Summary:

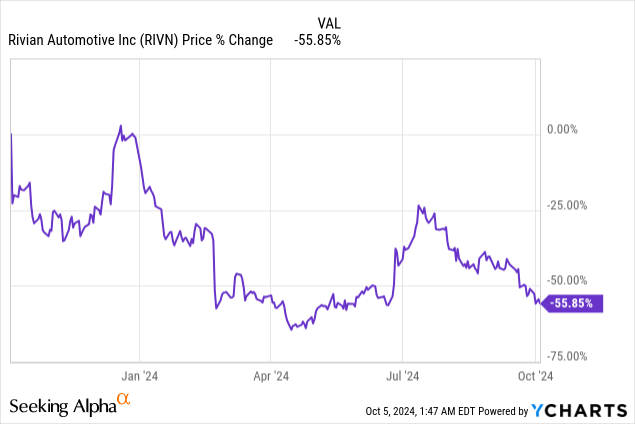

- Rivian’s shares fell 3% after reporting Q3 deliveries and a significant cut in its FY 2024 production target.

- The lowered production outlook suggests widening losses per EV sold and potential downward revisions in revenue estimates.

- RIVN’s FY 2024 production guidance was reduced from 57,000 to 47,000-49,000 vehicles, marking a 16% decline at the midpoint, officially for supply shortage reasons.

- The production cut raises concerns about Rivian’s profitability as well as demand, as the company continues to lose money on each vehicle sold amidst a challenging EV market.

jetcityimage/iStock Editorial via Getty Images

Shares of Rivian Automotive (NASDAQ:RIVN) tumbled 3% on Friday as the company reported Q3 deliveries and, importantly, significantly lowered its full-year production target based off of what the company called a “parts supply shortage.” Tesla (TSLA) saw positive year-over-year delivery growth in Q3, but missed estimates as well, indicating that the sector at large is still suffering from weakening demand. I believe the revised production outlook is a negative for Rivian, as the EV company is most certainly going to see higher gross losses and higher losses per vehicle sold. Also, analysts are going to submit their revenue estimate revisions, which could pressure shares in the short term.

Previous rating

I rated shares of Rivian a strong buy — Rivian: A Value Deal — after the company’s second-quarter earnings release because the electric vehicle firm managed to narrow its losses and, especially, its losses per electric vehicle sold. Unfortunately, the lowered production outlook for FY 2024 strongly suggests that losses per electric vehicle sold are now set to widen again in the second half of the year. With new uncertainty about electric vehicle demand weighing on Rivian, shares are at risk of a longer-term correction.

Bad news for Rivian

Rivian reported on Friday that it delivered 10,018 electric vehicles in its third fiscal quarter, which represented a 36% decline compared to the year-earlier period. This fell significantly short of analysts’ consensus expectations of 13,000 deliveries for the third-quarter. The EV company’s Q3 production was 13,157 EVs and declined 19% year-over-year.

|

Volumes |

Q3’23 |

Q4’23 |

Q1’24 |

Q2’24 |

Q3’24 |

Y/Y Growth |

|

Deliveries |

15,564 |

13,972 |

13,588 |

13,790 |

10,018 |

-35.6% |

|

Production |

16,304 |

17,541 |

13,980 |

9,612 |

13,157 |

-19.3% |

(Source: Author)

Unfortunately, Rivian lowered its FY 2024 production outlook from 57,000 electric vehicles (which was confirmed just in the previous quarter) to a new range of 47,000 and 49,000 vehicles, which marks a decline, at the mid-point, of 16%. Rivian said in its statement announcing production figures that this reduction was necessary in light of supplier shortages related to certain parts for the R1 and commercial van.

A lower production volume is obviously not good news for Rivian and shares of the electric vehicle maker are now back to where they were before Rivian announced a major strategic equity investment and partnership with Germany-based Volkswagen Group in June: Volkswagen Deal Is A Game Changer.

To provide some context, Tesla also reported Q3 production and delivery volumes last week: the biggest EV company in the U.S. delivered 462,890 electric vehicles to customers in Q3, showing a year-over-year growth rate of 6.4%. Tesla missed expectations with regard to its delivery volume, as analysts expected a total 463,897 deliveries.

There is a possibility that what Rivian called “supply shortages” are really demand issues, which investors have heard a lot about in recent quarters. Lucid Group (LCID) stopped reporting reservation numbers last year and multiple times lowered its annual production forecast. Other EV start-ups, like Fisker, went out of business altogether as they misjudged demand for electric vehicles. Supply issues tend to be more short term in nature, while demand issues may have longer-lasting effect on a company’s revenue trajectory. In this regard, the next several earnings reports will shine a light on what the issue at Rivian is.

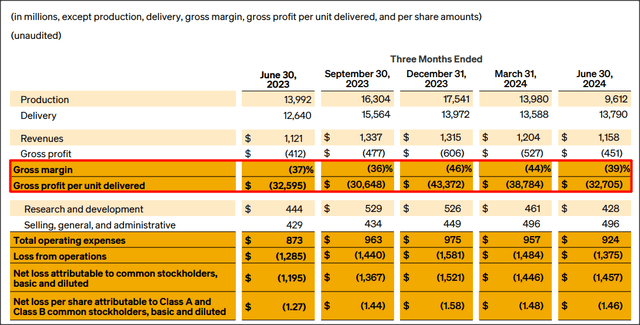

Nonetheless, I feel compelled to react to the production target revisions by downgrading Rivian’s shares. In the last year, I repeatedly pointed to Rivian’s potential to lower its losses per-vehicle sold in case it managed to ramp up its production volume significantly. As a reminder, in Q2’24, Rivian Automotive lost $32,705 per electric vehicle sold (on a gross margin basis) compared to $43,372 per vehicle at the end of FY 2023, so the trajectory here was a positive one.

Now that Rivian expects to roll fewer EVs off of it factory belts, the losses stand to widen again, which is a major setback for the bull case, and it potentially pushes out Rivian’s profitability time-line. Unfortunately, investors must now expect Rivian to report higher gross losses again in the second half of the year.

Rivian

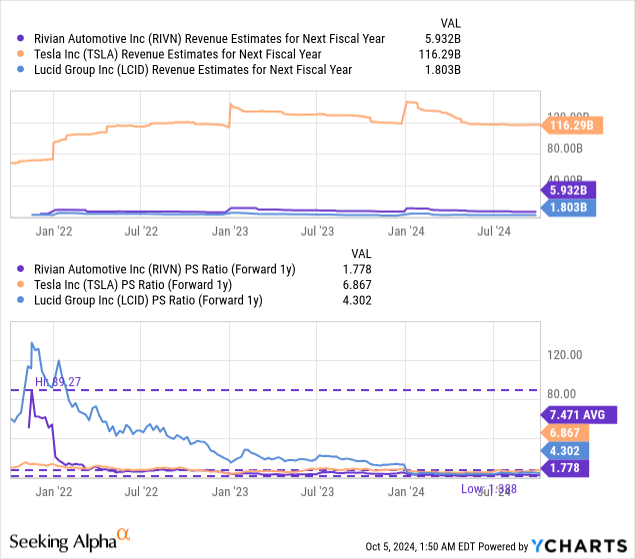

Rivian’s valuation and revenue estimate revisions

Rivian, as I said before, represented one of the best values in the large-cap U.S. EV market, at least until recently. Tesla, however, is the uncontested market leader with significantly higher delivery volumes, revenues and earnings, and therefore is by far the most expensive EV play for U.S. investors with a forward P/S ratio of 7.5X. Tesla also has a couple of catalysts coming up, including its robotaxi event, which, I believe, could help change the narrative about Tesla a little bit as the company moves closer to realizing the autonomous vehicle opportunity: Strong Buy Before Robotaxi Event.

Rivian is currently valued at a price-to-revenue ratio of 1.78X based off of $5.93B in estimated revenues in FY 2025, which makes Rivian still the cheapest large-cap EV company in the U.S. market. Rivian has a significantly higher EV production volume than Lucid — the EV company expects to deliver approximately 9k electric vehicles this year — which makes the valuation contrast between these two EV companies especially glaring.

Rivian’s changed production guidance for FY 2024 is set to trigger new revenue estimate downward revisions, which could weigh on Rivian’s valuation in the lead-up to the company’s third-quarter earnings report. As a result, I am downgrading shares of Rivian to hold, mainly for reasons of short term gross margin and earnings uncertainty.

I believe Rivian could trade at a P/S ratio of 2.0X in the longer term, assuming that the company can get a grip on its profitability situation and lower its losses per vehicle sold (in my last work, I proposed a 3.0X P/S ratio). I lower my fair value P/S ratio chiefly because of increased earnings risks after Rivian’s revision of its FY 2024 production guidance. A 2.0X P/S ratio implies a fair value of $11.60 per-share, compared to a current share price of $10.44. Since my revised fair value target has been about reached, I feel most confident with a hold rating at this point of Rivian’s production ramp.

Risks with Rivian

The lowered production guidance for FY 2024 is going to have a significant impact on Rivian’s profitability profile. Rivian is still losing money for each electric vehicle it sells, so a material volume contraction is going to negatively impact the firm’s gross profit per-vehicle trajectory. In that sense, Rivian is likely going to report higher gross and operating losses in the next two quarters. What would change my mind about Rivian is if the company were to see a reacceleration of its production and delivery growth in FY 2025.

Final thoughts

The production update for FY 2024 was bad news for investors, and it created new negative sentiment overhang, especially because investors are perceiving the “supply shortage” to really have more to do with weak demand for high-priced electric vehicles in a market that has already seen slowing EV adoption. I believe the production target revision is a major setback for the EV company and its shareholders, and Rivian is looking at a potentially significant widening of its operating losses in the second half of the year. With new earnings and gross margin uncertainty on the horizon, I am downgrading shares of Rivian to hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.