introduction of large-scale battery storage is expected to stabilize the grid as renewables penetration increases. This year, Texas is projected to install 12.7 gigawatts of utility-scale solar power. To put things in perspective, this accounts for 35% of the total US additions.

Therefore, the outlook for the ERCOT market doesn’t seem very promising for Riot Platforms, since the energy grid is expected to stabilize with the integration of large-scale battery systems.

Another headwind comes from the increase in network difficulty.

To put it simply, network difficulty measures how tough it is for miners to solve the cryptographic puzzles needed to add a new block to the Bitcoin blockchain. The Bitcoin network adjusts this difficulty approximately every two weeks to ensure that blocks are mined on average every 10 minutes, regardless of changes in the hash rate on the network.

In the last quarter, the network difficulty increased by 59% YoY, with the hash rate rising by 4% QoQ.

It seems that the rise in Bitcoin’s price during 2024 attracted more miners, with more powerful and efficient mining equipment. An example is Riot’s MicroBT miners. As a result, the network difficulty rose to maintain the block time at 10 minutes.

Another challenge is the rise in electricity prices, coupled with a shift at the Rockdale facility from fixed contracts to variable. Additionally, the new Corsicana facility has been procuring more electricity at spot market rates.

The latest earnings report shows that the average power cost increased to 3.1 cents per kWh in the last quarter, up from 2.7 cents per kWh in Q2 this year.

SG&A and Litigation Expenses

A closer look at the income statement shows a sharp increase of 130% in SG&A.

In my view, the drivers for this increase are quite concerning. Let’s start with the first one.

Stock-based compensation increased by $13.5 million YoY, sitting at $30.6 million in the last quarter.

If we consider the nine months ended September 30, 2024, stock-based compensation was $94.7 million, compared to just $14.7 million in the same period in 2023.

It seems that this increase is driven by the long-term incentive program implemented by the company in July 2023.

Look, I don’t blame the company for rewarding and motivating employees, officers, and directors by offering performance-based and service-based equity awards.

However, if the share price hasn’t been moving, these rewards are not justified, in my view.

A quick look at the chart below shows a decline of close to 20% since July last year.

Therefore, a 5x increase in stock-based compensation doesn’t make the slightest sense to me (aside from retaining your employees / directors / officers).

Another factor that contributed to the increase in SG&A was $4.2 million in advisory fees and $3 million in litigation expenses.

One of the legal cases the company is dealing with involves a dispute with Rhodium, which has since filed for bankruptcy. In Q1 2023, Whinstone, a Riot’s subsidiary, filed claims against Rhodium for breaches of hosting agreements, seeking recovery exceeding $26 million.

I considered including an excerpt from the Q1 2023 earnings report with more details about this claim:

In the amended petition, Whinstone asserts breach of contract claims for Rhodium’s failure to pay certain hosting and service fees under certain hosting agreements and seeks a declaration that certain hosting agreements with Rhodium are terminated and that no power credits are owed to Rhodium under any agreement. Riot seeks recovery of more than $26 million, plus reasonable attorneys’ fees and costs…

Since then, in September 2023, the District Court ruled that Whinstone’s claims against Rhodium must be resolved through arbitration.

However, as I mentioned before, Rhodium went bankrupt in August this year, which paused the arbitration process.

Below, I’ve included some paragraphs from the last 10-Q published with additional information that I found relevant for this case:

On September 13, 2023, the District Court compelled Whinstone’s claims against Defendants to arbitration over Whinstone’s objection and stayed the lawsuit pending such arbitration.

On December 11, 2023, Rhodium submitted an arbitration demand to the American Arbitration Association (“AAA”), seeking damages and specific performance of unspecified contracts. Rhodium amended its demand on June 4, 2024 to include additional claims and disclosed it seeks at least $67 million in damages.

After a permanent arbitrator was appointed and written discovery commenced, Rhodium filed for bankruptcy protection on August 24, 2024 and August 29, 2024 in a now jointly administered proceeding styled In re: Rhodium Encore LLC, et al., Case No. 24-90448 (ARP), in the United States Bankruptcy Court for the Southern District of Texas—Houston Division. Therein, Rhodium filed a motion to assume the Hosting Agreements, and the court set a contested hearing on the matter commencing November 12, 2024.

Another legal case involves GMO Gamecenter USA, initially seeking over $150 million in damages for alleged breaches of a colocation services agreement. However, this amount was later amended to $496 million in October last year.

Again, I considered including some quotes from the most recent 10-Q to provide more context:

On June 13, 2022, GMO Gamecenter USA, Inc. and its parent, GMO Internet Group, Inc. (collectively “GMO”), filed a complaint against Whinstone alleging breach of a colocation services agreement between GMO and Whinstone, which has since been terminated, seeking damages in excess of $150.0 million for lost profit and profit-sharing payments GMO alleges it was owed from Whinstone.

On October 19, 2023, GMO filed its fourth amended complaint claiming an additional $496.0 million in damages, for loss of future profits and future profit-sharing payments GMO alleges would have been received through the term of the agreement, based on Whinstone’s allegedly wrongful termination of the colocation services agreement as of June 29, 2023.

Delayed Expansion Plans

Riot has lowered its hash rate growth projections for 2024 and 2025 due to delays in expansion projects at its Kentucky and Corsicana facilities.

Riot initially projected a year-end hash rate of 36.3 EH/s for 2024. The revised guidance is 1.4 EH/s lower than its prior guidance.

By the end of 2025, the company’s goal is to reach 46.7 EH/s, down from their previous estimation of 56.6 EH/s.

Considering that the company has pushed the Kentucky expansion into 2025, with design modifications and new equipment required, and one of the three new buildings at Corsicana is now delayed into 2026, I believe the company might struggle to reach the 2025 hash rate target.

The New Administration

The Guardian mentions in one of their articles a so-called “Trump pump”.

Since November 6th, Bitcoin’s share price increased by over 20%.

It seems that Donald Trump’s re-election as US President has sparked a bull run in Bitcoin due to expectations that his administration will implement policies favorable to cryptocurrencies.

These include promises to reduce regulatory hurdles, including potential changes in leadership at the Securities and Exchange Commission.

Additionally, in a keynote address at the Bitcoin 2024 conference in Nashville, he stated his intent to make the US the “crypto capital of the planet” and proposed the creation of a strategic Bitcoin reserve.

How Can I Be Wrong?

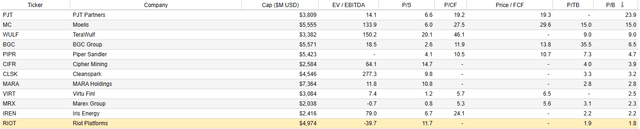

Let’s start with valuation.

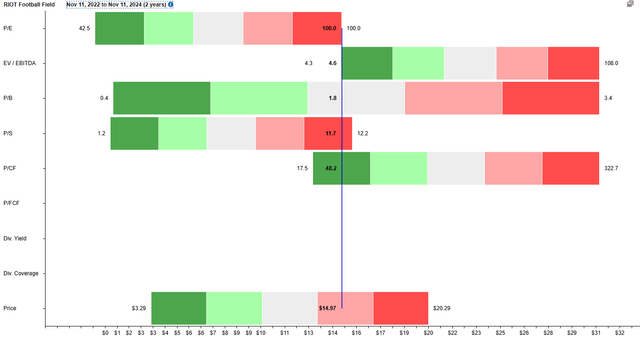

In my view, paying 1.8x the book value of the company seems to be quite cheap.

As a matter of fact, if we compare the company with its industry peers (notice not all are direct competitors) using P/B as the comparison metric, Riot Platforms is the cheapest in the group.

Additionally, a closer look at the chart below shows the P/B of the company trading in the middle of the 2-year historical range.

Therefore, I believe the company is relatively cheap compared to its book value.

Another factor that could break my bear thesis (at least, in the short run) is the recent increase in Bitcoin mining revenue of 116% YoY, mainly driven by higher Bitcoin prices in the last year, and expanded operational capacity.

If the current Bitcoin excitement persists, I anticipate a further increase in Bitcoin prices, at least, until the end of the year.

Considering that the company holds 10,427 Bitcoin on its balance sheet, this bull run could be quite favorable in the short term.

Finally, there is a chance that the engineering division (managed through Riot’s subsidiary ESSMetron) could recover in 2025, as Riot announced that the delayed government contract was finally shipped by the end of last quarter.

This means that one-third of ESSMetron’s warehouse capacity is now available for higher-margin projects, like data center development and power distribution for growing industries like AI and HPC.

Conclusion

In my view, the challenges and headwinds the company is facing outweigh the limited upside, which, I believe, is mainly driven by shareholder excitement following changes in the US administration.

If we look at the cost structure of the company, things don’t look particularly favorable, with the average mining costs skyrocketing to $35,376 per Bitcoin.

With ERCOT grid stabilization from large-scale battery storage, Riot’s ability to capitalize on power credits has diminished significantly, dropping 75% YoY.

In my view, this structural shift in ERCOT’s grid stabilization likely marks the end of Riot’s previously lucrative power strategy.

Operational delays further erode my conviction in this stock. Management has already revised its hash rate projections downward for 2024 and 2025 due to setbacks at its Kentucky and Corsicana facilities.

Additionally, the 130% increase in SG&A expenses makes me sweat, especially with a 5x in stock-based compensation. In my view, this compensation is unjustifiable given the company’s declining stock performance since the all-time highs in early 2021. Legal disputes only compound this problem.

The main risk to my bear thesis is the recent Bitcoin rally. However, I believe that the nature of this bull run is temporary and speculative, as with many other Bitcoin bull runs.

Another risk is the attractive P/B ratio of the company, which could attract “deep value investors” in the crypto world with a high risk – high reward appetite.

Overall, I believe the risks outweigh the potential benefits, which is why I’m giving this company a sell rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.