Summary:

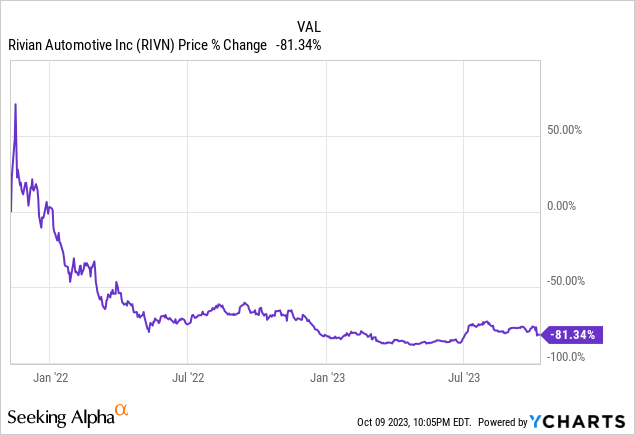

- Rivian stock has fallen over 81% from its all-time highs and could fall further after a dilutive bond sale.

- Rivian reported massive quarterly losses of $1.2 billion while Wall Street Journal stated that the company is losing $33,000 per EV.

- The US stock market is overvalued and unprofitable high growth stocks like Rivian could be heavily impacted during a market downturn.

hapabapa

Rivian (NASDAQ:RIVN) is one of the few EV stocks that I’ll continue to avoid due to massive downside risk at current price levels.

RIVN stock has fallen over 81% from its all-time highs and could fall even further after the latest dilutive bond sale.

The bold sale provides extra liquidity for Rivian’s balance sheet due to the company’s massive quarterly losses. Rivian lost $1.2 billion in Q2 2023 and doesn’t show any signs of profitability anytime soon.

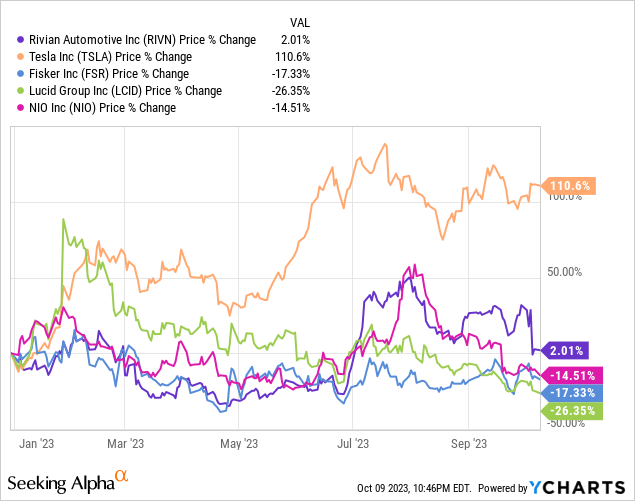

On a positive note, Rivian has outperformed Lucid, Fisker, and Nio YTD but lagged behind only Tesla in terms of stock price performance.

According to the Wall Street Journal, Rivian loses $33,000 per EV and plans to scale even faster by delivering more EVs in an attempt to become profitable.

Rivian’s Q2 2023 Results Show The Company Isn’t Close to Profitability

Rivian sells two electric trucks: the R1T and R1S for an average cost of $80,000 per vehicle. The company was founded by RJ Scaringe in 2009 who encouraged Amazon founder Jeff Bezos to invest in this volatile EV startup.

Founder-led companies tend to outperform all other companies so it’s nice to see RJ Scaringe running his personal startup nearly after 14 years.

However, Rivian has a huge cash burn problem that’s putting downside pressure on RIVN shares.

Rivian finished Q2 2023 on a positive note in terms of production but showed more vulnerability with its huge $1+ billion in losses. The company generated $1.2 billion in revenue and delivered 12,640 EVs (Up 183% YoY) with a goal to deliver 52,000 EVs in 2023.

While Rivian hasn’t released its Q3 2023 earnings report yet, the company reported 15,564 Q3 2023 deliveries in a preliminary report.

Management made several rosy promises including cost-cutting measures and employee headcount reduction to reach the goal of positive gross profit in 2024.

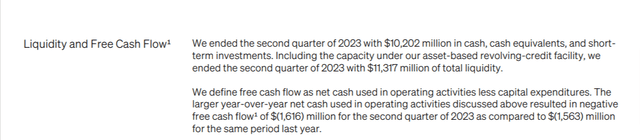

The company reported an increase in negative free cash flow of $1.616 billion in Q2 2023 compared to $1.563 billion in Q2 2022.

Rivian Q2 2023 Negative Free Cash Flow (rivian.com)

Rising negative free cash flow forces companies to take on debt or dilute shareholders to keep the lights on.

Rivian continues to dilute shareholders with the sale of convertible notes including a $1.3 billion offering in March and the most recent $1.5 billion offering in October 2023.

Will more convertible bond sales come in the future? That’s the risk you are taking right now.

RIVN Could Dip Below $10 In the Next 3 to 6 Months

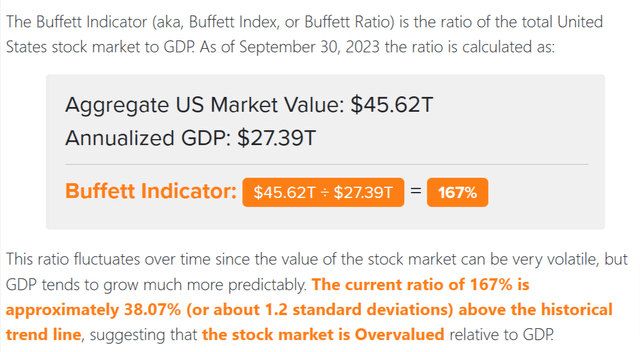

According to the Buffett Indicator, the US stock market is overvalued and could dip much lower over the next few months due to more interest rate hikes, a decrease in discretionary spending due to student loan repayments, and negative geopolitical events.

Buffett Indicator October 2023 (currentmarketvaluation.com)

Unprofitable high-growth stocks will get crushed during a market downturn, which could send RIVN shares dipping a lot more.

While many investors are buying the dip at $18, I think RIVN could dip below $10 in the short run.

With RIVN shares trading at a $17 billion market cap, I’m afraid that further dilution would hurt the stock price and compound Rivian shareholder losses even further.

Risk Factors

- Share Dilution: Rivian has negative free cash flow and continues to scale quickly. With already 2 dilution convertible bond sales in 2023, Rivian may dilute shareholders again to fund production.

- Higher Interest Rates: If the Fed continues raising interest rates, then consumers will spend more money to purchase an EV. Inflation hasn’t cooled fast enough and has proven disastrous for growth stocks during the current interest rate cycle.

- Reduced Quality from Aggressive Cost-Cutting Measures: Rivian CEO RJ Scaringe wants to cut $40,000 from each electric truck cost to become profitable. How is this possible without sacrificing too much quality? The average Rivian EV sells for around $80,000 so I don’t see how this is achievable anytime soon. Lower quality may lead to poor reviews and lower consumer demand.

- Potential Price Cuts: Tesla and Lucid both cut the price of their EVs to increase demand in a tough inflationary environment. If Rivian is forced to cut prices, then RIVN shares could fall even further.

- Trading Near 200-Day Moving Average: RIVN shares are trading just above its 200-day MA of $18.21. RIVN stock could fall if the price dips below this key technical support level.

Could Rivian Turn Things Around and Become Profitable?

Anything is possible and I am well aware of management’s goal to reduce the cost of each EV by $40,000. Lithium prices are falling and perhaps Rivian reduces costs by removing several components from its initial EV concept to lower expenses. It’s definitely something to pay attention to.

Another interesting turn could happen if Rivian settles its convertible bonds before the maturity date in 2030. The sale of these bonds will fund the production of the Rivian SUV and the proposed $5 billion Rivian production plant in Georgia.

If Rivian does well over the next few years, then convertible bond holders will prefer common shares instead of bond repayments.

I believe a much lower RIVN share price would reduce this potential risk and provide a better “margin of safety”.

I’m Avoiding Rivian Stock for Now

I didn’t buy the Rivian IPO hype and don’t plan on buying any shares until RIVN shares trade much lower. There’s no reason to FOMO into Rivian if more dilution is needed to keep the company in business.

The RIVN weekly RSI chart shows a slow but steady decline since the July 2023 spike and I don’t see any reason to catch a failing knife right now.

RIVN weekly RSI chart (tradingview.com)

Watch out for a dip below the 200-day moving average support level of $18.21.

When Ford sold its majority stake in Rivian, prospective investors should have taken a hard look at Rivian’s business model in the short run.

Rivian should avoid growing too quickly and instead focus on quality to satisfy customers over the long run. Driving too quickly to your destination is a guaranteed way to speed out of control and never reach your final destination.

Rivian is backed by Amazon so I don’t think the company will go out of business, but be prepared for more dilution and lower RIVN stock prices in the near term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.