Summary:

- Rivian investors enjoyed a remarkable surge spurred by the recent Volkswagen deal.

- However, the whole deal is predicated on achieving the required technological and financial milestones. It isn’t “free money.”

- Rivian is still a fundamentally weak company in an intensely competitive EV industry.

- The recent mean reversion from oversold levels hasn’t altered RIVN’s long-term downward bias.

- I argue why RIVN investors waiting to cut should capitalize on the recent spike to get out.

hapabapa

Rivian: Deliveries Performance Closely Watched

Rivian Automotive, Inc. (NASDAQ:RIVN) investors have staged a remarkable revival since its bottom in April 2024. The recent Volkswagen-Rivian joint venture announcement spurred a further recovery in June, helping RIVN stock reach levels last seen in February 2024. RIVN maintained its production guidance and surpassed its Q2 delivery estimates, which has helped maintain the recent bullishness. Therefore, the momentum seems to have returned to RIVN at a pivotal moment as the EV maker attempts to reignite its growth prospects.

I last cautioned RIVN investors in an article in early May 2024. I wasn’t bearish on the stock then, as I anticipated a potential mean-reversion opportunity. RIVN’s relatively high short-interest ratio was also susceptible to rapid short-covering. However, I also urged investors to consider taking advantage of surges to cut exposure, as Rivian is not a fundamentally strong EV company.

While Rivian has maintained its annualized production guidance of 57K vehicles for 2024, it aligns with last year’s results. Consequently, the company must justify its ability to scale faster while betting that the EV demand dynamics could improve with more conviction. EV leader Tesla, Inc.’s (TSLA) recent delivery performance has given EV investors renewed vigor. While Tesla’s Q2 deliveries surpassed downbeat estimates, investors still need to potentially navigate a more competitive EV market environment amid a slowing economy. Coupled with the challenges of a potentially higher-for-longer Fed, interest rate headwinds are still expected to be significant challenges for fledgling EV makers like Rivian.

Rivian: Volkswagen Deal Is Pivotal

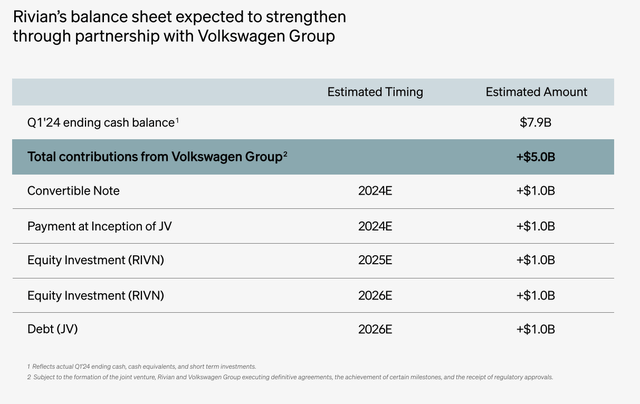

Rivian-Volkswagen partnership (Rivian filings)

Volkswagen AG’s (OTCPK:VWAGY) (OTCPK:VLKAF) JV with Rivian is significant. Europe’s leading automaker has a total commitment of $5B to Rivian through 2026. The deal is also structured to reduce equity dilution risks to Rivian shareholders. CFO Claire McDonough articulated her confidence that Rivian “prioritizes achieving milestones to potentially minimize dilution impact through increased stock valuation.”

Therefore, Rivian is betting that it can execute well and convince the market of the technological superiority of its tech stack to benefit the JV. Achieving the required financial and technological milestones should bolster the market’s confidence in re-rating RIVN’s valuation. Consequently, it should mitigate the equity dilution risks from Volkswagen’s anticipated $2B equity investments from 2025-26.

Furthermore, the commitment of $2B by the end of 2024 is significant, lending credence to Volkswagen’s recognition of Rivian’s technological leadership. As a reminder, the Volkswagen-Rivian JV is limited in scope and primarily focused on network architecture and software. In addition, the JV is expected to be loss-making in the near term. However, there are opportunities to license the technology to other automakers in the future, potentially benefiting Volkswagen and Rivian.

RIVN: Improved Momentum Doesn’t Change Weak Fundamentals

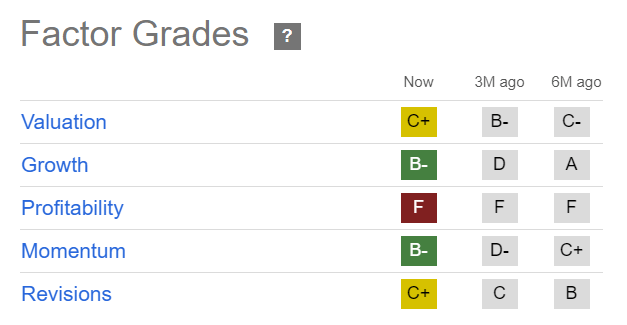

RIVN Quant Grades (Seeking Alpha )

Notwithstanding the recent market euphoria on RIVN, it’s critical to note that Rivian is still unprofitable (“F” profitability grade). Rivian is not expected to turn free cash flow profitable through the FY2027 forecast period. Therefore, a weaker-than-expected ramp could extend the FCF breakeven prospects, necessitating more funding.

However, I assess that the market has likely reflected the improved confidence of Rivian getting the endorsement from a leading automaker of its tech stack. Volkswagen’s struggles with software are well-documented. Therefore, partnering with Rivian also recognizes that pure-play EV makers like Rivian with a “clean sheet” approach have inherent advantages. Furthermore, the need for Volkswagen to pivot competitively in the long-term EV transition should support Rivian.

Whether Rivian can count on Volkswagen to provide even more funding, if needed, remains to be seen. The additional funds as part of the JV are already predicated on achieving certain technological and financial milestones. Therefore, investors shouldn’t expect “free money” to rain down on Rivian, suggesting execution must remain the utmost priority for the EV maker.

Is RIVN Stock A Buy, Sell, Or Hold?

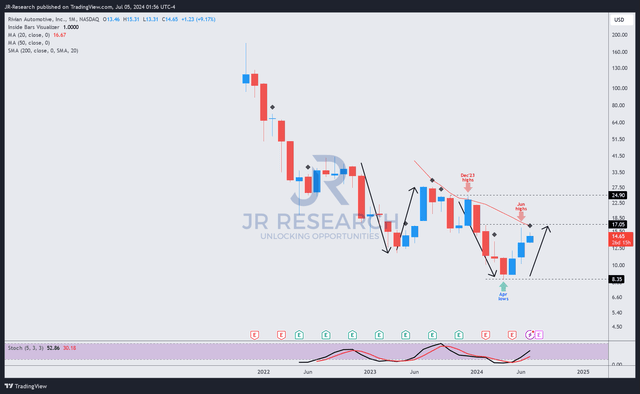

RIVN price chart (monthly, long-term) (TradingView)

RIVN’s price action suggests the mean-reversion opportunity that I discussed in my previous article has panned out. Therefore, investors who have waited for an opportunity to cut exposure should capitalize on the surge to get out.

Note that the recent surge has not altered RIVN’s long-term downtrend bias. RIVN could face more intense selling pressure below the $18 level before potentially resuming its downward trend.

Given its weak fundamentals, RIVN’s reversal from its oversold position in April shouldn’t be misconstrued as a buying opportunity. While the Volkswagen deal has lifted investor sentiment, much still depends on Rivian’s execution to obtain the necessary funding.

Moreover, the headwinds attributed to the macro environment are arguably out of Rivian’s control. Therefore, it may still face significant hurdles in its ambitions to ramp production and improve demand dynamics.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!