Summary:

- RIVN has underperformed the wider market again, demonstrating the lack of bullish support while discrediting our Buy ratings thus far.

- It remains in the startup mode with uncertain profitability prospects, with a capital raise/ debt reliance very likely based on its current cash burn rate.

- The consensus forward estimates show optimism for RIVN’s growth potential, if it can successfully bring R2 to market while bridging its balance sheet through H1’26.

- However, with the stock consistently falling while charting lower lows/ highs, we prefer to downgrade it to a Hold until a floor has materialized and gross profitability is achieved in FQ4’24.

- Even so, anyone still holding RIVN here should also remain (extremely) patient, while sizing their portfolio according to their risk appetite.

selimaksan

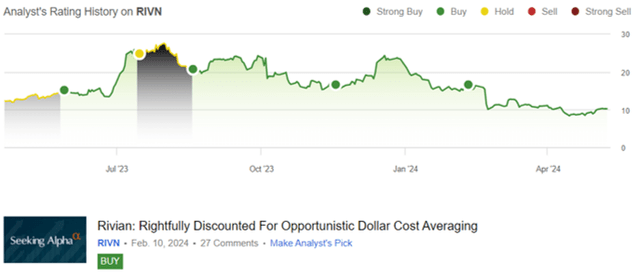

We previously covered Rivian Automotive (NASDAQ:RIVN) in February 2024, discussing why we had continued to rate the stock as a Buy, attributed to the attractive risk/ reward ratio from the misunderstanding surrounding RIVN’s supposed delivery miss in FQ4’23.

With the PPI in the Automotive sector already peaking and borrowing costs likely to moderate as the Fed pivot, we believed that its top line expansion/ improved scale of economy might outperform expectations, due to the double-digit growth recorded in its production and delivery capabilities.

Since then, RIVN has unfortunately pulled back by another -35.9%, well underperforming the wider market at +3.7%, demonstrating the lack of bullish support thus far.

Combined with the massive pessimism embedded in the EV sector, its deteriorating balance sheet, and uncertain balance sheet bridging through 2026, it appears that RIVN’s investment thesis has soured with no floor in sight, warranting a downgrade to Hold instead.

The RIVN Investment Thesis Has Soured Drastically – Uncertain Near-Term Prospects

For now, RIVN has a reported a mixed FQ1’24 earnings call, with revenues of $1.2B (-8.3% QoQ/ +82.1% YoY), gross margins of -43.7% (+2.3 points QoQ/ +37.2 YoY), and adj operating margin of -103.9% (+85.2 points QoQ/ inline YoY) after discounting for Stock-Based Compensations.

It is apparent from these numbers that the automaker remains in the startup mode, with uncertain profitability prospects.

The same has been observed in RIVN’s deteriorating balance sheet at cash/ short-term investments of $7.84B (-16.2% QoQ/ -30.2% YoY) and estimated quarterly cash burn rate of $1.5B, which it is almost certain that the management may engage on another capital raise and/ or further debt reliance by H1’25, if not earlier.

With borrowing costs still expensive and the Fed yet to pivot, it is undeniable that both options are unpalatable, with share dilution likely to trigger further pessimism and higher debts triggering higher interest expenses than the annualized sum of $300M reported in FQ1’24 (+2.7% QoQ/ +97.3% YoY).

While RIVN may have reported a narrowing gap in its production to delivery ratio of 97.1% (+17.5 points QoQ/ +12.6 YoY), based on the 13.98K produced (-20.2% QoQ/ +48.8% YoY) and 13.58K delivered in FQ1’24 (-2.7% QoQ/ +71% YoY), demand headwinds remain a concern indeed.

The automaker continues to report elevated finished inventories of $972M (-6.1% QoQ/ +74.8% YoY), though well balanced by the moderating write-downs/ losses on firm purchase commitments of $150M (-34.4% YoY).

The same demand headwind has been reported by Tesla (TSLA), with the drastic price cuts tremendously impacting its automotive gross profit margins to 15.6% (-1 points QoQ/ -2.6 YoY) and overall operating margins to 5.4% (-2.8 points QoQ/ -6 YoY) in FQ1’24.

Legacy automakers, such as Ford (F) also increasingly steer away from EV investments to Hybrids instead, temporarily bridging the gap before the second wave of adoption commences in the second half of the decade, with the management backtracking their 2030 commitment.

Then again, with RIVN still reiterating their FY2024 production guidance of 57K vehicles (inline YoY), “modest gross profits by Q4’24,” and “sufficient capital to bring R2 to market” by H1’26, it appears that the management is confident about its game plan in bridging its profitability and balance sheet over the next two years, no matter the market’s pessimistic reaction thus far.

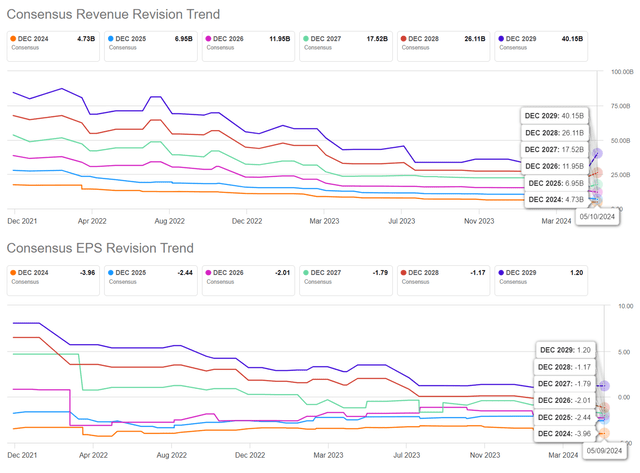

The Consensus Forward Estimates

The same quiet optimism has also been observed in the consensus raised forward estimates, with RIVN expected to generate a top-line CAGR of +41% through FY2027, compared to the previous estimates of +37%.

It appears that for so long that RIVN is able to successfully push R2 to market by 2026, as battery costs moderate – bringing EVs closer to cost parity with ICEs by 2025, and public charging stations continue to grow, we may see EV demand eventually return.

This may also be aided by the normalizing macroeconomic outlook over the next two years, as borrowing costs for new vehicles moderate from the 7.2% as of April 2024, nearing the normalized 5.4% in December 2019.

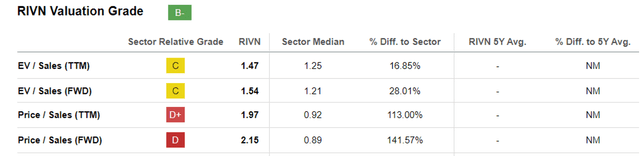

RIVN Valuations

Before then, we can understand why RIVN appears to be expensive at FWD EV/ Sales of 1.54x, compared to the sector median of 1.21x and its legacy automaker peers, such as Ford (F) at 1.02x, General Motors (GM) at 0.91x, and Stellantis (STLA) at 0.33x.

While RIVN may appear to be reasonably valued compared to Tesla (TSLA) at 5.32x, it remains expensive compared to its other BEV/ PHEV peers, such as BYD Company (OTCPK:BYDDF) at 0.81x and Li Auto (LI) at 0.62x, offering interested investors with a minimal margin of safety.

So, Is RIVN Stock A Buy, Sell, Or Hold?

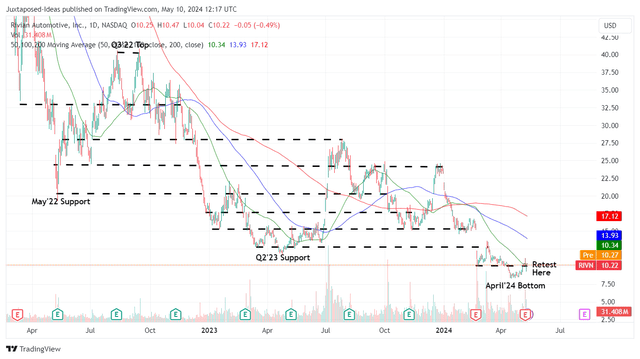

RIVN 2Y Stock Price

The same pessimism is also observed in RIVN’s lower highs and lower lows over the past few quarters, with the stock seemingly failing to find a bottom thus far.

Author’s Rating

So how does it go from here? Nothing is certain for sure, especially since RIVN’s lack of bullish support has naturally discredited our Buy ratings thus far.

With the management only guiding gross profit profitability and operating profitability still very far away, as estimated by the consensus by FY2029, it is apparent that the automaker is likely to continue burning cash ahead, as the stock-based compensation grows to $233M (+8.3% QoQ/ +27.3% YoY) and dilution persists to 978M (+16M QoQ/ +48M YoY) by FQ1’24.

As a result of the potential capital losses, we have to unfortunately eat our words and downgrade RIVN as a Hold instead, with its investment thesis likely to underwhelm in the intermediate term, worsened by the massive volatility from its elevated short interest of 20.5% at the time of writing.

Not all investment stories turn out the way as expected after all.

Moving forward, anyone still holding here should also remain (extremely) patient, since it remains to be seen when RIVN may achieve operating profitability and when the stock prices may reverse the ongoing decline.

With more uncertainty ahead, it goes without saying that the stock is only suitable for those with higher risk tolerance.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.