Summary:

- After the close of Tuesday’s session, shares of electric vehicle manufacturer Rivian Automotive rallied by more than 50% following news of an initial $1 billion investment by Volkswagen.

- In addition, the companies intend to establish a 50:50 joint venture to develop next generation electrical/electronic architecture for electric vehicles.

- Should the proposed joint venture come to fruition, Volkswagen intends to invest an additional $4 billion in shares of Rivian and into the joint venture.

- Essentially, Volkswagen appears to be buying into Rivian’s architecture to address persistent issues with its own CARIAD software unit, which have resulted in multi-year delays of some of its highest profile EVs.

- While the proposed transaction will address the greatest individual blind spots of both companies, an outright takeover of Rivian by Volkswagen looks unlikely at this point.

- With further near-term capital raises now unlikely, I am raising my rating on Rivian Automotive’s common shares from “Sell” to “Hold”.

jetcityimage/iStock Editorial via Getty Images

Note:

I have covered Rivian Automotive, Inc. (NASDAQ:RIVN) previously, so investors should view this as an update to my earlier article on the company.

After the close of Tuesday’s session, shares of electric vehicle manufacturer Rivian Automotive, Inc. or “Rivian” soared by over 50% on the heels of an initial $1 billion investment by Volkswagen Group (OTCPK:VWAGY, OTCPK:VLKAF, OTC:VLKPF), the world’s largest automotive manufacturer by revenue.

In addition, the companies intend to establish a 50:50 joint venture to develop next generation electrical/electronic architecture for electric vehicles:

Upon successful implementation of the joint venture, Volkswagen would receive immediate access to Rivian Automotive’s current E/E architecture technology for using it in its electric vehicles.

However, according to the Volkswagen press release, a final decision has not yet been made (emphasis added by author):

The actual establishment of the joint venture depends on a series of different parameters, in particular, the final results of the further review of the technical feasibility of the integration of the E/E-architecture in vehicles of Volkswagen, the further negotiations between the parties as well as regulatory approvals. Against this background, a final decision on the establishment of the joint venture has not been made yet.

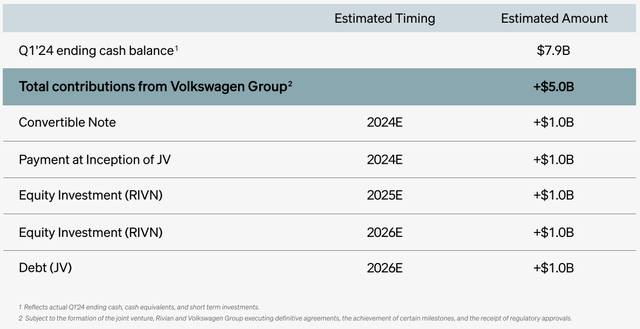

Should the proposed joint venture come to fruition, Volkswagen intends to invest an addition $4 billion in shares of Rivian and into the joint venture:

According to statements made in Rivian’s shareholder letter, the Volkswagen investments are expected to provide the capital to fund Rivian’s operations through the ramp of the R2 at its existing Normal, Illinois facility, as well as the company’s midsize platform at the yet-to-be-constructed in Stanton Springs, Georgia plant thus enabling “a path to positive free cash flow and meaningful scale“.

Essentially, Volkswagen appears to be buying into Rivian’s architecture to address persistent issues with its own CARIAD software unit which have resulted in multi-year delays of some of its highest profile EVs.

While the joint venture is expected to close in Q4, Volkswagen won’t utilize Rivian’s software stack before the second half of the decade.

In the shareholder letter, Rivian outlines anticipated incremental benefits like material cost savings, operating expense efficiencies and future revenue opportunities. That said, on the conference call, management didn’t have much to offer with this regard.

For my part, I was disappointed by the lack of strategic color provided by management on the conference call which actually reinforced my view of the transaction being mostly the result of the urgent requirement to address key issues at both companies (Volkswagen: Software – Rivian: Capital).

With Rivian’s shares trading at $17.50 in after hours, Volkswagen is already sitting on an approximately $300 million gain from its initial $1 billion convertible note investment as $500 million are convertible into new common shares at a price of $10.84 per share while the remaining $500 million will be convertible “based on the 45-trading day VWAP on the later of required regulatory approvals or December 1, 2024“.

Volkswagen is expected to purchase an additional $2 billion in Rivian common shares in two tranches over the next two years with pricing based on the 30-day VWAP prior to the date of the investment.

Moreover, Volkswagen will invest $1 billion directly into the joint venture and provide another $1 billion in form of a loan.

Suffice to say, the proposed transaction will extend Rivian’s cash runway and reduce the potential of further near-term capital raises.

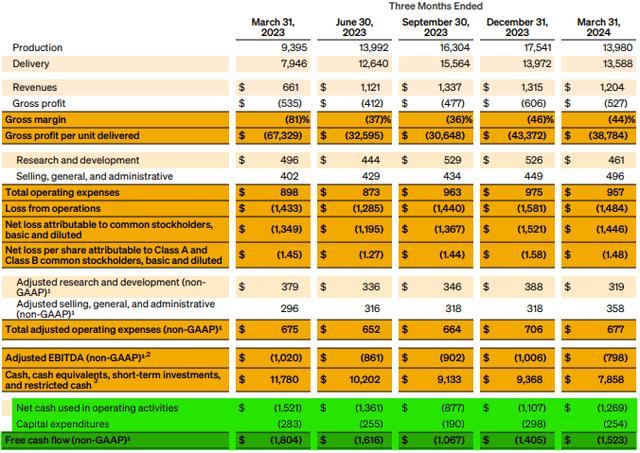

The company ended Q1/2024 with $9.05 billion in total liquidity but cash burn of $1.5 billion remained elevated due to increased accounts receivable and higher inventory balances despite another sizeable writedown:

That said, management expects the negative working capital trends to reverse over the balance of the year and beyond, as outlined on the Q1 conference call:

(…) we expect to generate a slight cash benefit from working capital for the year.

Over the next 18 months, we plan to reduce our gross inventory balance by more than 25%, providing a significant working capital benefit.

Previously, the company projected existing funds being sufficient to carry Rivian through the launch of the R2 in the first half of 2026.

Due to the Volkswagen investment, the company now expects to have sufficient cash to start construction of its new Georgia facility which had been delayed after the recent decision to start production of the R2 in Illinois.

In Georgia, Rivian plans to launch its new midsize platform which in addition to the R2 will include the R3 crossover and its R3X performance variant. With pricing for the R2 expected to start around $45,000 and the R3 expected to be priced below the R3, the company’s next generation product lineup will be more affordable than its current EVs.

Even better, Rivian now sees a path to positive free cash flow. While certainly an optimistic projection, particularly when considering most recent industry demand trends, I would expect the company to be fully-funded until the end of 2027.

Moreover, with the backing of Volkswagen, Rivian might be able to raise additional capital at more favorable terms in the future.

However, with Volkswagen apparently focused on addressing its long-standing software issues, investors shouldn’t bet on the German automotive giant outright purchasing Rivian anytime soon if ever.

Bottom Line

Rivian is getting a decent amount of much-needed funds for sharing its software architecture with Volkswagen thus extending the company’s cash runway by an estimated 18 months and potentially even longer as management now sees a “path to positive free cash flow“.

While the proposed transaction will address the greatest individual blind spots of both companies, an outright takeover of Rivian by Volkswagen looks unlikely at this point.

However, with further near-term capital raises now unlikely, I am raising my rating on Rivian Automotive’s common shares from “Sell” to “Hold“.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.