Summary:

- Rivian’s success in the US BEV pickup truck market depends on overcoming obstacles, including competition from Tesla’s Cybertruck.

- The company’s strong performance in 2Q23 and 3Q23 indicate potential for growth.

- Rivian’s use of LFP batteries and its efforts to improve the economics of its vehicles could contribute to its success.

hapabapa

Introduction

My thesis is that there is a path for Rivian (NASDAQ:RIVN) to be successful with BEV pickup trucks in the US if they can get through some obstacles in the next few years.

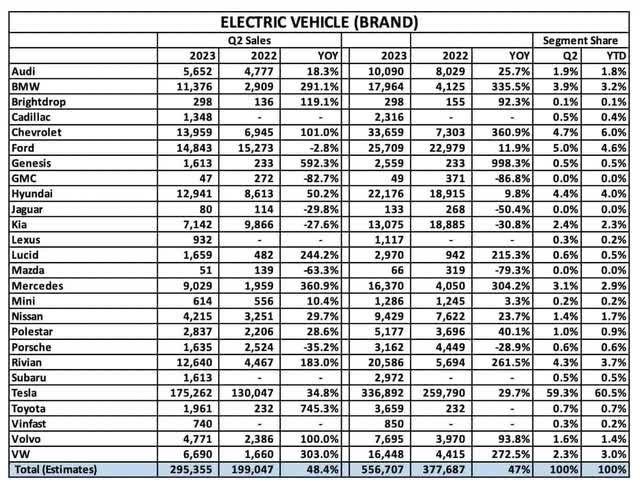

Rivian makes the R1T pickup truck, the R1S SUV, and the Electric Delivery Van (“EDV”). Historically most of the produced units have been R1T pickups but lately, the R1S has overtaken the R1T. Rivian’s 3Q23 statement of overall production and delivery shows figures of 16,304 and 15,564, respectively. These are well above the respective 2Q23 figures of 13,992 and 12,640, respectively. Unlike other automakers, Rivian’s focus is centered on the US market at this time. Looking at Cox Automotive, we see estimated 2Q23 electric vehicle sales in the US by brand:

2Q23 US Electric Vehicle Sales (Cox Automotive)

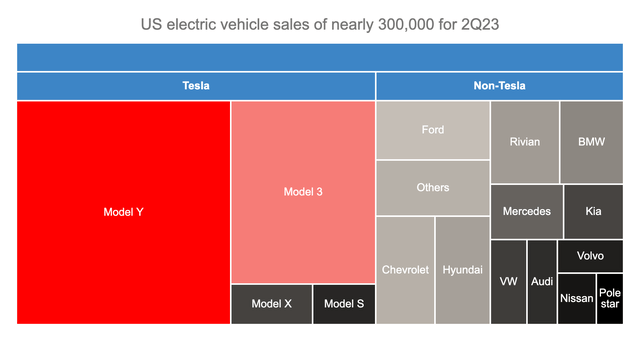

I like to visualize the nearly 300 thousand US electric units for 2Q23 in a treemap chart. Polestar (PSNY)(PSNYW) is the smallest rectangle with a little over 2,800 units while the Tesla (TSLA) Model Y is the biggest with a little over 105,000. Rivian did well in the period with 12,640 units and they are well positioned with respect to all the competitors out there except Tesla:

2Q23 US Electric Vehicle Market (Author’s spreadsheet based on Cox Automotive estimates)

Rivian is finding early success with BEV pickup truck market share in the US. In 2Q23, their 12,640 overall deliveries were mainly composed of the R1S SUV and the R1T pickup truck as opposed to their Amazon (AMZN) EDVs. Tesla has the Cybertruck on the horizon but it isn’t out yet. The substantial majority of Chevrolet (GM) BEV sales in the US are from the Volt; Chevy is not yet in the BEV pickup truck market in a meaningful way as the Silverado EV isn’t widely produced yet. Per Cox Automotive, most of Ford’s (F) 2Q23 electric sales were from the Mustang Mach-E; only 4,466 F-150 Lightning pickup trucks were sold in 2Q23. The Stellantis (STLA) Ram 1500 REV BEV pickup truck is coming eventually but it isn’t a factor yet.

Success With BEV Pickup Trucks

One of the first obstacles Rivian must navigate in order to be successful in the US BEV pickup market is the Cybertruck but it isn’t a zero-sum game between Rivian and Tesla. Both companies can find success relative to others. Rivian CEO RJ Scaringe said recently in an interview transcribed by The Verge that there’s probably not a lot of overlap between R1T buyers and Cybertruck buyers. Part of this is because the R1T looks like a truck whereas the Cybertruck looks like something else. If the Cybertruck ends up being a niche truck like the Model X niche SUV as opposed to the Model Y mainstream SUV then there is plenty of room in the market for Rivian to continue with their growth. Even if the Cybertruck does really well, there should still be opportunities for Rivian if the speed of BEV adoption quickens in the pickup space.

Another obstacle for Rivian on the pickup side is the economic picture. Despite the 25% chicken tax on competitors who build trucks outside the US, Rivian said in the 2Q23 call that the R1S SUV is more profitable than the R1T pickup. However, the economics for the R1T can improve as competitors who are immune to the chicken tax are held back by the UAW strike. TechCrunch explains how Rivian will save on R1 expenses by consolidating Electronic Control Units (“ECUs”):

ECUs are essentially little computers that have a specific set of functions or domains that they control. ECUs are found in every modern car and their numbers have grown as automakers have added more technology. Traditionally, legacy automakers have bought ECUs – and the software that sits on them – from a variety of Tier 1 suppliers. Scaringe said that outsourcing makes it challenging to improve the software stack, including rolling out wireless updates to vehicles. Rivian, like its predecessor Tesla, has developed its own ECUs and software. As part of the hardware upgrade, which will roll out to its R1 vehicles next year, the company is switching to a so-called zonal control architecture. This means that instead of an ECU having a specific role, the computers are tasked with zones or regions within the vehicle. The result is a reduced number of ECUs and improved efficiency. It’s also easier to manufacture and gets rid of lots of extra wiring.

US News explains how Rivian is working on making their BEVs more economical by switching to LFP batteries (emphasis added):

While they don’t have the power density of the more common nickel-manganese-cobalt batteries, LFP batteries can be charged more than twice as many times in their life. Without the need for nickel, cobalt or magnesium, LFP batteries are cheaper to build, more stable and better for the environment.

Valuation

Looking at the 2Q23 10-Q and the 2022 10-K, trailing twelve-month (“TTM”) gross profit is $(2,864) million or $(947) million + $(3,123) million – $(1,206) million. This comes from TTM revenue of $2,981 million or $1,782 million + $1,658 million – $459 million. Future cash flows are what counts and it is hard to put a valuation on a business with negative gross profit. Given the growth expected ahead, I’m not looking to argue with investors who think Rivian’s market cap and convertible debt is worth up to seven times TTM revenue or $21 billion.

The 2Q23 10-Q shows 940,311,391 A shares plus 7,825,000 B shares for a total consideration of 948,136,391 common shares. The market cap based on the October 13 share price of $19.30 is $18.3 billion. There is also the recent $1.5 billion convertible debt issuance for a total consideration of $19.8 billion. They have a lot more cash than debt on the balance sheet so the enterprise value is ostensibly lower than this consideration right now but they’re burning through cash at a fast rate so I like to focus on the common equity and the convertible debt from a valuation perspective.

Rivian delivered 36,150 BEVs from January to September which came from subtotals of 7,946, 12,640 and 15,564 from quarters 1, 2 and 3, respectively. Again, their common market cap is about $18.3 billion and they have a new $1.5 billion convertible bond issuance for a total consideration of about $19.8 billion. Tesla delivered 1,324,074 BEVs worldwide from January to September which came from subtotals of 422,875, 466,140 and 435,059 from quarters 1, 2 and 3, respectively. This is nearly 37 times as many BEVs as Rivian. Tesla’s market cap is about $800 billion which is about 40 times the $19.8 billion consideration for Rivian. Tesla vehicles are profitable whereas Rivian still loses money on every vehicle built. Also, Tesla has other considerations such as self-driving, energy and Optimus that may explain why the market places a slight premium on them relative to Rivian in terms of value per BEV unit sold.

Other OEMs are out there with lower market caps relative to BEVs sold. Chinese entrepreneur Eric Li Shufu has already found a way to sell Chinese-made vehicles abroad with Volvo Car Group (OTCPK:VLVOF) (OTCPK:VLVCY) and Polestar. He might be successful in doing this in large numbers with Geely (OTCPK:GELYY) (OTCPK:GELYF) in the years ahead as well. Looking at a September sales volume announcement, Geely shows 228,534 BEVs were sold from January to September although this figure is a little bit inflated as it includes 100% of BEV units from LYNK and Livan despite their ownership not being 100%. Geely’s market cap is only about $12 billion despite them selling hundreds of thousands of BEVs each year. Volvo Car Group sold 80,629 BEVs from January to September. In addition to this, Volvo Car Group’s ownership of Polestar is about 50%. The market cap for Volvo Car Group is only about $12 billion. Polestar is much smaller than Rivian in the US but they have similar unit numbers on a global level. Polestar delivered 41,700 BEVs from January to September and they expect to deliver 60 to 70 thousand for the year. Polestar’s market cap is only about $6 billion. It can be puzzling as to why Geely, Volvo Car Group and Polestar have such small market caps relative to BEV units sold. Part of the answer is Geely and Volvo Group being discounted due to incumbent issues covered in The Innovator’s Dilemma book. Also, Geely sells nearly all their BEVs in the highly competitive China market but Volvo Group and Polestar have robust sales around the globe. One key reason Rivian is at a premium relative to Geely, Volvo Group and Polestar is that Rivian has a chance to be the #1 OEM in the highly profitable US truck market.

At this time I’m neutral on Rivian. It isn’t easy for me to have conviction buying or selling Rivian during this incipient stage of the US truck market moving towards BEVs.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN, AMZN, BYDDY, GELYY, PSNY, STLA, TSLA, VLVCY, VLVOF, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.