Summary:

- Rivian’s lack of profitability and poor fundamentals are coming home to roost.

- Rivian guided to a markedly lower-than-expected Q1 production outlook.

- Rivian’s lack of scale and sustainable moat makes it highly challenging to compete effectively as EV growth has slowed.

- Its lack of diversification compared to its legacy peers has intensified its concentration risks.

- With Rivian not expected to turn profitable through 2027, why are RIVN holders still holding on to their pain?

Justin Sullivan

Investors in pure-play EV automaker Rivian Automotive, Inc. (NASDAQ:RIVN) have experienced significant volatility since my previous update in November 2023. While I anticipated RIVN’s selling pressure had abated in my November article, I cautioned investors about turning bullish on RIVN. I highlighted that Rivian’s lack of profitability is a crucial concern. Furthermore, I underscored the need for Rivian to demonstrate its ability to “continue scaling up on its R1 platform” while also “building up the underlying demand for its R2 and EDV in the medium term.”

Notwithstanding my caution, dip-buyers returned to RIVN, causing it to surge. However, its poor fundamentals (“F” grade for profitability) likely weren’t sufficient to sustain its buying momentum. As a result, RIVN has given up all its gains since my article, collapsing nearly 40% from its December 2023 highs through yesterday’s close. In other words, the market was correct in assessing a weak outlook even before its earnings scorecard. However, even the market also didn’t expect Rivian to stun investors with a much lower-than-expected production guidance.

Rivian delivered its fourth-quarter earnings release yesterday after the market closed. Selling pressure intensified as Rivian reported highly disappointing guidance, coming way below analysts’ estimates. Rivian management attributed its cautious outlook to macroeconomic headwinds and high-interest rates affecting demand dynamics. Given the headwinds seen in market leader Tesla’s (TSLA) “lack of firm sales guidance” during its earnings conference in January 2024, I believe that is already expected.

Management didn’t address its lack of a hybrid strategy, which is now a hindrance to scaling its production. I addressed the importance of a well-diversified automotive strategy in a recent Ford (F) article, arguing why an EV slowdown is good for the company. Ford management deliberately reduced its investments in full-battery EVs, focusing more on its core legacy segment in response to a downturn in EV demand. Leading lithium miner Albemarle’s (ALB) recent downward revisions to ALB’s long-term outlook suggest that the previous long-term EV growth outlook was overestimated. Analysts have likely placed too much optimism on consumers’ inclination toward a full-fledged EV transition. Bloomberg also reported similar observations in China (the world’s largest EV market), as Chinese consumers increasingly prefer hybrids. As a result, BYD Company (OTCPK:BYDDF) (OTCPK:BYDDY) has risen over Tesla’s market leadership, becoming the most significant EV market leader (including hybrids) globally.

Given Rivian’s sole focus on BEVs, I’m not surprised that Rivian didn’t address its lack of a hybrid strategy to the extent Ford has managed to capitalize. While the world continues its long-term transition toward electrification, these pure-play EV makers like Rivian have started to realize the critical gap. As a result, Rivian needs to bank on a more successful rollout of its mass-market vehicle platform, coined the R2. Management has placed significant emphasis in 2024 on retooling its manufacturing lines to prepare for an R2 scale. As a result, it has impacted its production outlook for 2024. Rivian guided for 2024 production of just 57K, way below Wall Street’s estimates of 66K. It indicates a slight increase over FY23’s production of 57.23K vehicles.

Furthermore, with Rivian needing to expand its manufacturing scale, the company intends to increase its CapEx to $1.75B in 2024, well above 2023’s CapEx of $1.03B. With that in mind, the market is increasingly concerned about whether Rivian can scale effectively, notwithstanding its commitment to drive its R2 platform. With its weak fundamentals and not expected to turn profitable through FY27, I believe investors are pricing in much lower expectations in Rivian. It makes sense, as RIVN’s “C” valuation grades suggest a lack of valuation dislocation.

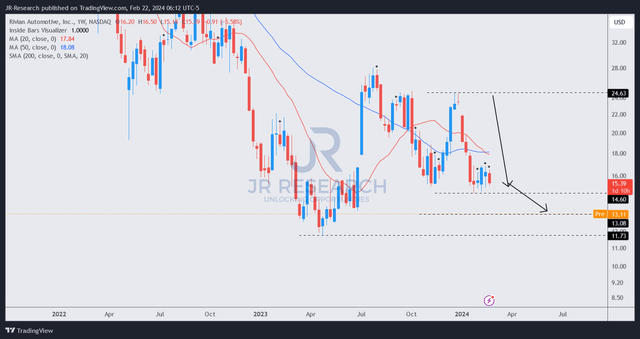

RIVN price chart (weekly, medium-term) (TradingView)

As seen above, RIVN is trading close to the low $13 zone in pre-market trading. As a result, the pre-earnings consolidation has failed miserably, as buyers threw in the towel, given Rivian’s poor outlook.

As seen in RIVN’s price action, most of the losses from its December highs were accumulated pre-earnings. As a result, the market had already attempted to price in bad news heading into its fourth-quarter earnings release. Therefore, it’s a solemn reminder for investors considering investing in companies like Rivian, which have no clear path toward profitability.

Given its lack of moat and scale, weaker demand dynamics are expected to hit Rivian harder than legacy peers (with profitable segments) and profitable EV leaders like Tesla. Furthermore, with BYD expected to enter the US market to challenge Tesla’s dominance, smaller players like Rivian have their work cut out for them.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ALB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!