Summary:

- Rivian Automotive cut its 2024 production forecast due to a parts shortage, but long-term growth prospects remain strong, making the current dip a buying opportunity.

- Despite missing 3Q24 delivery expectations, Rivian’s substantial cash reserves (74% of market valuation) mitigate risk and support potential for a rebound.

- The overall EV market is robust, with strong sales from competitors like Ford, GM, and Tesla, indicating Rivian’s issues are supply related, not demand-driven.

- With strong technical support around $10 and nearing oversold RSI levels, a contrarian position in Rivian could be advantageous for investors.

hapabapa

Rivian Automotive (NASDAQ:RIVN) cut its production forecast for 2024 amid a shortage in parts that exerted additional pressure on the EV company’s valuation as of late.

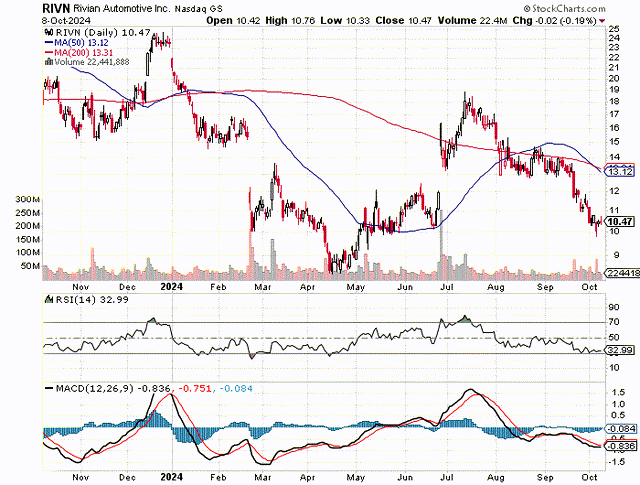

In August, Rivian Automotive fell through the 200-day moving average line, shortly after breaching through the 50-day moving average line in the same month and failing to recover this important short-term trendline.

With that being said, Rivian Automotive is set for long-term growth in the EV market and the slashed production forecast is not fundamentally altering the company growth prospects.

Since cash reflects 74% of Rivian Automotive’s market valuation, investors might want to consider buying the drop.

My Rating History

My last stock classification for Rivian Automotive’s stock was Buy as the electric-vehicle company worked hard to achieve lower-than-expected losses in 2Q24.

Rivian Automotive also did a deal with Volkswagen AG (OTCPK:VLKAF) at the end of June which presented an opportunity for the EV company to get access to more cash for the scaling of its production.

I think the slashed production forecast is not a big issue, and it’s time to back up the truck here.

Rivian Automotive Cuts Forecast, Overall EV Market Situation Still Is Robust

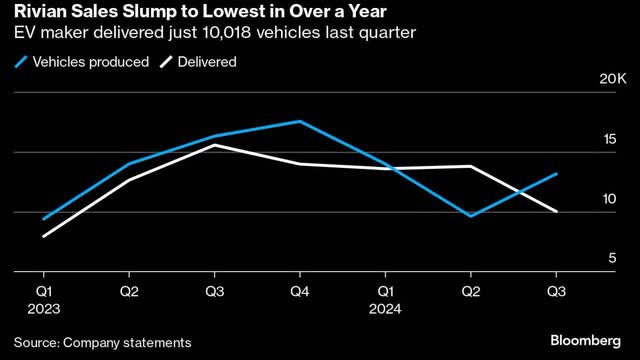

Rivian Automotive anticipated a total annual production volume of 57,000 electric-vehicles up until October 3, 2024, but said on October 4, 2024 that it was forced to slash its forecast to 47,000 and 49,000 electric-vehicles. The reason for the revision is that the EV company is seeing an acute parts shortage which started in 3Q24 and necessitates a change in the short-term production outlook. In the worst case, Rivian Automotive is thus poised to produce 10,000 fewer vehicles than originally planned.

The change in the guidance was made in conjunction with the report of delivery numbers for 3Q24: Rivian Automotive delivered 10,018 electric-vehicles during the third quarter, which unfortunately missed expectations by about 3K EVs.

With that said, investors should not make the mistake and assume that Rivian Automotive is suffering from softening demand and I think that the parts shortage explanation is genuine. I say this because delivery results for the third quarter were generally good across the board.

Vehicles Produced (Bloomberg)

Third-quarter U.S. new vehicle sales for Ford Motor (F) rose 0.7% with EV sales up 12.2% YoY. Total sales of General Motors (GM) fell 2.2% in 3Q24, but EV sales surged 60% YoY to a record of 32,095. Tesla, Inc. (TSLA) saw its global sales rise 6.4% in the third-quarter.

These numbers strongly tell investors that Rivian Automotive’s slashed production guidance is not related to a ‘demand dip,’ as some may fear, but rather to a shortage of critical parts as explained in Rivian Automotive’s press statement.

Technical Chart Situation

Rivian Automotive’s stock fell through the 50-day moving average trendline in August (and failed to recover it in September) and through the 200-day moving average shortly after. The chart picture, from a technical angle, has turned bearish, but RIVN has strong support around the $10 price zone at which point I would anticipate an upside retracement.

Based on the Relative Strength Index, Rivian Automotive (32.99) is very close to being oversold (which would be the case at an RSI value of 30 or lower). I think that the technical chart profile is not nearly as bad as investors might think, partially because investor sentiment took a short-term hit after last week’s production forecast revision. In the long-run, production and deliveries should rebound, however, leaving substantial room for a retracement.

Moving Averages (StockCharts.com)

Rivian Automotive Has Big Percentage Of Market Valuation In Cash

The electric-vehicle company had a total market value of $10.6 billion as of 10/9/2024, down $3 billion since I last reviewed Rivian Automotive. The EV manufacturer had $7.87 billion in cash and short-term investments as of June 30, 2024 on its balance sheet, which means that 74% of Rivian Automotive’s market valuation consisted of cash.

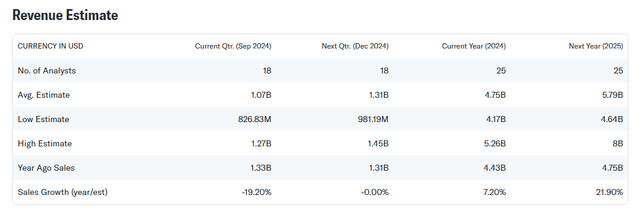

In terms of estimated 2024 sales, Rivian Automotive is going to take a hit here, obviously. The market presently models $4.75 billion in sales for this year, which is down from $4.86 billion in August. I think with the present production forecast of 47,000-49,000 EVs this year, sales estimates are also poised to reset lower: A range of $4.0-4.2 billion seems more realistic now when taking into account an average sales price of around $85,000 per electric-vehicle. This in turn reflects back to us a 2024 sales multiple of 2.6x.

Based on RIVN owning a big amount of cash, however, I think that the risk of owning stock here is quite low, particularly as I anticipate the company’s production and sales estimates to rebound in the short term.

Revenue Estimate (Yahoo Finance)

Why The Investment Thesis Might Disappoint

Should the situation turn out to be only a shortage in EV parts, I would anticipate a rather fast upside retracement. This, in my view, is the most likely scenario when taking into account that the U.S. EV market actually produced good results for a number of electric-vehicle companies.

On the flip side, should Rivian Automotive run into trouble ramping its production again, the electric-vehicle company might see a deterioration in its short-term profitability.

In the long-run, given that the EV market overall is still growing, I am not overly concerned about Rivian Automotive’s slashed production forecast for 2024.

My Conclusion

In my view, investors should consider buying the slump after last week’s reduced production forecast. Though it is true that Rivian Automotive’s 3Q24 deliveries were kind of a let-down, the market overall is in good shape and I don’t think investors need to be fearful of moderating growth for EV manufacturers. What should assuage investors’ fears is that Rivian Automotive has a lot of cash and short-term investment to keep the company afloat for the next year.

Furthermore, Rivian Automotive, should it need more cash, could probably access debt markets again and raise more cash via the issuance of convertible debt. Rivian Automotive’s market valuation consists primarily of cash.

Since RIVN has some very solid technical support at $10 and since the stock is very close to being oversold, I think a contrarian position here could make sense for investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.