Summary:

- Amazon is a multinational company that is one of the world leaders in e-commerce, cloud computing, and artificial intelligence.

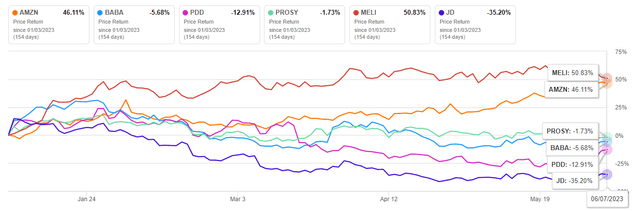

- The company’s share price has risen by around 46.11% since the beginning of 2023, outperforming key competitors in retail and cloud computing markets.

- Amazon released financial results for Q1 2023, showing continued growth in North America, International, and AWS segments despite external challenges.

- To recapture the segment’s revenue growth of 2023, Amazon announced a multi-billion-dollar investment in late July to expand its AWS datacenter operations.

- We initiate our coverage of Amazon with a “hold” rating for the next 12 months.

fotostorm/E+ via Getty Images

Amazon (NASDAQ:AMZN) is a multinational company that is one of the world leaders in e-commerce, whose 1,541,000 employees continue to contribute to strengthening its dominant position in the field of cloud computing and artificial intelligence. On its platforms, the company sells hundreds of its products and provides access to third-party sellers to market its merchandise. In addition, Amazon owns Twitch, one of the largest live-streaming gaming platforms in the world, and creates content for Amazon Prime Video, a subscription video streaming service that includes hundreds of shows and movies.

AWS’ layoffs are worrisome, as they signal that the weak pace of the global economic recovery continues to put pressure on advertising budgets and the ability of young companies to increase their use of Amazon’s services and platforms. But despite this, at the end of July, Amazon announced a multibillion-dollar investment to expand the operations of its AWS data center, which will help close the technology gap from Microsoft Azure.

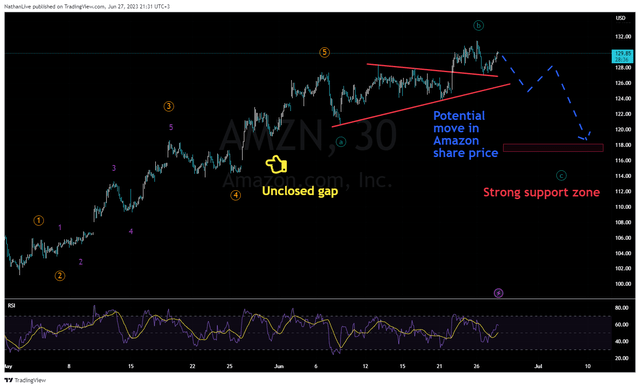

In terms of technical analysis, we believe that we are in the process of forming a corrective A-B-C pattern, which will end when a strong support zone is reached in the region of $116.50-$118 in the next three months.

On April 27, 2023, Amazon released financial results for the first three months of 2023, which not only continued to beat analysts’ expectations but were able to demonstrate that the revenues of the North America segment, the International segment, and the Amazon Web Services (AWS) segment continue to grow year on year, despite the strengthening of the US dollar and the war between Ukraine and Russia, which led to the imposition of sanctions against Russia and Belarus. Since the beginning of 2023, Amazon’s share price has risen by around 46.11%, which is an excellent result given the intensification of competition in the retail and cloud computing markets from key competitors such as Alibaba Group (BABA), Alphabet (GOOG), JD.com (JD), and Microsoft (MSFT).

Author’s elaboration, based on Seeking Alpha

We initiate our coverage of Amazon with a “hold” rating for the next 12 months.

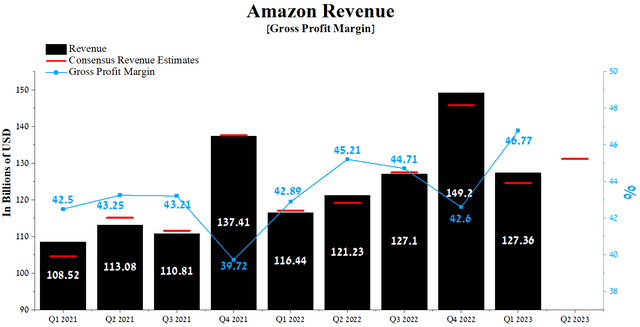

The financial position of Amazon and its prospects

Amazon’s revenue for the first three months of 2023 was $127.36 billion, down 14.6% from the previous quarter and up 9.4% from the first quarter of 2022. As a result of continued geopolitical tensions in Eastern Europe, a challenging macroeconomic environment, higher interest rates negatively affecting the purchasing power of the population, and the continued strengthening of the US dollar against foreign currencies, Amazon’s actual revenue has beaten analyst consensus estimates in only four of the past nine quarters. At the same time, Amazon’s Non-GAAP P/S [TTM] is 2.52x, which is 197.8% higher than the average for the sector, but 25.35% lower than the average over the past five years.

Author’s elaboration, based on Seeking Alpha

The North America segment revenue was about $76.88 billion, up 11% year-over-year but down 17.7% sequentially. The growth in sales primarily reflects an increase in product expansion, a gradual recovery in demand for advertising services, and an increase in fees associated with Amazon Prime membership. At the same time, the decrease in revenue relative to the previous quarter does not raise questions since, in each of the fourth quarters, there is a seasonal increase in demand for Amazon products on the eve of such holidays as New Year, Christmas, and Thanksgiving.

On the other hand, AWS reported $21.35 billion in revenue in Q1 2023, up 15.8% year-over-year, driven by increased customer use of Amazon’s cloud computing platforms.

Amazon’s Q2 2023 revenue is expected to be $127-$133.28 billion, up 5.3% from the first three months of 2023. These expectations are in the range of the guidance indicated by Amazon management in the report for the first quarter of 2023, which undoubtedly reduces the risks of slowing sales growth and makes the company’s outlook more predictable. This is especially important for investors as the company went through two rounds of layoffs in 2023, affecting 27,000 employees, including those at AWS, Amazon stores, Twitch, and more.

AWS’ layoffs are worrisome, as they signal that the weak pace of the global economic recovery continues to put pressure on advertising budgets and the ability of young companies to increase their use of Amazon’s services and platforms. Moreover, competition in the cloud computing market is rising, despite its high expansion rate. One of Amazon’s key competitors in this market is Microsoft Corporation, which continues to invest billions in OpenAI, one of the primary beneficiaries of the artificial intelligence hype and whose technology continues to change the world for the better.

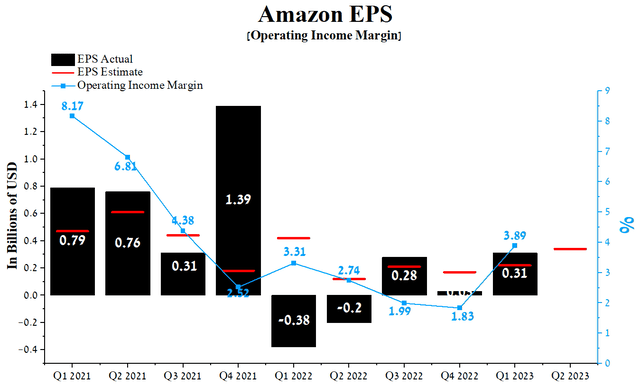

Amazon’s Q1 2023 margin operating profit was 3.89%, up year-on-year and quarter-on-quarter. However, this financial figure is not only lower than that of the consumer discretionary sector, but also that of major competitors such as PDD Holdings and Alibaba, which is another factor that discourages investors from choosing Amazon as a long-term investment.

We forecast Amazon’s operating income margin to reach 4.3% by 2023 and rise slightly to 5.5% by 2024, driven by lower raw material and shipping costs, staff reductions, and increased efficiency in cost structure management.

The company’s earnings per share (EPS) for the first three months of 2023 was $0.31, up 933.33% quarter-on-quarter, but only beat analyst consensus estimates in five of the last nine quarters. However, Amazon’s Q2 EPS is expected to be in the $0.14-$0.43 range, up 9.7% from the Q1 2023 consensus estimate.

On the other hand, Amazon’s Non-GAAP P/E [FWD] of 81.23x is 478.6% higher than the sector average and 191.15% higher than the average over the past five years, which is one factor indicating a significant overvaluation of the company in the current period of global economic recovery.

Author’s elaboration, based on Seeking Alpha

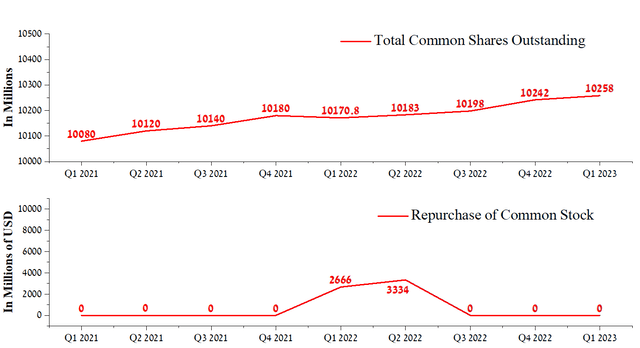

However, we believe that Amazon’s beating of consensus EPS is mainly due to its improved segment margins, as it has not used cash flow to buy back shares in the past three quarters. At the same time, the company has the authorization to buy back shares for a total of $6.1 billion, an insignificant amount in anticipation of increased volatility in the stock market due to a possible increase in interest rates.

Author’s elaboration, based on Seeking Alpha

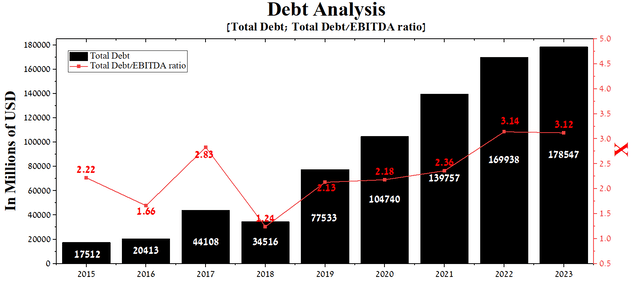

At the end of the first quarter of 2023, Amazon’s total debt stood at about $178.55 billion, a significant increase from 2021 due to the urgent need to invest in the development of cloud computing platforms and new businesses to increase the rate of revenue growth. At the same time, due to the growth of EBITDA in recent quarters, the total debt/EBITDA ratio decreased slightly and amounted to 3.12x.

Author’s elaboration, based on Seeking Alpha

But at the same time, given the stable cash flow, the improvement in the margins of the North America segment, and the maturity dates of senior notes and loans, we do not expect Amazon to have problems with their redemption, and the company will continue to invest in expanding the its business to increase its share in the eCommerce market.

Conclusion

Amazon is a multinational company that is one of the world leaders in e-commerce, whose 1,541,000 employees continue to contribute to strengthening its dominant position in the field of cloud computing and artificial intelligence.

In 2023, Amazon’s capitalization continued to increase despite the slowdown in net income and revenue growth, thanks to the positive news from Mr. Market about the implementation of initiatives from CEO Andy Jassy to improve the efficiency of business process management and stricter control over operating costs.

AWS’ layoffs are worrisome, as they signal that the weak pace of the global economic recovery continues to put pressure on advertising budgets and the ability of young companies to increase their use of Amazon’s services and platforms. Moreover, competition in the cloud computing market is rising, despite its high expansion rate. To recapture the segment’s revenue growth of 2023, Amazon announced a multi-billion-dollar investment in late July to expand its AWS data center operations.

Given the rise in geopolitical tensions in Eastern Europe and the reduction in AI hype, we expect Amazon’s share price to correct to a strong support zone around $116.50-$118 in the next three months.

Nathan Aisenstadt—TradingView

We initiate our coverage of Amazon with a “hold” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.