Summary:

- Rivian is focused on long-term growth, aiming to produce over 600K EVs annually by the end of the decade despite current production setbacks.

- Investors should not be swayed by short-term issues; Rivian’s retooling and cost-reduction efforts are expected to improve gross margins and profitability.

- The company’s production capacity has increased, and new vehicle models like the R2 and R3 will drive future growth and revenue.

- Rivian’s current market cap of $10 billion presents a buying opportunity, with significant upside potential as the company scales and improves efficiencies.

wbritten

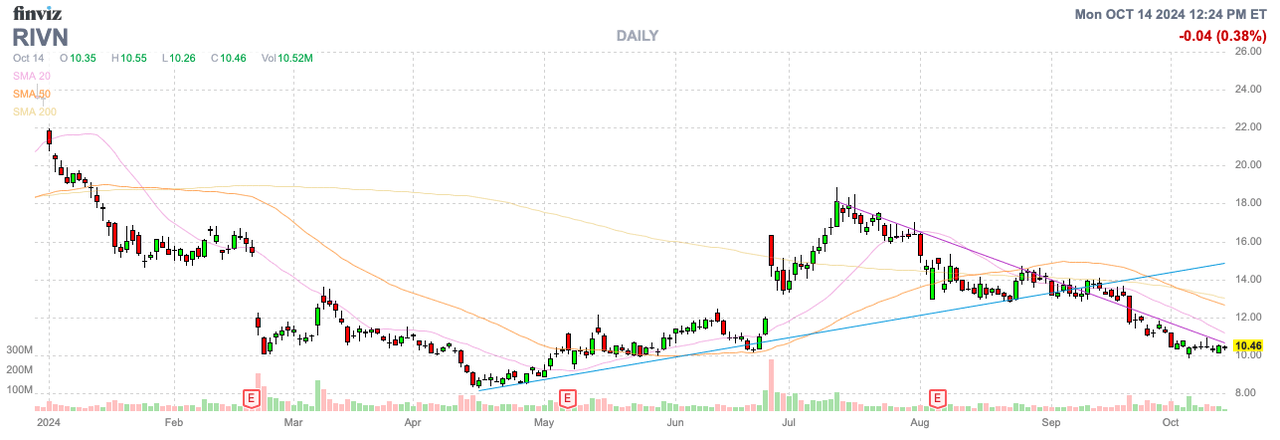

Rivian Automotive, Inc. (NASDAQ:RIVN) is busy building an EV brand and platform for the future while investors are trading the stock based on everyday moves. The EV manufacturer has definitely hit some speed bumps this year, but investors shouldn’t trade the stock based on short-term details. My investment thesis remains ultra-bullish on Rivian heading towards the business turning gross profit positive, along with catalysts from the expansion of the vehicle line in the next year or so.

Source: Finviz

Production Speed Bump

Rivian is focused on a path to produce over 600K EVs annually long before the end of this decade. Investors appear focused on how many premium EVs the company produces in 2024 while retooling their manufacturing plant.

The EV manufacturer just announced a part shortage was leading to a production cut for this year. Rivian now forecasts only 47,000 to 49,000 vehicles will be produced in 2024 as follows:

- Q4E – 10,251 to 12,251.

- Q3A – 13,157.

- Q2A – 9,612.

- Q1A – 13,980.

Rivian had last forecast production of 54,000 vehicles this year. The supply shortage is impacting a rather large 7,000 units after the company just spent parts of Q2 retooling the manufacturing facility in Normal, Illinois and implementing new features for the 2nd-generation R1s.

The big focus for the 2H was Rivian proving the ability to produce premium EVs with a positive gross margin. The long-term investment story is all about the production of additional vehicle models expanding annual capacity to 615K EVs via the eventual opening up of the Georgia plant.

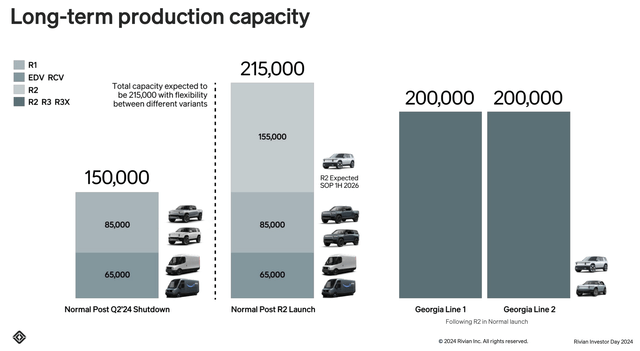

Source: Rivian Investor Day presentation

In essence, this target is for production of at least 10x the 2024 target in a few short years. The big question is why anyone would sweat this production speed bump.

The EV manufacturer can now produce 4x more vehicles from the plant than the cut 2024 target, recently increasing the production capacity from 150K to 215K. Rivian isn’t likely to boost production much in 2025, but the capacity will allow for a big opportunity to build the R2s and R3s at the existing plant starting in 2026 before needing to construct the large plant in Georgia.

Margin Hiccup

Investors should definitely brace for a margin disappointment in Q3’24. The big plan for the 2H was for Rivian to utilize the retooling of the plant to both reduce the material costs and boost the production efficiencies in order to wipe out the $33K in per-vehicle losses from the last quarter.

Rivian only delivered 10,018 vehicles in the quarter, so the company isn’t going to see the benefits of scale in the quarter. Investors should get a better indication of the reduction in material costs from both better pricing and the reduction in materials used per vehicle.

With the Q2 shareholder letter, the company confirmed a comparable R1 dual-motor would see a 20% material cost reduction in the second generation vehicle from Q1 this year to Q4. Investors should still see this lower cost.

The issue will be the lack of sales of the second generation R1s and the lack of scale from producing more vehicles with the same or less resources. Rivian will only produce up to 12K EVs in Q4, down from the nearly 14K in Q1.

The key is investors won’t see much proof in the following statement from Rivian in the Q2’24 shareholder letter:

The second-generation R1 body has been re-engineered to optimize cost by eliminating 65 parts and reducing nearly 1,500 joints. The use of high-pressure die castings simplifies the battery pack and significantly reduces the number of parts. Beyond the body improvements, cycle time improvements were made throughout the entire plant to support an overall expected increase in R1 vehicle production line rate of 30%.

If this statement were still accurate, Rivian would technically take the Q1 production rate of 14K and boost the total to 18K per quarter depending on the EDV portion of the equation. In addition, the company could add a third production line to build more R1s.

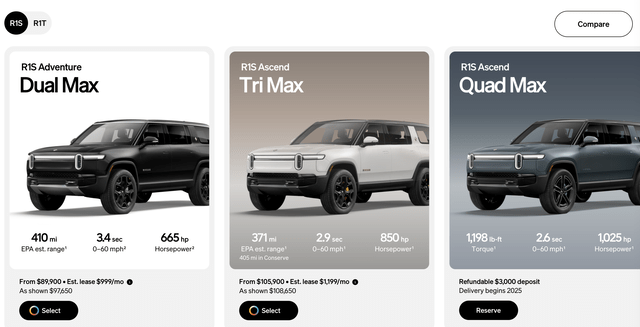

The last portion of the business plan to reach gross margins in Q4 started taking shape in Q3. Rivian announced the release of the trimotor as part of the plan to scale revenues per delivered unit through this product mix with higher pricing, along with software and services and other revenues.

The R1S Tri Max has an initial list price of $16K more per vehicle versus the Dual Max version. Rivian lists the R1S Tri Max with a starting price of $105,900 while the 1,025 hp Quad Max doesn’t start delivery until 2025 and will further boost the ASP.

Source: Rivian

The company forecasts only needing to reach around 200K production capacity in the Normal plant to hit adjusted EBITDA profits. Rivian can get a lot closer to those volume totals in 2025 via the expected demand increase for the commercial van program with the flexibility to flex production up to 65,000 units now.

The EV manufacturer is likely still reliant on the R2 production in 2026 to really move the growth needled due to the prohibitive costs of the premium R1 units, but the EDVs are generally ignored right now. The 215,000 units of installed capacity does give a lot of flexibility to the R1 and EDV programs while the flexibility was positioned for the R2 to have a total maximum capacity of 155,000 units of available volume.

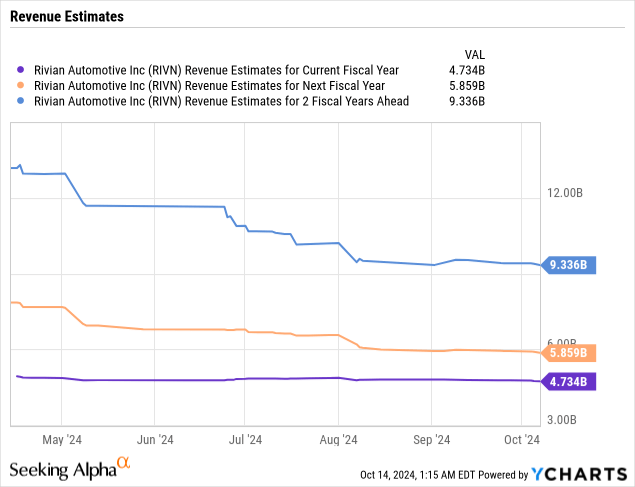

While Rivian has definitely seen revenue estimates slip due to EV demand questions, the company still has a lot of shots on goal in order to substantially boost revenue over time. The current consensus analyst estimates have 2024 revenues of $4.7 billion nearly doubling to $9.3 billion in 2026.

The current supply hiccup on top of the plant closure provides the fuel for bears, but the long-term story hasn’t changed. Rivian remains a well-loved EV brand and the company has the business primed for massive growth throughout the end of the decade.

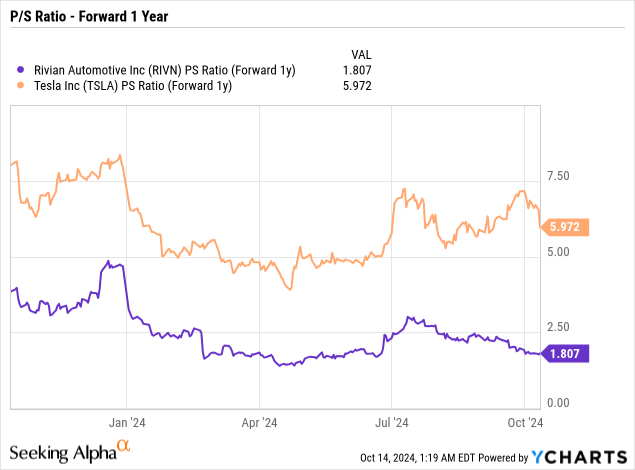

Tesla, Inc. (TSLA) just had a Robot event that fell flat, yet the stock still trades at 3x the forward P/S model of Rivian. Tesla now trades at 6x sales targets.

With Rivian guiding to about 50% of the cost reductions via a reduction in variable costs from R1 engineering design changes, commercial supplier negotiations, and lower raw material costs, the company should be able to eliminate half of the $33K losses. The other 35% reduction via fixed costs won’t see much of a benefit in the 2H due to low production.

The goal should be for Q3 per unit losses to dip into the $15K range, somewhat depending on timing. The market should reward Rivian in such a scenario with further indications the remaining losses will be stripped away via production efficiencies and the additional revenues from bigger motors and services.

Takeaway

The key investor takeaway is that Rivian remains appealing here with only a $10 billion market cap and a platform for a much larger business. As with any EV manufacturer, the company faces extra risks regarding future funding needs, especially if EV demand lags. Also, any failure to eliminate the ongoing per-vehicle losses would raise concerns regarding future profitability prospects.

Investors should use the weakness to load up on Rivian.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in RIVN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start Q4, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.