Summary:

- Rivian Automotive is a major player in the EV market, with sales expected to grow due to global EV market expansion and backing from Amazon.

- Despite its significant cash burn, RIVN has shown resilience in revenue growth and is expected to improve its financials in the coming years.

- RIVN has significant potential, but should start working on improving its cash flow, while continuing its strong growth.

- We compare RIVN to other companies within the industry. We come to the conclusion that RIVN is decently valued based on different metrics.

- We currently rate RIVN as a buy.

Mario Tama

Introduction

Rivian Automotive, Inc. (NASDAQ:RIVN) is an American company that manufactures and sells electrical vehicles (EVs). The company was founded in 2009 but did not go public until 2021.

RIVN is one of the most recognizable names in the EV industry, as it gained many investors’ attention during the EV craze in 2021. Today, RIVN’s market cap has shrunk from nearly $100B in 2021 to just over $20B at the moment of writing. However, RIVN is not a company to shy away from – quite the opposite.

In this article, we will explore some of the main reasons investors should pay attention to this stock, as it has the backing of another major company and is rapidly improving sales.

In addition, the global EV market is set to undergo significant growth, which we will discuss here.

The Outlook for the EV Market

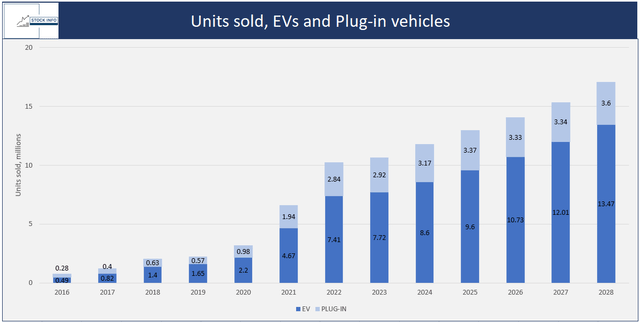

Global EV sales are projected to capture nearly one-fifth of the overall car market and drive a transformative shift in the auto industry with implications for the energy sector as a whole.

The latest edition of the IEA’s Global Electric Vehicle Outlook reveals that over 10 million electric cars were sold worldwide in 2022, and sales are expected to reach 17 million by 2028.

This surge in electric vehicle adoption has propelled the market share of EVs from 4% in 2020 to 14% in 2022, and it is estimated to increase further to 18% by the end of 2023. Needless to say, the car market seems to be moving heavily toward EVs, which highly benefits companies such as RIVN.

Most EV sales worldwide come from China, Europe, and the United States, where most of RIVN’s sales primarily come from the US.

RIVN has revealed that they also have ambitions to expand into China as they look to take advantage of increased interest in EVs overseas. Such expansion could attract new customers, as China is preparing a nationwide program to boost EV adoption.

In addition, the EU has launched the Fit for 55 package, which includes regulations that aim to lower CO2 emissions, benefitting EV manufacturers.

Furthermore, the Inflation Reduction Act in the United States is expected to increase sales of electric vehicles in the coming years through tax credits for consumers – this already went into effect on January 1st, 2023.

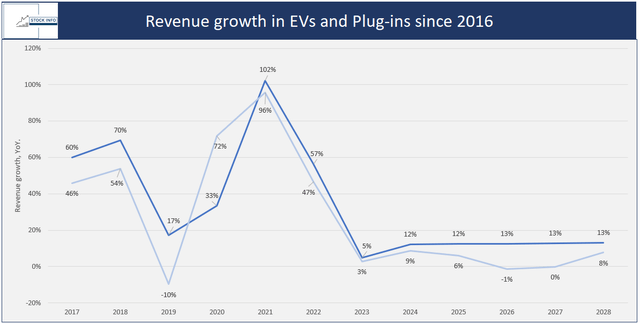

In addition, revenue growth from EV sales is expected to grow at an annual rate of 12%-13% from 2024 to 2028, according to Statista. Such a level of growth would indeed play into RIVN’s favor as they establish themselves on the market in the coming years.

Beating Expectations and Still Backed by Amazon

RIVN surpassed Wall Street’s expectations in their Q1 2023 earnings by producing a higher number of EVs than anticipated by the market. The stock price surged on the day but ultimately continued its downtrend in the following days.

The CEO, however, reaffirmed the company’s guidance to stay on track to manufacture 50,000 EVs in 2023. This comes after RIVN produced just under 25,000 vehicles in 2022. There have also been reports that RIVN’s board had internally discussed the possibility of making 62,000 vehicles this year.

RIVN aims to solidify its position among EV startups challenging the already established names, such as Tesla (TSLA). While RIVN had a highly successful market debut in 2021, it has faced supply-chain hurdles, reduced expectations, and a significant decrease in its market value.

In its last quarter, Rivian produced 13,992 vehicles and delivered 12,640 vehicles to customers, surpassing analysts’ estimates of approximately 12,562 vehicles. The quarterly production increased from the 9,395 vehicles manufactured in the previous quarter.

RIVN has been able to exceed the projected produced vehicles by developing their own powertrain, which compliments the motor in their vehicles. The powertrain has boosted the production of RIVNs most popular car, the R1S.

Another significant tailwind for RIVN is that Amazon (AMZN), their largest shareholder, has recently reiterated its belief that the two companies can benefit from each other mutually. This comes amid talks to end the exclusivity deal between the two companies. By removing exclusivity, Rivian would have the opportunity to seek new customers as it ramps up production and raises funds for its upcoming R2 model. While Amazon initially committed to purchasing 100,000 vehicles, recent reports suggest it may only order around 10,000 this year. However, Amazon clarifies that there have been no changes to its order volume or partnership with Rivian.

RIVN is currently in a position where Amazon is keeping their original order of 100,000 vehicles originating from the exclusivity deal but may, at the same time, get out of the agreement while still holding the big order of EVs from Amazon. This could be very beneficial for RIVN in the future.

Financials

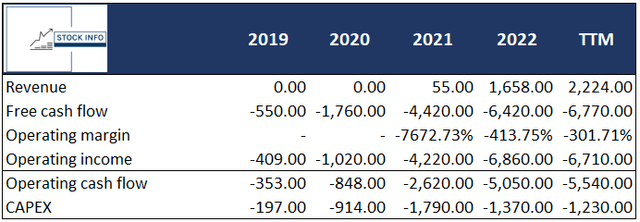

Given that RIVN is such a young company, it is still in the growth stage. As a result, RIVN is burning lots of cash. However, the company has been focusing on reducing its capital expenditure since 2021. In addition, revenue experienced significant growth, reaching $55.00M in 2021, followed by a substantial surge to $1,658.00M in 2022 and further growth to $2,224.00M in TTM.

However, the company faced negative free cash flow challenges, declining from -$550.00M in 2019 to -$4,420.00M in 2021 and even further to $-6,710.00M in TTM. Nonetheless, it is important to mention that Rivian has around $12B in cash and ST investments on its balance sheet. So even if the company isn’t able to improve its FCF, they are good to go for close to 2 years.

The operating margin exhibited improvement from -7672.73% in 2021 to -301.71% in the TTM period but is still far from a satisfactory percentage.

Despite the negative operating income, RIVN showed resilience in revenue growth. It will be crucial for the company to focus on generating positive cash flow, managing costs effectively, and improving profitability to ensure long-term success.

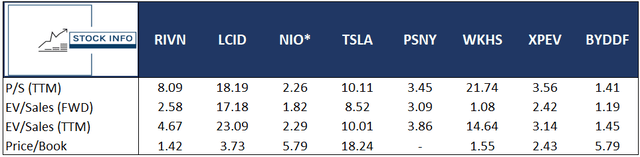

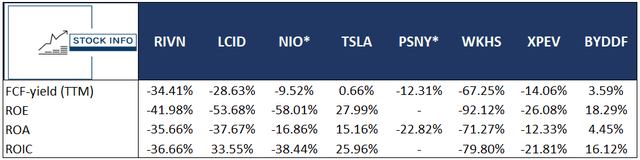

Looking at key valuation metrics, we first compare RIVN with Lucid (LCID) and Nio (NIO), as they are their closest competitors. RIVN lands between LCID and NIO based on P/S, EV/Sales (FWD), and (TTM).

RIVN seems much cheaper based on the price/book value. In addition, a P/B of 1.42 is a very attractive measure when looking for decent value in an investment. Thus, we believe RIVN has an edge over its competitors based on these value metrics.

If we compare RIVN to the more prominent companies, such as Tesla, which are more established, we see that RIVN again lands in the middle of the pack while. It should be noted that RIVN is still the cheapest company based on the P/B metric.

Looking at other financial indicators for the companies, RIVN has the worst FCF yield of all companies with the exception of Workhorse (WKHS). This may not be surprising, given the cash they have been burning through. However, with the strong backing from Amazon, it may not be as big of an issue as it would appear at first sight, given Amazon’s 17% stake in the company already.

With Amazon being the biggest shareholder it seems like they have an incentive to provide support given they want RIVN to reach production of 600k vehicles annually in the next few years. So if necessary, it seems likely that the company would step in if necessary. However, we believe this won’t be necessary due to the increasing sales.

In addition, all companies exhibit negative ROE, ROA, and ROIC apart from BYD Company (OTCPK:BYDDF) and TSLA which is to be expected for companies still in their growth phase.

Looking at the table below, it does not appear that any company has a clear edge over the others.

Furthermore, RIVN has some way to go in terms of generating returns before it can compete with tech giants such as TSLA. However, when we compare RIVN to its closest competitors as well as WKHS and XPEV, they are not far behind and pulling away from the competition.

Technical Analysis

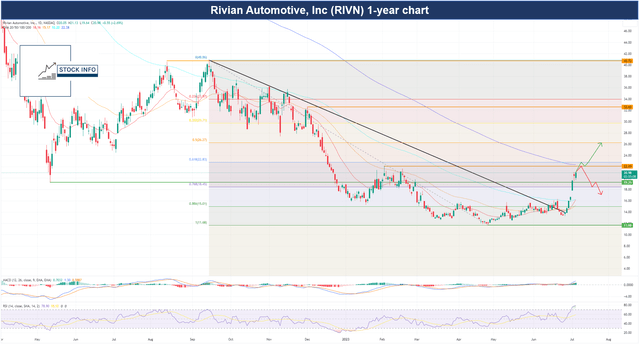

Moving on the RIVN’s 1-year chart, the stock recently experienced a significant upswing, primarily caused by the better-than-expected sales we discussed earlier.

Before this, the stock was in a noticeable downtrend, reaching an all-time low of $11.68 in April. The downtrend was caused by concerns over a rapid cash burn rate and future demand for their products. The sentiment has now changed, as the stock is surging toward new local highs.

The recent upswing could be a pivotal point for RIVN, as it is approaching prices not seen for months. RIVN has broken through the black trendline, which remained unbroken for several months.

In addition, the stock is currently trading above all included EMAs, except for the 200 EMA. It should also be noted that the 20 EMA recently crossed the 50 EMA and is on its way to crossing the 100 EMA – this could be a strong buy signal for momentum investors.

We see a reasonable likelihood that RIVN can continue the uptrend it is currently in. However, if the stock pulls back, we believe it will more than likely test the 100 EMA.

A move back to the 100 EMA could provide an interesting dip buying opportunity for investors who missed the first leg up in the past week. We advise investors to keep an eye on this level.

If the uptrend continues, the stock needs to break through the $22 level. Beyond this, there should be plenty of room for the stock to increase further.

Does This Make Rivian a Buy?

To conclude, Rivian is setting itself up to be a major player in the global EV market for years to come, as its sales are starting to pick up and making strategic choices to expand into China.

Although their earnings may set off alarm bells for investors, it is essential to remember that they are setting up for the future. Their earnings have shown signs of improving on the top line over the past years, which could also start delivering on their bottom line soon.

Reports of higher-than-expected orders and produced vehicles have significantly changed the sentiment on RIVN on the market, as the stock is currently more than 100% from its lows in April. However, investors need to pay attention to the rate they are burning cash, as the levels they are at now are not sustainable for most businesses.

In addition, political actions in the United States, Europe, and China paved the way for drivers to switch from fossil-fuel cars to electric vehicles. If RIVN can capitalize on this and continue its growth in the past year, it could truly solidify itself as one of the big names in the EV sector.

On the technical level, the fact that RIVN has been able to break confidently through the resistance level shown in the previous section should be a tell-tale sign for investors that the trend for the stock has most likely shifted to the upside.

Many investors may not be comfortable taking on sizable positions in RIVN after it has surged so significantly – it may be strategically sound to wait for the stock to correct itself slightly near a level we have outlined in this article.

Overall, we believe RIVN has a bright future ahead with heavy investment from governments into EVs and solid backing from Amazon. As such, we rate this stock as a buy for the long term. But, it is important to keep in mind that like most other businesses in this sector, the company has lots to prove. A close follow-up is thus needed.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.