Summary:

- Rivian Automotive faces short-term production issues and potential loss of EV tax credits but remains a strong long-term investment with significant cash reserves.

- Despite production setbacks and a revised forecast, Rivian’s valuation offers a high margin of safety, making it a compelling buy.

- Rivian’s focus on reducing operating expenses is crucial for future profitability, even as it scales up new EV models.

- The market’s reaction to potential policy changes is exaggerated; Rivian’s innovation and cost-efficiency will drive long-term growth.

hapabapa

Rivian Automotive (NASDAQ:RIVN) is dealing with the fallout from a short-term production snag and owns a substantial portion of its market valuation in cash.

Rivian Automotive’s stock plunged 14% last Thursday on news that the incoming Trump administration could consider slashing or abolishing entirely existing EV credits which could deal a blow to demand for electric-vehicles.

The concerns came only a month after the EV manufacturer issued a warning about a shortage of supplies that necessitated a revision of Rivian Automotive’s forecast for 2024.

In my view, concerns about both EV credits and production are exaggerated and I think that Rivian Automotive is poised to grow with or without EV incentives in the long-run.

My Rating History

In my last piece on Rivian Automotive’s stock, I made the case that the lowered production forecast for 2024 was not that big a deal for investors and didn’t fundamentally alter the underlying long investment thesis for the electric-vehicle company.

Rivian Automotive lowered its production forecast from more than 57,000 electric-vehicles to a range of 47,000 to 49,000 electric-vehicles last month, due to what the company said at the time was a parts shortage. I think that Rivian Automotive, at its present valuation, offers investors a very high margin of safety.

Rivian’s Production Ramp Faces A Short-Term Snag

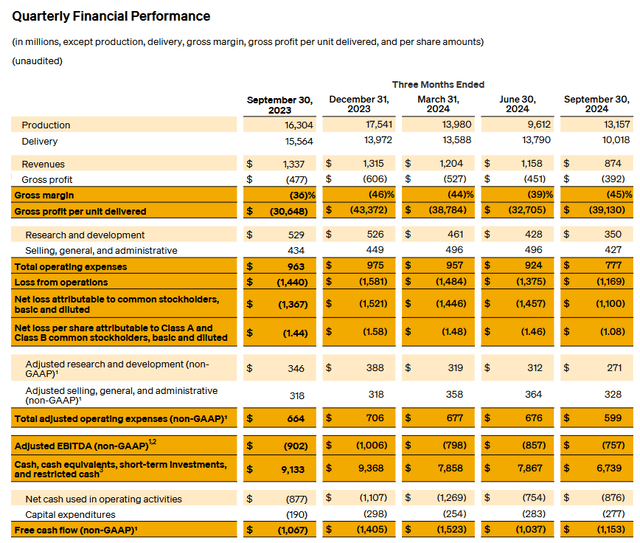

In the third quarter, Rivian Automotive produced 13,157 vehicles and delivered 10,018 vehicles which compares against a production of 16,304 electric-vehicles and deliveries of 15,564 vehicles in 3Q23.

In October, Rivian Automotive warned that it would fall short of its earlier production forecast of 57,000 electric-vehicles and the company blamed a shortage in supply of auto parts for the need to revise its guidance.

As I explained in my last piece on Rivian Automotive in October, I don’t think that the setback in terms of production fundamentally impairs the investment thesis with respect to the EV company. For the present year, Rivian Automotive anticipates to deliver 50,500 to 52,000 electric-vehicles which reflects YoY growth of 1-4%.

Rivian Automotive continued to lose a boatload of money on its electric-vehicles in the third quarter and investors should not expect this to change in the near-future. The electric-vehicle company produced $874 million in sales, down 25% QoQ, as it is dealing with a short-term setback in its production. The EV company’s gross margin was negative 45%, decreasing 6 percentage points QoQ on lower production and delivery figures.

With production slowing due to a lack of available parts, the only two metrics that Rivian Automotive can control to any meaningful degree in order to improve its profitability are its spending on operating and capital expenses. Operating expenses, which for that reason are likely going to be the most important key performance metric for Rivian Automotive moving forward, fell to $777 million in 3Q24, down 16%.

As expected, Rivian Automotive’s free cash flow looked scary as well, being negative $1.15 billion, down $116 million QoQ. The higher negative free cash flow was primarily catalyzed by higher capital expenditures.

With R2, R3 and R3X production scaling up until the first half of 2026, I would not anticipate Rivian Automotive to report positive free cash flows in the near-future either.

Quarterly Financial Performance (Rivian Automotive)

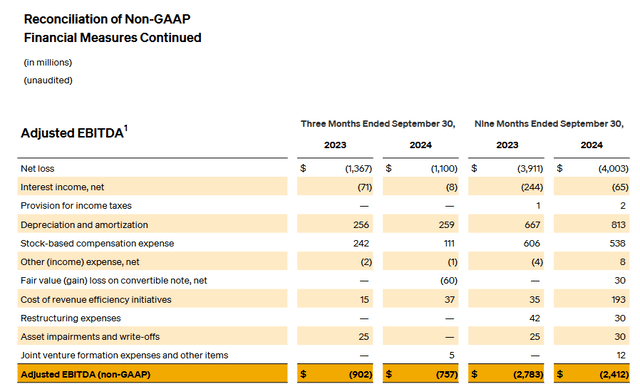

In terms of EBITDA, the electric-vehicle had a year-to-date loss of $2.41 billion which included a $757 million loss sustained in the third quarter. Rivian Automotive is forecasting a loss of between $2.825 billion and $2.875 billion in 2024 which implies that the electric vehicle company anticipates an EBITDA loss of $438 million for the fourth quarter.

Reconcilitation Of Non-GAAP Financial Measures (Rivian Automotive)

Rivian Investment’s Valuation Reflects A High Margin Of Safety

Rivian Automotive’s stock price suffered some escalating selling pressure after Trump’s election as some investors fear the abolishment of taxpayer-funded subsidies on which many electric-vehicle companies rely.

Concerns about unfavorable EV industry treatment in a second Trump term, in my view, are not entirely unfounded, but this hardly affects the viability of Rivian Automotive’s investment thesis, particularly as the EV company gears up to launch more cost-effective EV options for consumers, such as the R2 and R3.

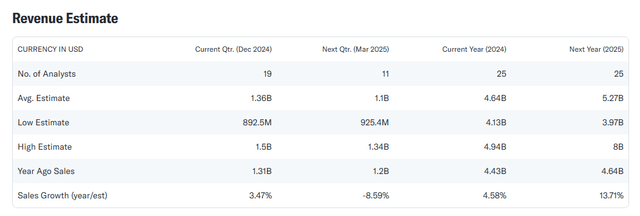

The market presently models $5.27 billion in sales for the electric-vehicle company, on average, for the 2025 financial year, which reflects 14% YoY growth. The high point estimate stands at $8 billion compared to just $4 billion for the low point estimate.

For the present year, the market anticipates $4.64 billion in sales which is down from $4.75 billion in sales in October, mainly because of Rivian Automotive’s revised production forecast for 2024.

Since Rivian Automotive has a market valuation of $10 billion, the EV company’s stock is presently selling for a 2.2x 2024 sales multiple. The electric-vehicle company also had $6.74 billion in cash + cash equivalents + short-term investments available as of September 30, 2024 which means that 67% of Rivian Automotive’s market valuation consisted of liquid assets.

Rivan Automotive has other sources of cash, however: In 2024, the EV company worked out a partnership deal with Volkswagen AG (OTCPK:VLKAF) in 2024 that would see the German auto giant invest $5.0 billion into a joint venture to mutually develop EV driving technology. This amount was raised to up to $5.8 billion in November and could help counterbalance Rivian Automotive’s negative free cash flow.

In addition, Rivian Automotive has the option to raise debt via convertible notes offerings which is what the EV manufacturer did last year to fund the production ramp of the R1 and R3. Rivian Automotive lost an average of $1.28 billion per quarter in free cash flow in the last four quarters and the company presently has enough liquidity to operate for another 5-6 quarters, not counting any cash infusions from the Volkswagen deal or convertible debt offerings. This in turn equates to a high margin of safety, in my opinion, and is the singular reason why I doubled down on Rivian Automotive last Friday.

Tesla, Inc. (TSLA) has a market value of $1.06 trillion and is anticipated to produce sales of $100.0 billion in 2024 reflecting back to us a leading sales multiple of 10.6x. Relative to Tesla, Rivian Automotive is a complete and utter bargain and since the majority of the company’s market valuation is backed by liquid assets, I think the EV manufacturer is a promising EV investment to buy.

Revenue Estimate (Yahoo Finance)

Why The Investment Thesis Might Be Wrong

Presently, buyers of an electric-vehicle in the United States get a tax credit of up to $7,500 per qualified electric-vehicle which obviously is a big incentive for buyers that contemplate purchasing an EV.

In the long-run, however, I would anticipate for EV purchase incentives to fall by the wayside anyways due to improvements in battery technology which make electric-vehicles more competitive with gas-powered cars.

Obviously, Rivian Automotive’s high cash use, as shown by its high negative free cash flows, could become a major problem for the company if it fails to scale up production. Taking into account market concerns about slowing growth in the electric-vehicle segment, which were further stoked by Rivian Automotive’s slashed production forecast in October, I think that investors’ tolerance for high, persistent levels of cash burn is diminishing.

Thus, if Rivian Automotive continues to lose a billion dollars or more each quarter without a substantial increase in deliveries next year, the company’s cash could be depleted and the investment thesis might turn more bearish.

My Conclusion

Rivian Automotive slashed its production guidance in October and the incoming Trump administration is rumored to want to abolish EV tax credits which might curtail demand for electric-vehicles in the short-term.

In the long-run, I expect EV companies to be able to compete with gas-powered cars on a level playing field, however. The absence of EV incentives might also force the electric-vehicle sector to become more innovative and cost-efficient.

Rivian Automotive’s operating expense trend points to improvements in the cost setup for the electric-vehicle company and I think that the key to higher profitability will be a strict and laser-sharp focus on cutting operating expenses in the future.

In my view, Rivian Automotive is a highly promising investment and the big chunk of cash + cash equivalents + investments on the company’s balance sheet substantially lowers investment risks for investors. These liquid assets made up two-thirds of Rivian Automotive’s market valuation which reflects a high margin of safety.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.