Summary:

- Rivian Automotive, Inc. beat sales estimates, but disappointed with its production forecast for 2024, leading to a 15% stock price drop.

- The weak outlook raises questions about the demand for electric vehicles and may impact Rivian Automotive’s valuation.

- Despite the disappointing forecast, Rivian Automotive has a strong balance sheet and sufficient liquidity to operate without tapping into capital markets.

Mario Tama

Rivian Automotive, Inc. (NASDAQ:RIVN) released quarterly earnings for its fourth quarter yesterday, and though the electric vehicle (“EV”) company beat sales estimates, the production forecast for 2024 was a huge disappointment.

The earnings release, and the guidance for 2024 production in particular, triggered a 15% selloff in the after-hours market.

The outlook raises serious and uncomfortable questions about the demand situation for electric vehicles that may continue to pose a valuation headwind for Rivian Automotive stock in 2024.

A Hold stock classification seems the most logical response to Rivian Automotive’s fourth quarter earnings release.

My Rating History

I modified my stock classification for Rivian Automotive from Buy to Hold in October due to the electric vehicle company offering yet another Convertible Notes offering in the amount of $1.5 billion that posed dilution risks to shareholders.

The forecast for 2024, however, disappointed greatly as the company anticipates practically no production growth this year.

With sales coming in better than expected and Rivian Automotive’s balance sheet being a major asset, I maintain my Hold stock classification for Rivian Automotive.

Rivian Automotive’s Q4 2023 Earnings Were A Shocker

The electric vehicle company reported Q4 sales ($1.32 billion) that came in higher-than-expected ($1.25 billion) which unfortunately did little to cushion the blow from the EV company’s very weak guidance.

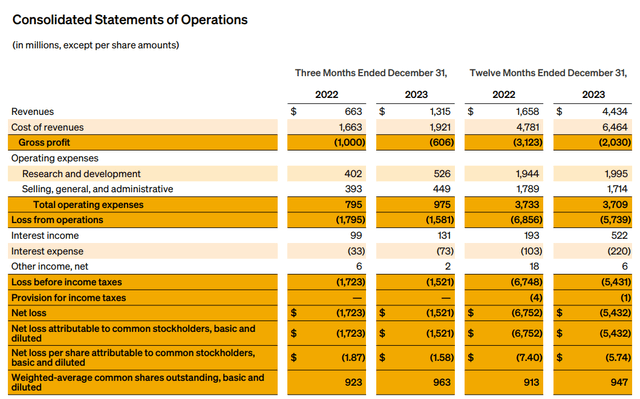

As anticipated, Rivian Automotive continued to rack up a boatload of losses in the fourth quarter and in 2023 due to the company’s R1S and R1T ramp. Operating losses for Q4 2023 summed up to $1.58 billion, while full year operating losses hit a whopping $5.74 billion.

With that being said, for both reporting periods, Rivian Automotive actually saw lower losses compared to last year.

Consolidated Statements Of Operations (Rivian Automative)

Rivian Automotive produced 57,232 vehicles in 2023, which exceeded the company’s 54,000 production goal. The production goal itself was raised twice by Rivian Automotive, by 2K EVs each in the latter half of 2023.

Though Rivian managed to beat its own production estimate by more than 3K units, the guidance for 2024 was quite bad and was the main driver of Rivian Automotive’s 15% stock price dive in the after-hours market yesterday.

Rivian Automotive’s production outlook for 2024 was a shocker, as it assumes a total volume of only 57K electric vehicles. In 2023, Rivian Automotive produced 57,232 vehicles, so the outlook is specifically not factoring in any real growth in the company’s production. The complete lack of growth reflected in Rivian Automotive’s guidance is probably a reflection of weaker demand in the EV industry more generally.

Both Ford Motor Company (F) and General Motors Company (GM) have said they are seeing weakness in electric vehicle demand, which caused Ford to cut back on production shifts in order to adjust its F-150 Lightning production volume downward.

Weakness with regards to EV demand appeared in the latter half of 2023, which is when dealers started to see longer lot turnaround times for EVs, which in turn caused major automakers like Ford and General Motors to manage investor expectations and guide for slower EV growth moving forward. This slower-than-expected growth has now caught up to Rivian Automotive.

Thankfully, Rivian is one of the best capitalized electric vehicle companies in the market, with a sizable balance sheet and substantial cash to ride out a slowdown in electric vehicle demand.

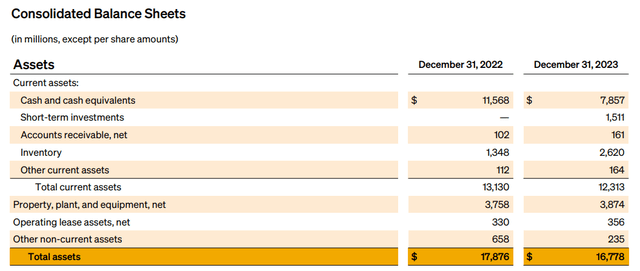

Rivian Automotive had on-balance-sheet-cash of $7.9 billion, which reflected a reduction from the $11.6 billion reported for the end of 2022. The amount of cash is comforting now that major manufacturers have succeeded in resetting investor expectations with respect to EV demand.

Consolidated Balance Sheets (Rivian Automotive)

Rivian Now Has A Valuation Problem

My last Rivian rating was Hold due to the company’s growing dilution risks related to Convertible Debt Offerings. The reason why I don’t change my stock classification after the guidance disappointment is that Rivian Automotive retains a fortress balance sheet.

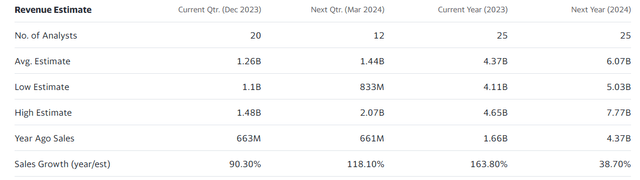

Unfortunately, Rivian Automotive, after presenting “a no-growth” forecast for 2024, faces estimate corrections for its sales. The market models now only 39% growth in sales this year, down from 167% in 2023. With $6.1 billion in sales expected this year, Rivian Automotive stock has a sales multiple of 2.4x. As far as sales estimates go, since my last review, average sales expectations for the present year have fallen by $830 million. More estimate cuts are likely after Rivian Automotive’s 2024 guidance, which in turn creates additional valuation risk.

Revenue Estimate (Yahoo Finance)

Why Rivian Automotive Might Do Well Regardless

Though 2024 is clearly not going to be a year of growth for the electric vehicle company, Rivian Automotive’s robust balance sheet does limit the downside risk, in my view.

With $7.9 billion in balance sheet cash, the EV company has sufficient liquidity to keep operating in 2024 without having to tap the capital markets.

With Rivian Automotive being one of the best-funded EV companies in the industry, the automaker has much less risk than other startups, which face the prospect of having to raise capital in a market that is seeing weakening demand for EVs. This inherent strength could be attractive to investors moving forward, particularly if EV demand rebounds.

My Conclusion

Rivian Automotive’s stock price plummeted 15% in after-hours trading in a direct response to the electric vehicle company issuing a guidance shocker that calls for practically no YoY production growth in 2024.

This slowdown reflects weakening consumer demand for electric vehicles, which other EV manufacturers, like Ford and General Motors, also already have reacted to.

I think that the guidance and slowing production growth were major disappointments. It still works in favor of Rivian Automotive that the company has a boatload of cash available for investment into, for instance, newer and cheaper electric vehicles.

I anticipate that Rivian Automotive’s disappointing production growth for 2024 will be reflected in sales (growth) estimate corrections, which may add to the EV company’s valuation stress.

Right now, in my view, the most sensible thing is probably to stay on the sidelines for Rivian Automotive, Inc. stock and wait things out.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.