Summary:

- RIVN’s lack of bullish support continues despite the $5B investment from VWAGY, attributed to the former’s projected lack of profitability until 2027.

- While the management guides “modest positive gross profit in the fourth quarter of 2024,” we believe that it may be a rather slim profit margin indeed, if not break even.

- RIVN’s “normal facility will not be producing vehicles for more than one month during the second half of 2025 year” as well, with it implying further cash burn.

- While we remains optimistic about its highly competitive pickup truck, EDV, and eventual R2/ R3 pipelines, we believe that the intermediate term boost on its prospects is likely to be limited.

- Combined with the downtrend observed in RIVN’s stock prices, we believe that things may get much worse before getting better.

photoschmidt

We previously covered Rivian Automotive (NASDAQ:NASDAQ:RIVN) in May 2024, discussing the stock’s painful underperformance which had discredited our numerous Buy ratings thus far.

Combined with the massive pessimism embedded in the EV sector, its negative profit margins, deteriorating balance sheet, and uncertain cash flow bridging through 2026, it appeared that its investment thesis had soured with no floor in sight, warranting a downgrade to Hold instead.

Since then, RIVN has risen drastically attributed to the unexpected Joint Venture [JV] announcement with Volkswagen Group (OTCPK:VWAGY), with the $5B investment temporarily bolstering its balance sheet.

Even so, with the automaker’s gross margins still at high double digit negatives and the management guiding a transition period in H2’25, we believe that there may be more pain in the intermediate term, as observed in the stock’s sustained downtrend thus far.

We shall discuss further.

RIVN’s Path To Positive Gross Profit May Be Painful In H2’25

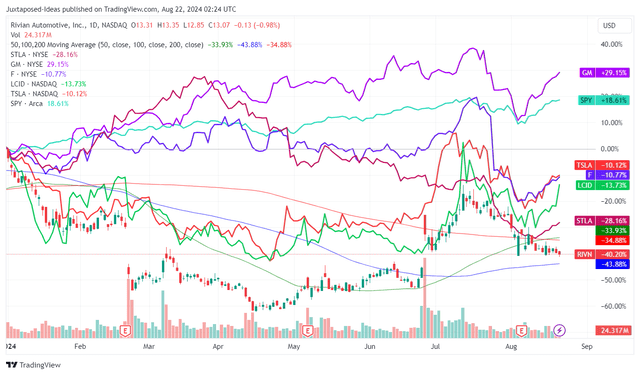

RIVN YTD Stock Price

As demand for EV stalls, it is unsurprising that pure-play EV stocks, including RIVN, Lucid (LCID), and Tesla (TSLA) have had underwhelming YTD performances, with legacy players such as General Motors (GM) exceeding expectations and Ford (F) temporarily impacted by the FQ2’24 top/ bottom-line misses.

On the one hand, RIVN has announced the JV on a timely basis, with the former’s $4.4B gain in market cap nearly matching the total expected deal size of $5B – lifting other EV stocks as observed in the late June 2024 rally.

On the other hand, it is also apparent that much of those gains have been moderated by now, thanks to the market rotation from growth stocks by mid July 2024 as RIVN also reports a mixed FQ2’24 earning performance.

This is with deliveries of 13,790 (+1.4% QoQ/ +9% YoY), total revenues of $1.15B (-4.1% QoQ/ +2.6% YoY), and impacted gross profit margins of -38.9% (+4.8 points QoQ/ -2.2 YoY).

While RIVN continues to guide “modest positive gross profit in the fourth quarter of 2024 and for the full year of 2025,” we believe that it may be a rather slim profit margin indeed, if not break even, partly aided by the $200M in regulatory credits guided for FY2024.

This is because FQ2’24 still brings forth a GAAP gross profit loss per vehicle at -$33K and adj gross profit loss per vehicle at -$14.4K (after discounting depreciation and amortization expense, stock-based compensation expense, and other revenue efficiency initiatives).

While RIVN has highlighted the possible of saving “additional capital on components, such as chipsets, printed circuit board assemblies and other hardware” through its strategic JV with VWAGY, it is uncertain how much impact we may see in H2’24, since the JV is only expected to be finalized by Q4’24.

Perhaps the key to RIVN’s FQ4’24 positive gross profit margins is attributed to the retooling upgrade in its Normal facility, which has already contributed to a +30% increase in its production line rate – with it likely triggering lower manufacturing/ operating costs.

Therefore, the automaker’s FQ3’24 performance will be highly telling about the gross margin bridge to FQ4’24 results, with it likely being a pivotal show-me-the-money moment.

Readers may want to pay attention indeed, since we may see RIVN’s stock prices drastically impacted either way.

Even so, investor may also want to temper their near-term expectations, since the automaker is not expected to be cash flow positive over the next few years, as it looks to launch R2 in 2026.

Most importantly, RIVN has highlighted that its “normal facility will not be producing vehicles for more than one month during the second half of the year as we upgrade and integrate new equipment into the plant ahead of our first half of 2026 R2 launch.”

While the management has reiterated their FY2024 production guidance of 57K vehicles (inline YoY) and capex of $1.2B (+17.6% YoY), we may see FY2025 bring forth drastically lower deliveries, impacted H2’25 top/ bottom-lines, and elevated cash burn from the planned factory upgrade in H2’25.

As a result, we can understand why RIVN has fallen by -92% from the November 2021 heights, especially since the automaker may potentially require even more cash injection after the cash/ equivalents of $7.86B on its balance sheet (inline QoQ/ -22.9% YoY) are drained over the next six quarters.

While we remain optimistic about its R2 mid-sized platform and R3 smaller crossover ambitions, attributed to the expansion of its total addressable market beyond the current pickup truck and delivery vans, it is now apparent that things may get much worse before getting better.

This is especially since it is uncertain if these efforts may be instrumental to RIVN’s plans to achieve “positive adjusted earnings before interest, taxes, depreciation and amortization in 2027,” with positive free cash flow generation still uncertain and more cash burn likely.

Consumer trends continue to highlight growing hybrid vehicle demand along with commercial electric vehicles (including school buses, delivery vans, semi trucks, etc), as numerous legacy automakers increasingly launch new EV models while cutting prices.

This is also why Ford (F) has announced its plans to delay its EV launches while prioritizing “the development of hybrid models,” to deliver a “profitable, capital-efficient and growing” electric vehicle business – with it suggesting that RIVN’s entry into the EV mid-sized/ crossover market may not pay off as handsomely as expected.

So, Is RIVN Stock A Buy, Sell, or Hold?

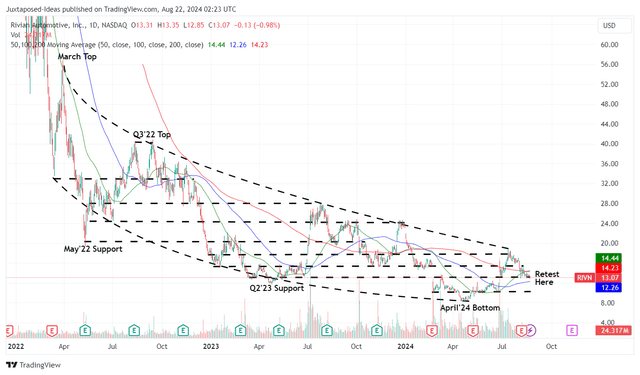

RIVN 2Y Stock Price

As a result of these developments, we can understand why RIVN is back on the downtrend after the recent VGAWY boost, worsened by the “paused production of the electric commercial van it makes for Amazon (AMZN) due to a parts shortage.”

With FQ3’24 top lines likely impacted by the delayed AMZN deliveries, it is unsurprising that the stock is currently retesting the previous support levels of $13s with a further pullback to $10s likely in the near-term.

While we remains optimistic about RIVN’s highly competitive pickup truck and electric van offerings, as the management conducts test EDV pilots for interested enterprises, we believe that the near term boost on its prospects is likely to be limited, prior to widespread electrification adoption and the completion of its Normal factory upgrade by the end of 2025.

As a result of the unattractive risk/ reward ratio and the uncertain market sentiments surrounding pure-play EV stocks, we prefer to prudently maintain our Hold rating here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.