Summary:

- Despite personal enthusiasm for electric vehicles, the current market is highly competitive, with slowing sales growth and increasing model availability.

- Rivian Automotive faces significant challenges, including high production costs and negative cash flow, leading me to maintain a ‘sell’ rating.

- RIVN’s ambitious production goals and potential revenue growth are overshadowed by substantial financial risks and competitive pressures.

- The company’s recent performance shows minimal sales growth and continued losses, making it unlikely to achieve its lofty margin targets.

hapabapa

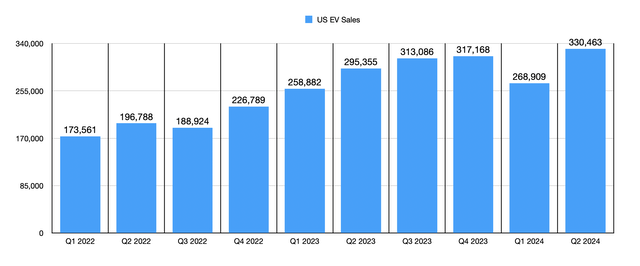

Conceptually speaking, I am a huge fan of the movement away from fossil fuel powered vehicles and toward electric vehicles. I believe the end result will be better off for almost everyone involved. But as an investor, it’s imperative not to let one’s personal feelings get in the way of objective reality. And the fact of the matter is that right now is not a particularly good time for the electric vehicle market. While the industry itself is expanding, with the second quarter of this year boasting the highest ever in unit sales in the US with 330,463 compared to the 295,355 reported one year earlier, sales growth is slowing, and the competitive environment is becoming even more extreme.

In an earlier article, I discussed how electric vehicles are approaching pricing parity with traditional vehicles. This on its own is a good thing for the players in the market. However, there has been a massive increase in the number of models put out, meaning that there are more companies fighting over consumers in this space than ever before. For context, back in 2015, there were only 21 different models of electric vehicle sold in the US. This number jumped to 48 by 2020. By 2023, it had grown to 88. And the most recent projections I found called for this number to swell to 134 this year.

These competitive pressures have resulted in industry leader Tesla (TSLA) losing a good chunk of its market share over the last couple of years. However, in the long run, it might be alright. One company that is on shakier ground though is Rivian Automotive (NASDAQ:RIVN). In my original article about the company in April of this year, I detailed how the company might be facing an existential crisis. This led me to rate the business a ‘strong sell’. But in late June 2024, in response to the company landing what I called a ‘miracle deal’ with Volkswagen, I ended up upgrading it to a ‘sell’. Since then, shares are down 14.5% while the S&P 500 is up 2.7%. As much as I would like for this drop to be large enough to justify a further upgrade, I’m not yet convinced that the company can appropriately weather this storm without extreme hardship. So because of that, I am keeping it rated a ‘sell’ for now.

Selling hope

Over the past few years, Rivian Automotive has seen rather impressive growth. The investments that management is making should set the stage for further growth. However, I have doubts over the ability of the company to truly thrive moving forward. To start with, though, I think it is worth working at what I would consider to be the dream scenario for investors. Today, the company has operational capacity at its facilities to produce up to 150,000 vehicles per year. This includes 65,000 vehicles that are classified as either electric delivery vans or electric commercial vans. A lot of these activities are centered around its deal with Amazon (AMZN) to deliver 100,000 of its electric delivery vans to the e-commerce giant. The other 85,000 units that it can produce annually fall under its R1 model.

At one point in time, management had the ambitious goal of opening production facilities in both Normal, Illinois and Stanton Springs North, Georgia. Due to cost issues and the company’s desire to become cash flow positive, it has halted plans on its $5 billion Georgia facility that would have, at peak production, produced as many as 400,000 vehicles annually. Its focus, instead, is now to focus entirely on production of its R2 model in Illinois. With a price target of between $45,000 and $55,000, this model will appeal to a larger number of potential buyers compared to the $71,700 to more than $100,000 that its R1 costs. But the first production of these vehicles won’t occur until the first half of 2026.

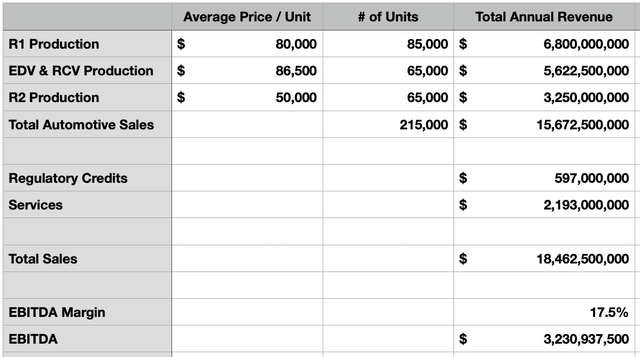

If everything goes according to plan, Rivian Automotive will be capable of producing up to 215,000 vehicles each year. Up to 155,000 of these will be R2 units. However, that would come at the sacrifice of as many as 90,000 other units. In the table above, I used current pricing estimates for the different vehicles the company produces and plans to produce during this time in order to calculate estimated automotive revenue. However, the company should also generate income from regulatory credits and from services that management plans to offer. We have absolutely no idea what these numbers will look like. But as a proxy, I assumed that the percent of automotive revenue that these would equal would be the same as what rival Tesla has achieved so far this year.

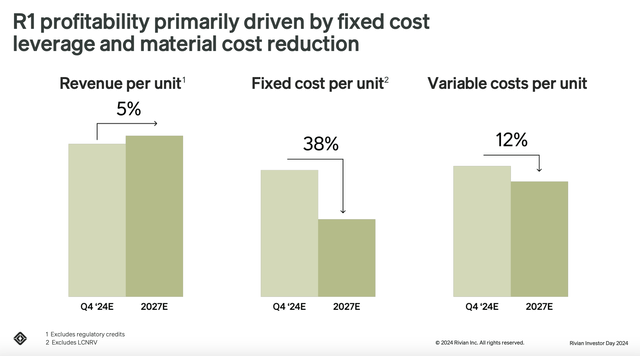

If we assume that the company doesn’t reach full production until 2027, that year we should see revenue of $15.67 billion just coming from automobiles alone. Total revenue would come in at about $18.46 billion. In the image above, you can see that management has plans to decrease fixed costs per unit and variable costs per unit. The hope is that, eventually, this will result in an EBITDA margin that’s in the high teens. This would unlikely be for the 2027 fiscal year. But even if we use an EBITDA margin of 17.5%, which would be at the midpoint of the high teens rate, we would end up with annualized EBITDA of $3.23 billion.

At this time, Rivian Automotive has an enterprise value of only $9.01 billion. And this is not even factoring in the other $4 billion of investments that the company should still collect from its Volkswagen deal that was announced earlier this year. Given all of this, I can understand why investors might be bullish. However, this is a lot of hope that they have to have that everything plays out right. There are plenty of problems with this kind of approach to thinking as well. For instance, this year alone, the company plans to allocate around $1.20 billion toward capital expenditures. Only $537 million of this amount was spent in the first half of this year. Management is also anticipating negative EBITDA this year to the tune of $2.70 billion. Add on top of this another $1.50 billion worth of capital expenditures next year, not to mention whatever the company spends in 2026 and 2027, and continued negative cash flows during this time, and it’s difficult to imagine its enterprise value not soaring (without factoring in changes in market capitalization) solely as a result of a decline in net cash.

As I talked about in an article that I wrote about Tesla, the electric vehicle space is becoming increasingly competitive. Cheap foreign labor is creating the risk that American manufacturers might no longer be competitive. And already, Tesla, which boasts economies of scale that Rivian Automotive can only dream of, not to mention additional revenue through its Energy Generation and Storage segment that is responsible for only 9.9% of the firm’s revenue so far this year but 13.8% of total segment profits, has an EBITDA margin of only 12.7%. It seems very unlikely to me that Rivian Automotive will achieve these lofty margin targets.

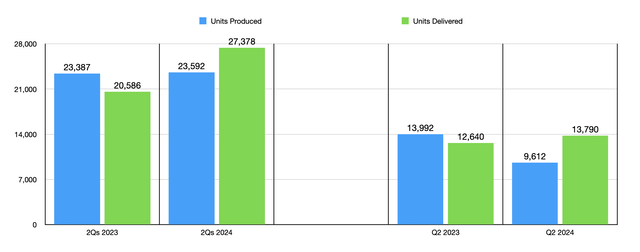

Recent performance achieved by the company is also concerning. In the second quarter of the 2024 fiscal year, the company generated sales of only $1.16 billion. This is barely above the $1.12 billion generated the same time one year earlier. Even though the company succeeded in growing deliveries from 12,640 units in the second quarter of last year to 13,790 the same time this year, management acknowledged to having cut the average selling price of its first generation R1 vehicles ahead of their second generation ones that were introduced in June. This on its own makes sense. However, this year as a whole, the company intends to produce only 57,000 total vehicles. This is in line with the 57,232 that the company produced in 2023.

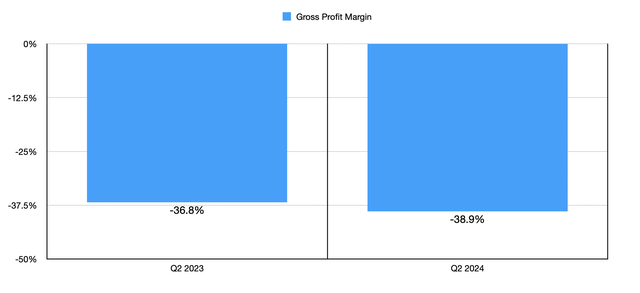

Considering that its production capacity is nearly three times what it’s currently producing, you would think that management would be ramping up output. But by the companies own admission, it is purposely curtailing production because of high production costs. In my prior article on the business, I talked about the fact that the firm had been successful in improving its gross profit margin from negative 845.5% in 2021 to negative 45.8% in 2023. In the second quarter of this year, the company’s gross profit margin was negative to the tune of 38.9%. But that was actually worse than the 36.8% by which it was negative at the same time last year. This means that, in addition to worsening year over year, the company continues to lose almost $33,000 on every vehicle that it produces. And that doesn’t even factor in operating costs like research and development, selling, general, and administrative costs, and more.

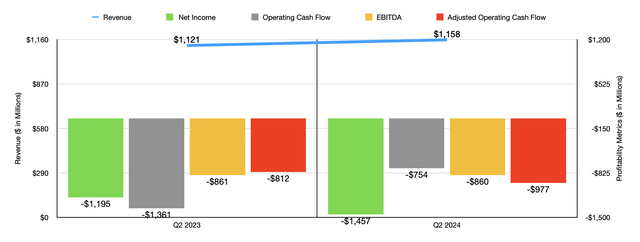

In the most recent quarter, the company incurred a net loss of $1.46 billion. That’s far worse than the $1.20 billion reported one year earlier. It is true that operating cash flow improved from negative $1.36 billion to negative $754 million. But if we adjust for changes in working capital, it worsened from negative $812 million to negative $977 million. Meanwhile, EBITDA was nearly flat year over year, coming in at negative $860 million compared to the negative $861 million reported the same time in 2023.

Takeaway

At the end of the day, it is very possible that Rivian Automotive will end up being a large and thriving company in the space in which it operates. If the firm can deliver on its plans, then the end result for shareholders might be solid. But the amount of cash and time needed to get to that point, as well as the significant risks in the assumptions that we are looking at, such as the assumption that the electric vehicle market won’t become more competitive than it is already, or the assumption that the company can actually produce anywhere near its claimed capacity, it creates a tremendous amount of risk for investors. Relative to the reward that this could provide, I believe that the company deserves the ‘sell’ rating that I assigned it previously, solely because, on a risk-adjusted basis, I suspect that the company will underperform the broader market moving forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!