Summary:

- When Rivian went public in 2021 it became the largest US company with zero sales.

- The IPO move was smart since the company raised finance at peak level of market valuations, nowadays the balance sheet is strong.

- However, the company is still burning cash and is not expected to turn profitable until FY 2028, according to consensus estimates.

- From the theoretical perspective, valuation analysis suggests the stock is undervalued but the level of uncertainty is massive, so I am not buying the stock in the foreseeable future.

Michael M. Santiago

Investment thesis

Rivian Automotive (NASDAQ:RIVN) was making a lot of bombastic headlines in the late 2021. The company went public in November 2021, and the IPO was successful – RIVN reached over $100 billion valuation with literally zero vehicles sold. The stock has lost almost 90% of its price since then, and I believe that the risks of investing in RIVN are still substantial. The company is not expected to turn profitable in the next couple of years, so the level of uncertainty is very high. Moreover, the company is facing a callous macro environment, which is backed by the recent production and delivery figures for Q1 2023.

Company information

Rivian Automotive is an American automaker that designs and manufactures electric vehicles [EV]. The company’s flagship products are the R1T electric pickup and R1S electric SUV. Giant shareholders like Amazon and Ford back RIVN business. Though, a couple of months ago, Ford trimmed its stake in Rivian to a tiny 1.15%.

Apart from the pickup and the SUV, RIVN has an exclusive agreement to deliver 100,000 electric delivery vans [EDV] for Amazon by 2030. Rivian management is striving to revisit the exclusivity clause with Amazon because it does not allow the company to expand its customer base for EDV.

The company operates in one operating segment and one reportable segment.

Financials

As I mentioned earlier, the company went public very recently so not much time passed to form a reliable horizon to analyze historical financial performance. Therefore, I will shortly review the latest earnings and preview the upcoming ones.

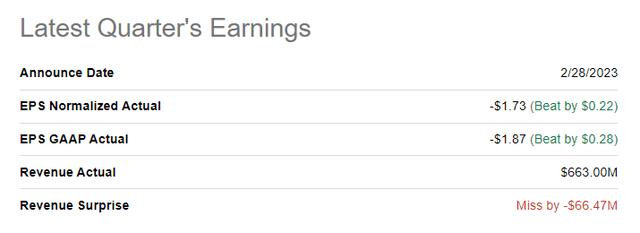

The company announced its latest available earnings on February 28. RIVN significantly missed consensus estimations on revenue but delivered better-than-expected EPS.

The company delivered over 10,000 vehicles in Q4 2022, representing a 36% sequential increase. Deliveries for the quarter comprised slightly above 8,000 vehicles, a 22% increase QoQ. The company’s adjusted EBITDA for 4Q 2022 was negative $1.5 billion, compared to negative $1.1 billion YoY.

The next earnings release of the Q1 FY2023 is expected on May 9, 2023. While we are currently experiencing a very uncertain macro environment, I believe we can build pretty reliable expectations on the company’s quarterly figures, especially regarding the topline.

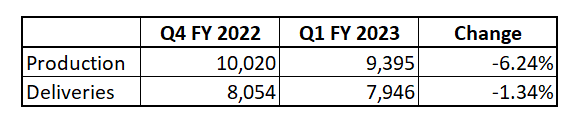

On April 3, the company shared its production results for the first quarter. According to the release, during Q1 2023, RIVN produced 9,395 vehicles at its manufacturing facility in Illinois and delivered 7,946 vehicles during the same period. I see two big problems with these production figures here.

First, for the upcoming earnings, consensus estimates expect revenue to be flat sequentially, meaning the number of deliveries should also be flat as well. Based on the below table you can see that the number of deliveries declined by almost 1.5%, so it is highly likely that the company will slightly miss consensus revenue estimates.

Author’s calculations

Second, let me remind you that the company’s production guidance for 2023 is at 50,000 vehicles. I know that it would be too simplistic, but I will explain below why it is not complete nonsense: if we implement a Q1 run-rate for the full 2023 here, it means the company will produce below 40,000 vehicles this year which is by far below the guidance. It is obvious that the company is able to ramp up production and there is a lot of free capacity in Normal, but what the news suggests is the fact that the demand for EVs is decelerating amid tough macroeconomic conditions. Declining sequential deliveries of Rivian also suggests the demand is weakening. Therefore, it is highly likely that the company will reiterate its full-year guidance because there is no sense for Rivian to double production YoY and burn cash to end up the year with high inventories and low cash.

We can see the management’s response to weakening demand in production figures – they declined more than 6% sequentially, which I believe is very significant for a growing company like Rivian. The company will strive to save variable costs and, therefore, will cut production targets, in my opinion.

Valuation: the level of uncertainty is very high

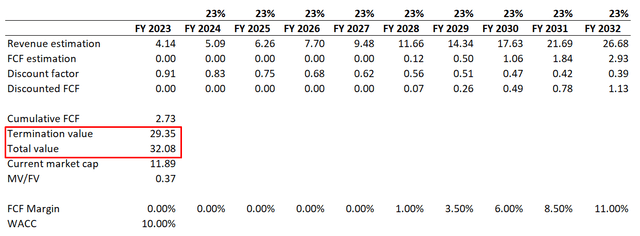

Rivian is far from paying dividends, and the history of valuation multiples dynamics is very short, so, for valuation, I see discounted cash flow [DCF] approach as the only option here. And this one is very tricky because I believe the uncertainty level for the assumptions is massive.

First, in terms of revenue growth, consensus estimates project that the company’s revenue will reach almost $77 billion by FY 2032, meaning sales will increase 48-fold compared to FY 2022 figures. This represents an above 40% CAGR, which is very aggressive. Some might argue that Tesla (TSLA) delivered a 45% revenue CAGR in the last ten years. But let me remind you that Tesla started its business when less than 60,000 electric vehicles were sold worldwide compared to more than 10 million EVs sold globally in 2022. This represents a 53% CAGR of the physical EVs market between the years 2011 and 2022. In dollar terms, the market is still expected to grow substantially, but the deceleration of the growth pace is also very notable. Precedence Research expects a 23% CAGR for the EV market until 2032. I think that it is doubtful that Rivian will be able to grow two times faster than the EV market. So, for the revenue growth of Rivian, I see very high uncertainty. And to be conservative, I use a 23% CAGR for RIVN revenue growth over the next decade.

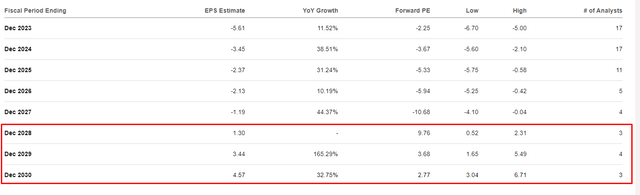

Second, the timing for a company to start generating positive free cash flow is also very uncertain. Claire McDonough, the company’s CFO, expects the company to turn to a positive gross margin at the end of 2024. Consensus estimates project RIVN EPS to turn positive in FY 2028, which is very far from now, and thus the level of uncertainty is too high.

According to the CFO, the company’s long-term financial goals include a 25% gross margin target, high teens EBITDA margin target, and 10% free cash flow target. Thus, for my valuation analysis, I expect the company to start generating a 1% FCF margin starting from the year 2028 and improve it by 2.5 percentage points each year. For WACC I use Gurufocus estimations rounded up to 10%.

Incorporating all the assumptions together gives me a fair value of RIVN business at $32 billion, which is almost three times higher than the current market cap. But, apart from the fact that this model is based on very uncertain assumptions, on the below picture you can see that a very large part of calculated valuation consists of the termination value, which is a risky fact to rely on.

When I implement my judgment, I prefer substance over form, so I believe this undervaluation is purely “on paper” and far from being realistic. So I cannot conclude that the stock is undervalued, considering the level of uncertainty related to the underlying assumptions for the DCF.

Risks for the thesis

I believe that the major risk for my bearish thesis is the Fed. In late 2021 we all saw how Rivian’s market cap easily outnumbered the unrealistic $100 billion level with zero vehicles sold.

So, if the Fed starts easing its monetary policy earlier than the market expects, it is highly likely that there will be a substantial positive turnaround for risky assets. Valuations will expand, especially for long-duration assets like Rivian stocks. Potential additional liquidity will also be a significant positive catalyst for the stock market.

Also, Rivian is working heavily on increasing production efficiency, enabling the company to optimize costs. There is a possibility that the company might announce some new technological advancements, which will mean a significant decrease in production costs, enabling the company to reach breakeven earlier than expected. This will also positively affect the valuation.

Bottom line

To conclude, I believe that investors should not buy the stock since the risks and uncertainties for the company’s business are massive. Of course, the possibility that RIVN can become the next Tesla for its early shareholders is not equal to zero. But such a possibility is very low in the short term. As we saw from my analysis, the likelihood of a strong earnings report is very low, and positive catalysts are out of the company’s control. In my opinion, it would be complicated for the company to deliver strong figures over the next quarters, given the multiple headwinds RIVN is facing.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.