Summary:

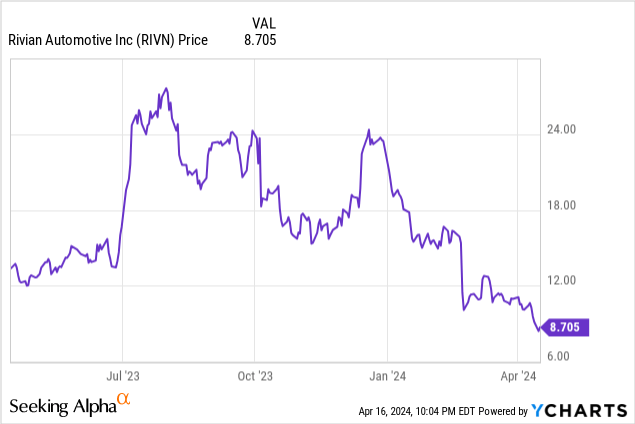

- Rivian Automotive, Inc. stock has seen deep losses this year, down nearly 60% year to date, but its lower valuation makes it an appealing investment.

- Rivian stock has tanked on both lower production guidance and deeper price competition from Ford this year.

- Still, the company is only expecting flat y/y production because of a planned factory shutdown, which will improve production rates and materially raise gross profit per unit.

- Despite current losses, Rivian has ample liquidity with over $7 billion in cash and is expected to achieve gross margin profitability by the end of 2024.

hapabapa/iStock Editorial via Getty Images

Amid general market euphoria this year, perhaps no sector has been as badly damaged as the electric vehicle (“EV”) sector. Stemming from concerns over weak demand, macro pressures, soft signals from China, and ramping competition among vehicle makers, every EV stock has seen deep losses this year.

But few stocks have been hammered as hard as Rivian Automotive, Inc. (NASDAQ:RIVN), which is down nearly 60% year to date:

I last wrote a bullish note on Rivian in January, back when the stock was trading closer to $15 per share. Admittedly, my call was premature, as Rivian has hit new all-time lows. But at the same time, my conviction in Rivian’s ability to surmount its current crisis still remains firm, especially with the appeal of its lower valuation.

When we step away from the near term, here are all of my longer-term reasons to be bullish on Rivian:

- Secular tailwinds toward electrification. Despite shorter-term demand headwinds, I still very much believe in an electrified future. Legislation such as California’s plan to end gas-powered vehicle sales by 2030 is likely to be followed across the globe, as electric vehicles provide transportation in a cheaper and more sustainable way.

- Differentiated brand. While Tesla (TSLA) has become the everyman’s EV, Rivian has distinguished itself as a more rugged truck and SUV option that is more suited to adventurers.

- Enterprise demand. Rivian has a long-standing partnership with Amazon (AMZN) to provide its electrified delivery vehicles. More commercial partnerships can help vault Rivian toward a much larger scale.

- Ample liquidity. Despite current losses (and note that Rivian has a path to getting to gross margin positive by the end of 2024), the company’s $7+ billion of cash provides ample liquidity as it continues to scale.

All in all, with the recent crash in share prices, I am upgrading my viewpoint on Rivian to strong buy and recommend investors buy this dip aggressively.

What’s ailing Rivian?

First, the elephant in the room: why exactly is Rivian down so sharply this year, beyond most other EV stocks?

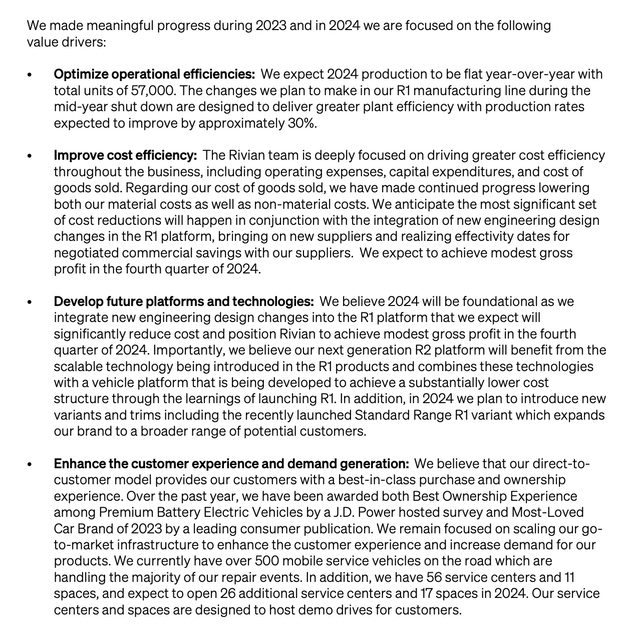

The company has received a double whammy of news this year. First, in late March when Rivian released Q4 earnings results, it also guided to flat y/y production of 57k units:

Rivian 2024 outlook (Rivian Q4 shareholder deck)

That’s even though the company reported exiting Q4 at an annualized production rate of 70k vehicles. Wall Street, at the time, had hoped for 80k vehicles produced in FY24. With this expectation of flat production (and thus, flat deliveries), growth expectations for FY24 were ratcheted back (though consensus is still calling for >50% revenue growth in FY25 after a flat year in FY24, which is something to look forward to if it materializes). The company recently released a Q1 production update in which it reported producing 13,980 cars in the period and delivering 13,588 units – this was in line with management’s targets – and also affirming the 57k production guidance for the current year.

The second drag for Rivian happened in early April, when rival Ford (F) indicated that it intended to play hardball pricing-wise in the EV space. Ford sliced the pricing on its F-150 Lightning vehicles by as much as $5,500, with the base model now starting at just $55k. Rivian’s R1T, meanwhile, starts much higher at $70k.

We do note that Rivian isn’t always doomed to be the high-end incumbent. In March, the company unveiled its long-awaited R2 model, a midsize SUV that it intends to start pricing at $45k. This is substantially below the company’s current R1S and R1T models, though it’s not expected to be available until 2026.

The upside drivers

Okay, so Rivian is expected to see slower production and deliveries this year, plus face greater competition from legacy carmakers. But at the same time, it’s not all bad news for the company.

First: note that one of the reasons Rivian is planning for flat y/y production is because it plans to shut down its factories for operational improvements midway through this year. Note that unlike other larger carmakers, Rivian has only a single production facility in Normal, Illinois.

More context from CEO RJ Scaringe’s remarks on the Q4 earnings call:

During our second quarter shutdown, we plan to incorporate additional material cost downs with the integration of new design engineering changes in the R1 platform, deliver further supplier cost reductions, capture the flow-through of commodity price improvements, and further optimize our manufacturing expenses. We believe these steps position us to achieve modest gross profit in the fourth quarter of 2024.

As we start 2024, I want to address the broader industry context, which I referred to during our third quarter call. Our business is not immune to existing economic and geopolitical uncertainties. Most notably, the impact of historically high interest rates, which has negatively impacted demand. In this fluid environment, we appreciate the expressed interest in demand visibility from the investment community. The conversion of orders to sales can be impacted by several factors, including delivery timing, location of order, monthly payments, and customer readiness.

Our order bank has notably reduced overtime as deliveries have more than doubled in 2023 versus 2022 along with the impact of cancellations due to both the macroenvironment and the customer factors I just referenced. For 2024, we expect our total deliveries to be derived from our existing backlog as well as new orders generated during the year. Our key focus is on increasing demand to achieve our 2024 delivery targets.”

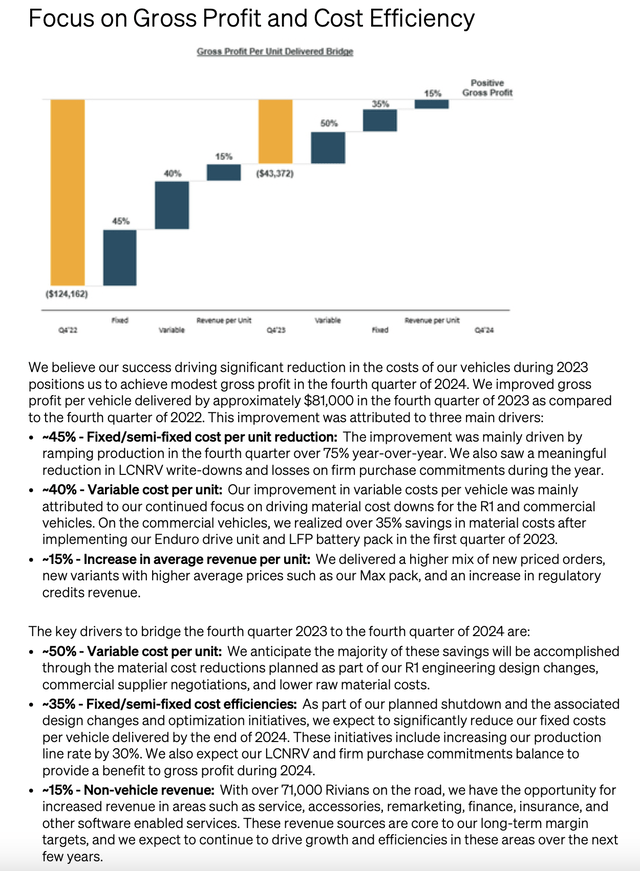

We emphasize the fact that Rivian is expected to make huge strides toward gross margin profitability this year. After improving gross profit per unit by more than $80k in FY23, the company will close the gap by the fourth quarter this year.

Half of that gap will be closed by design changes that will substantially bring down material costs (on top of supplier negotiations and underlying price reductions in raw materials).

Rivian path to positive gross margin (Rivian Q4 shareholder deck)

And fixed cost reductions, driven in connection with the company’s planned Q2 factory shutdown, are expected to improve production line rates by 30% as well. This will be a major step for Rivian as it prepares to launch its entry-level lineup and grab mass-market vehicle share over the next two years.

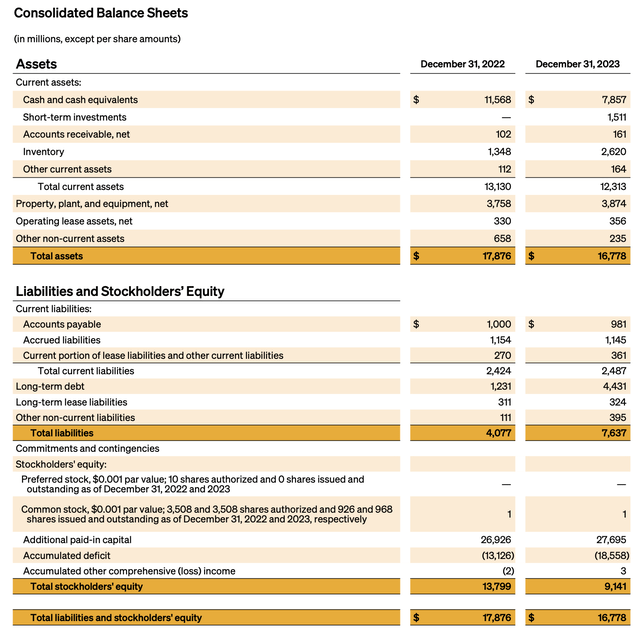

We also take comfort in the fact that Rivian is quite well capitalized to hit these longer-term targets. It had $9.4 billion of cash on its most recent balance sheet (alongside $4.4 billion of debt for $5 billion in net cash).

Rivian Q4 balance sheet (Rivian Q4 shareholder deck)

We can use the company’s adjusted EBITDA guidance of -$2.7 billion for FY24 as a proxy for operating cash flow (~30% reduced from FY23 losses of -$3.9 billion, against which OCF was -$4.8 billion), on top of guidance for $1.75 billion in FCF, to arrive at roughly ~$4.5 billion in expected FCF burn this year. In other words, Rivian has more than two years of liquidity on its balance sheet, and we should expect losses to slim down substantially once the company delivers positive gross profit per unit in 2025.

Key takeaways

Fears are currently exaggerated for Rivian, which remains a highly recognizable, rapidly scaling electric vehicle maker. I’d take advantage of currently depressed share prices as a very opportune buying moment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.