Summary:

- Rivian makes unique vehicles and has established a strong brand with a loyal fanbase.

- The company introduced new products and upgraded software in Q1 2023 to continue its goal of differentiating from legacy automobile brands.

- The good news ends there as the company’s financials are not good. Rivian has a negative net present value unless its growth drastically outpaces Tesla’s historical performance.

- The company’s stock-based compensation is high, skews cash flows, and not justifiable for a company that is losing massive amounts of money.

- Rivian trades in a popular growth sector and speculators may push the stock price up dramatically, but fundamentally, the company is not worth a $12 billion market cap.

Michael M. Santiago

Company Background

Rivian (NASDAQ:RIVN) is an electric vehicle manufacturer which differentiates itself from competitors by providing proprietary services and vertical integration. The company believes these value-added services will be the driving force behind obtaining consistent, recurring revenue from a loyal customer base. In other words, the company does not see itself simply as an OEM, but rather a dynamic automotive value chain.

The company currently has two retail models available, the R1T (pick-up truck) and the R1S (SUV) and commercial vehicles on its RCV Platform (Rivian Commercial Vehicle). Part of this division is a collaboration with Amazon in which the latter has agreed to purchase 100,000 electric delivery vehicles. The company primarily serves the US market, followed by Canada and Europe. Rivian has over 14,000 employees.

The Cars

Rivian’s two retail models have been well received and already have established an extremely loyal fan base. While I am not a fan of pick-ups or SUVs, I can certainly see the appeal of Rivian’s products: they are unique and exciting. Rivian knows their target market and has catered these vehicles exactly for customers who want a functional, ergonomic design that offers off roading capabilities, practical towing, and modern luxury. Rivian has delivered on those fronts extremely well. Even though the company’s P&L line is poor at the moment, you have to give credit where credit is due: Rivian’s cars are different and in strong demand. In fact, some popular YouTube car reviewers are calling them the best trucks ever made.

The Competitors

Rivian’s most obvious comparison is Tesla, but other luxury electric vehicle manufacturers are also in the game now. That list includes many of the world’s most popular automobile companies such as, BMW, Mercedes, Audi, etc. You can make the case Rivian’s consumer demographic is different from those companies listed, but for now I am grouping EVs together because the industry is still in an early stage.

Q1 2023

Let’s take a look at some of the quarter’s results. Overall, the hardware and software introductions are exciting, but that feeling quickly gives way to disappointment when the financials are brought into the picture.

Hardware

Rivian successfully introduced their new motor (Enduro) and battery pack (LFP), both in commercial vehicles. The former supplies massive torque plus a 0-60 time in 3.5 seconds and the latter improves durability cycles.

In the quarter, Rivian produced slightly under 10,000 cars and delivered about 8,000 of them to customers. The company reaffirmed its guidance to produce 50,000 vehicles, a 100% YOY increase.

Software

Hardware catches the eye, but software captures the heart.

– Raul Shah

Ok, I just made that up, but it is kind of true. Rivian understands that having intuitive, functional, and updated software is one of the most important factors in automobile differentiation and can be its competitive advantage. The tech, software, and screens inside cars is what dates them the most. By providing new software updates, it makes owners feel like they have a new product (similar to Apple’s iOS updates).

One of the coolest new features introduced as a software update this quarter was the Gear Guard system which is a security system that automatically records your car from the outside. It includes Drive Cam which enables the external cameras to record driving events.

Cash Burn

Rivian used $1.4 billion in cash for the quarter, and simultaneously issued convertible notes totaling $1.5 billion in proceeds, hence why the cash on the balance sheet was unchanged at $11.7 billion. In addition, the company increased its credit line from its revolving facility to $1.5 billion.

If investors assume the cash burn rate stays the same (which it won’t, it will increase), then the company will use $5.6 billion in cash for 2023. Therefore, the cash on the balance sheet combined with the revolving facility will provide enough liquidity for about two years ($5.6 billion x 2 = $11.2 billion, which is covered by cash on balance sheet of $11.7 billion). By the EOY 2025, Rivian will issue additional debt and/or stock, although the latter is less likely if the stock price remains low.

Net Loss

The company produced a net loss of $(1.35) billion in Q1 2023 versus $(1.6) billion Q1 2022. This represents a 19% improvement. However, this improvement in net loss was not a function of improved business operations, but rather a decrease in stock-based compensation expense of $284 million. Management accelerated its SBC expense based on conditional provisions, which made their results for the quarter appear better than reality. Cheeky accounting does not slip through the cracks with me.

Tesla Comparison

I know many readers become frustrated when they see an analyst compare Rivian and Tesla as they claim these two companies are entirely different. However, purchasing stock requires the investor to accurately value it, otherwise there is no way to tell if the market price is a steal or rip off. When a company has no earnings and no history, you have to find a comparable to gain perspective on valuation. It is not perfect, but it is the most appropriate method given the circumstances.

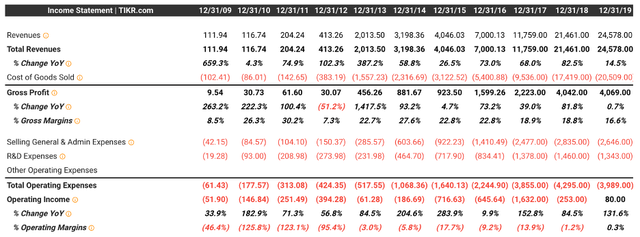

Tesla’s Income Statement (TIKR)

From the above, we can see that it took Tesla ten years to produce an operating profit. However, it is interesting to note, that each year during that span it was producing gross profits.

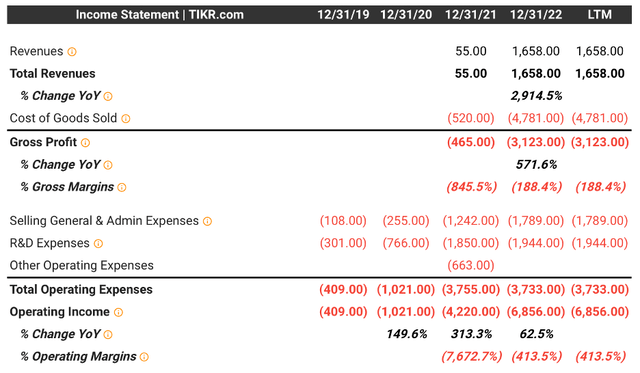

Rivian’s Income Statements (TIKR)

Starting at the top, a point of undeniable strength is the company’s revenue growth, which it achieved in half the time it took Tesla. This goes back to my earlier point that there is incredible demand for Rivian’s cars. Anecdotally, I have seen dozens on the road in the last few months compared to having never seen one in my life prior to that.

Moving to the bottom, we can see that Rivian is producing massive losses. Mentioning the word profitability at this stage is futile; not every company needs to be profitable today to have value, however, every company does need to ultimately become profitable to have value.

Therefore, we need context to determine if $12 per share is justified. The best way to do that is to take Tesla’s revenue and margins and apply them to forecast Rivian’s future cash flows, while also accounting for attributes specific to Rivian (i.e. shares outstanding, CAPX, cash/debt, etc).

Valuation

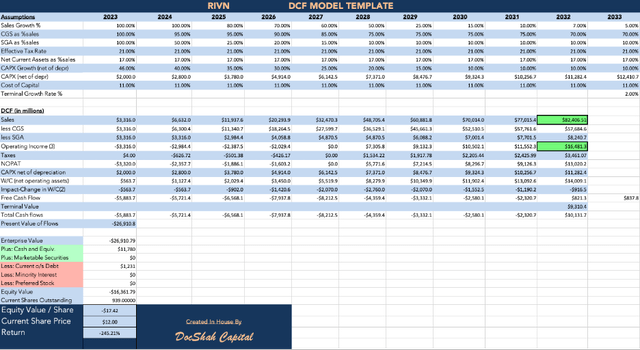

Valuation is an art and science. No two investors are going to arrive at the same fair value as we all have our own forecasts. Mine will be based on several assumptions, the main of which is that in ten years, Rivian’s sales will be equivalent to Tesla’s sales today. Utilizing Tesla as a benchmark to make a comparison provides perspective on Rivian’s current stock price.

Sales Growth

I applied a rapid growth rate until Rivian ultimately reaches $82 billion in sales in ten years, which is equivalent to Tesla’s sales last year.

COGS

I factor in management’s guidance that Rivian will be produce a gross profit in 2024.

SGA

I slowly reduce the operating costs over time until operating margins reach 20% in ten years. This not a conservative estimate as Tesla’s margins are significantly lower, but I will give Rivian the benefit of the doubt.

Tax Rate, CAPX, and WC

The tax rate is unchanged. Capital expenditures are $2 billion based on Q1 2023 updated guidance and the CAPX growth is conservative at around half of revenue (in reality, CAPX growth will likely be much higher in order to fund the company’s massive expansion plans). Working capital is maintained at Tesla’s three-year average of 20%.

WACC

The WACC is 11% and was determined by the CAPM model.

Terminal Value

The terminal growth rate is set to 2% to keep up with inflation.

DocShah’s DCF

RIVN DCF 2023 (Author, DocShah Capital)

Rivian experiences the same growth as Tesla (in ten years). What does all this say? Basically, if all of the following occur…

- Management cuts costs from 500% of sales to 80% (20% operating margin)

- No new shares are issued

- No new debt is issued

- Interest rates stop climbing

… then the stock is worthless. The cash outflows needed to grow revenue at a pace fast enough to make operations economical are unattainable without further financing. Rivian will ultimately have to raise billions of dollars through an FPO or issuance of new bonds. The problem (besides the obvious dilution and leverage) is that interest rates have gone up substantially, which makes raising capital today more costly than when Rivian IPO’d. The one thing Rivian has going for it is cash left over from its ridiculous IPO price of $78 per share.

Also, to be clear, raising capital to finance future products is not a bad thing by itself. It depends on the context of projects intended to be pursued. If the additional funding drives a project to earn more than the cost of funding, raising capital was a good decision. The issue in Rivian’s case is that the expected earnings, if any, are already so far out into the future. Rising rates not only postpones those cash flows more, but reduces them simultaneously. Investors waiting for Rivian to become profitable are going to subsidize exorbitant losses for a long time.

That being said, Rivian has a large, $12B market cap, which means there are lots of investors willing to subsidize these losses. Psychologically, any positive earnings report will send the stock skyrocketing because there are so many buyers who are willing to overlook the extensive timeline of potential earnings in order to make a quick buck. Rivian, therefore, is more a speculative play than a legitimate investment.

The only bullish investment case scenario is the company performs vastly better than Tesla. This could mean achieving Tesla’s sales in fewer than ten years, as predicted. The likelihood of this occurring is possible, but is difficult to foresee, and a $12 billion market cap is an expensive price to undertake that much uncertainty. At this point in the company’s timeline, it is irrefutable that purchasing shares of Rivian is an irrational risk/reward bet.

Excessive Stock-Based Compensation

The most overlooked metric in today’s stock analysis world is stock-based compensation. Investors and even the majority of analysts seem to completely ignore how misleading financial statements are without adjusting for SBC.

GAAP accounting rules allow companies to misrepresent cash flows by classifying SBC as a non-cash expense, which allows companies to add SBC to cash flow from operations. This magic trick allows companies producing massive losses to mask them under non-cash expenses, thereby showcasing positive (or less negative) cash flows. This perceived improved performance drives the stock price higher, which in turn increases the value of vesting options even more. The bottom line is SBC is a cash expense and should be subtracted from operating cash flow.

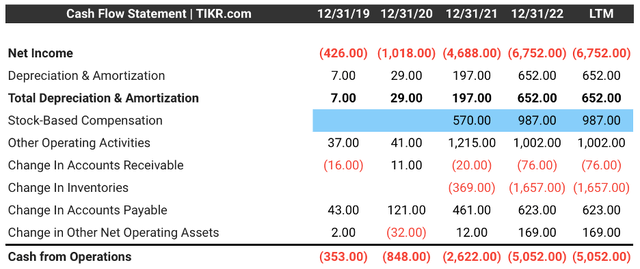

Rivian’s Operating Losses

Rivian’s CFFO (TIKR)

Adjusting for the effects of SBO (subtracting it out), the actual CFFO results are as follows:

2019 $(353) million

2020 $(848) million

2021 $(3.2) billion

2022 $(6.0) billion

The company’s last two years of operations are about 20% worse than reported. That is not a trivial amount.

Emergence of Meme Stocks

Unfortunately, in today’s market, unprofitable stocks tend to not only hold significantly high valuations, but also rise exponentially. The fact that Rivian’s IPO price was $78 per share highlights the fact that there are many speculators who are willing to pay multiples of 6x or more from today’s price for this stock. With so many meme stock buyers, Rivian might wind up rising on that basis alone. Needless to say, buying a stock in hopes speculators decide to uplift it is not a sound strategy and one I would implore readers to avoid.

Risks

Here are some risks to keep in mind:

- Rivian’s sales do not increase fast enough to become profitable

- Rivian’s high costs are not able to be reduced enough to become profitable

- CAPX requires additional capital via equity or debt financing

- Shareholders are diluted out of ownership of an already unprofitable investment

- EV regulations expand and add additional costs to an already underwater P&L line

- Recession further delays profitability in the future, reducing the valuation even more

- The cars wind up being unreliable and sales suffer

- Competition from established automakers steal market share

- For the company’s set of risks, please click here

Takeaway

There are far more compelling stocks to consider over Rivian. The future date and amount of the company’s profitability are so unpredictable, that it does not make sense to risk capital pursuing this endeavor. In a best case scenario where nothing goes wrong, maybe there is some value in the stock. In almost all other circumstances, the stock price has no value and the company will need massive additional funding at the expense of shareholders in order to continue subsidizing losses.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I/we have a beneficial long position in the shares of HIMS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.