Summary:

- Rivian’s shares plunged over 22% after announcing a convertible bond offering, presenting a potential opportunity for long-term investors.

- The company should raise more than $1 billion in net proceeds, and may do so without any net interest expense.

- Rivian set new records for production and delivery in Q3, with unit sales exceeding 15,000 for the first time.

John Sommer

One of the biggest losers in the market on Thursday was Rivian (NASDAQ:RIVN). The electric vehicle maker saw its shares plunge more than 22% after the company announced plans for a convertible bond offering. While the capital raise may have been a bit earlier than expected, I don’t think the selloff was warranted and this may be a good opportunity for long term investors.

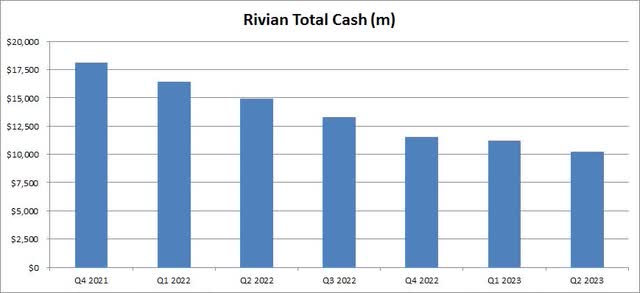

As Rivian works to reach true mass production of its vehicles, the company has been incurring large losses and burning through lots of cash. As I mentioned in my article discussing the Q2 report, another capital raise was going to be needed to get Rivian through its R2 platform launch in 2026. The company did have over $10 billion in cash at the end of June, although that number was down substantially over 18 months, as seen below. Cash was expected to be around $9.1 billion at the end of Q3, and I’ll update the chart here once we get the actual number. Thanks to the capital raise, Rivian’s end of year cash balance should be similar to the end of Q3 value, assuming no other major uses of cash or any other potential raises.

Management before this offering had stated that it had a cash runway for operations through 2025. However, the company was always looking at opportunities to raise more funds to keep its balance sheet strong. The latest green notes offering is for $1.5 billion in convertible debt due in 2030, with the potential for buyers to purchase an additional $225 million. The net proceeds won’t be that much because the company will be executing a capped call transaction as noted in the press release.

I’ll admit that this debt deal was a little earlier than expected. I thought that management might wait until next year to do so. This would put a few more quarters of results on the books, hopefully meaning investors would see reduced losses and cash burn. In that scenario, perhaps sentiment around Rivian would be improved and thus the company would be in a stronger place for a capital raise.

However, I also see the argument for raising capital now. Bond yields have been soaring recently, so what’s to say they won’t be even higher next year if the Federal Reserve keeps hiking? At the same time, Rivian shares had rallied more than $10 in about 15 weeks, so the size of the capital raise is a much smaller percentage of the company’s market cap than it would have been in late June. Also, because interest rates have risen so much, the company might not have much of a net interest expense because it can put this cash in short term highly liquid instruments that are yielding over 5%.

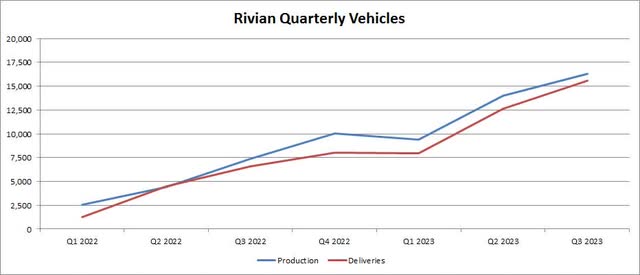

The other news we got from the company this week is the Q3 production and delivery report. Rivian again as expected set new records for both metrics, with unit sales topping 15,000 for the first time, as the chart below shows. Delivery figures came in a little stronger than expected, and management reiterated guidance for production of 52,000 vehicles. We might see a guidance hike at the Q3 report unless there is some Q4 downtime, because a repeat of Q3 production in Q4 would put the yearly total a couple of thousand units ahead of current guidance.

Rivian Quarterly Units (Company Press Releases)

Perhaps the one negative item in the preliminary Q3 results announcement was revenue. Rivian is guiding to total revenue of $1.29 billion to $1.33 billion, and the street was expecting the number to be at the top end of that range. At this point, I’m not as much concerned about total sales as I am with the company’s margin structure. Higher production and the ramp of the in-house Enduro motors are a key part of the cost savings plan for this year and next as detailed on the Q2 conference call. Rivian still had a negative gross margin of about 37% in that period, but that was dramatically better than the -709% figure reported just six quarters earlier.

I am upgrading Rivian to a buy today as the capital raise has strengthened the balance sheet in the near term, with the potential for near zero extra income statement costs. At the same time, shares have dropped more than 18% since my previous article, making the valuation more reasonable. Rivian now goes for just 2.5 times currently expected 2024 revenues, which is a fraction of the more than 6.7 times that Tesla (TSLA) currently goes for. Tesla does have the profitability and cash flow that Rivian doesn’t, but Tesla also has a lower growth profile in the coming years due to much larger base numbers. Rivian finished Thursday right around its 200-day moving average, so that could be a support level to watch.

There’s also one other point to be made about Tesla here. The EV leader is expected to launch its Cybertruck this quarter after years of delays, and there are fears that Rivian will be hurt as a result. The automotive industry is always going to be a competitive one, so Rivian is not going to be the only player here. However, as noted on the Q2 call, roughly 70% of Rivian production over the long term is expected to be the R1S, which is the company’s SUV, so the Cybertruck will be competing with the smaller part of Rivian’s business. The R1S is also the more profitable vehicle.

In the end, I believe the selloff in Rivian shares on Thursday was a bit unwarranted. Capital raises usually result in stock declines, especially if there is fear of dilution, but to lose more than a fifth of your value seems too much in this case. Rivian was going to need more capital at some point, so why not go for it with the stock up a bit in the past few months, especially if there is a potential net zero interest expense here. Rivian also announced mostly decent preliminary Q3 results as well, with 2024 expected to be a major year in terms of expense control and reduced cash burn.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.